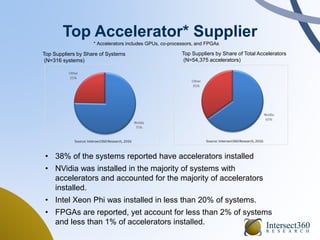

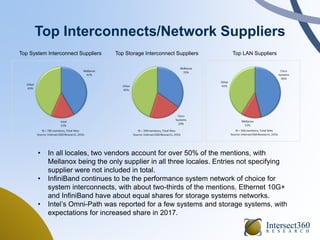

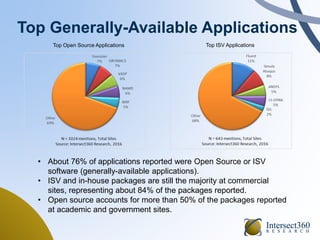

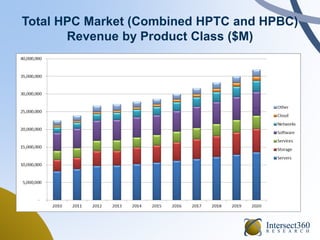

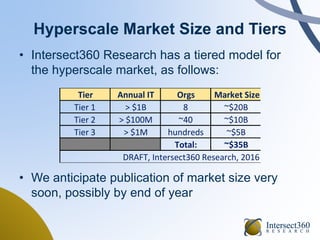

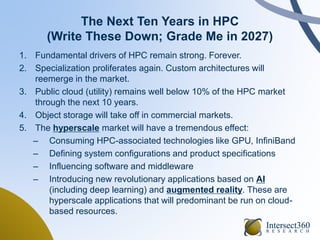

The document outlines trends in high performance computing (HPC) for 2017, highlighting the growth of hyperscale markets and the differing roles of cloud computing, AI, and custom architectures. Key findings include the prevalence of Nvidia accelerators, the continued dominance of Infiniband for system interconnects, and the expected significant growth of the deep learning market. Future predictions indicate strong drivers for HPC and a substantial impact from hyperscale applications in the coming decade.