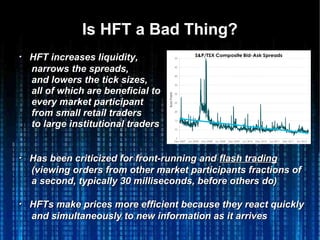

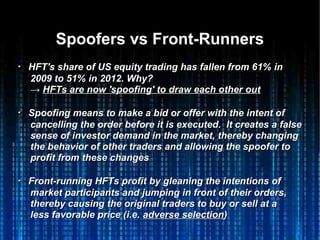

High-frequency trading involves using computer algorithms to analyze market data and make trades within microseconds. It has grown significantly since the 2000s due to advances in technology that allow for extremely low latency trading. In 2010, the Tokyo Stock Exchange introduced a new system that reduced latency to 2 milliseconds, enabling high-frequency traders to dominate trading, executing over 1,000 orders per second and accounting for 72% of trades. While high-frequency trading provides benefits like increased liquidity and narrower spreads, it is also criticized for strategies like front-running that see order flows and trade based on that information.

![Virtu FinancialVirtu Financial

From January 2009 to December 2014,From January 2009 to December 2014,

Virtu had only one overall losing trading day [1]Virtu had only one overall losing trading day [1]](https://image.slidesharecdn.com/yoshi-sato-hft-flashcrash-150615152948-lva1-app6891/85/High-Frequency-Trading-and-2010-Flash-Crash-9-320.jpg)

![Rebate Arbitrage / ELP – ExampleRebate Arbitrage / ELP – Example

At some point during the day, due to temporary selling pressure, there is a total of justAt some point during the day, due to temporary selling pressure, there is a total of just

100 contracts left at the best bid price of 1000.00. Recognizing that the queue at the100 contracts left at the best bid price of 1000.00. Recognizing that the queue at the

best bid is about to be depleted, HFTs submit executable limit orders to aggressivelybest bid is about to be depleted, HFTs submit executable limit orders to aggressively

sell a total of 100 contracts, thus completely depleting the queue at the best bid, andsell a total of 100 contracts, thus completely depleting the queue at the best bid, and

very quickly submit sequences of new limit orders to buy a total of 100 contracts at thevery quickly submit sequences of new limit orders to buy a total of 100 contracts at the

new best bid price of 999.75, as well as to sell 100 contracts at the new best offer ofnew best bid price of 999.75, as well as to sell 100 contracts at the new best offer of

1000.00. [2]1000.00. [2]](https://image.slidesharecdn.com/yoshi-sato-hft-flashcrash-150615152948-lva1-app6891/85/High-Frequency-Trading-and-2010-Flash-Crash-13-320.jpg)

![Rebate Arbitrage / ELP – Example (cont.)Rebate Arbitrage / ELP – Example (cont.)

If the selling pressure continues, then HFTs are able to buy 100 contracts at 999.75 andIf the selling pressure continues, then HFTs are able to buy 100 contracts at 999.75 and

make a profit of $1,250 dollars among them. If, however, the selling pressure stops andmake a profit of $1,250 dollars among them. If, however, the selling pressure stops and

the new best offer price of 1000.00 attracts buyers, then HFTs would very quickly sellthe new best offer price of 1000.00 attracts buyers, then HFTs would very quickly sell

100 contracts (which are at the very front of the new best offer queue), "scratching" the100 contracts (which are at the very front of the new best offer queue), "scratching" the

trade at the same price as they bought, and getting rid of the risky inventory in a fewtrade at the same price as they bought, and getting rid of the risky inventory in a few

milliseconds. [2]milliseconds. [2]](https://image.slidesharecdn.com/yoshi-sato-hft-flashcrash-150615152948-lva1-app6891/85/High-Frequency-Trading-and-2010-Flash-Crash-14-320.jpg)

![ETF Market Making - ExampleETF Market Making - Example

The S&P500 futures (blue) and SPY (green) should be perfectly correlated,The S&P500 futures (blue) and SPY (green) should be perfectly correlated,

and they are at minute intervals. But this correlation disappears at 250ms intervals. Thisand they are at minute intervals. But this correlation disappears at 250ms intervals. This

is the "market inefficiency" that HFT makes less so. [3]is the "market inefficiency" that HFT makes less so. [3]](https://image.slidesharecdn.com/yoshi-sato-hft-flashcrash-150615152948-lva1-app6891/85/High-Frequency-Trading-and-2010-Flash-Crash-15-320.jpg)

![Momentum Ignition - ExampleMomentum Ignition - Example

By trying to instigate other participants to buy or sell quickly, the instigator of momentumBy trying to instigate other participants to buy or sell quickly, the instigator of momentum

ignition can profit either having taken a pre-position or by laddering the book, knowingignition can profit either having taken a pre-position or by laddering the book, knowing

the price is likely to revert after the initial rapid price move, and trading out afterwards.the price is likely to revert after the initial rapid price move, and trading out afterwards.

