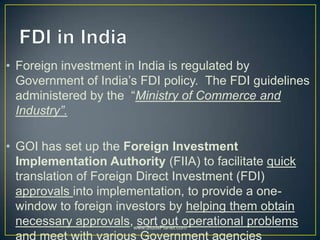

This document defines and describes foreign direct investment and foreign institutional investment. It provides key points about each:

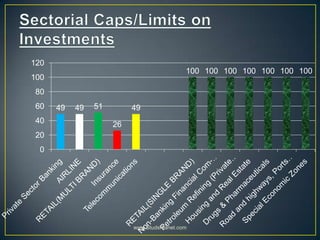

- Foreign direct investment is investment from one country into the assets and businesses of another, including buying shares/equity in companies or establishing new operations. It requires at least a 10% ownership stake.

- Foreign institutional investment refers to investment from foreign investment funds, pension funds, insurance companies etc. into the stock markets of another country.

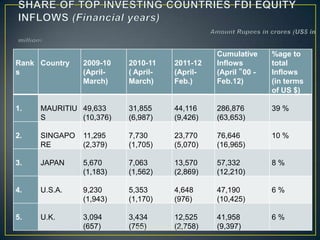

- The document provides statistics on top source countries for FDI in India and monthly FII flows into Indian equity and debt markets in 2012.