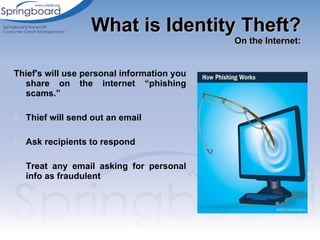

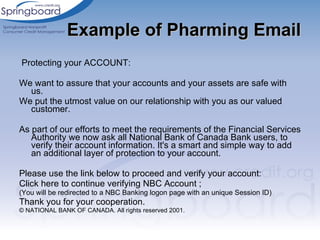

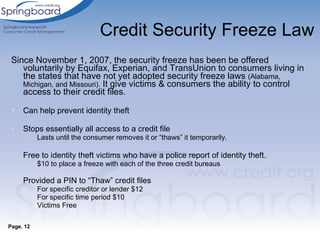

Springboard is a non-profit organization dedicated to personal financial education and identity theft prevention, offering various services such as credit counseling and debt management. Identity theft continues to be a major issue in the U.S., affecting millions and costing billions, with young adults experiencing the highest rates of fraud. The document outlines identity theft prevention tips, victims' rights, and resources available for those who have been affected by identity theft.