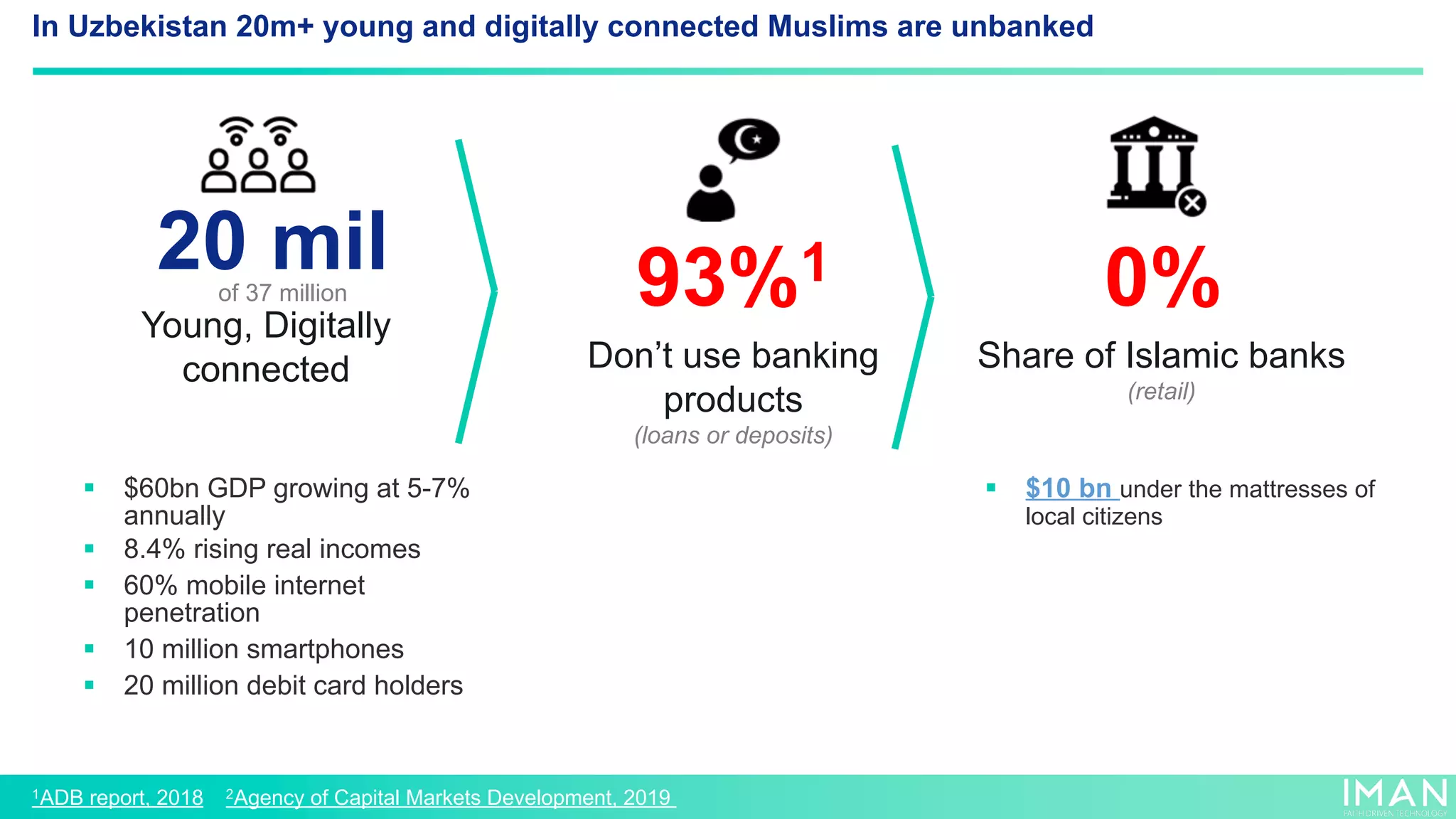

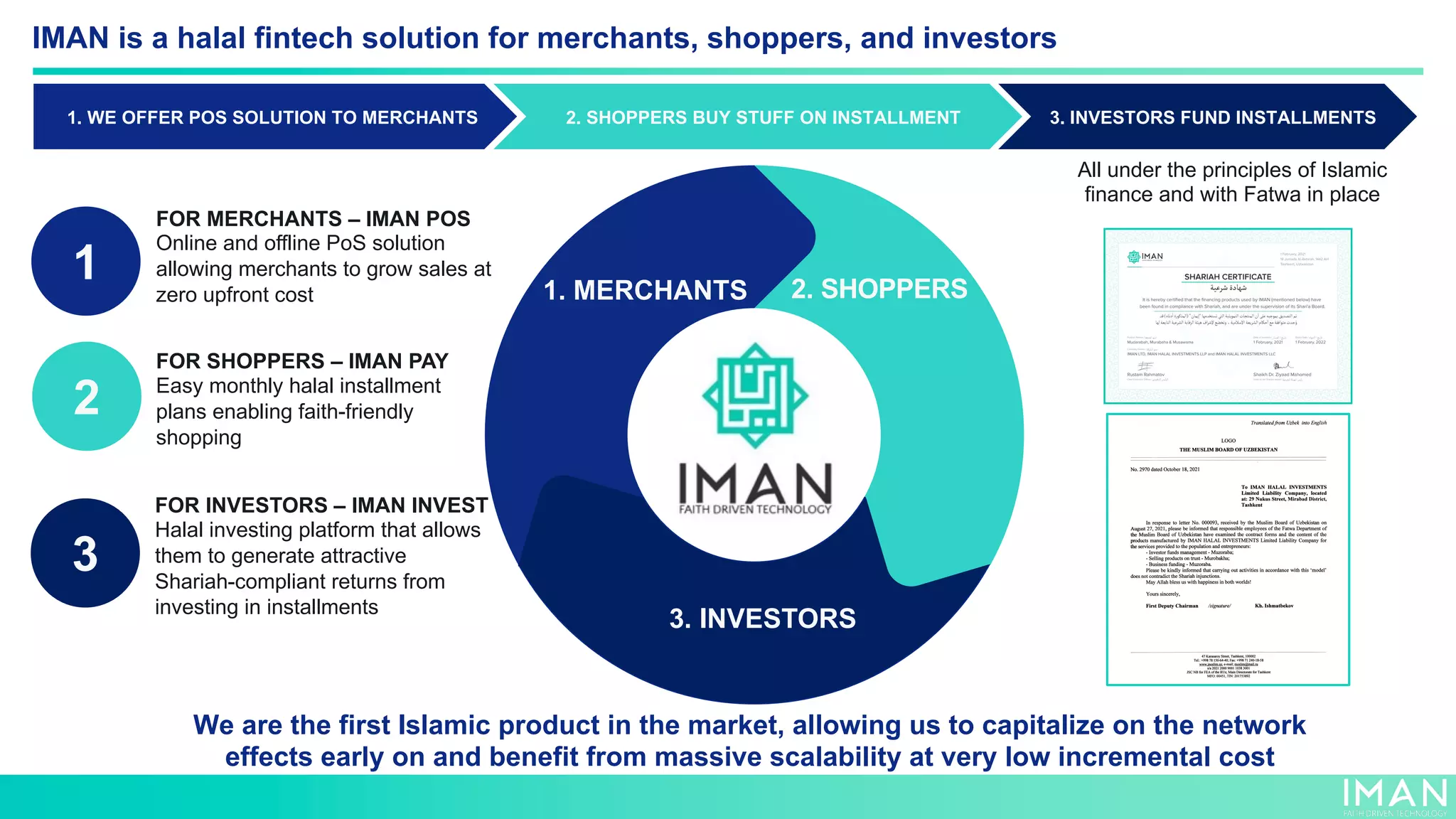

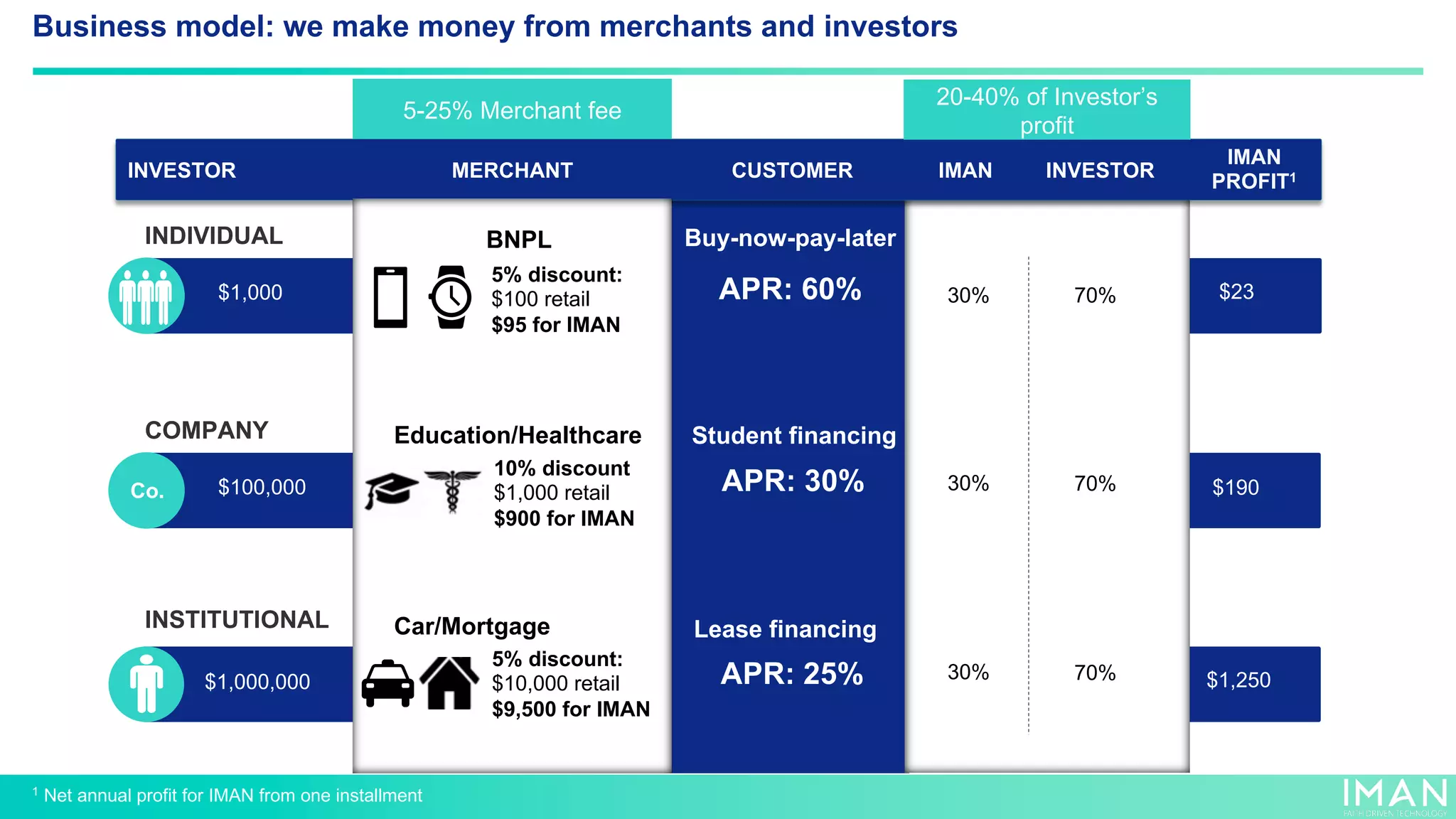

