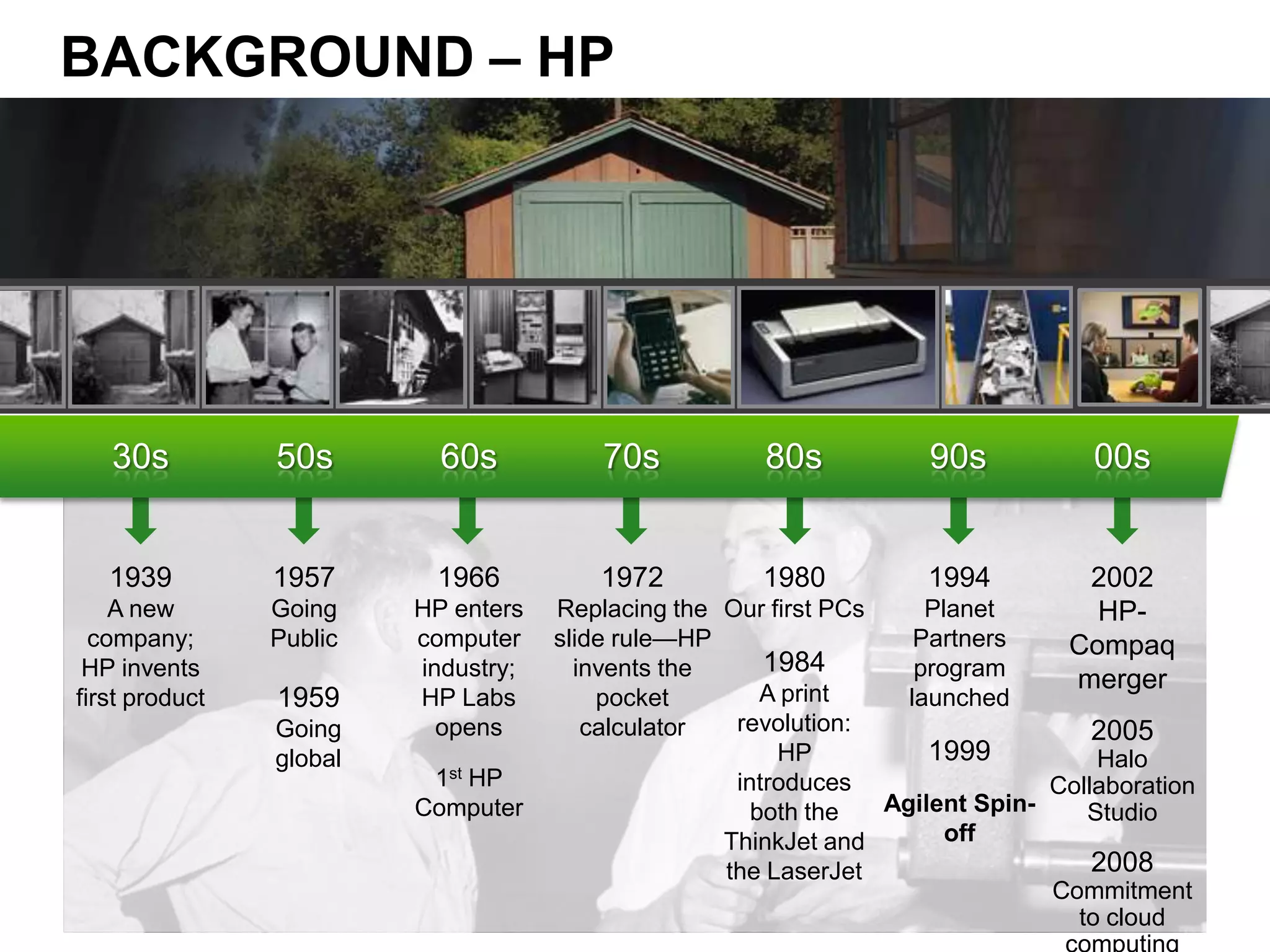

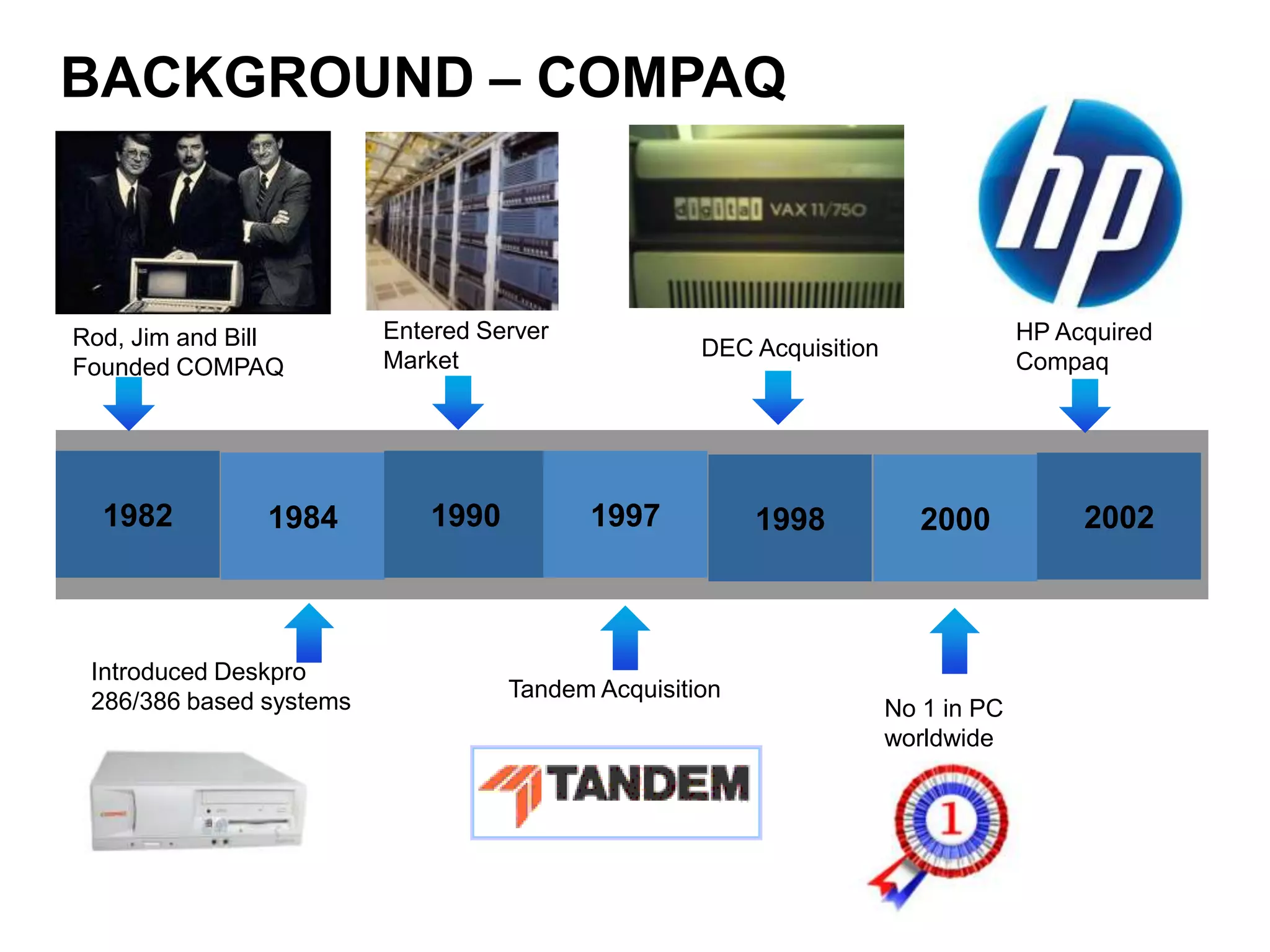

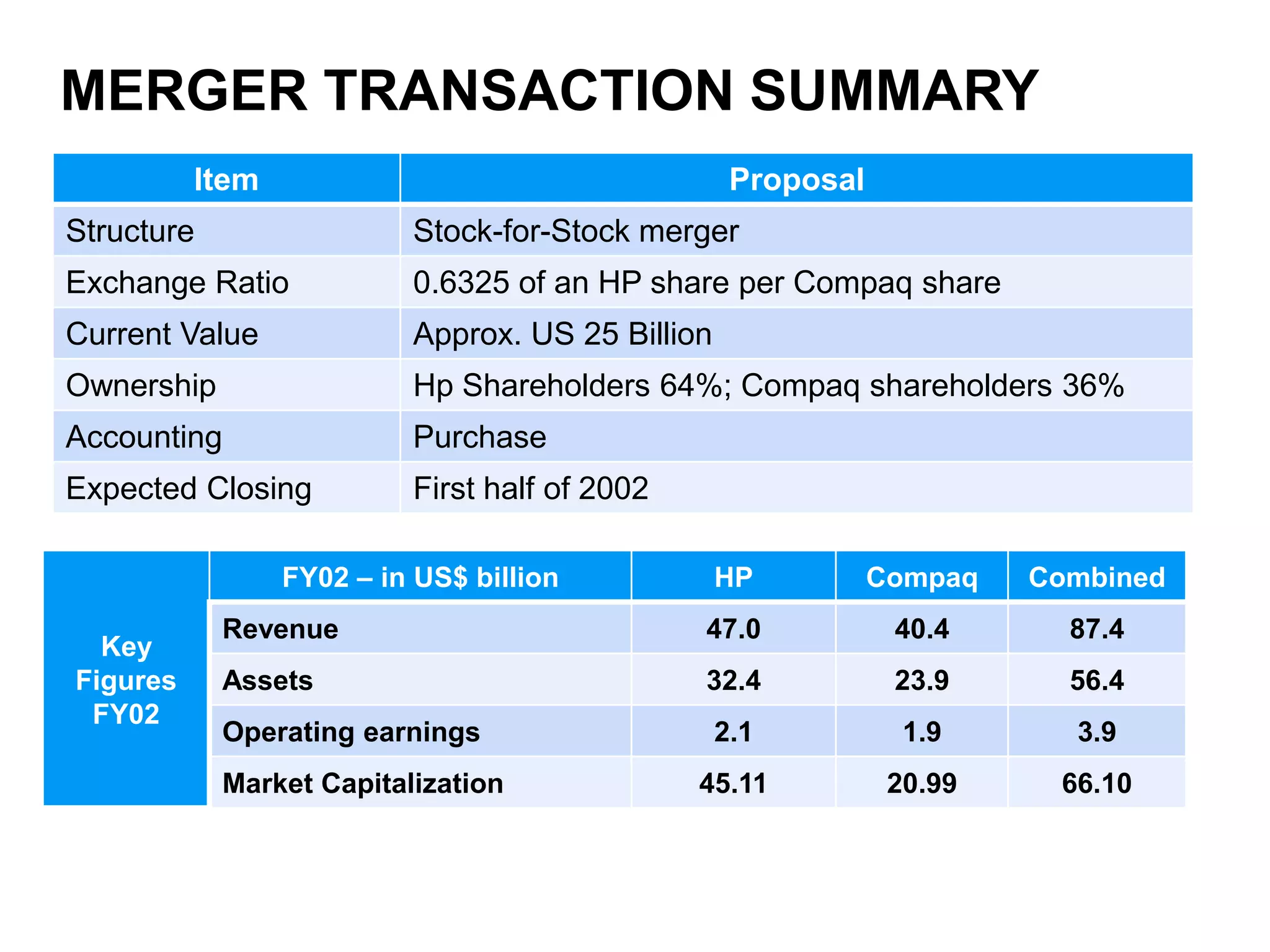