[4][4]](https://image.slidesharecdn.com/yoshi-sato-hft-flashcrash-150615152948-lva1-app6891/85/High-Frequency-Trading-and-2010-Flash-Crash-16-320.jpg)

![Spoofers vs Front-Runners (cont.)Spoofers vs Front-Runners (cont.)

・・ Front-running HFTs are profitable against human traders,Front-running HFTs are profitable against human traders,

but not against spoofing HFTs. When the front-runningbut not against spoofing HFTs. When the front-running

HFT algo jumps ahead of a spoof order, the front-runnerHFT algo jumps ahead of a spoof order, the front-runner

gets fooled and loses money because the algo can't easilygets fooled and loses money because the algo can't easily

distinguish between legitimate orders and spoofsdistinguish between legitimate orders and spoofs

・・ Spoofing therefore poses the risk of making front-runningSpoofing therefore poses the risk of making front-running

unprofitable, thus the front-runners make the rationalunprofitable, thus the front-runners make the rational

choice to do less front-runningchoice to do less front-running

・・ Anti-spoofing regulations not only fail to safeguard theAnti-spoofing regulations not only fail to safeguard the

integrity of the market; they exacerbate the very marketintegrity of the market; they exacerbate the very market

instability that lawmakers sought to remedy by enactinginstability that lawmakers sought to remedy by enacting

the prohibitions in the first place.the prohibitions in the first place. If front-running isIf front-running is

allowed to exist, spoofing is its best remedy.allowed to exist, spoofing is its best remedy. [5][5]](https://image.slidesharecdn.com/yoshi-sato-hft-flashcrash-150615152948-lva1-app6891/85/High-Frequency-Trading-and-2010-Flash-Crash-18-320.jpg)

![2010 Flash Crash – Timeline (cont.)2010 Flash Crash – Timeline (cont.)

・・ 13:45:28: E-Mini trading was paused for 5 sec when CME's13:45:28: E-Mini trading was paused for 5 sec when CME's

Stop Logic Functionality was triggered in order to preventStop Logic Functionality was triggered in order to prevent

a cascade of further price declines [2]a cascade of further price declines [2]](https://image.slidesharecdn.com/yoshi-sato-hft-flashcrash-150615152948-lva1-app6891/85/High-Frequency-Trading-and-2010-Flash-Crash-21-320.jpg)

![Navinder Singh SaraoNavinder Singh Sarao

・・ On April 21, 2015, a 36-year-old UK resident Nav Sarao wasOn April 21, 2015, a 36-year-old UK resident Nav Sarao was

arrestedarrested after US Department of Justice charged him withafter US Department of Justice charged him with

market manipulation in S&P500 E-Mini futures (violationmarket manipulation in S&P500 E-Mini futures (violation

of CME Rule 575), which CFTC accused of having contributedof CME Rule 575), which CFTC accused of having contributed

to the 2010 Flash Crashto the 2010 Flash Crash

・・ Sarao was an independent trader operating from his parents'Sarao was an independent trader operating from his parents'

house in West London. He used to spoof the market usinghouse in West London. He used to spoof the market using

bespoke software which allowed him to execute abespoke software which allowed him to execute a layeringlayering

algorithm against HFTsalgorithm against HFTs

・・ On May 6, 2010, his algorithm was turned on from 09:20,On May 6, 2010, his algorithm was turned on from 09:20,

selling 2,100 contracts, then again between 11:17 and 13:40,selling 2,100 contracts, then again between 11:17 and 13:40,

selling 3,600 contracts. These orders represented persistentselling 3,600 contracts. These orders represented persistent

downward selling pressure on the E-Mini price [6]downward selling pressure on the E-Mini price [6]](https://image.slidesharecdn.com/yoshi-sato-hft-flashcrash-150615152948-lva1-app6891/85/High-Frequency-Trading-and-2010-Flash-Crash-26-320.jpg)

