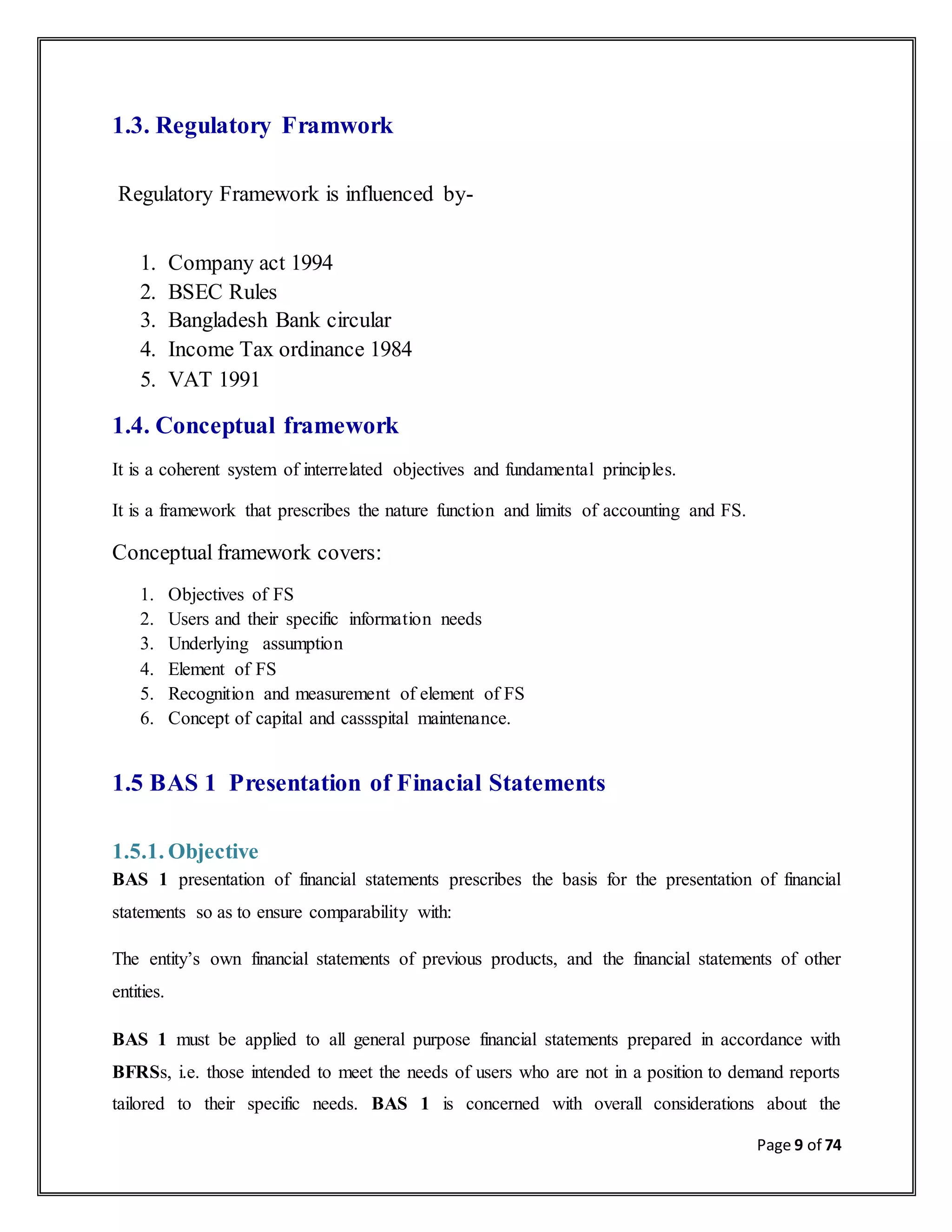

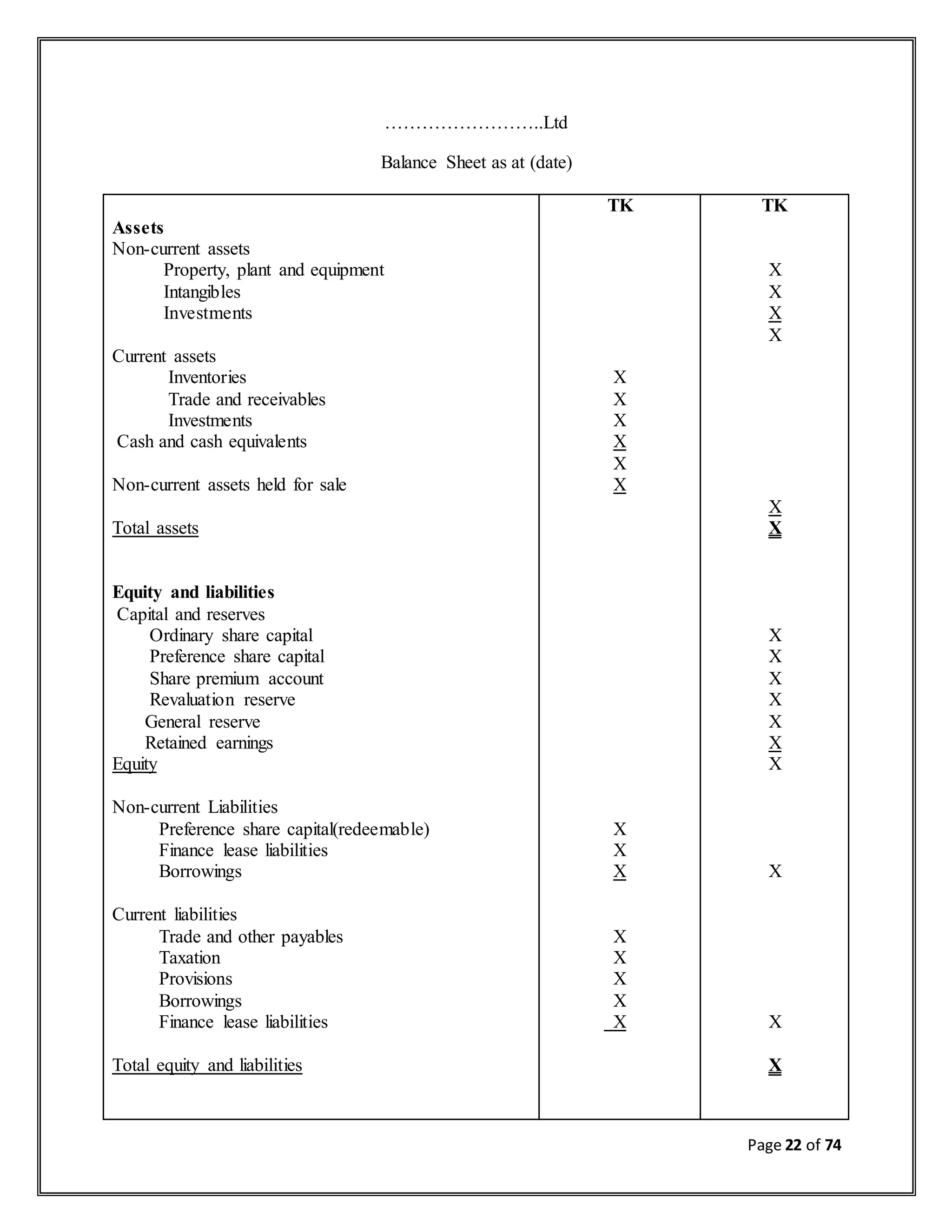

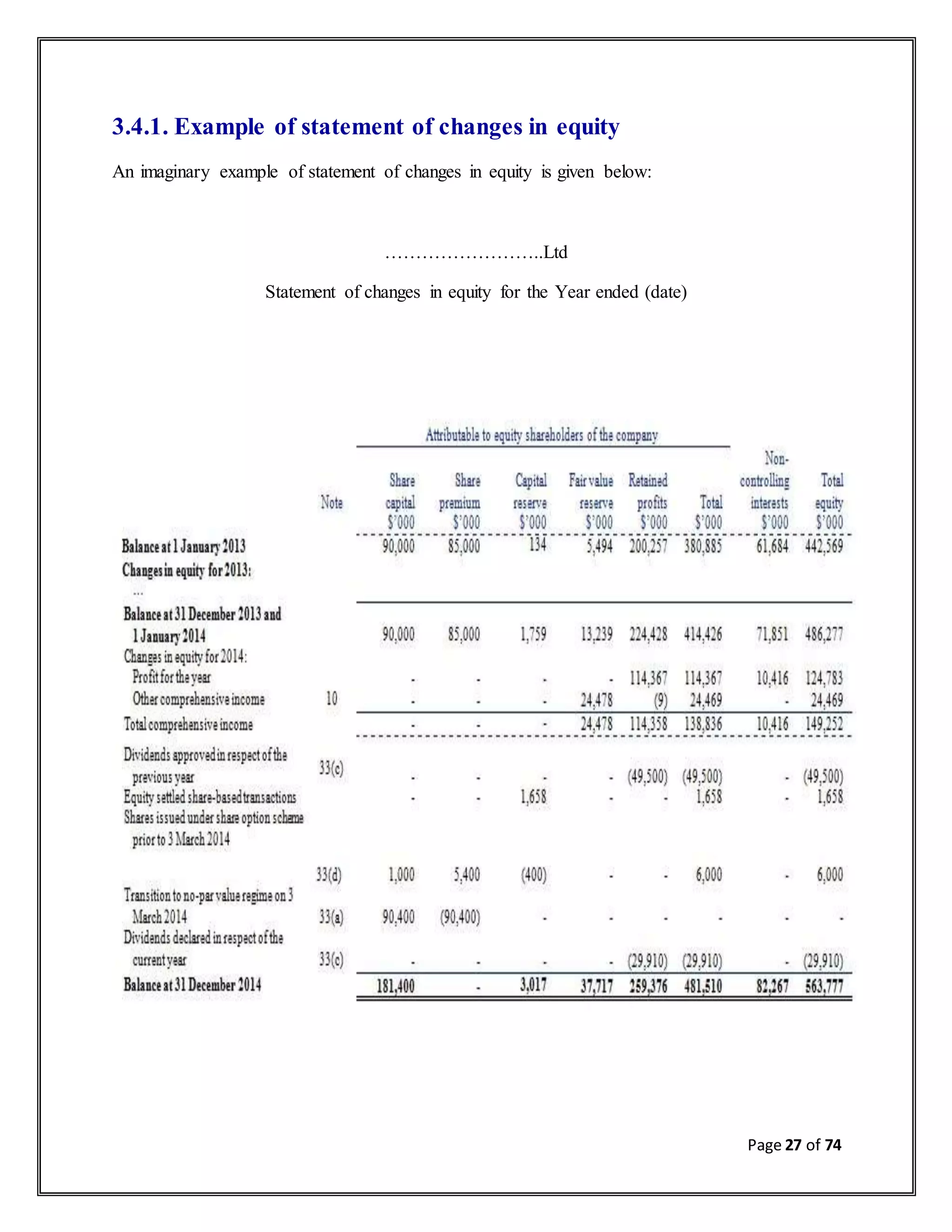

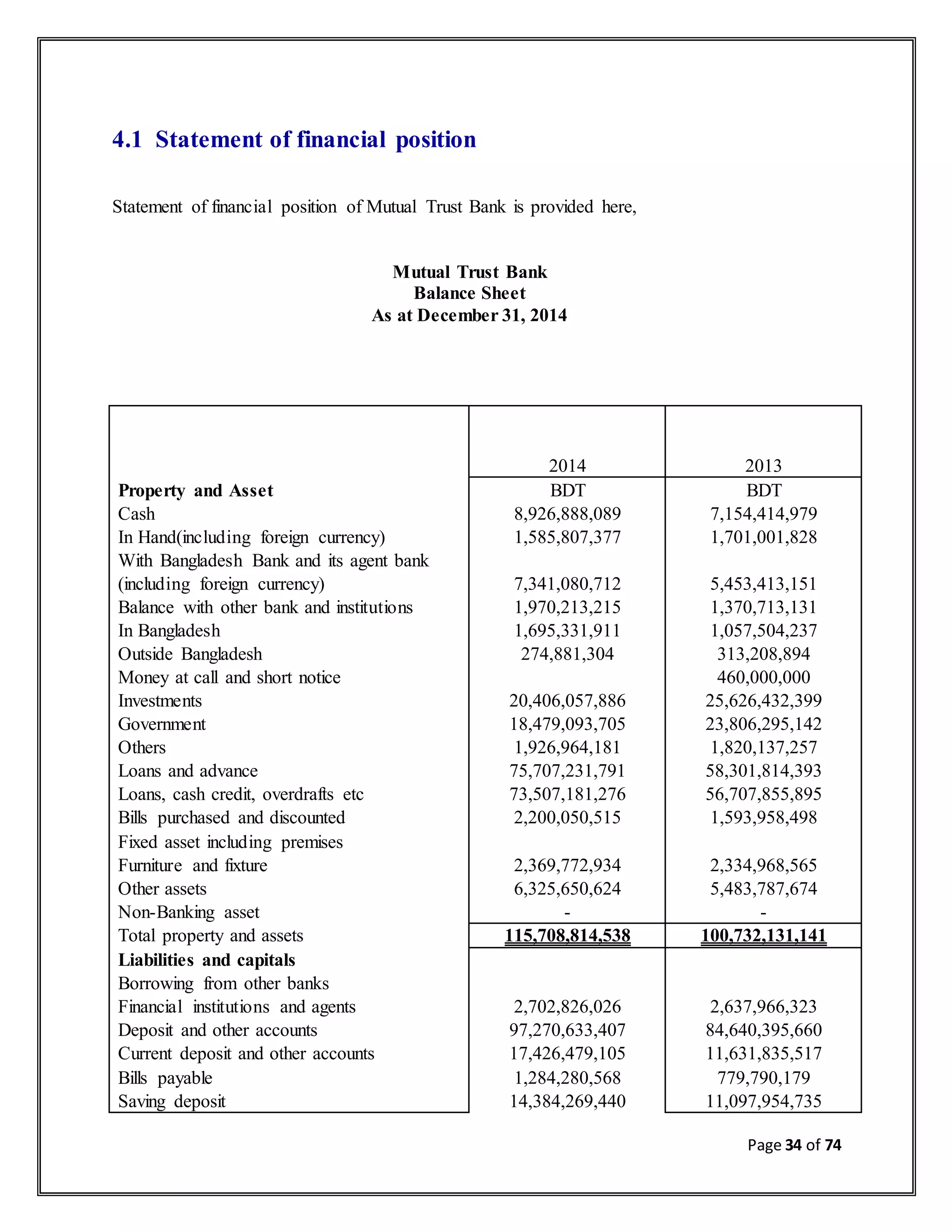

