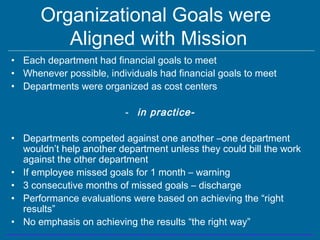

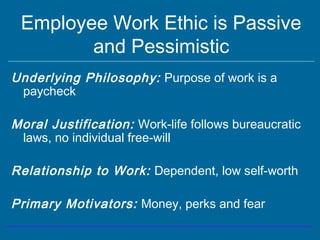

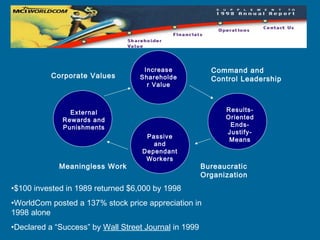

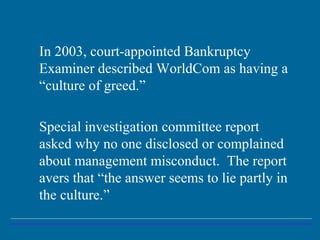

This document summarizes the rise and fall of WorldCom and analyzes the root causes of the corporate fraud that led to its bankruptcy. It describes WorldCom's hyper-focus on increasing shareholder value and results at all costs, which fostered a culture where employees felt like passive victims who had no choice but to follow orders from executives. This created an environment where massive accounting fraud could take place. The document argues that ethics training and compliance programs are insufficient to change a culture, and that true reform requires fostering autonomy, free will, transparency and meaning in work at all levels of the organization.

![In making a decision to seek an indictment against a corporation,

the US Department of Justice, will consider the corporate culture,

as measured by:

The company’s history of wrongdoing,

Its response to regulatory action,

Its reaction to the criminal conduct committed by its

employees, including the cooperation with the

Government’s investigation

The level within the corporation at which the crimes

were committed or conducted,

The pervasiveness of the criminal behavior within the

organization

According to the Department, the culture “is a web of attitudes and

practices that tends to replicate and perpetuate itself…[It] may

instill respect for the law or breed contempt and malfeasance.”](https://image.slidesharecdn.com/lessons-from-worldcom-1231784975071368-3-101022092004-phpapp02/85/Lessons-from-worldcom-1231784975071368-3-11-320.jpg)