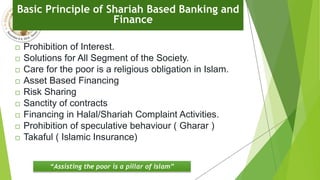

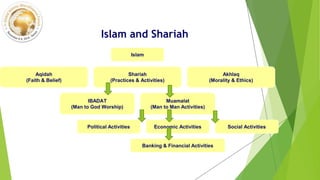

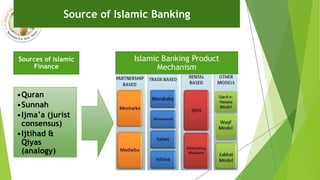

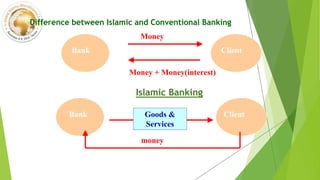

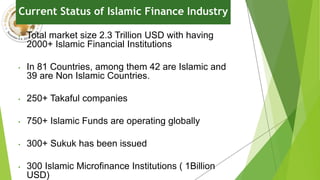

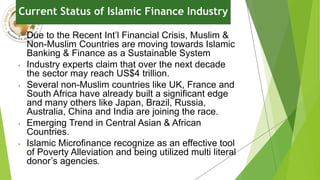

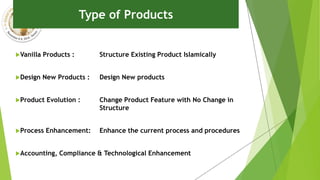

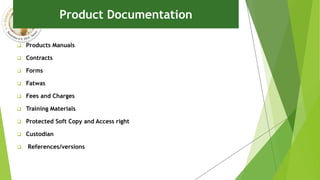

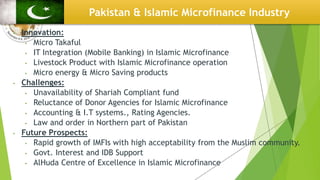

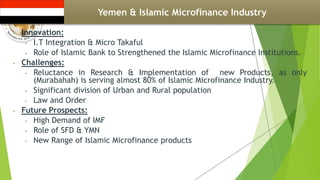

This document discusses Islamic microfinance principles and products. It provides an overview of the basic principles of Islamic banking such as a prohibition on interest and risk sharing. It then discusses the current state of the global Islamic finance industry, noting there are over 2000 institutions in 81 countries managing over $2.3 trillion in assets. The document also summarizes key innovations and challenges within the Islamic microfinance sectors of several countries, such as Pakistan, Afghanistan, Indonesia and Yemen.