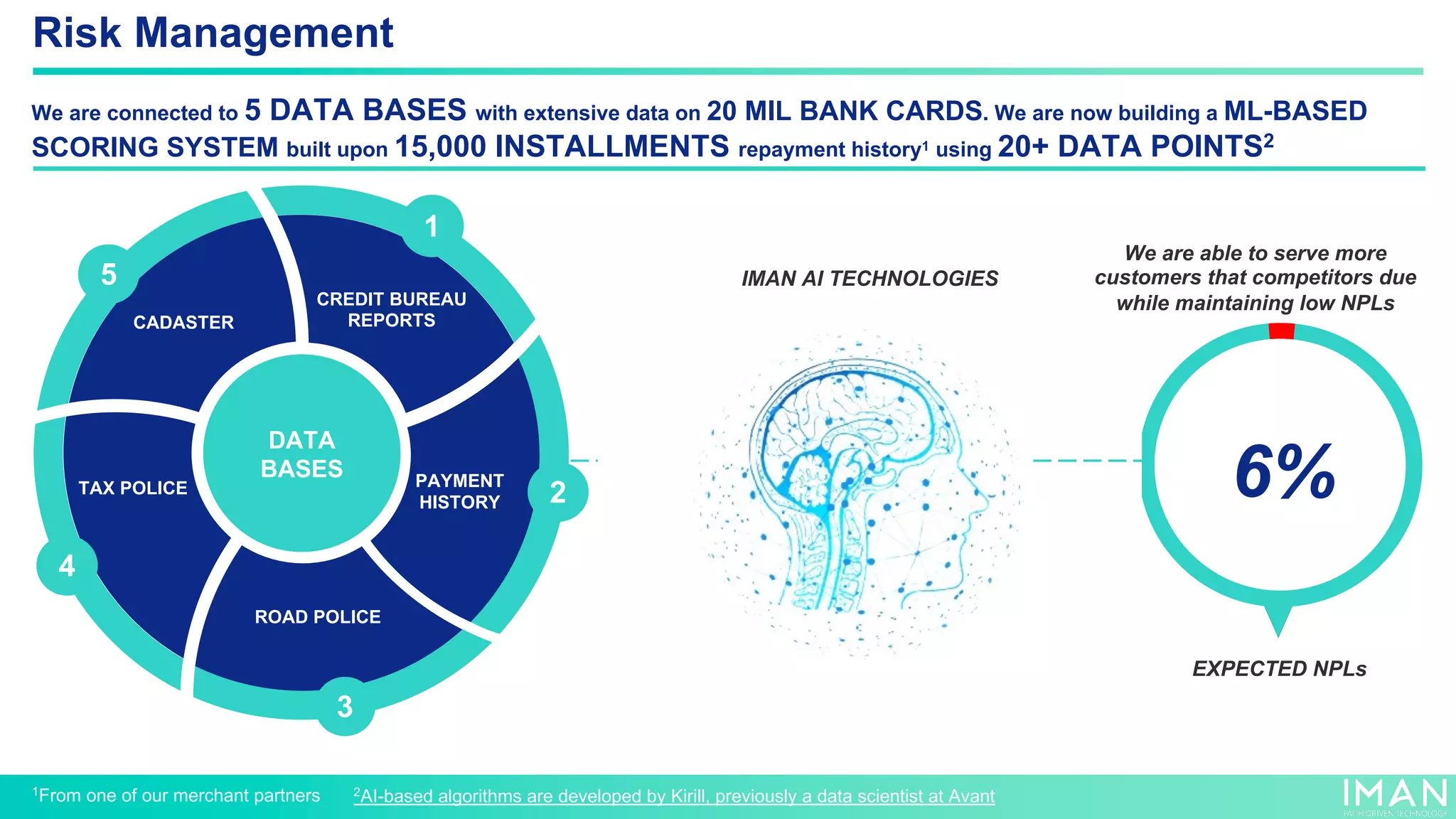

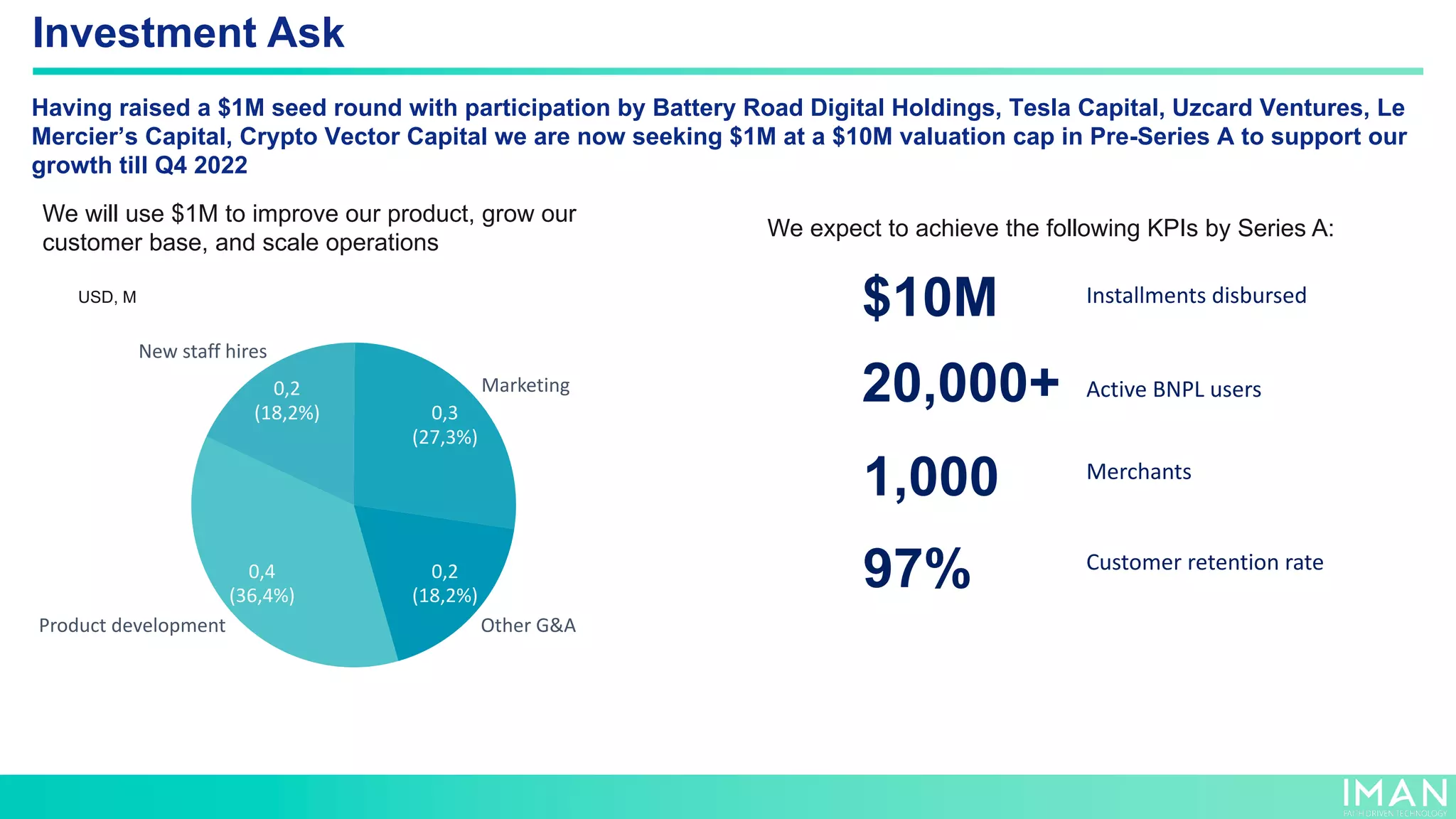

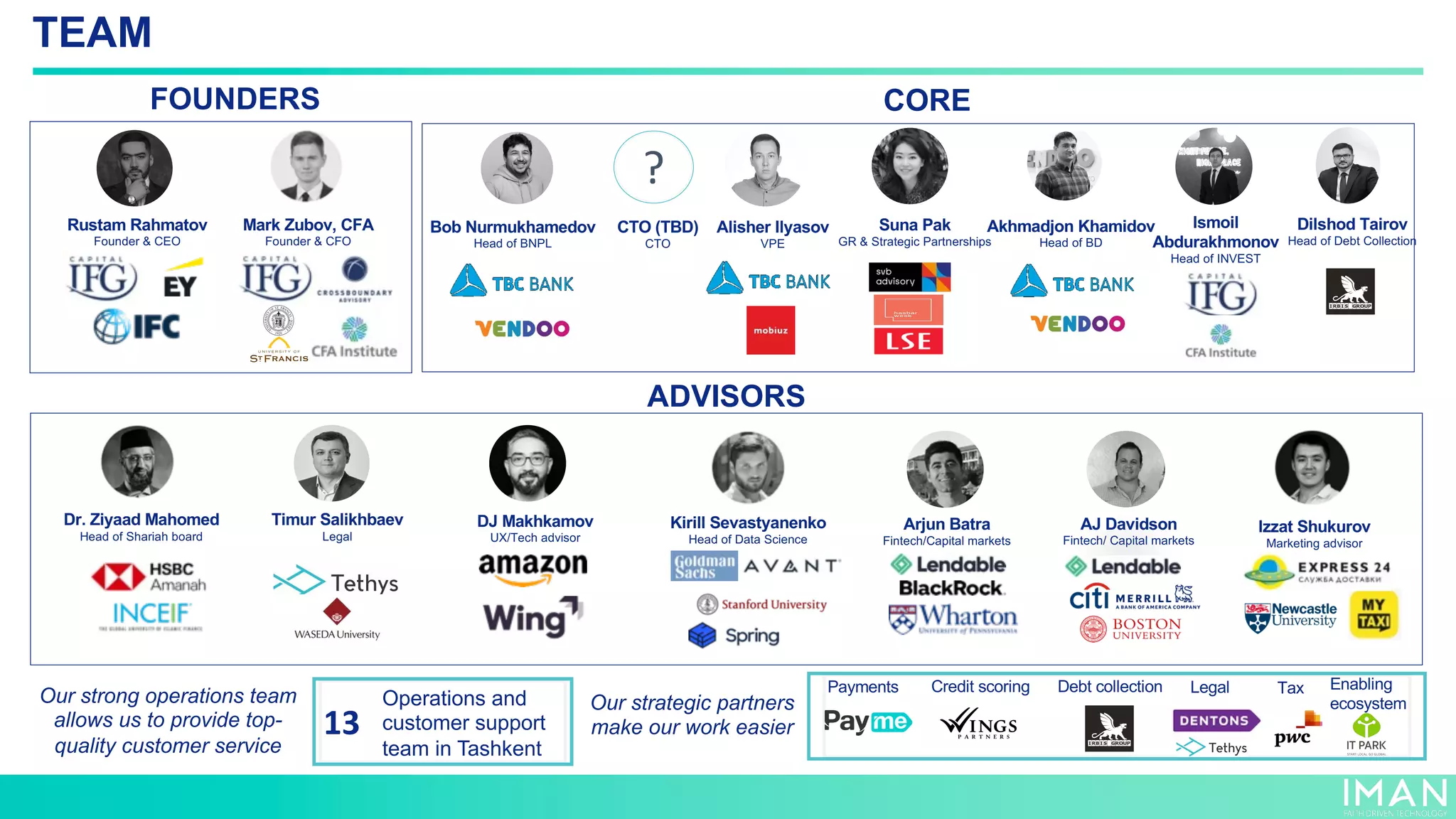