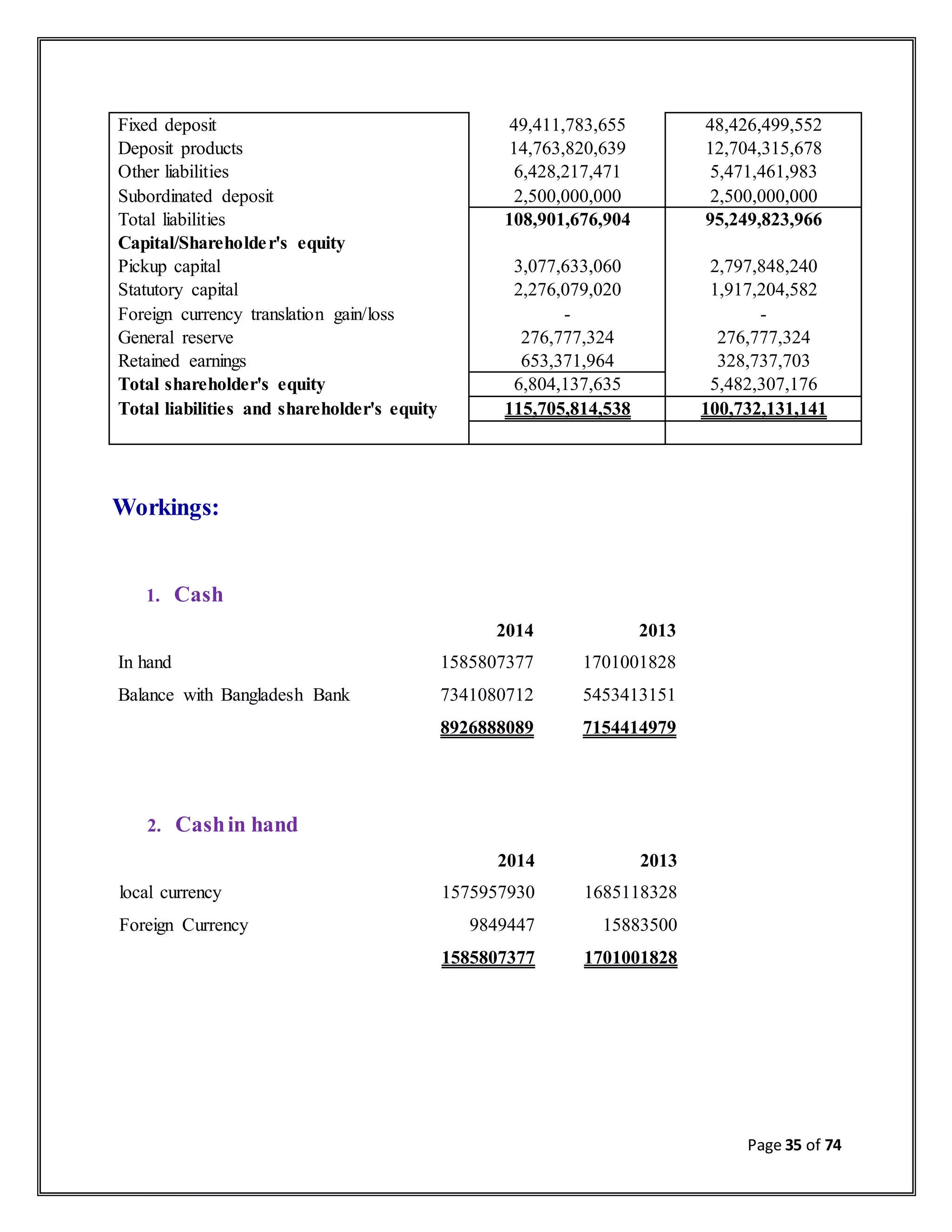

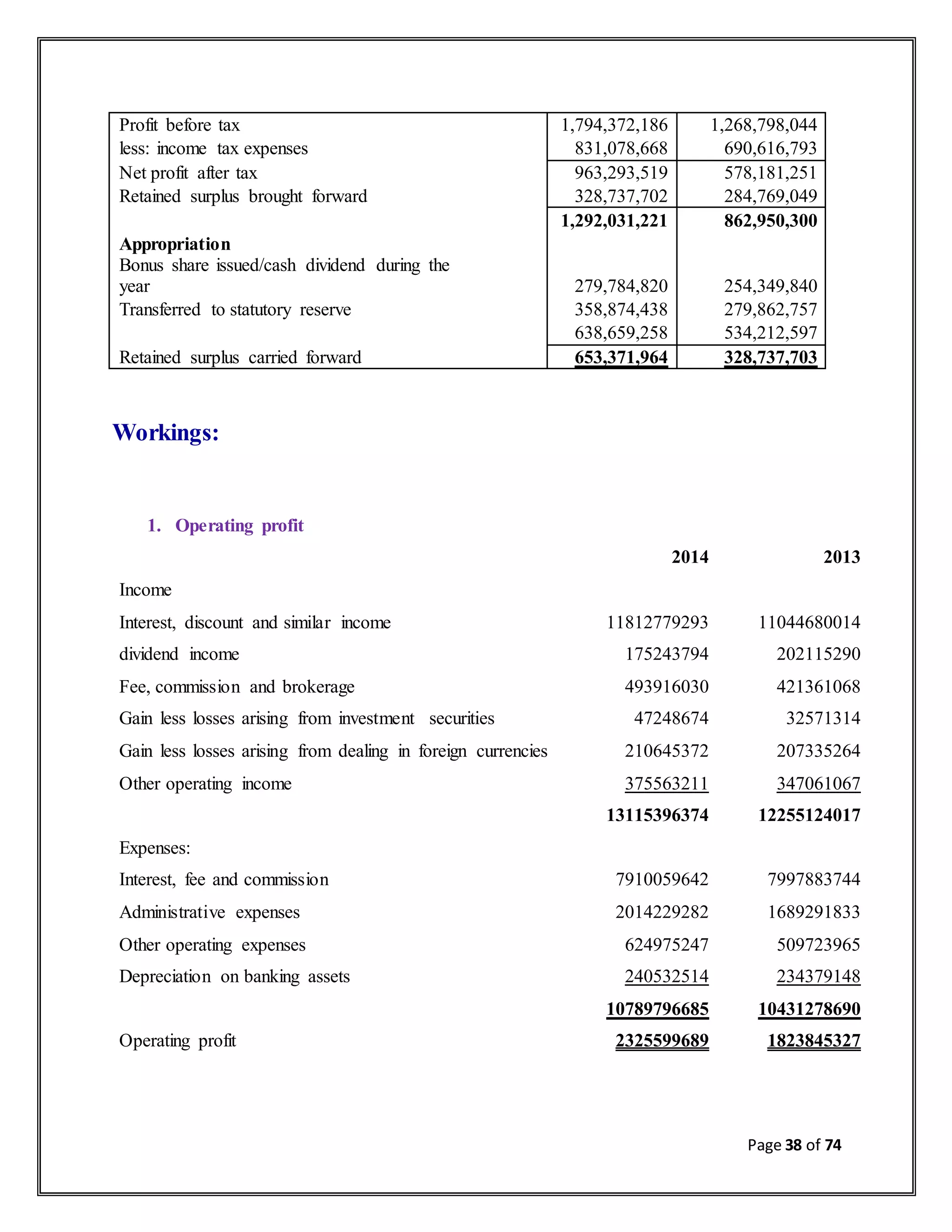

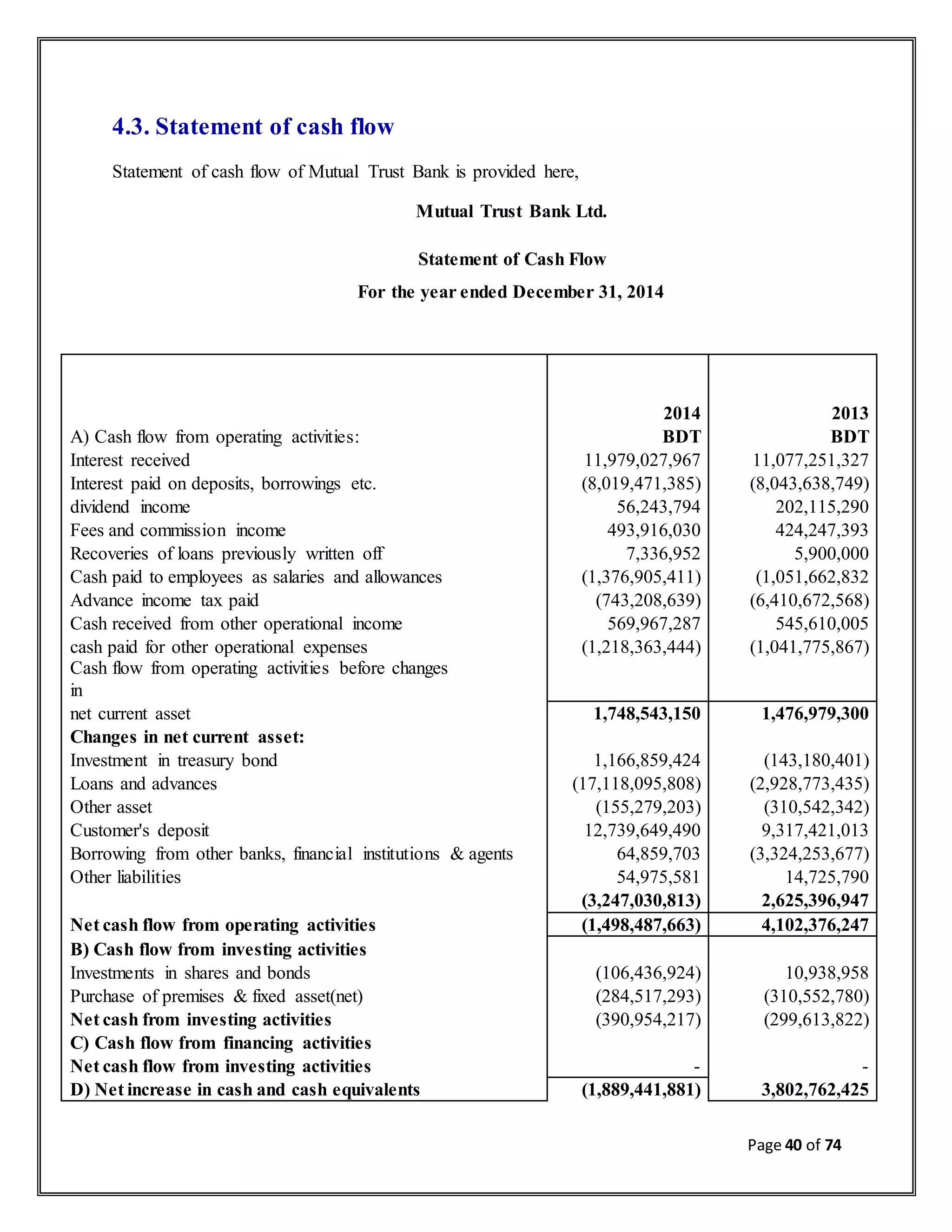

