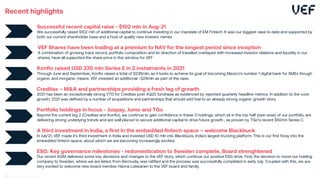

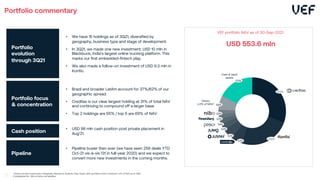

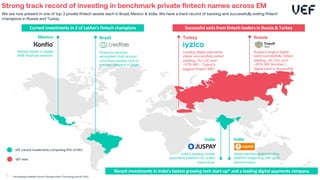

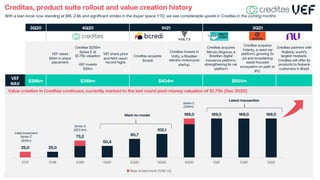

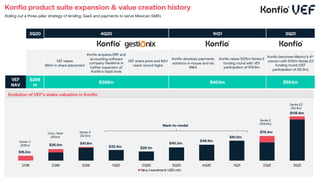

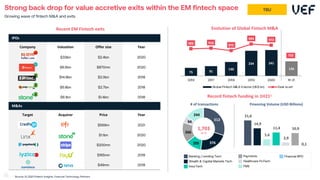

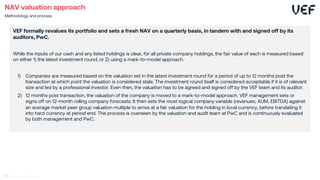

VEF is an emerging market fintech investor that recently held its AGM. Key decisions included the successful redomestication of VEF's holding company to Sweden. Recent portfolio highlights include continued strong performance from Creditas, Konfio raising $235 million, and a new $10 million investment in Blackbuck, India's largest trucking platform. VEF also recently raised $102 million in capital to continue expanding its portfolio of minority stakes in leading fintech companies across emerging markets.