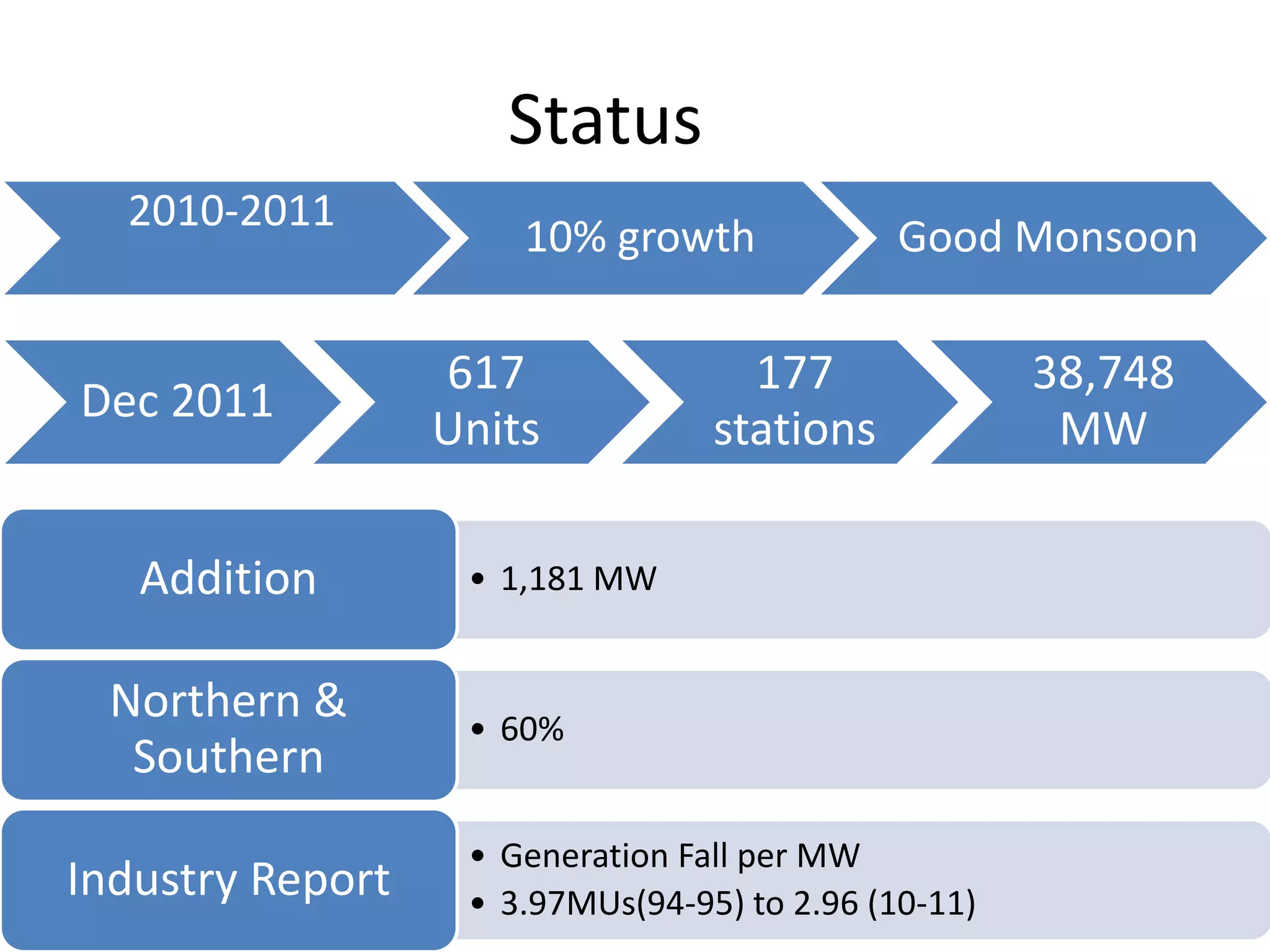

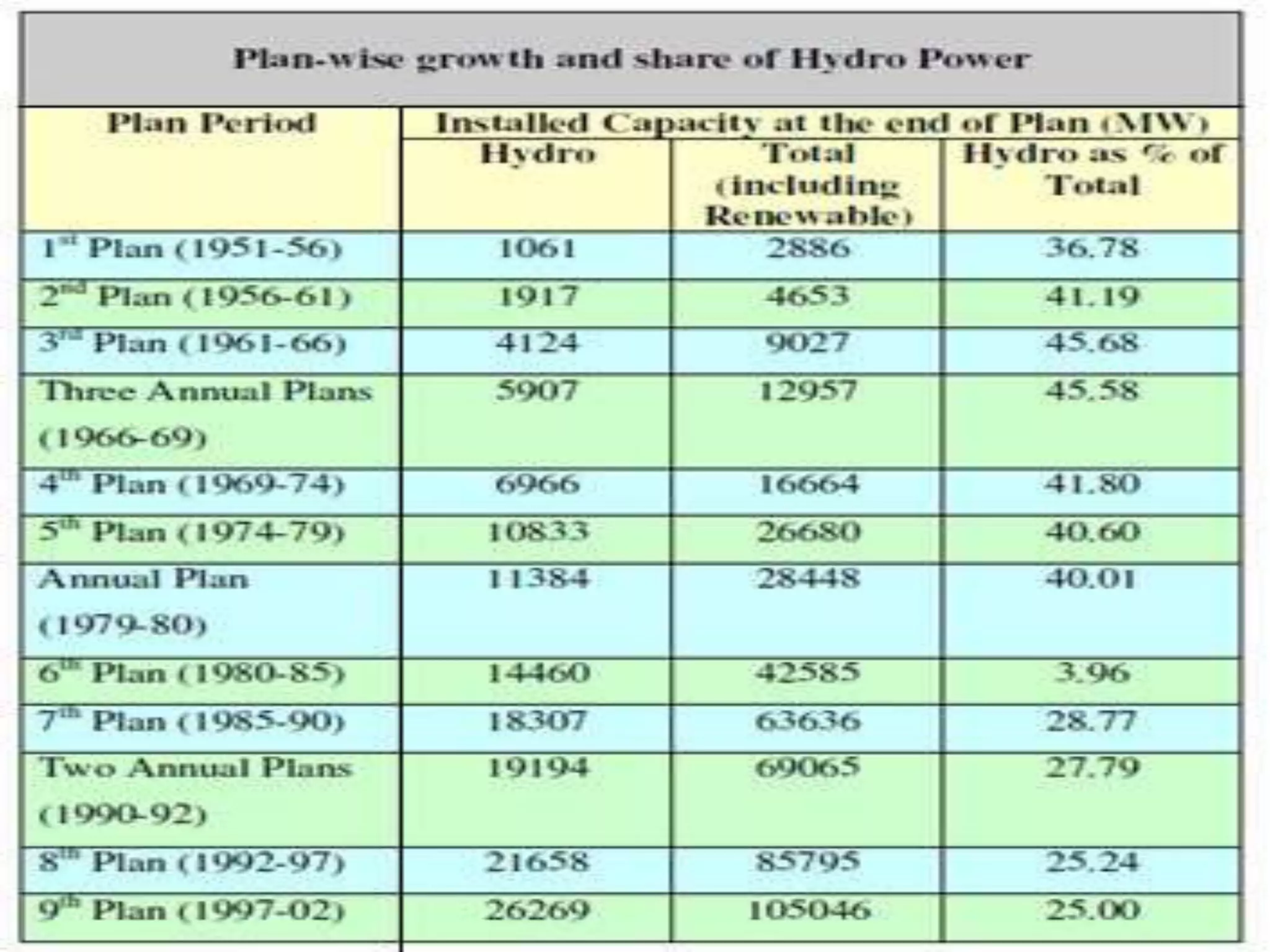

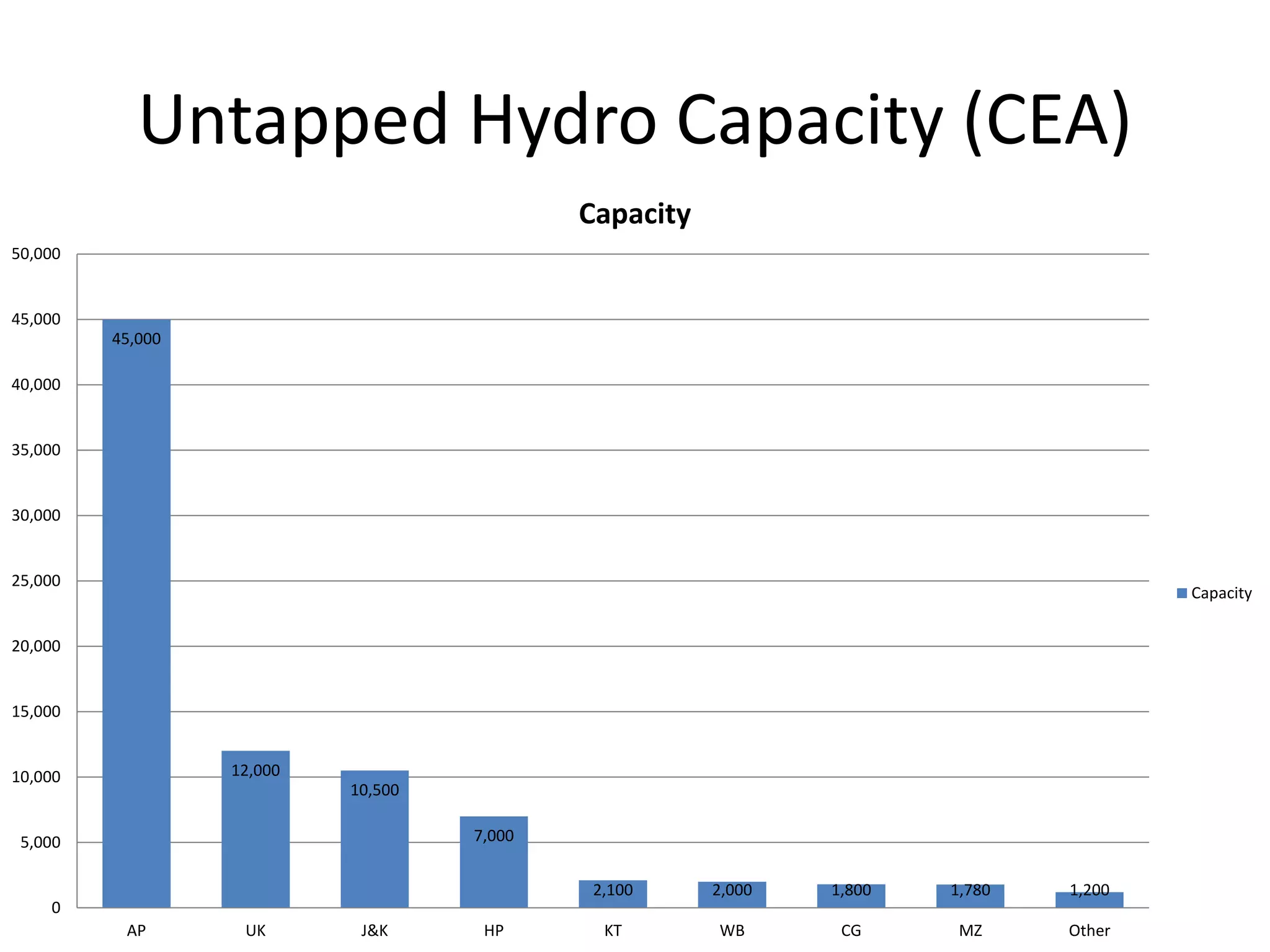

- Over 97,000 MW of India's hydro potential remains untapped despite efforts to encourage private participation in hydro development.