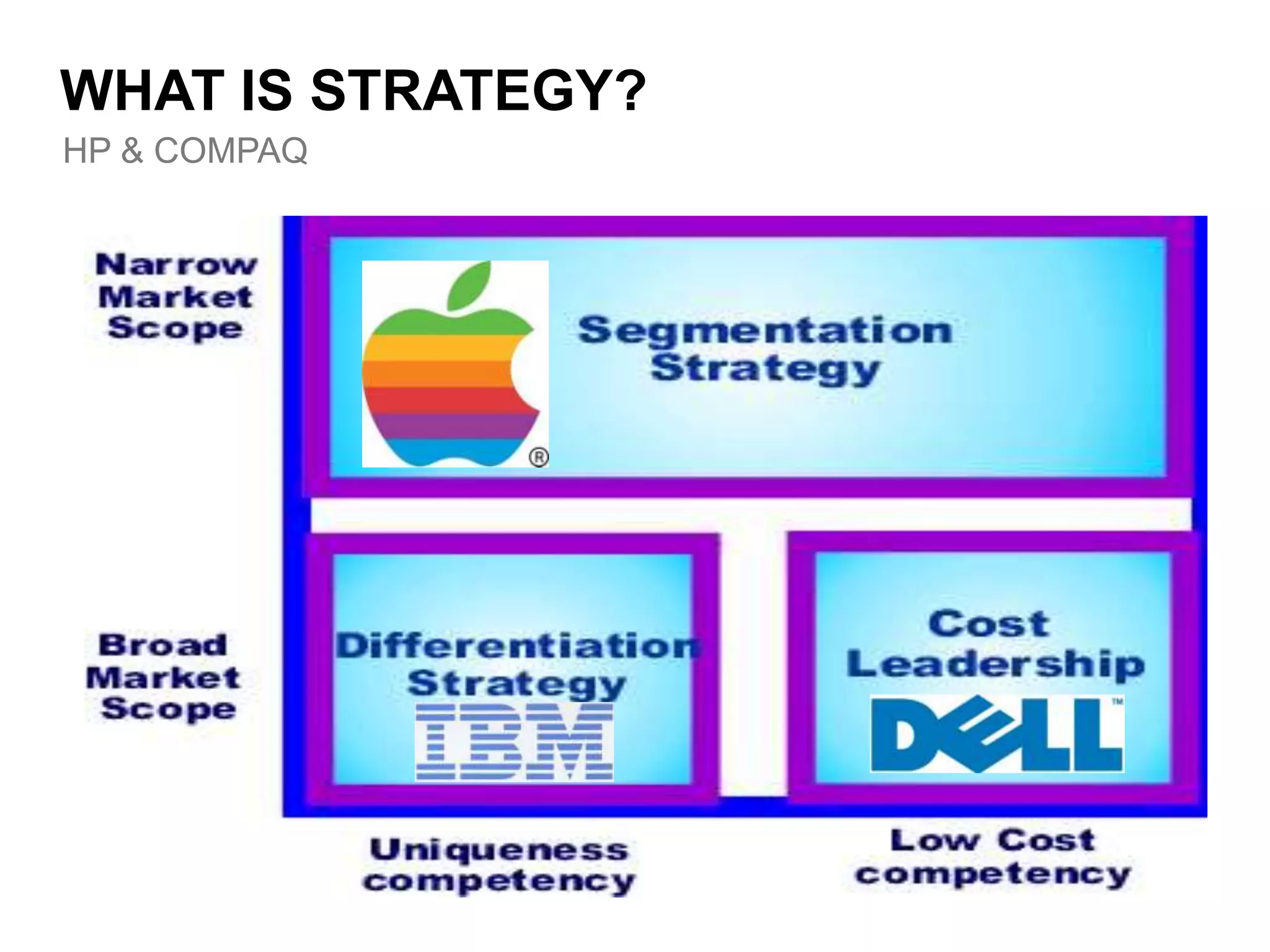

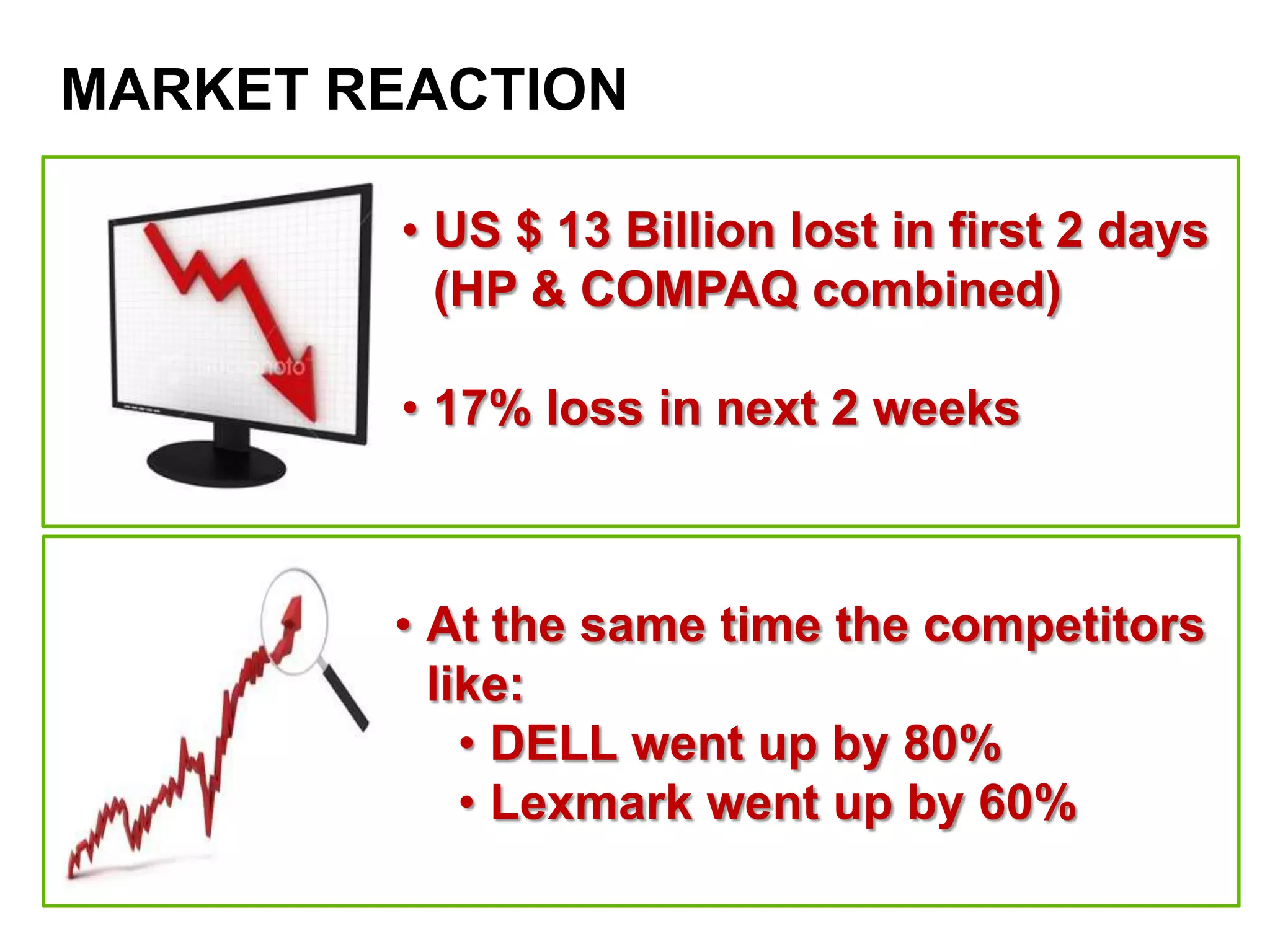

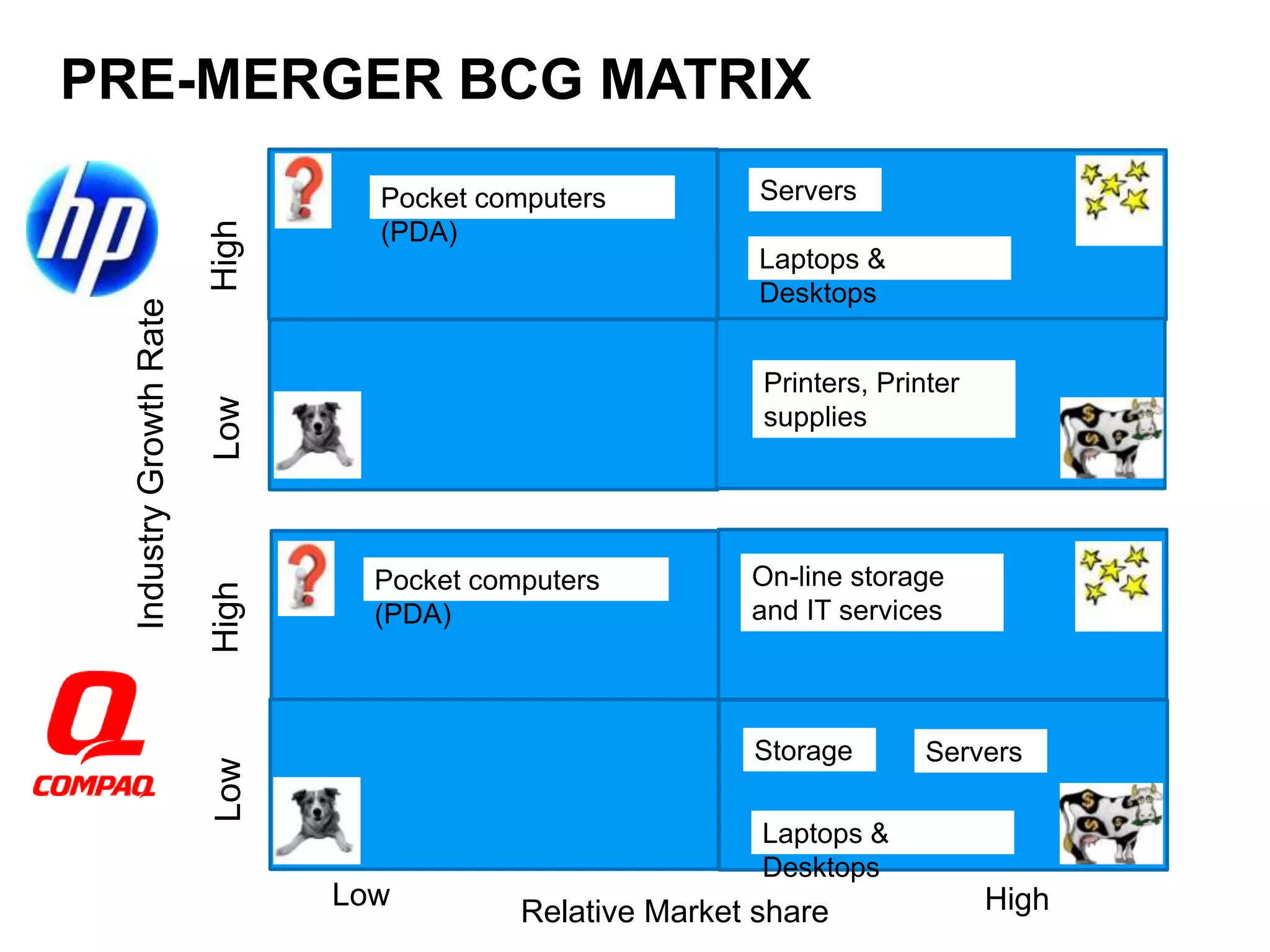

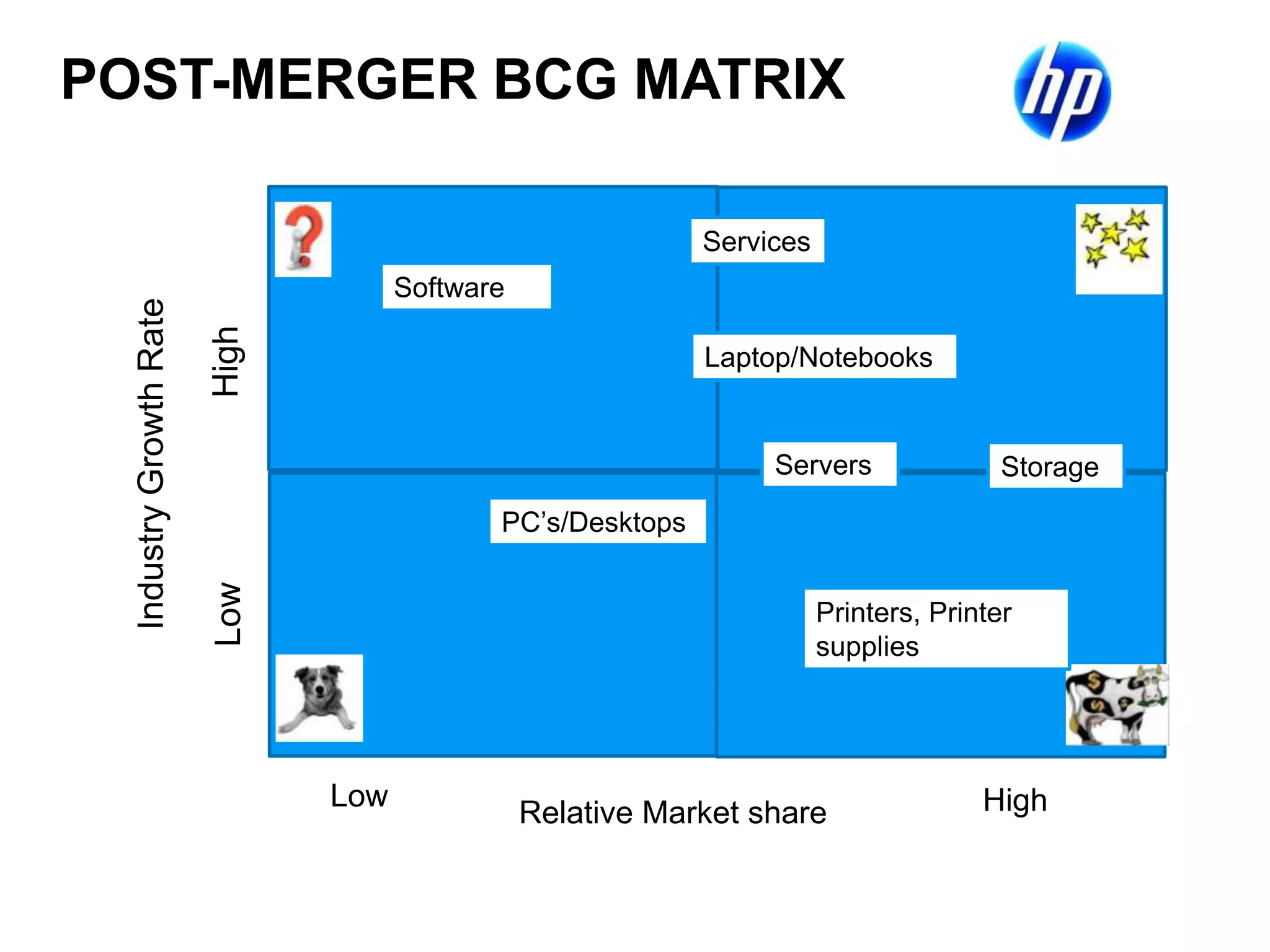

