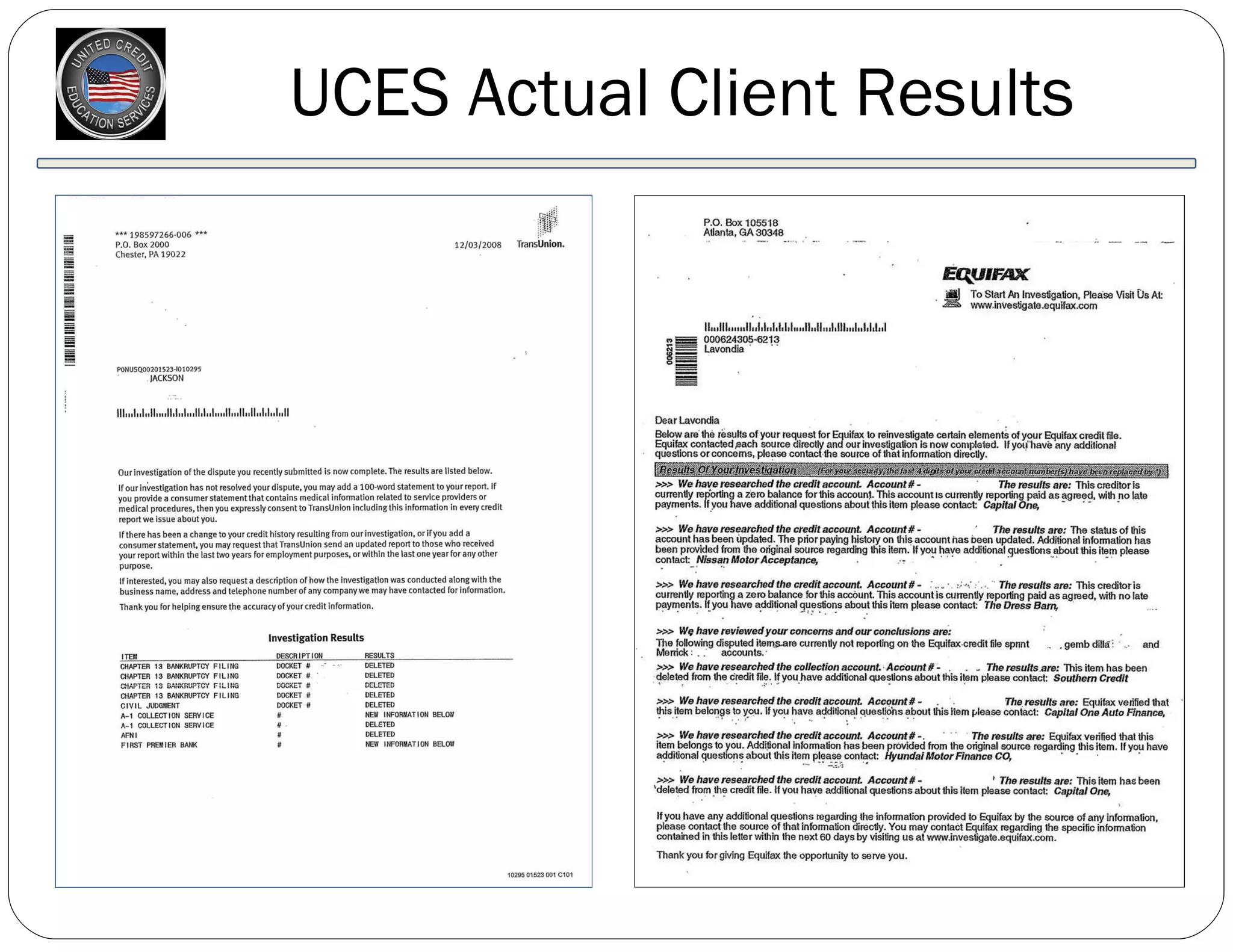

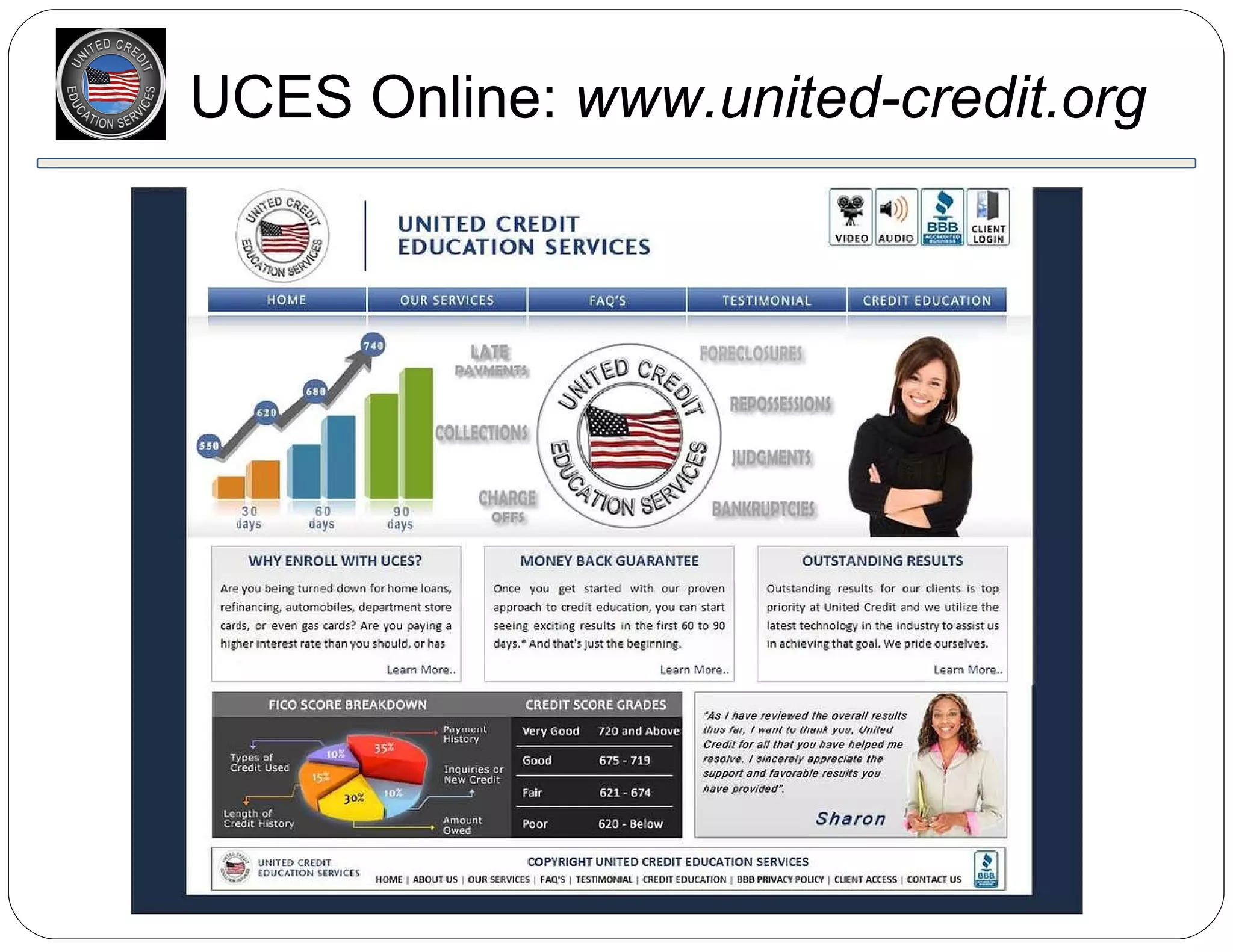

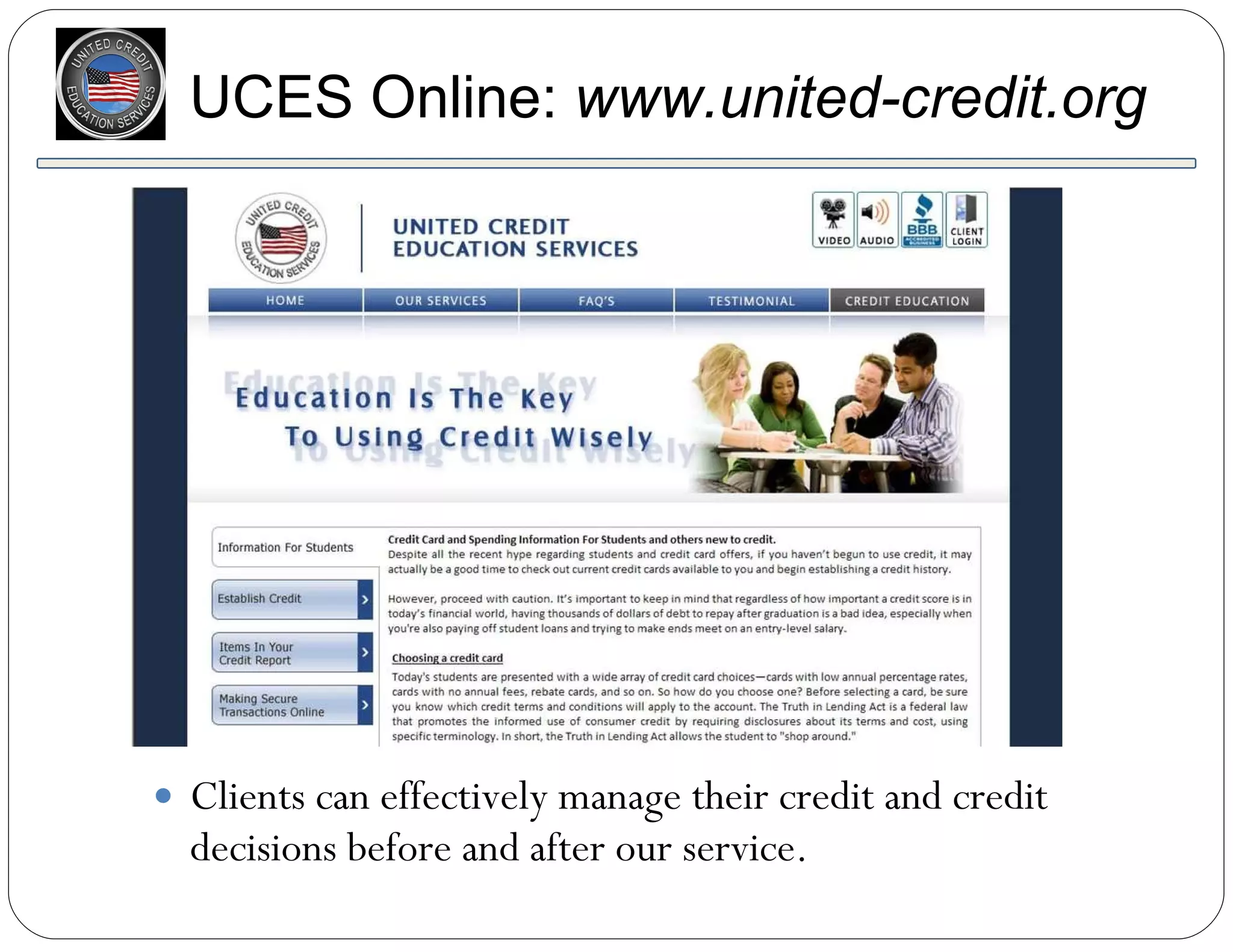