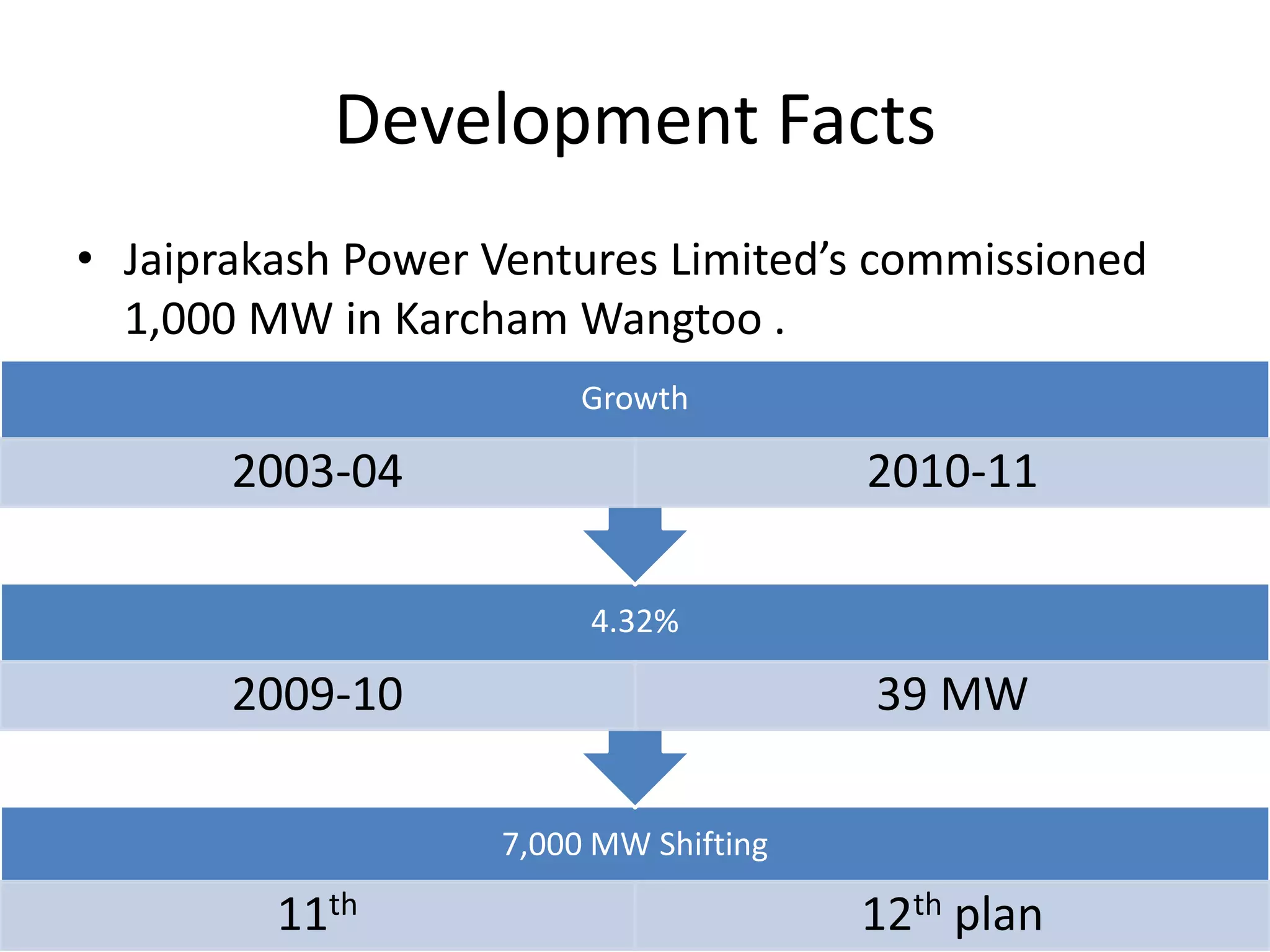

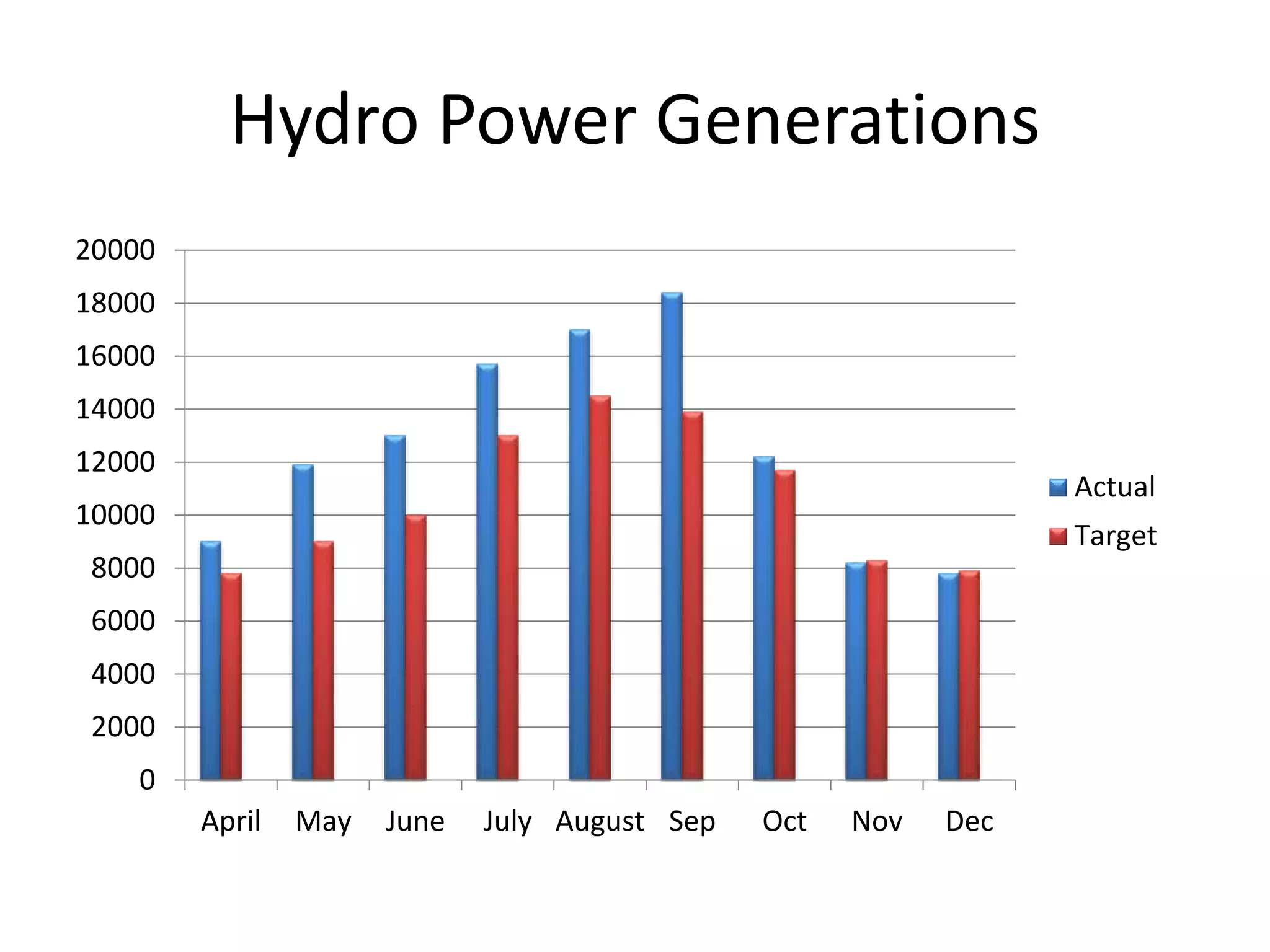

- Hydro capacity addition has been declining, with only 1,181 MW added in 2010-2011, well below targets.