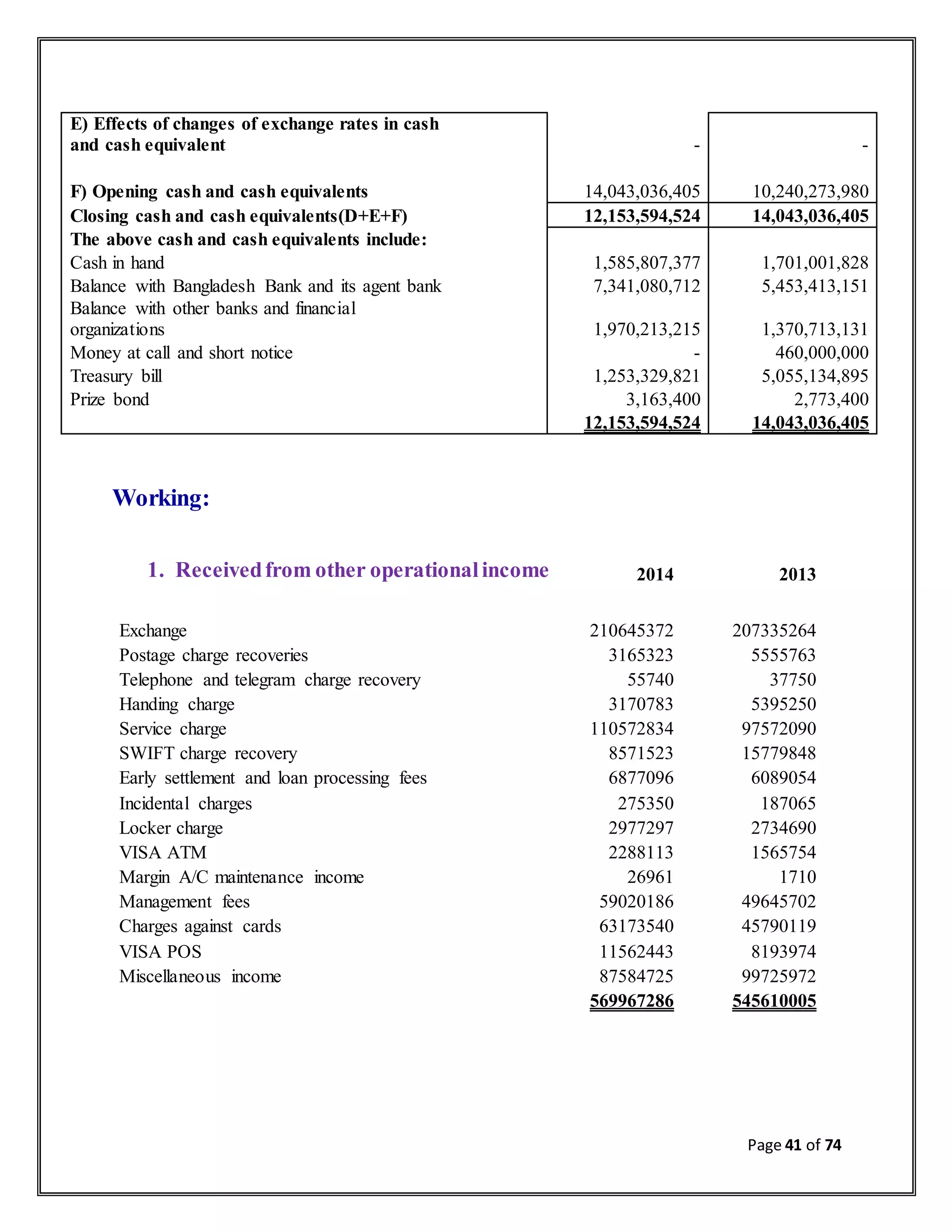

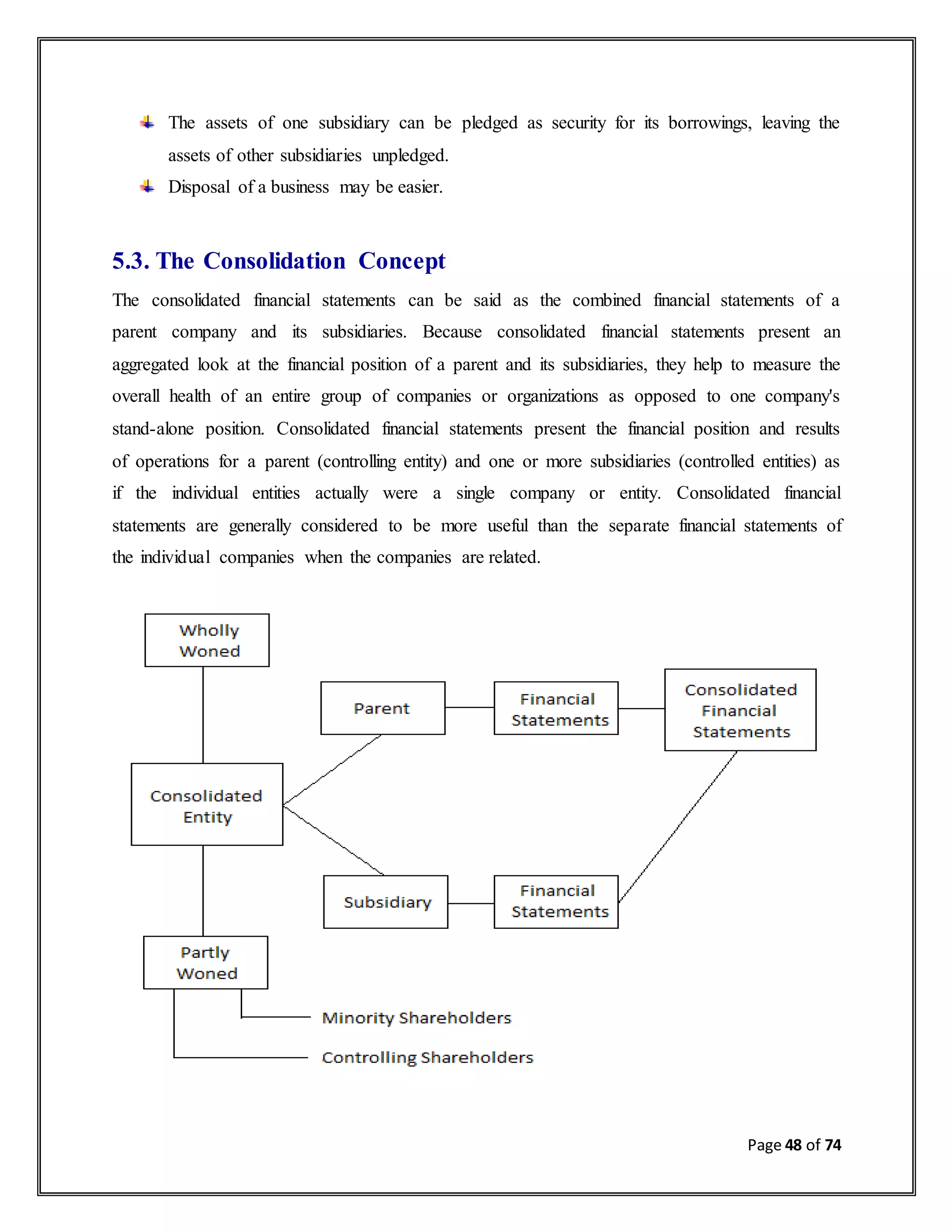

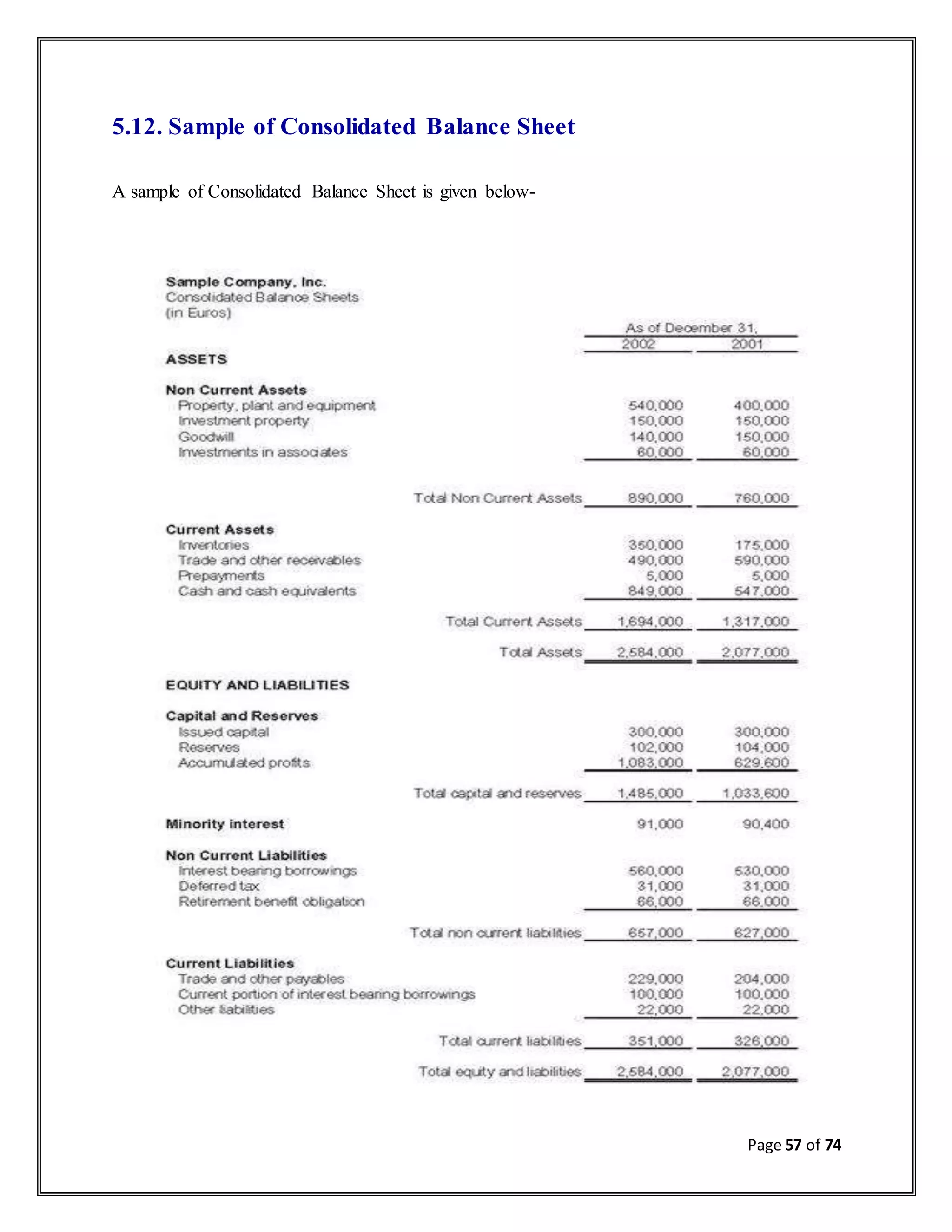

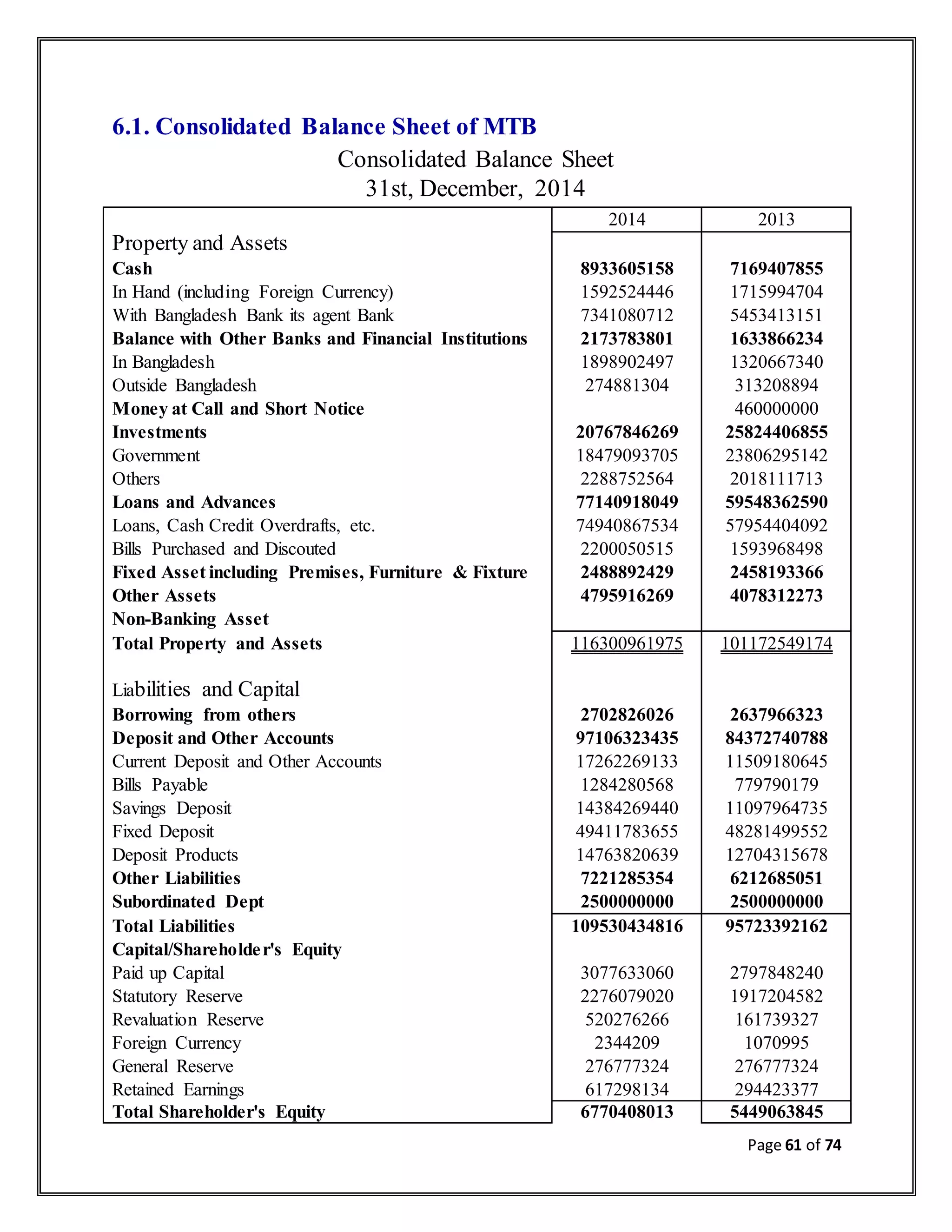

