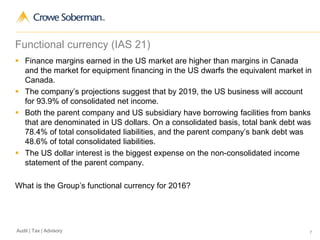

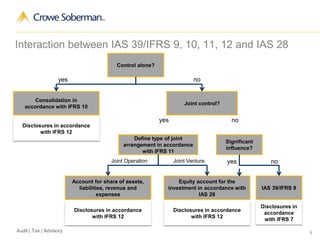

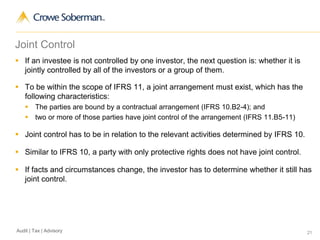

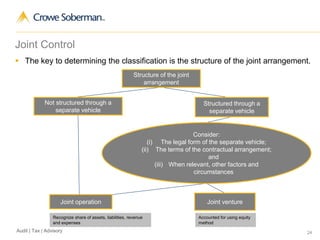

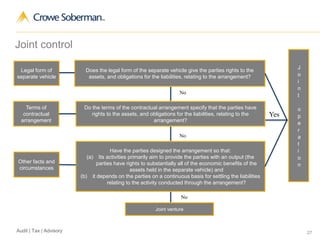

The document provides an overview of key IFRS updates related to functional currency and strategic investments, emphasizing the importance of determining an entity's functional currency based on its operational context, cash flows, and economic environment. It explains various operational and financial arrangements such as subsidiaries, joint operations, and joint ventures, detailing how entities should classify and account for these investments under the latest standards. Additionally, it outlines the parameters for control, joint control, and the factors influencing the determination of functional currency and consolidations.