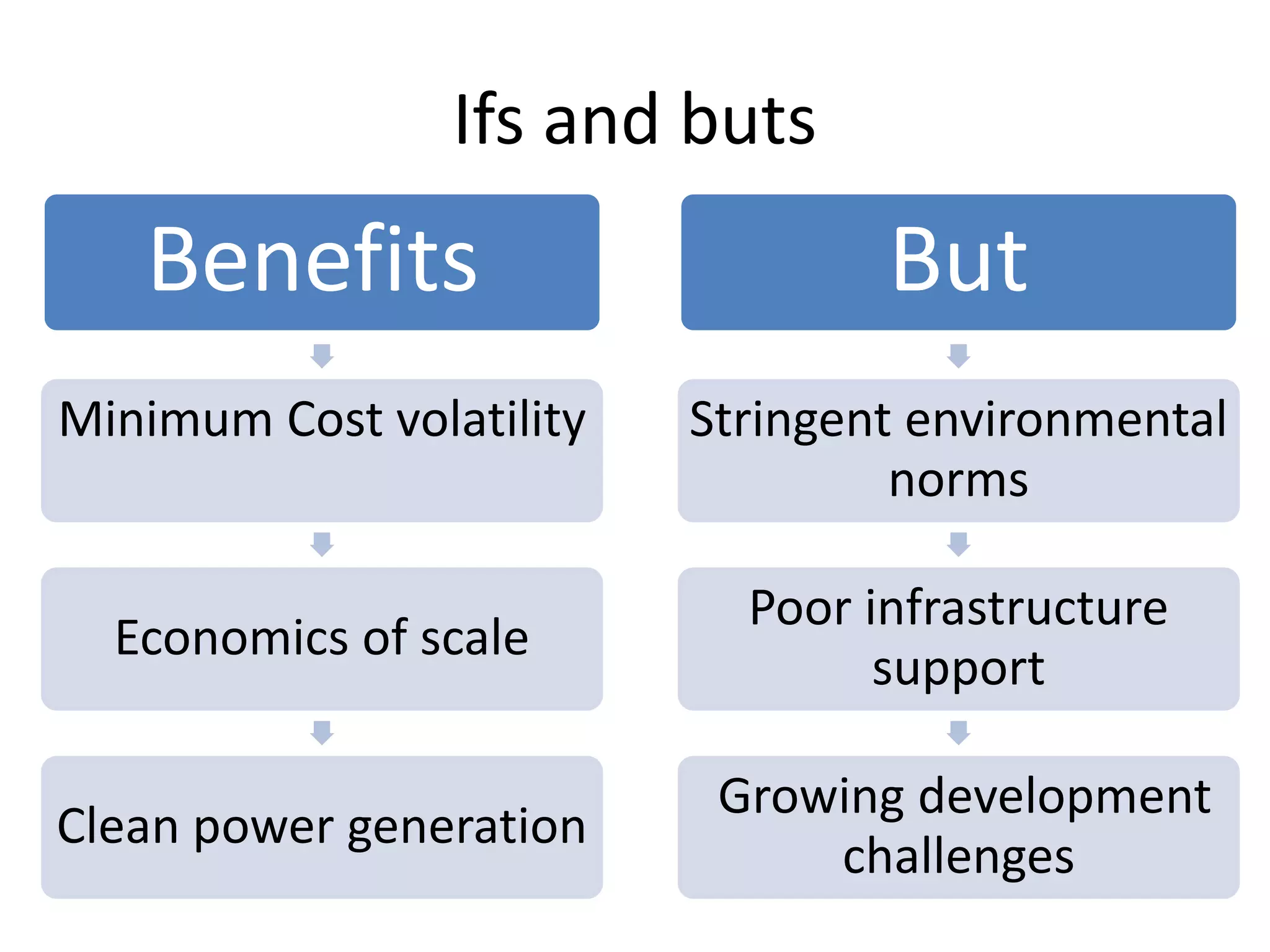

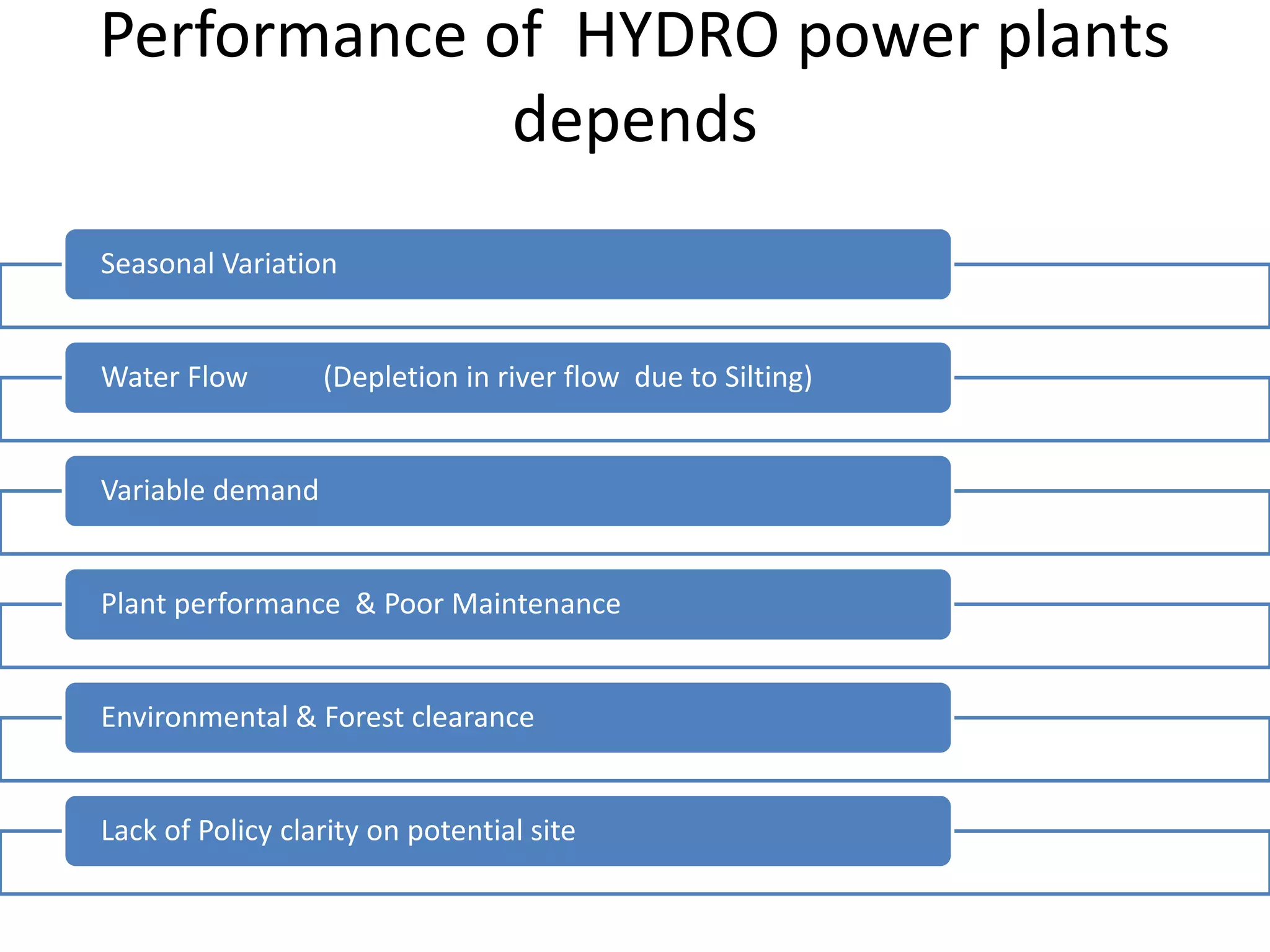

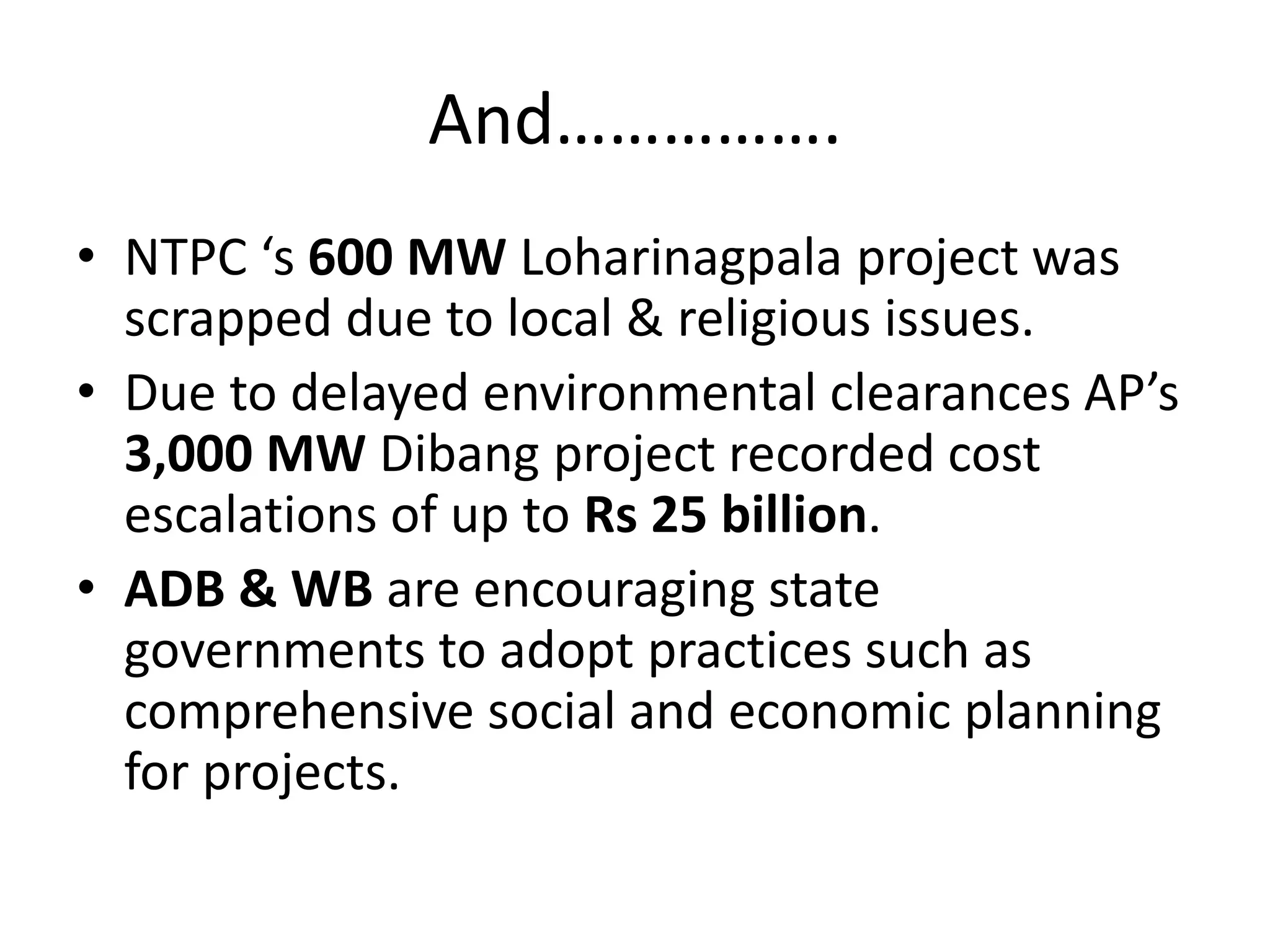

- Major challenges include stringent environmental norms, poor infrastructure, and rising development costs due to issues around land acquisition and local opposition.