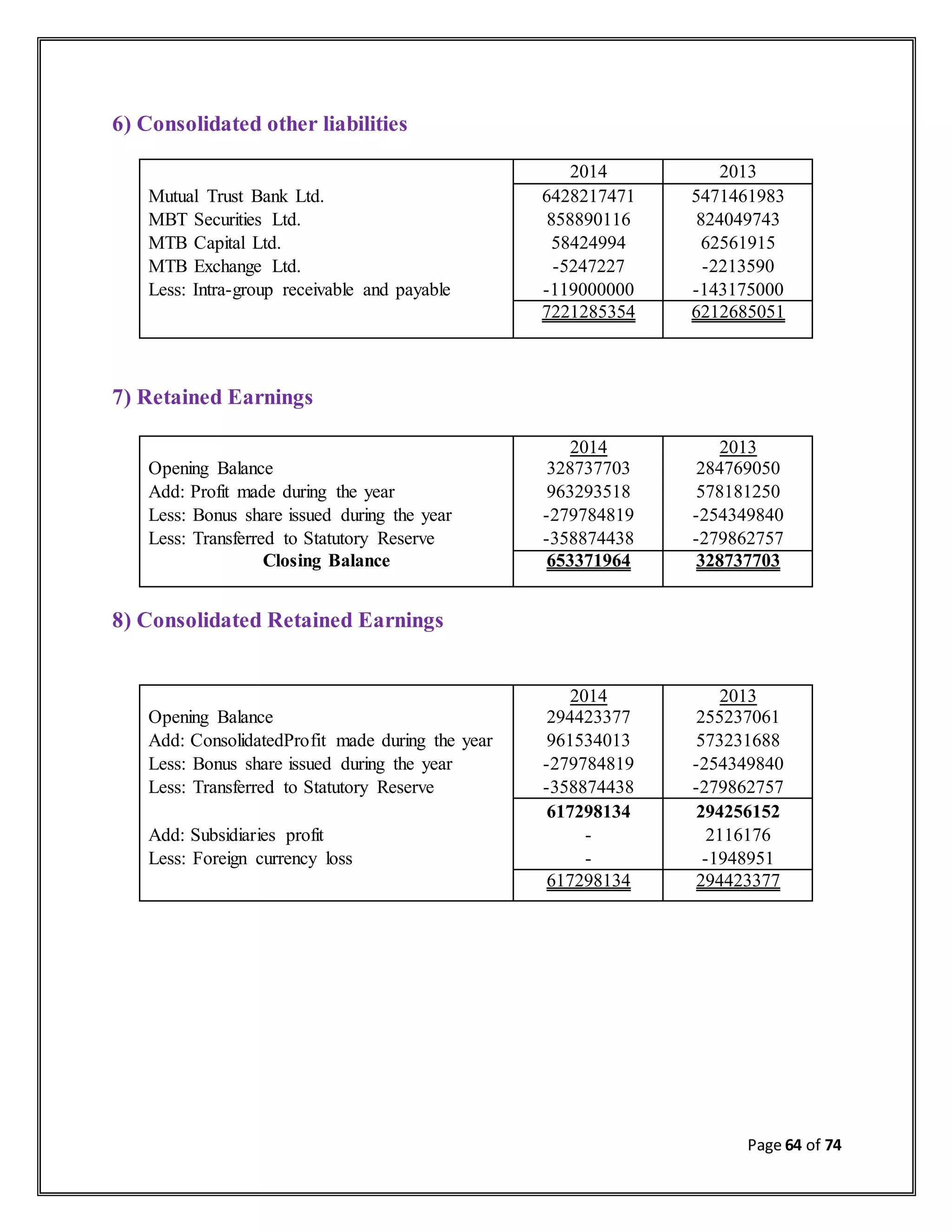

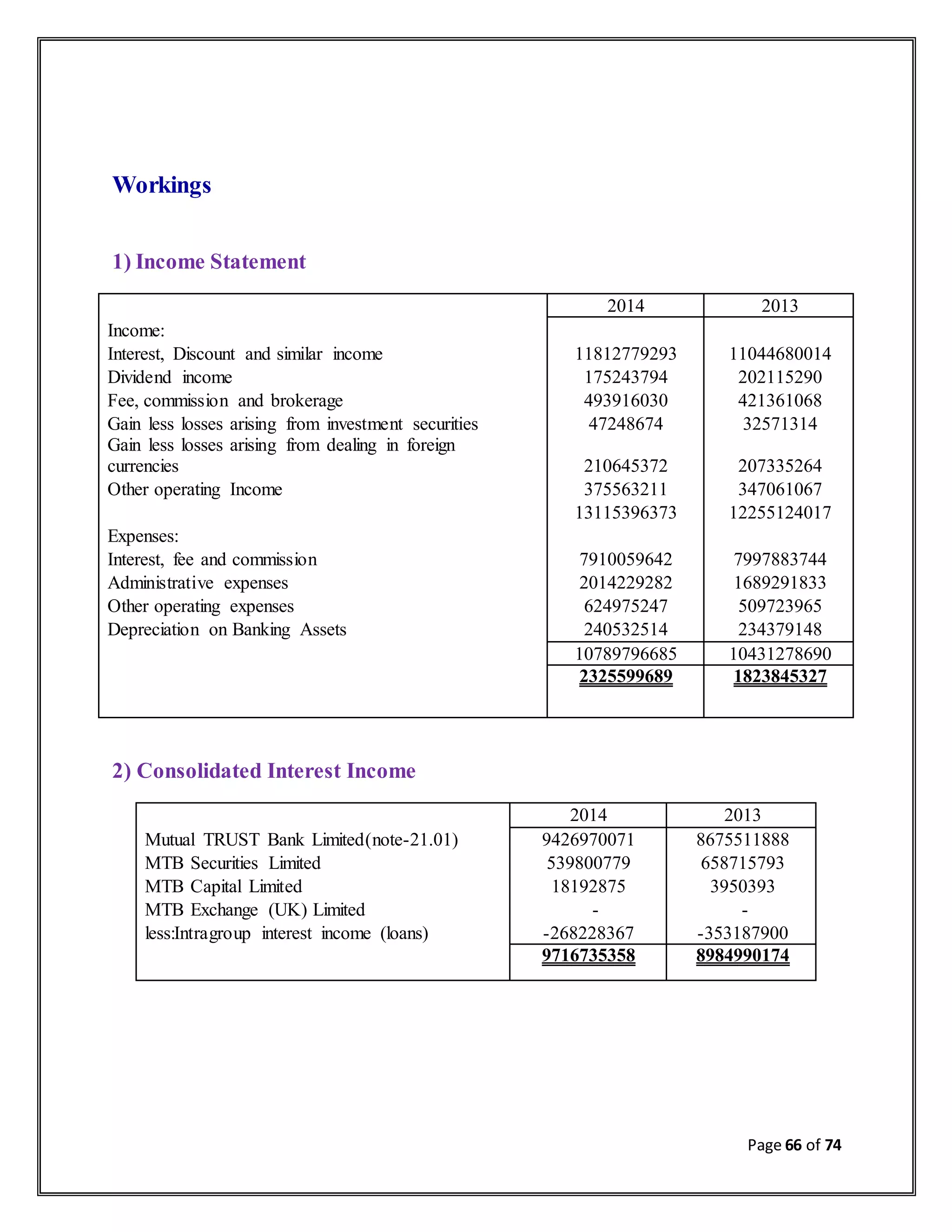

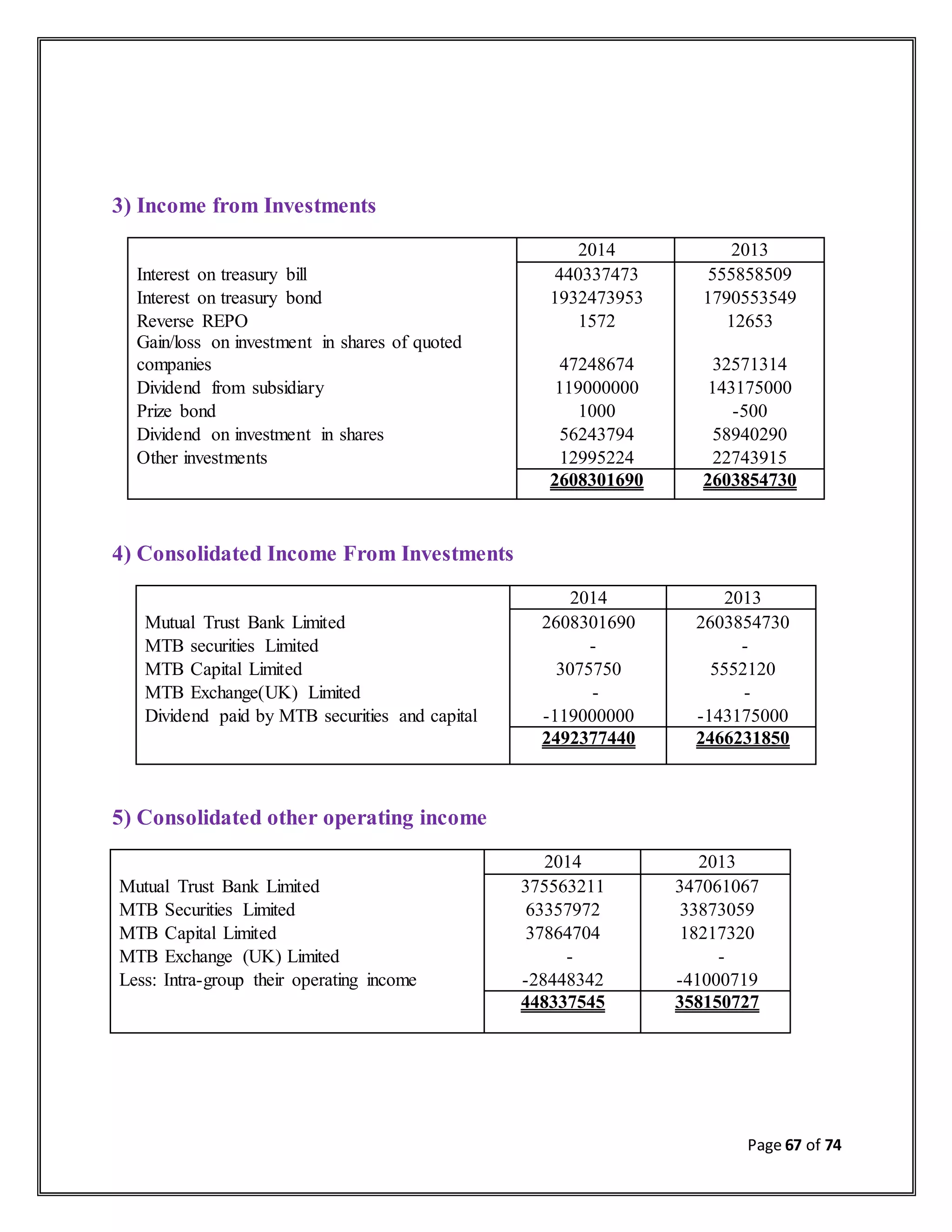