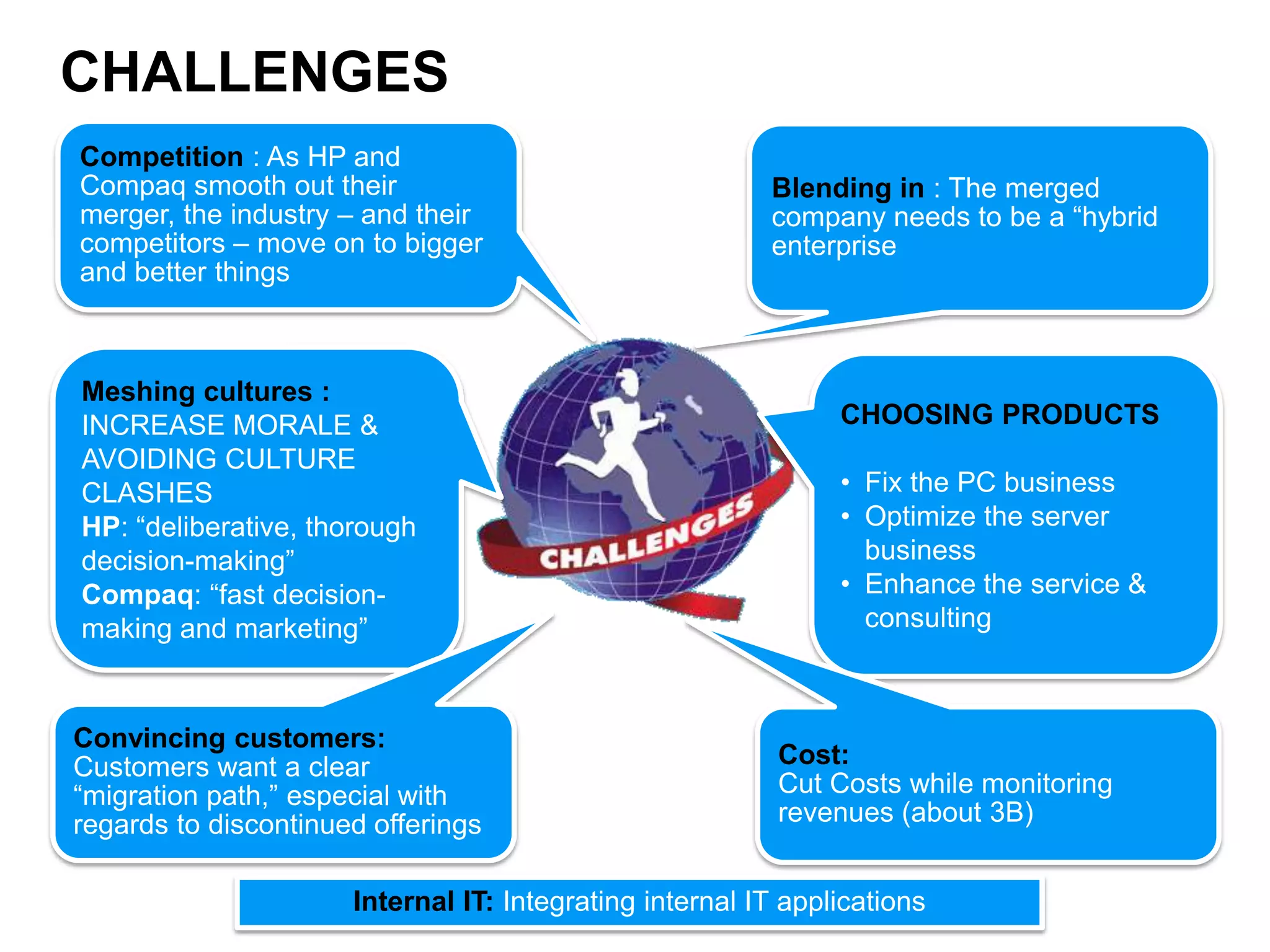

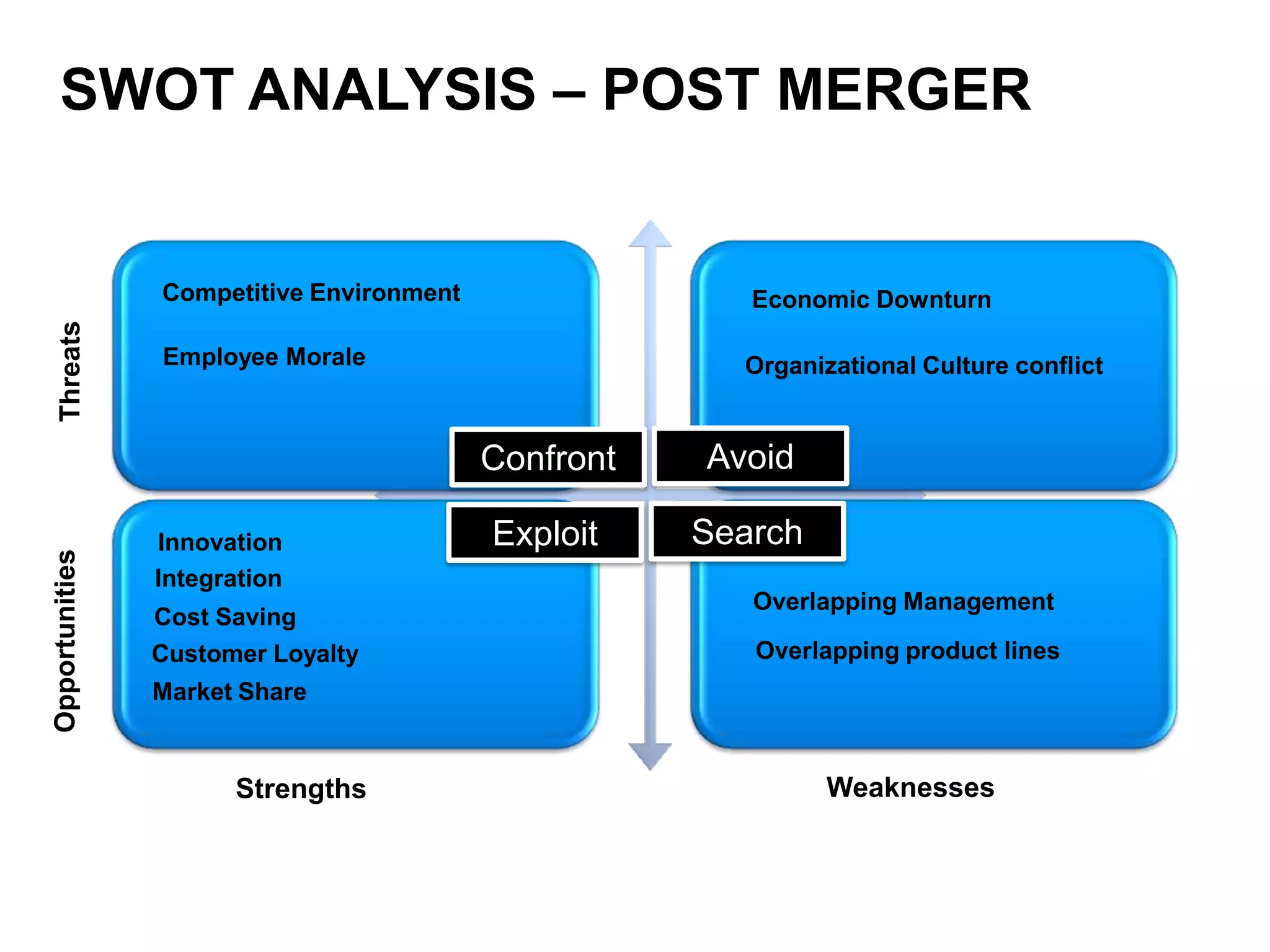

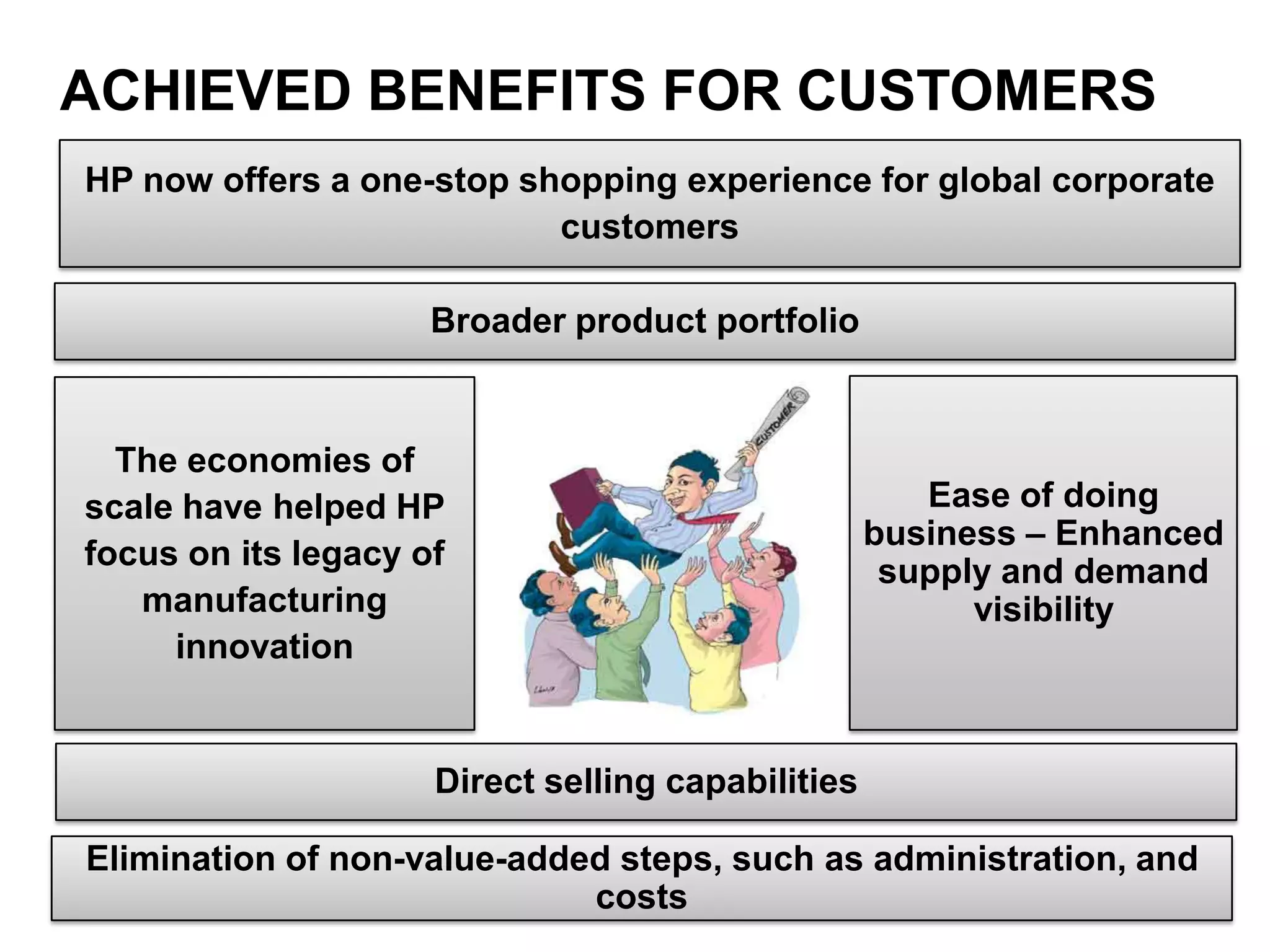

