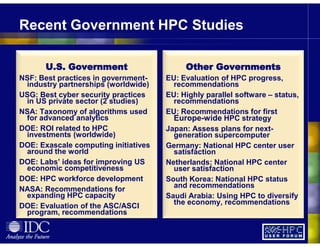

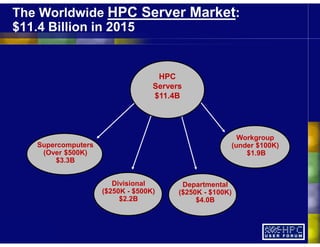

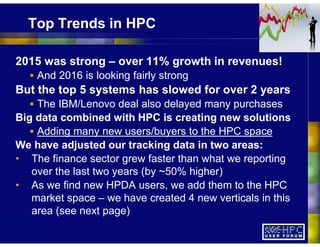

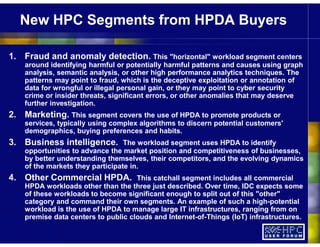

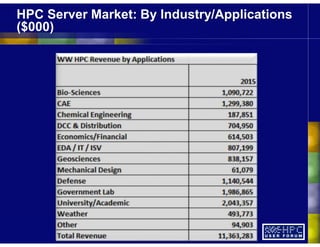

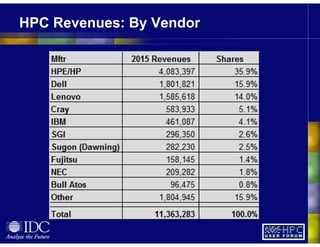

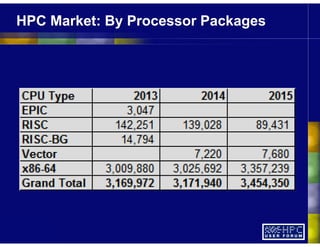

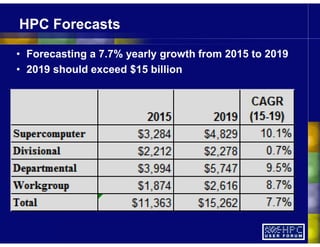

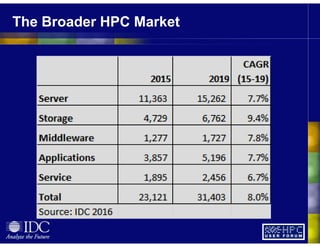

The IDC HPC Market Update outlines the status and trends in the high-performance computing (HPC) market, revealing a total market value of $11.4 billion in 2015 with anticipated growth of 7.7% annually through 2019. It identifies key trends, including an increase in big data applications, government investment in HPC for economic competitiveness, and a strong emphasis on HPC storage as the fastest-growing segment. Additionally, the document details new workload segments driven by high-performance data analytics and highlights the strategic importance of HPC across various industries.