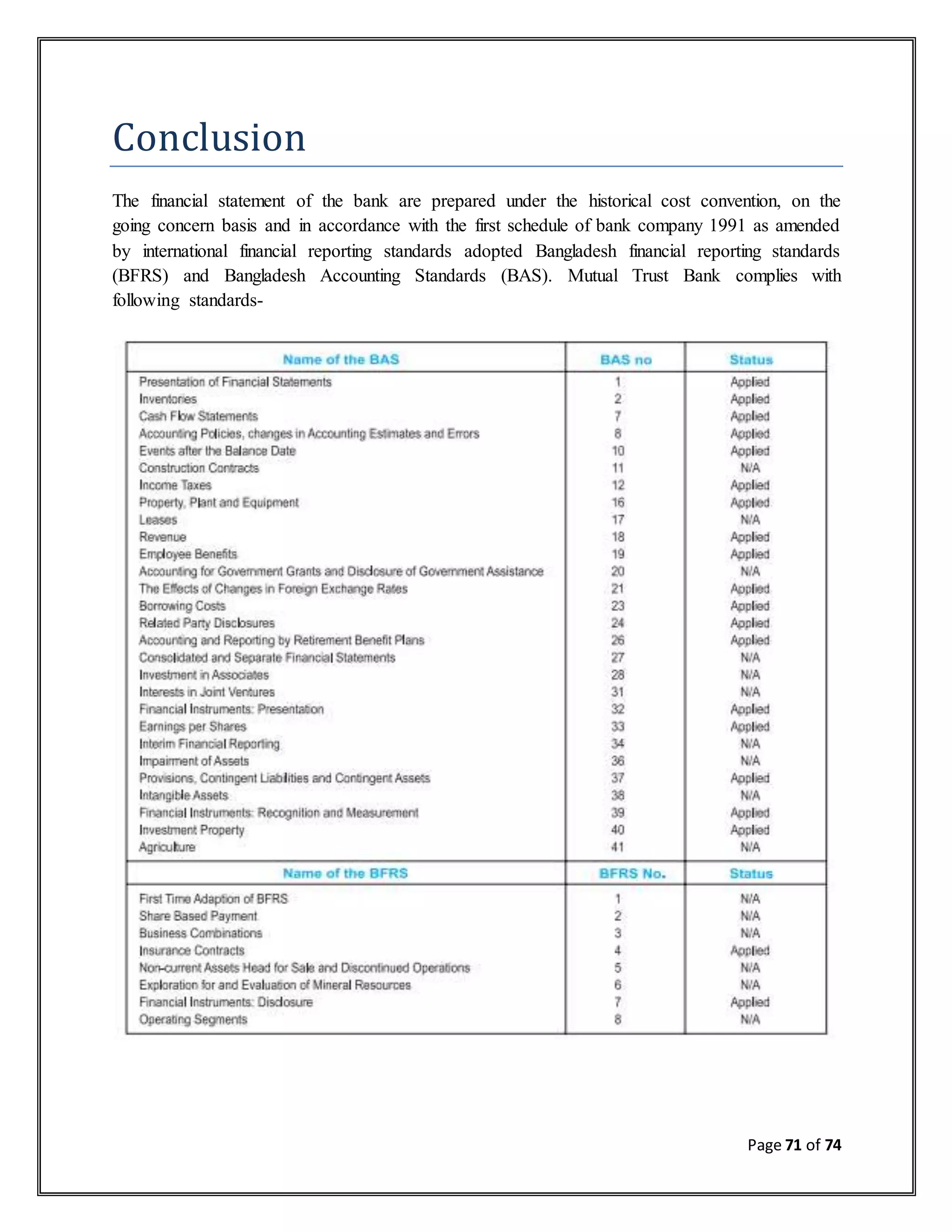

The document provides an overview of the consolidated financial statements of Mutual Trust Bank for the year ended 2011. It discusses the accounting standards and rules that were applied in preparing the financial statements, including BAS, BFRS, and standards around inventories, cash flows, policies, taxes, and more. It also provides background information on Mutual Trust Bank, including its subsidiaries, mission, vision, financial highlights for 2014, and components of financial statements like the balance sheet, income statement, and statement of cash flows.