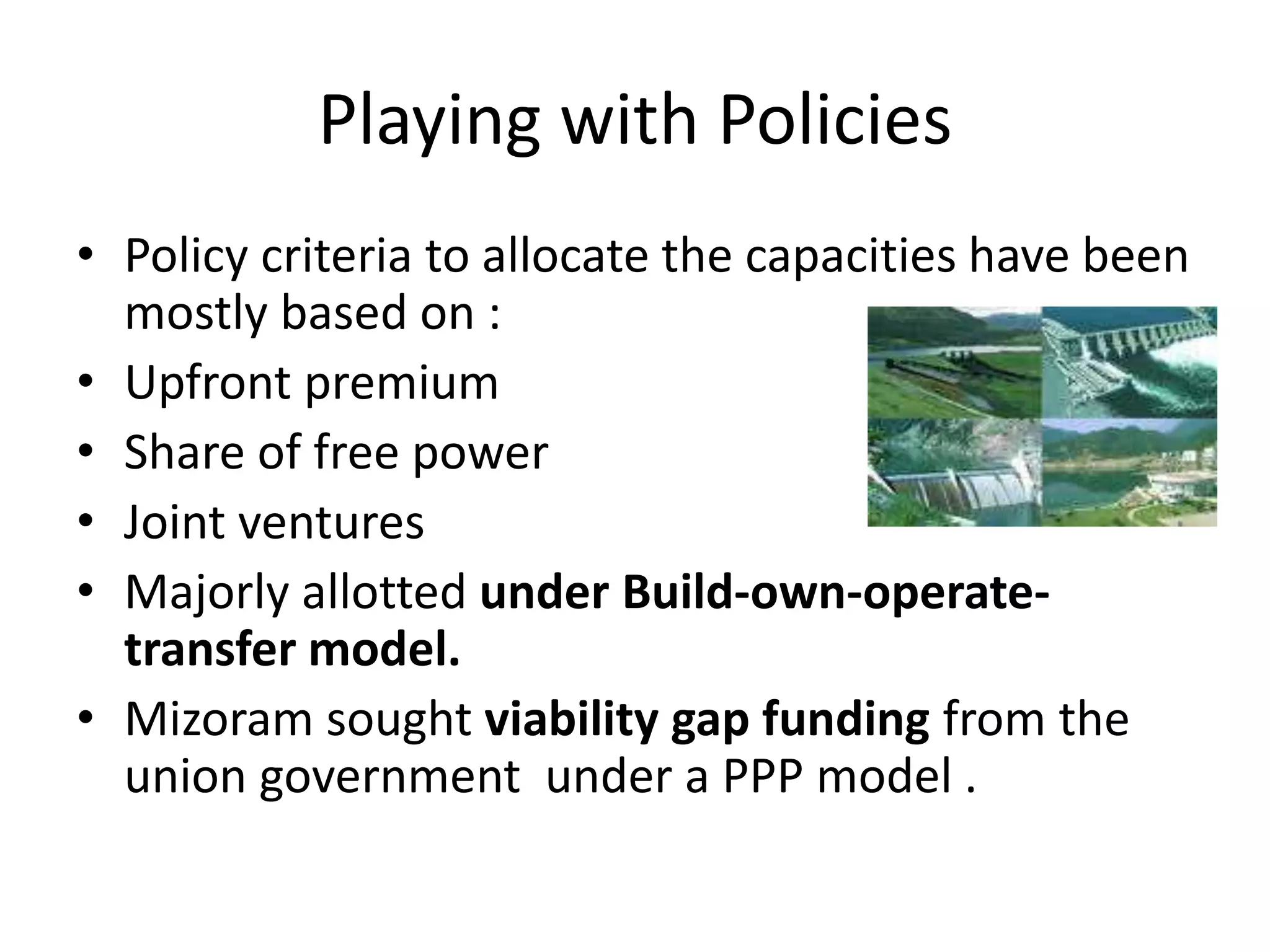

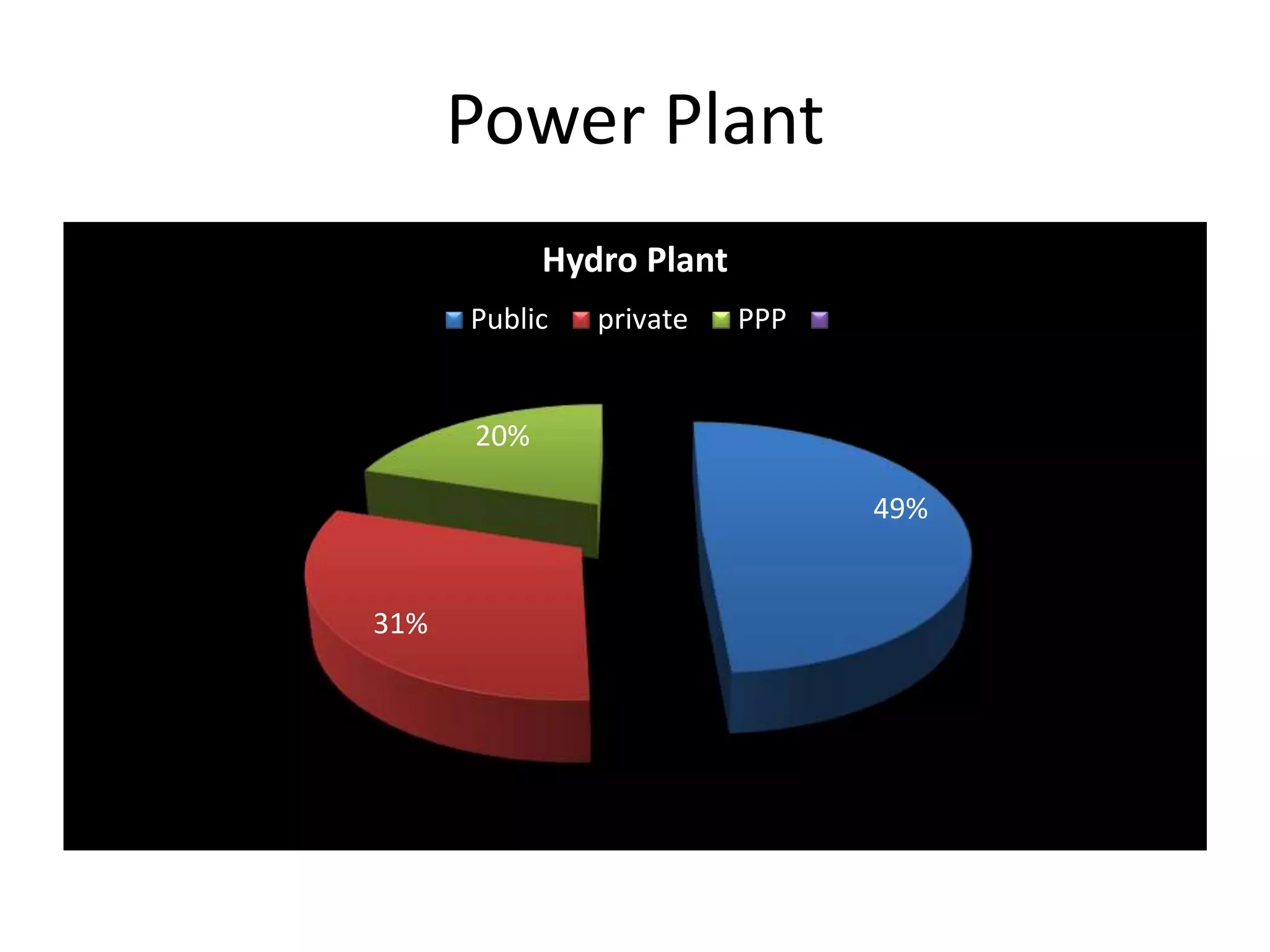

- States are implementing various policies to promote private investment, but challenges remain around taxation and delays in clearances for projects.