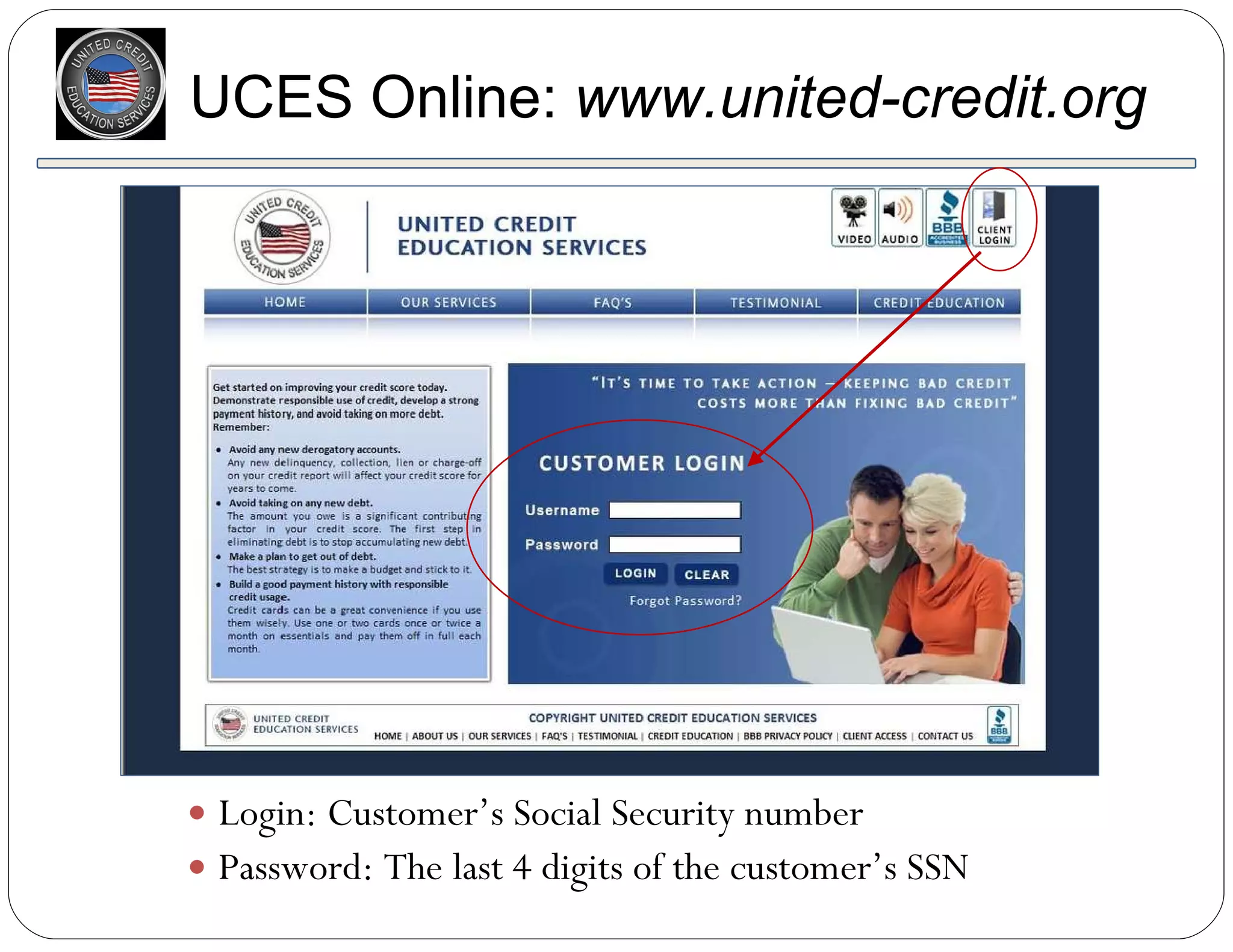

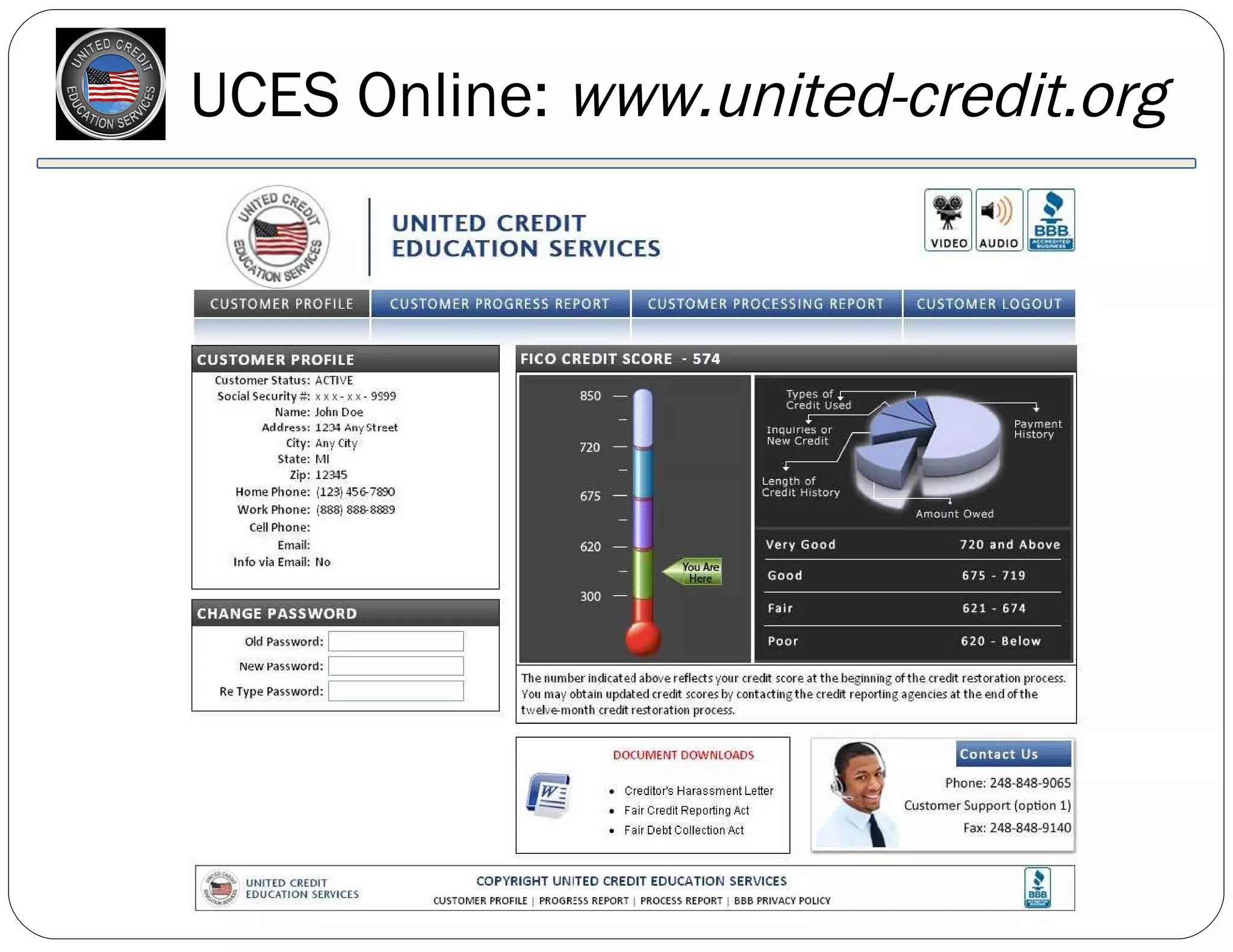

