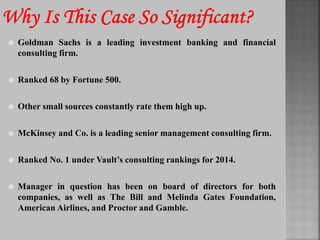

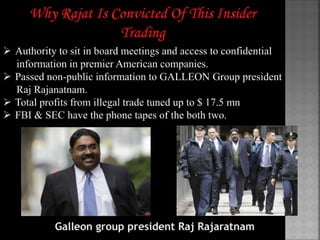

Rajat Gupta was a corporate director at Goldman Sachs and McKinsey who was found guilty of 3 counts of securities fraud for relaying confidential boardroom information from Goldman Sachs to hedge fund manager Raj Rajaratnam at Galleon Group. Wiretaps revealed Gupta discussing Warren Buffett's investment in Goldman Sachs and the company's quarterly losses with Rajaratnam. Rajaratnam then traded on this insider information for profit. Gupta faced up to 20 years in prison but was ultimately sentenced to 2 years.