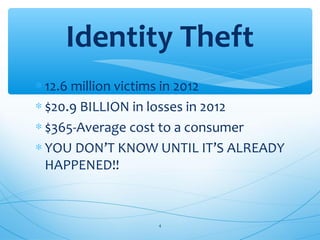

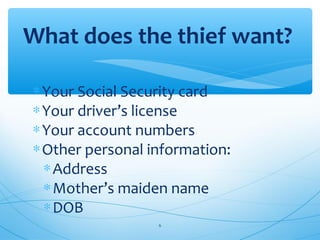

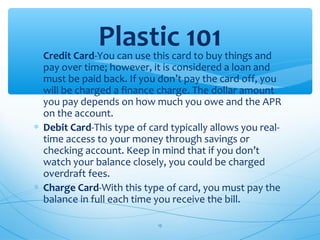

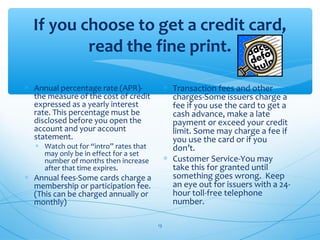

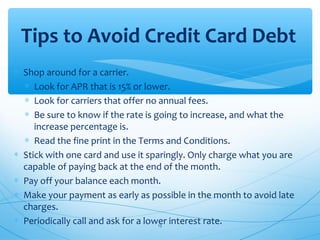

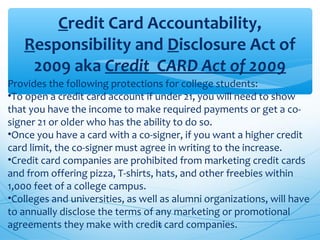

The document provides information to college students about identity theft, credit cards, and how to be a savvy consumer. It discusses the risks of identity theft and tips to protect personal information. It also covers important information about credit cards, such as annual percentage rates and fees. Additionally, the document recommends creating a budget, reading all agreements carefully, and checking out businesses with the Better Business Bureau before making purchases or accepting job offers.