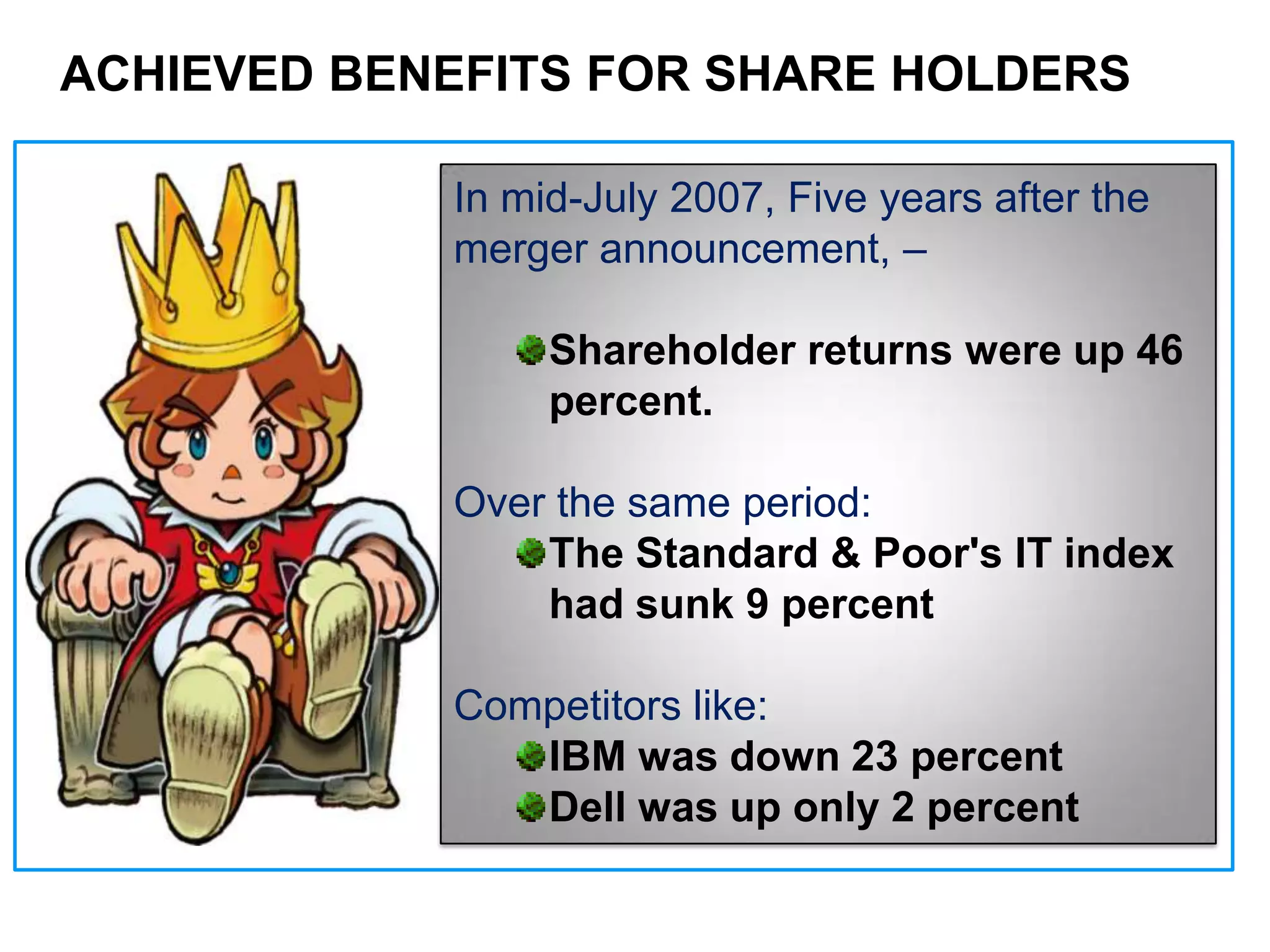

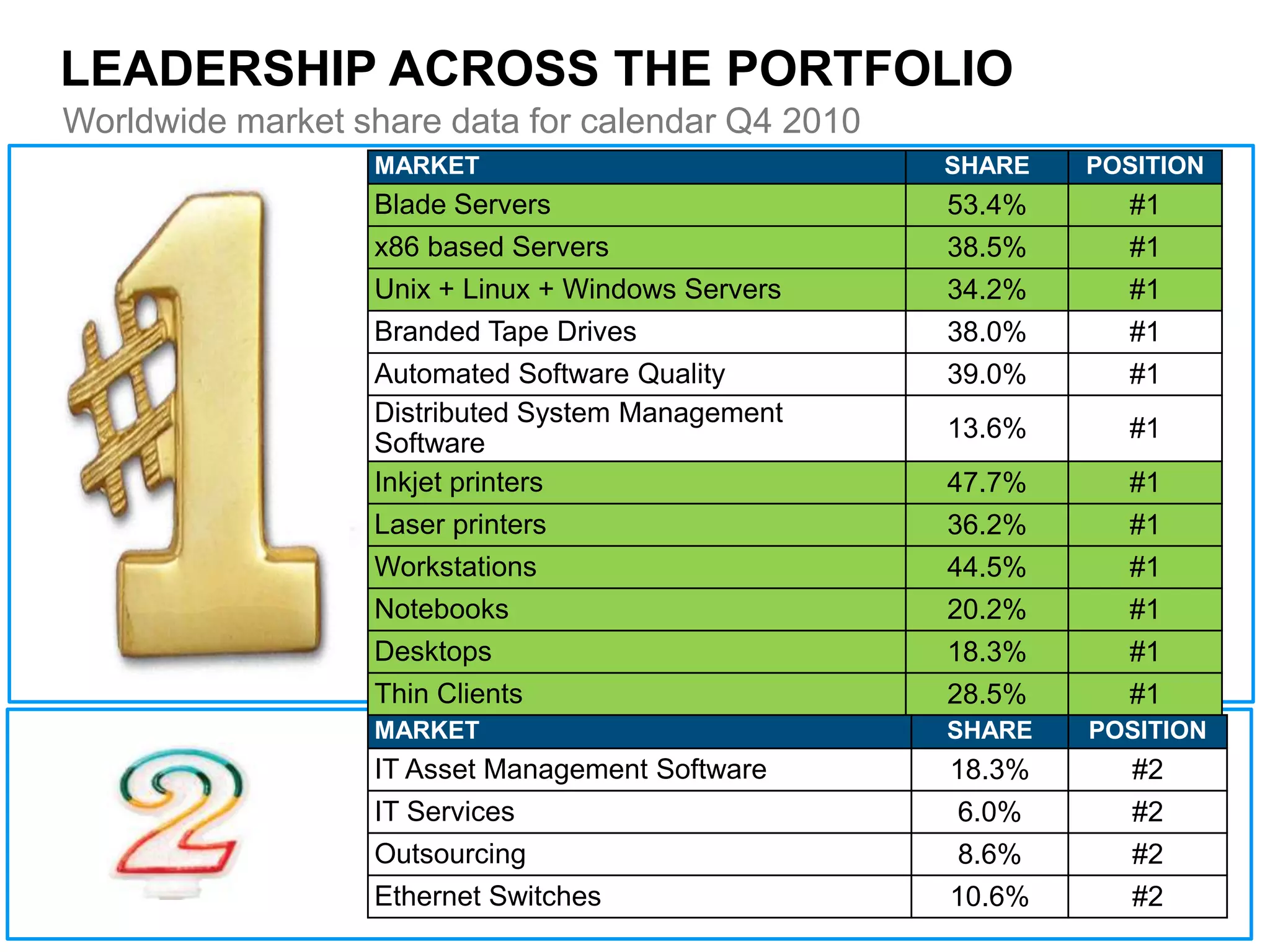

The document summarizes HP's acquisition of Compaq in 2002. It provides background on both companies and reasons for the merger, including achieving economies of scale, strengthening their business and product portfolio, and realizing estimated $2.5 billion in annual cost savings. However, there were also risks such as integration challenges and negative impact on stock prices. Five years after the merger, shareholder returns increased 46% and HP became the leader in various markets like servers and printers. The merger ultimately accomplished the goals of providing critical mass and ensuring long-term success in the transitioning industry.