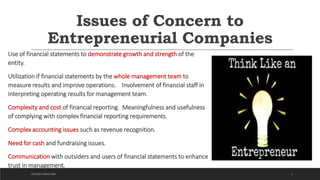

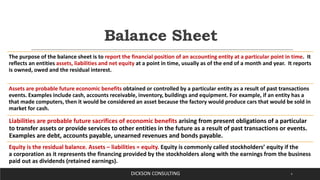

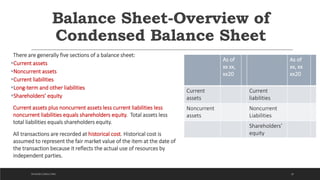

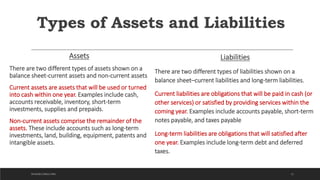

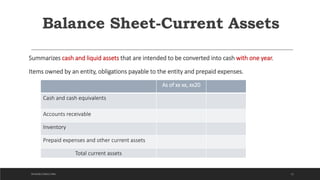

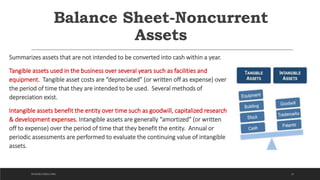

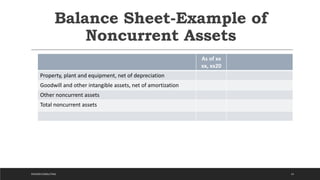

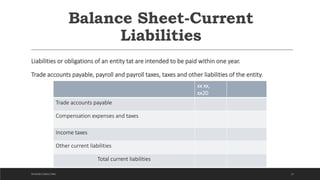

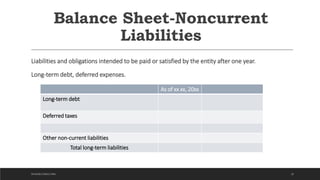

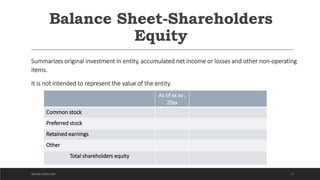

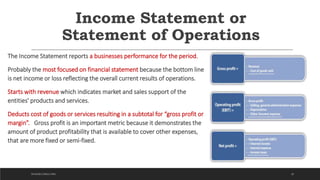

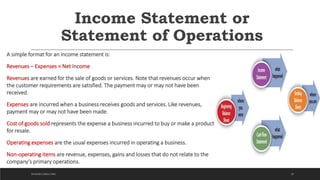

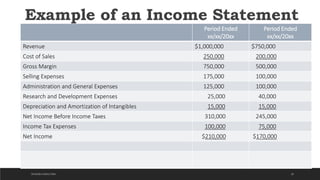

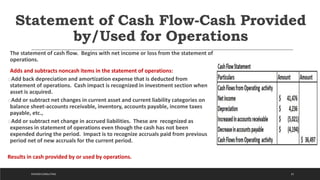

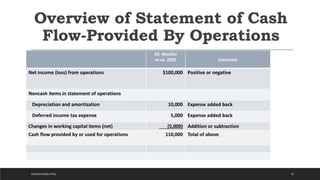

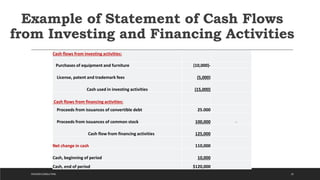

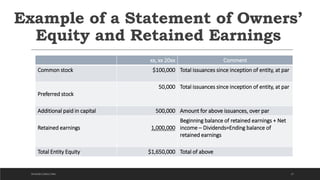

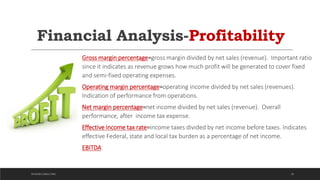

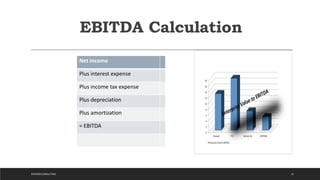

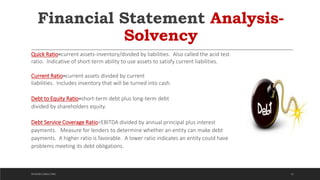

This document discusses financial statements and how they relate to entrepreneurial businesses. It provides definitions for key financial terms like assets, liabilities, equity, income statement, balance sheet, and cash flow statement. It explains the purpose and components of various financial statements. The document also discusses financial analysis metrics for evaluating a company's profitability, solvency, and efficiency.