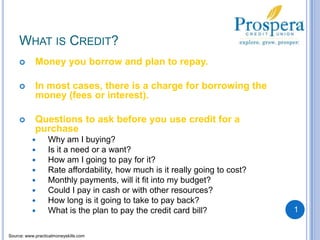

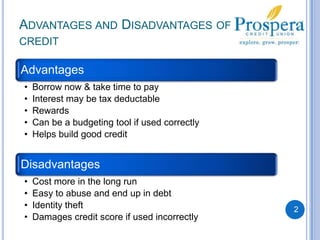

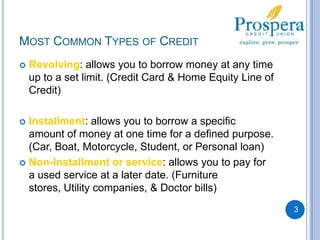

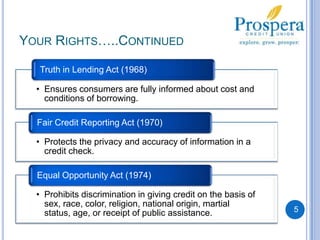

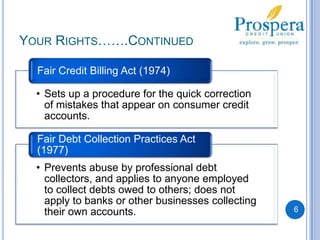

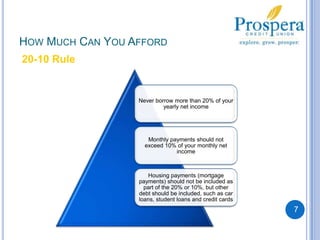

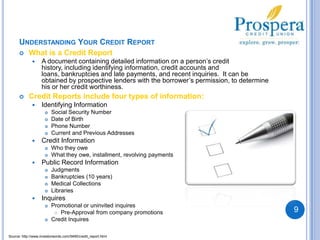

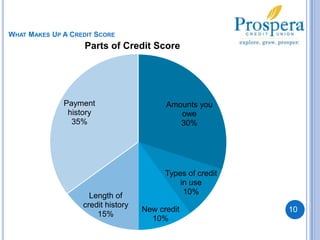

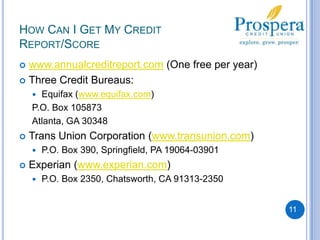

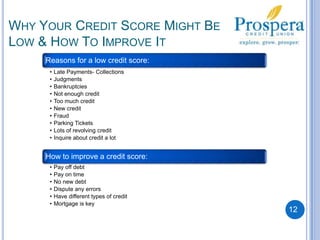

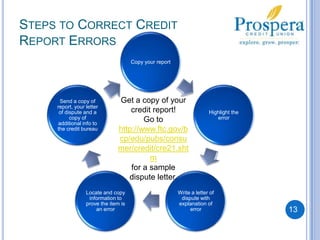

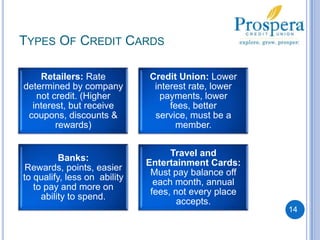

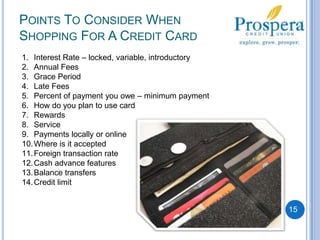

A person's credit report provides important information about their financial history and creditworthiness. It is important to understand credit reports and how to maintain good credit. Some key things to understand include the different types of credit, your rights and responsibilities regarding credit use, how to obtain and read your credit report, factors that affect your credit score, and steps to correct any errors on your report. Regularly reviewing your credit report and practicing responsible credit habits can help you make informed financial decisions and protect your credit rating over time.