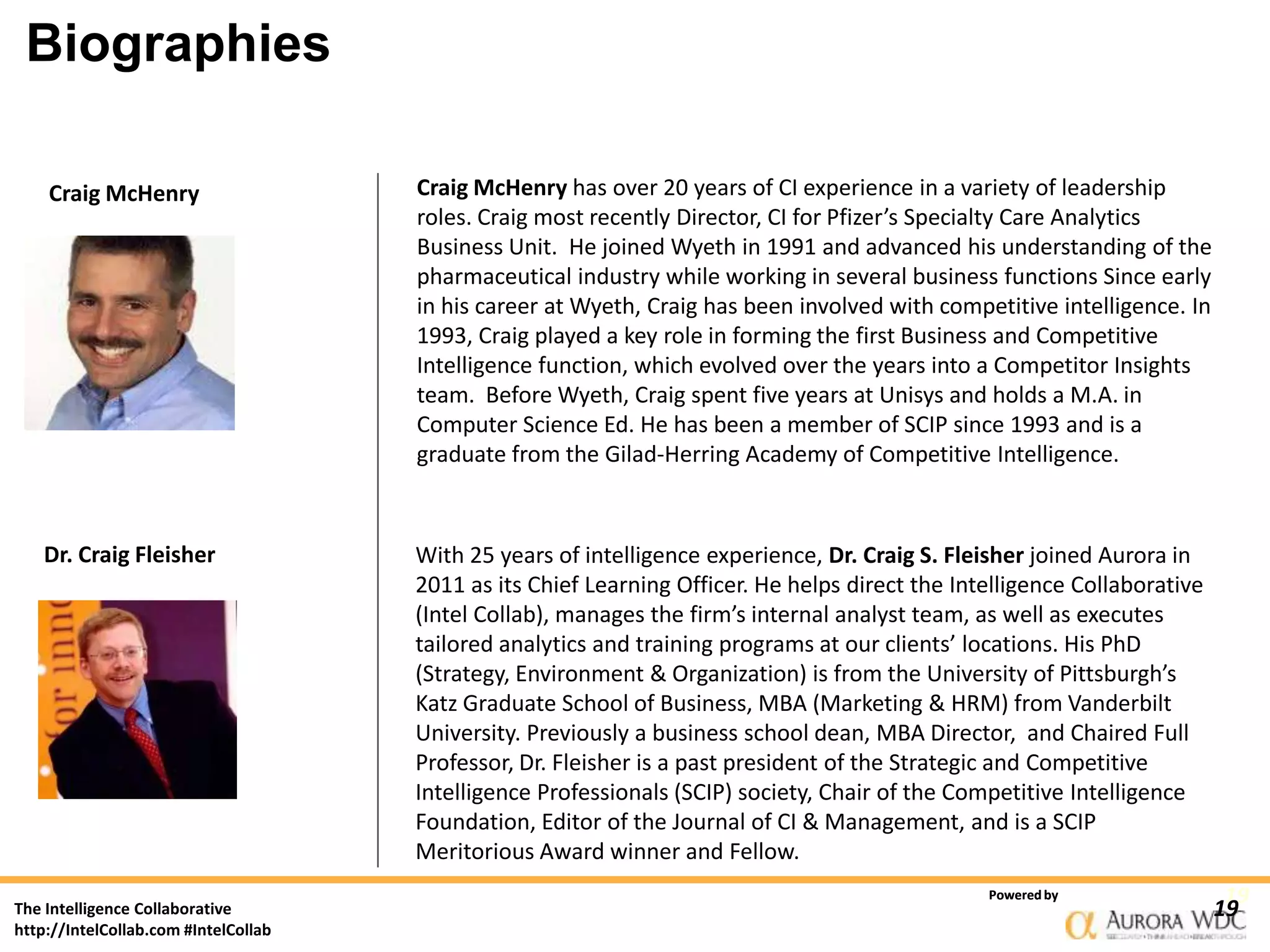

This document discusses a webinar on measuring the performance of strategic market and competitive intelligence (CI), emphasizing the importance of demonstrating CI value to stakeholders. It outlines strategies for overcoming common barriers to effectively measuring and articulating CI's impact on organizational performance, including calculating return on investment and fostering continuous improvement. The content is led by experts in CI, highlighting best practices for linking CI efforts to business outcomes and securing necessary resources.