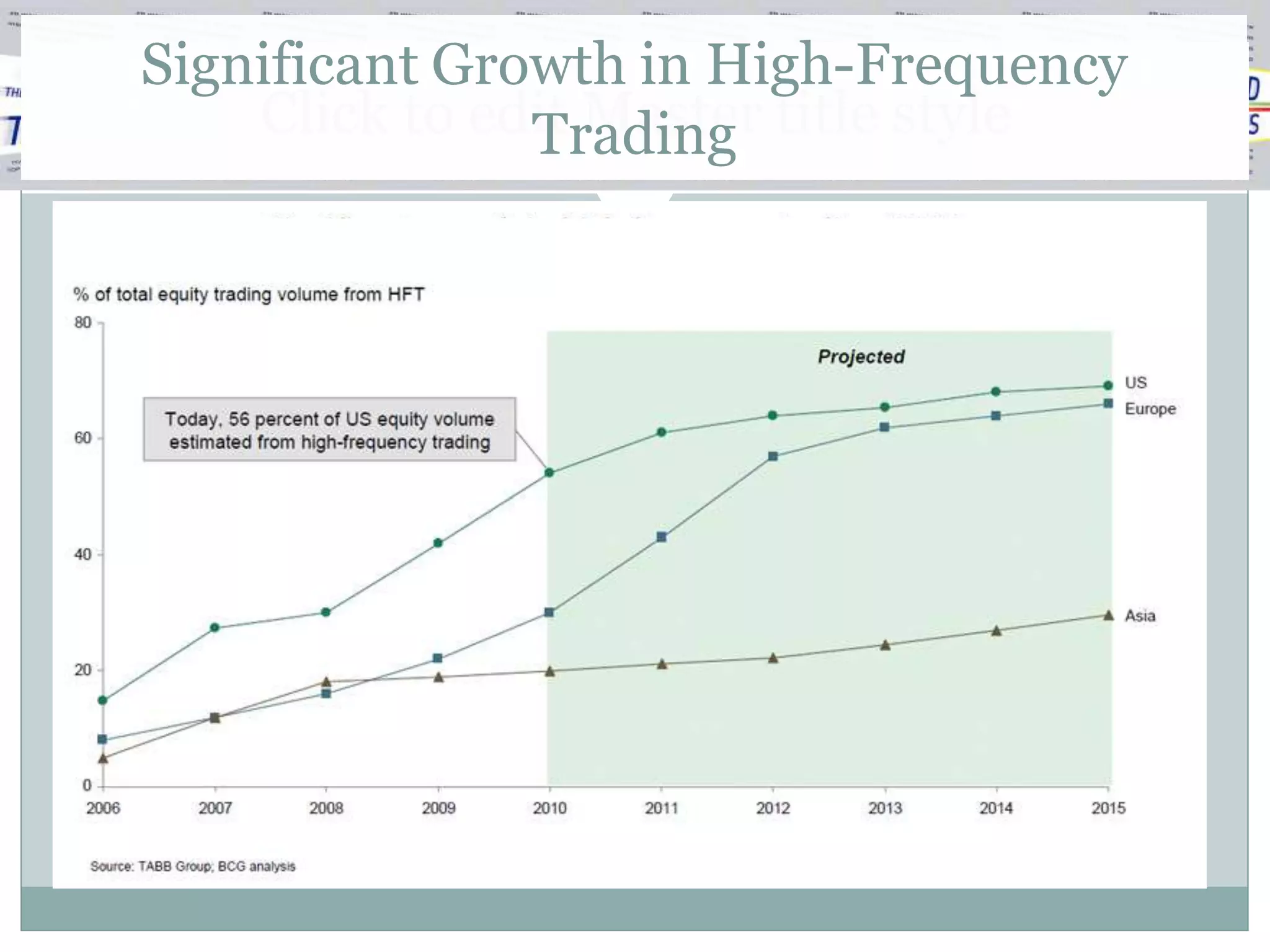

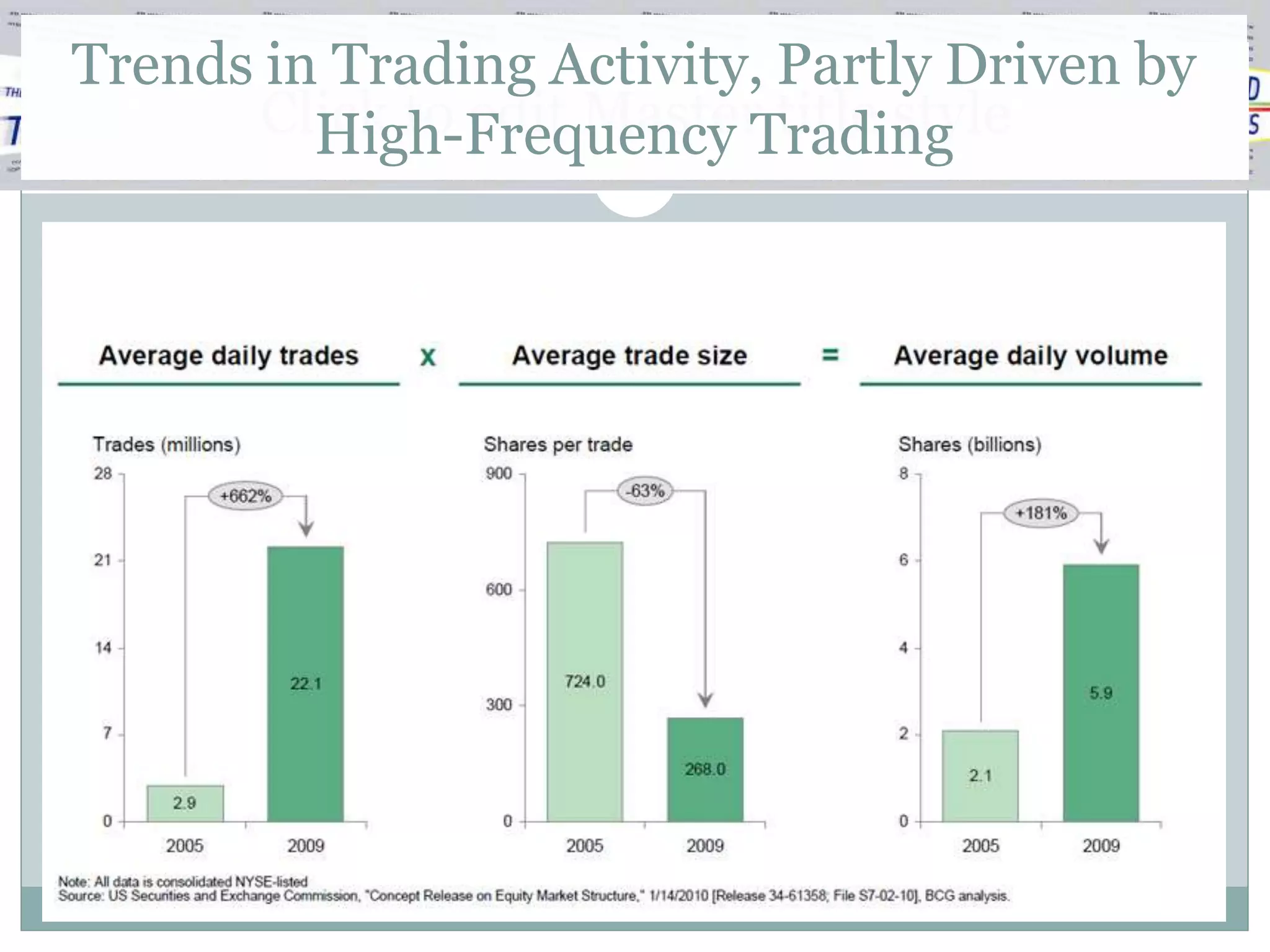

El comercio de alta frecuencia es un conjunto de herramientas y estrategias que priorizan la velocidad, baja latencia y altos volúmenes en los mercados financieros. Esta práctica ha revelado problemas estructurales en los mercados de valores de EE. UU. que están siendo analizados por legisladores y reguladores, mientras los comerciantes de velocidad buscan oportunidades de generación de alfa en nuevas clases de activos y geografías. La evolución tecnológica y los cambios regulatorios han permitido el crecimiento del comercio de alta frecuencia, que domina cada vez más el volumen de trading en los mercados de capitales.