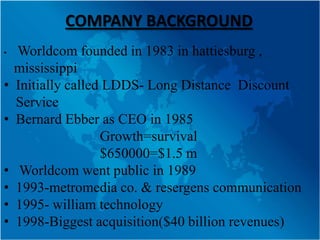

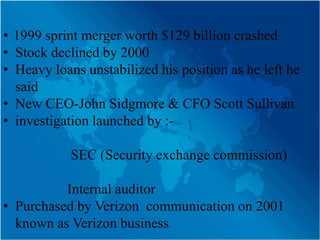

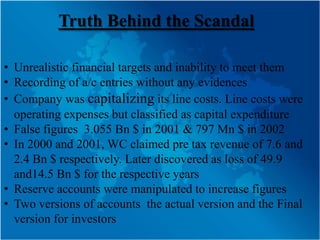

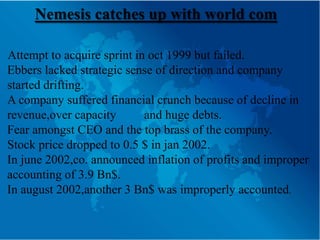

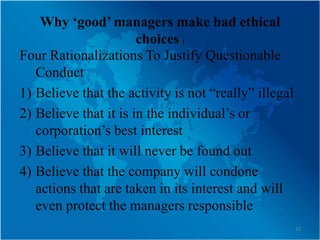

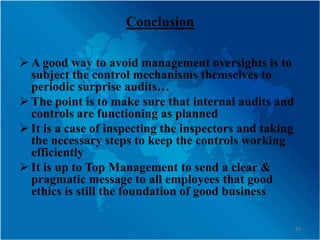

The document discusses the unethical practices that led to the downfall of WorldCom, including financial manipulation and misleading accounting practices that resulted in significant losses. It outlines the failure of leadership, unqualified management, and a toxic corporate culture as key factors contributing to the scandal. The conclusion emphasizes the importance of ethics in corporate governance and the need for robust internal controls to prevent such failures in the future.