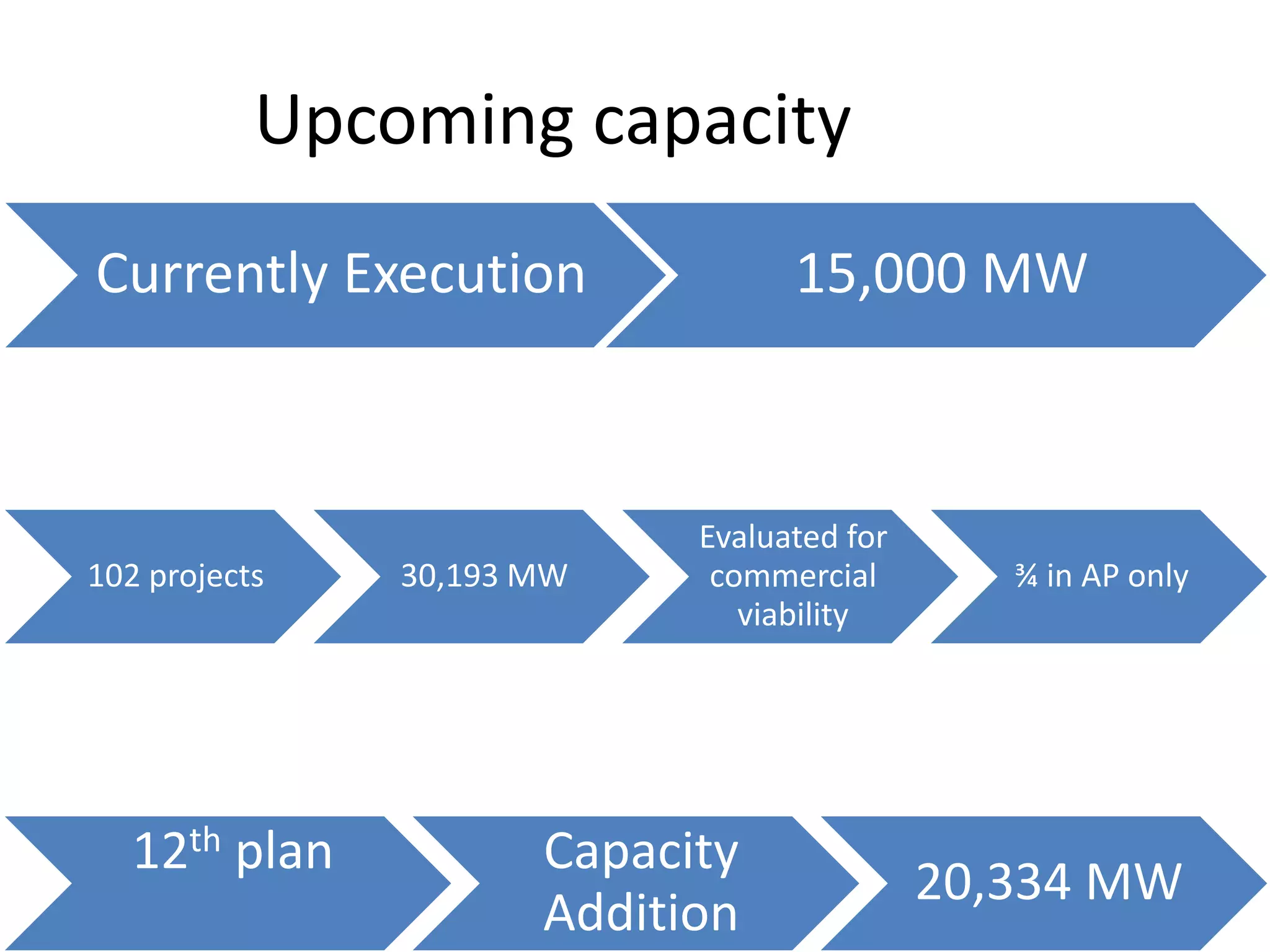

- Over 15,000 MW of hydro projects are currently under execution, but harnessing India's full hydro potential could help meet energy and climate goals.