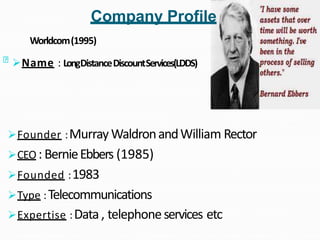

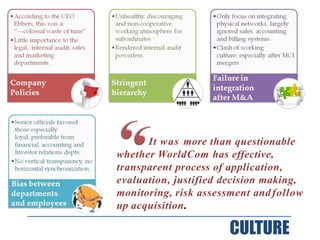

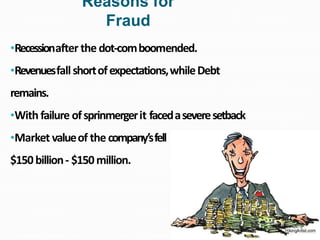

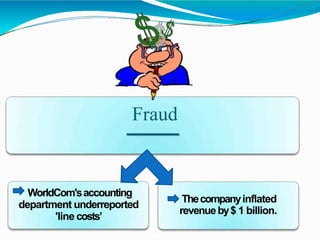

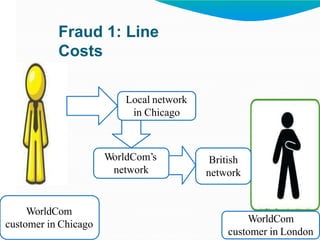

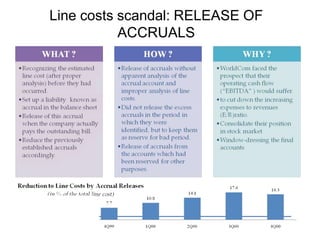

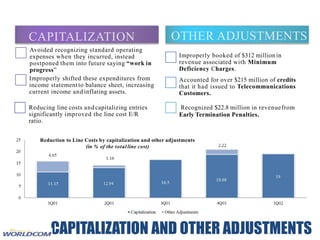

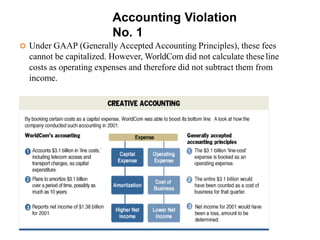

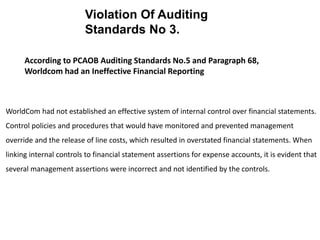

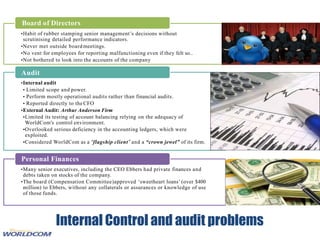

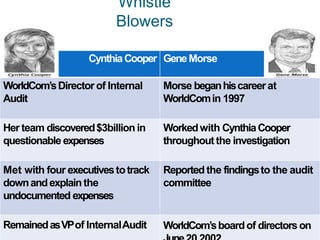

WorldCom was a telecommunications company founded in 1983 that grew through acquisitions in the 1990s. It was led by CEO Bernie Ebbers from 1985 until 2002. In 2002, WorldCom revealed it had committed accounting fraud by improperly capitalizing line costs and inflating revenue, totaling over $3.8 billion. This led to the bankruptcy of WorldCom and prosecution of its executives. An internal audit by Cynthia Cooper uncovered the fraud. Recommendations for preventing future fraud include ensuring independent audits, establishing ethical policies, and passing laws like Sarbanes-Oxley to improve accountability.