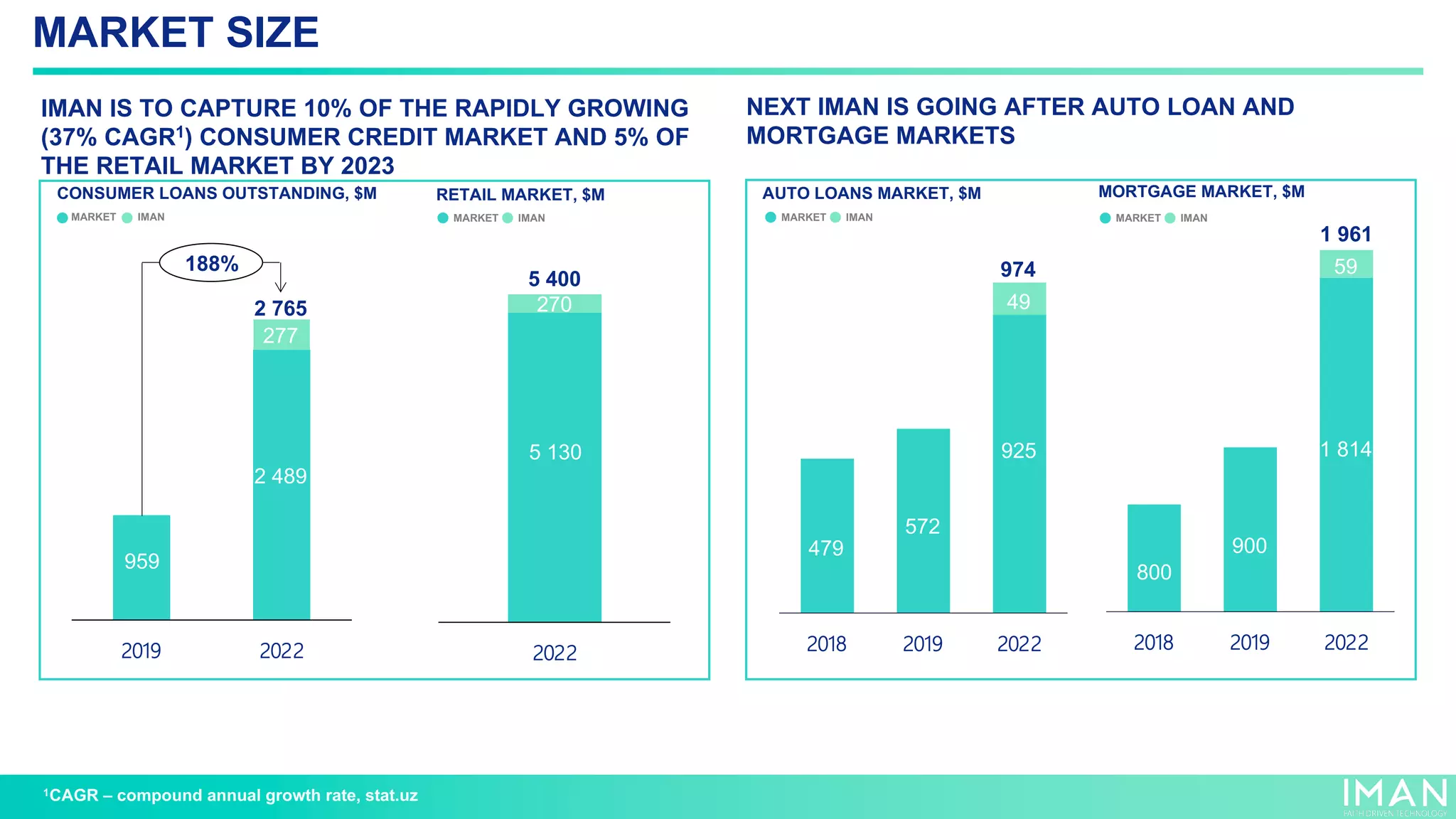

IMAN is a halal fintech startup based in Uzbekistan that offers a buy now pay later (BNPL) solution, investment platform, and marketplace for Muslims. It has raised $1 million so far and is seeking $1 million more in pre-series A funding to improve its product, grow its customer base, and scale operations. IMAN currently has over 30,000 active BNPL users, $1.3 million in installment loans booked, and 108 merchants on its platform. The company aims to become the leading BNPL provider in Uzbekistan and expand across Central Asia and Southeast Asia.