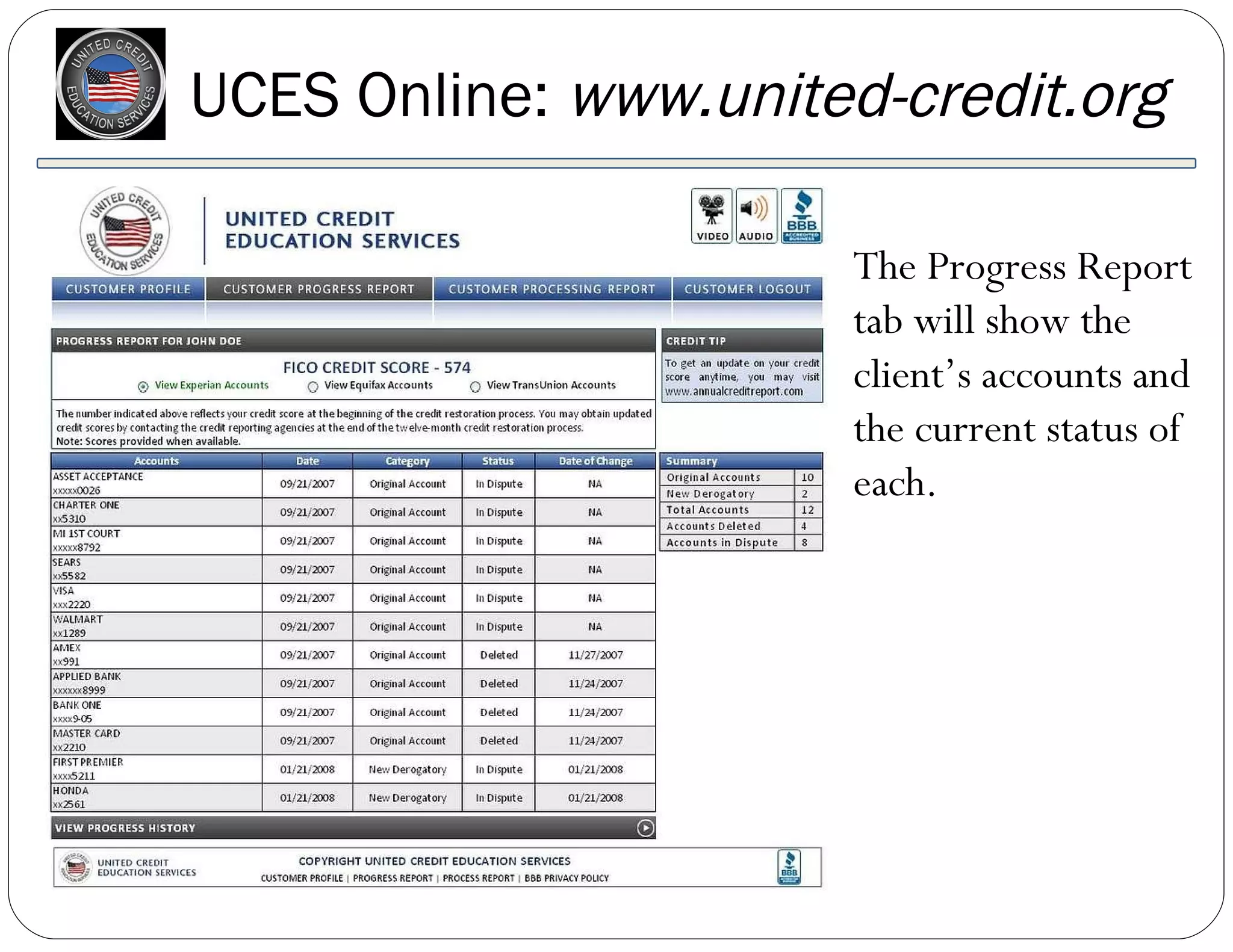

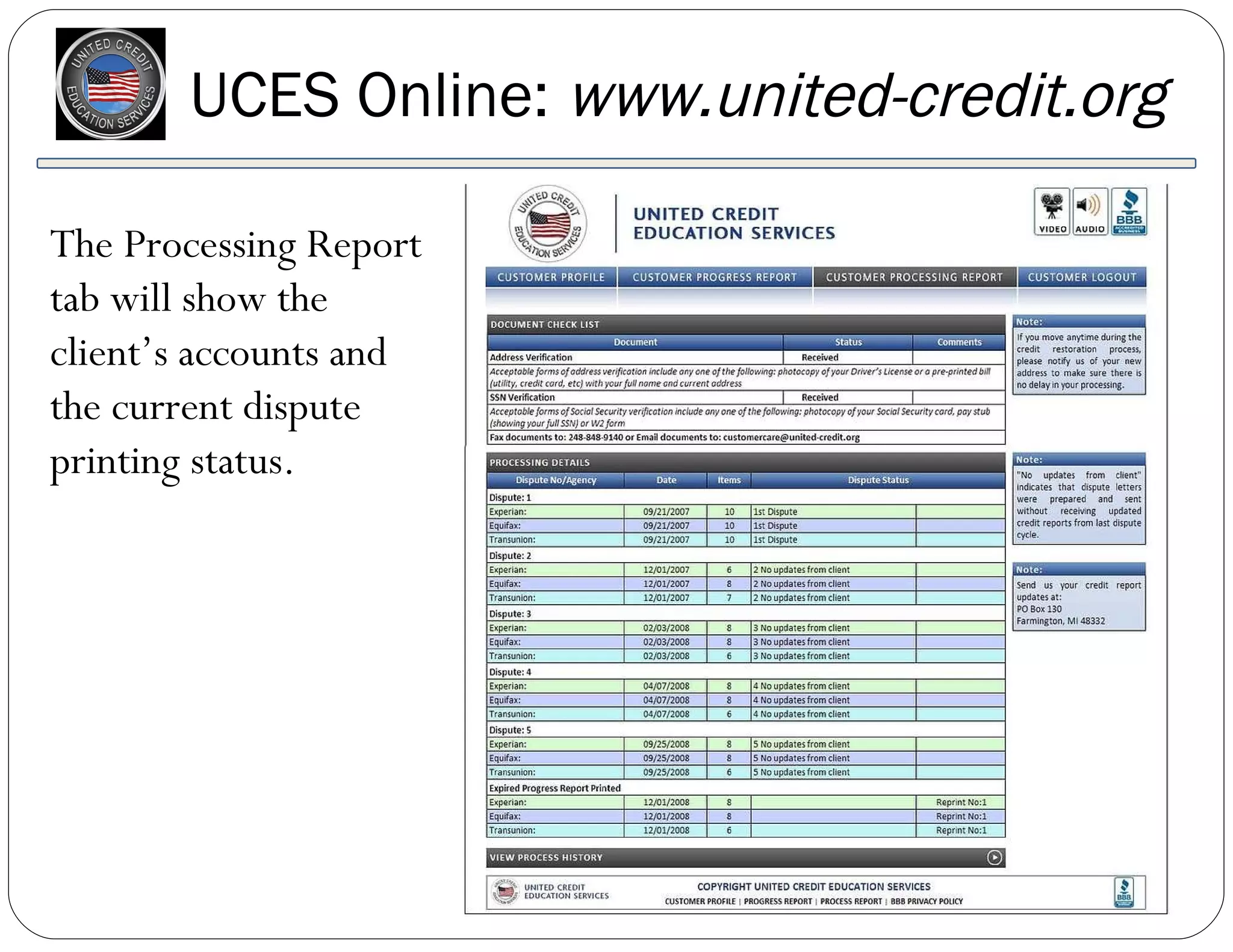

United Credit Education Services provides credit repair services to help consumers dispute inaccurate or outdated information on their credit reports from the three major credit bureaus. Their goal is to help clients improve their credit profiles and financial independence. They utilize the Fair Credit Reporting Act and dispute processes to challenge errors and remove negative items from credit reports through multiple dispute cycles over several months.