![LayeringLayering

・・ Layering is a type of spoofing which takes the form of aLayering is a type of spoofing which takes the form of a

trader placing a number of bogus sell orders – often attrader placing a number of bogus sell orders – often at

several price levels – to give the false impression ofseveral price levels – to give the false impression of

strong selling pressure and to drive the price downstrong selling pressure and to drive the price down

・・ By manipulating the price downward, the trader can thenBy manipulating the price downward, the trader can then

buy the stock at an artificially cheap price and trade outbuy the stock at an artificially cheap price and trade out

when the price reverts (the same holds for buying)when the price reverts (the same holds for buying)

・・ Layering is more viable for HFTs – their speed allows themLayering is more viable for HFTs – their speed allows them

to mitigate the risk of someone trading against those falseto mitigate the risk of someone trading against those false

orders by canceling immediately in response to anyorders by canceling immediately in response to any

upward moves [4]upward moves [4]](https://image.slidesharecdn.com/yoshi-sato-hft-flashcrash-150615152948-lva1-app6891/85/High-Frequency-Trading-and-2010-Flash-Crash-27-320.jpg)

![Sarao's Layering AlgorithmSarao's Layering Algorithm [7][7]](https://image.slidesharecdn.com/yoshi-sato-hft-flashcrash-150615152948-lva1-app6891/85/High-Frequency-Trading-and-2010-Flash-Crash-28-320.jpg)

![Did Sarao Cause the Flash Crash?Did Sarao Cause the Flash Crash?

・・ The sell orders of 3,600 contracts his layering algorithmThe sell orders of 3,600 contracts his layering algorithm

spoofed betweenspoofed between 11:17 and 13:4011:17 and 13:40 was much smaller thanwas much smaller than

the 75,000 contracts Waddell & Reed sold from 13:32the 75,000 contracts Waddell & Reed sold from 13:32

・・ His algorithm was already stopped at 13:40 when the FlashHis algorithm was already stopped at 13:40 when the Flash

Crash was ignited at 13:42Crash was ignited at 13:42

・・ Still, in addition to the layering algorithm, Sarao spoofedStill, in addition to the layering algorithm, Sarao spoofed

aggressively, selling 32,046 contracts manually betweenaggressively, selling 32,046 contracts manually between

12:33 and 13:45 [6]12:33 and 13:45 [6]

→→ He did not cause the Flash Crash directly, but contributedHe did not cause the Flash Crash directly, but contributed

to the extreme order book imbalance in the E-Mini marketto the extreme order book imbalance in the E-Mini market](https://image.slidesharecdn.com/yoshi-sato-hft-flashcrash-150615152948-lva1-app6891/85/High-Frequency-Trading-and-2010-Flash-Crash-29-320.jpg)

![ReferencesReferences

[1] http://www.sec.gov/Archives/edgar/data/1592386/000104746915001003/[1] http://www.sec.gov/Archives/edgar/data/1592386/000104746915001003/

a2219372zs-1a.htma2219372zs-1a.htm

[2] Kirilenko et al., “The Flash Crash: The Impact of High Frequency Trading on[2] Kirilenko et al., “The Flash Crash: The Impact of High Frequency Trading on

an Electronic Market,” 2014.an Electronic Market,” 2014.

[3] Budish et al., "The High-Frequency Trading Arms Race: Frequent Batch[3] Budish et al., "The High-Frequency Trading Arms Race: Frequent Batch

Auctions as a Market Design Response," 2013Auctions as a Market Design Response," 2013

[4] Tse et al., “High Frequency Trading – Measurement, Detection and[4] Tse et al., “High Frequency Trading – Measurement, Detection and

Response,” 2012Response,” 2012

[5] http://www.bloombergview.com/articles/2015-01-23/high-frequency-trading-[5] http://www.bloombergview.com/articles/2015-01-23/high-frequency-trading-

spoofers-and-front-runningspoofers-and-front-running

[6] http://www.cftc.gov/ucm/groups/public/@lrenforcementactions/documents/[6] http://www.cftc.gov/ucm/groups/public/@lrenforcementactions/documents/

legalpleading/enfsaraocomplaint041715.pdflegalpleading/enfsaraocomplaint041715.pdf

[7] https://twitter.com/nanexllc/status/592315463482216448/photo/1[7] https://twitter.com/nanexllc/status/592315463482216448/photo/1](https://image.slidesharecdn.com/yoshi-sato-hft-flashcrash-150615152948-lva1-app6891/85/High-Frequency-Trading-and-2010-Flash-Crash-31-320.jpg)