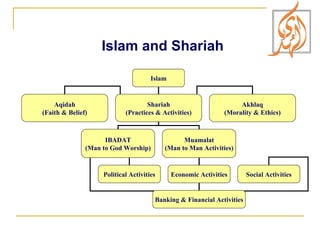

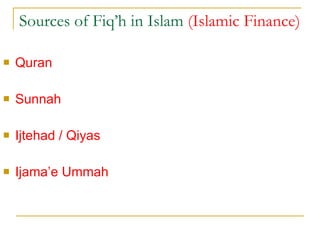

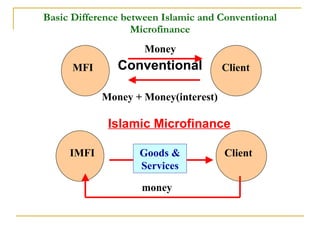

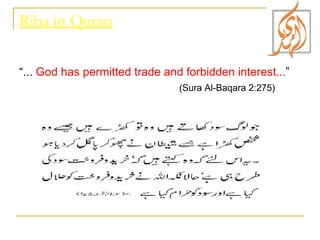

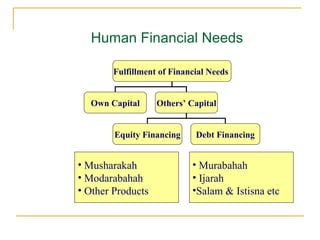

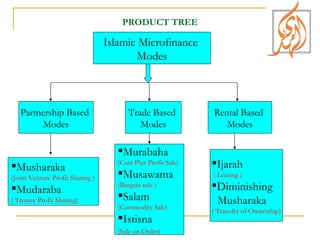

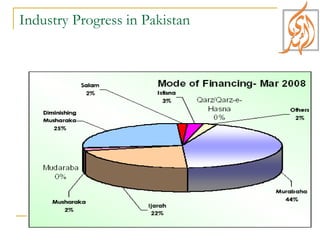

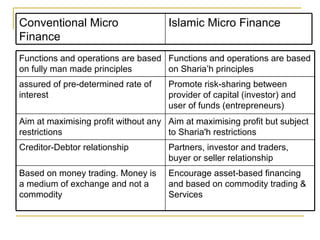

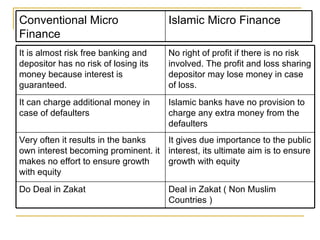

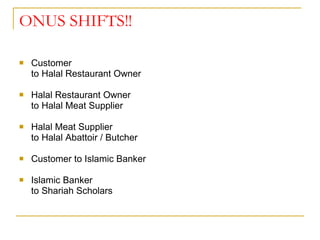

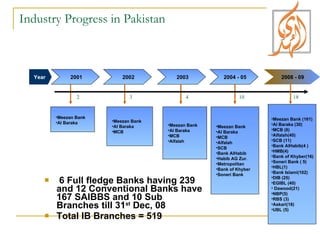

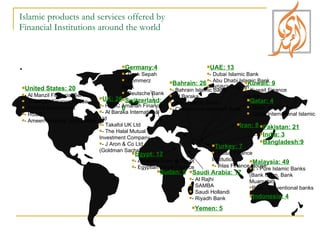

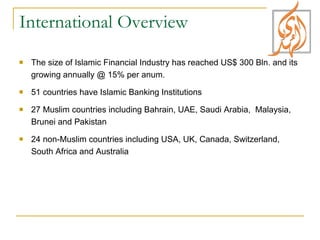

The document provides an introduction to Islamic microfinance. It discusses the differences between Islamic and conventional microfinance, highlighting that Islamic microfinance is based on risk-sharing partnerships rather than interest-bearing loans. Various Islamic microfinance products are described, including modes based on trade, partnership, and rental. The progress and growth of Islamic banking internationally and in Pakistan is also summarized.