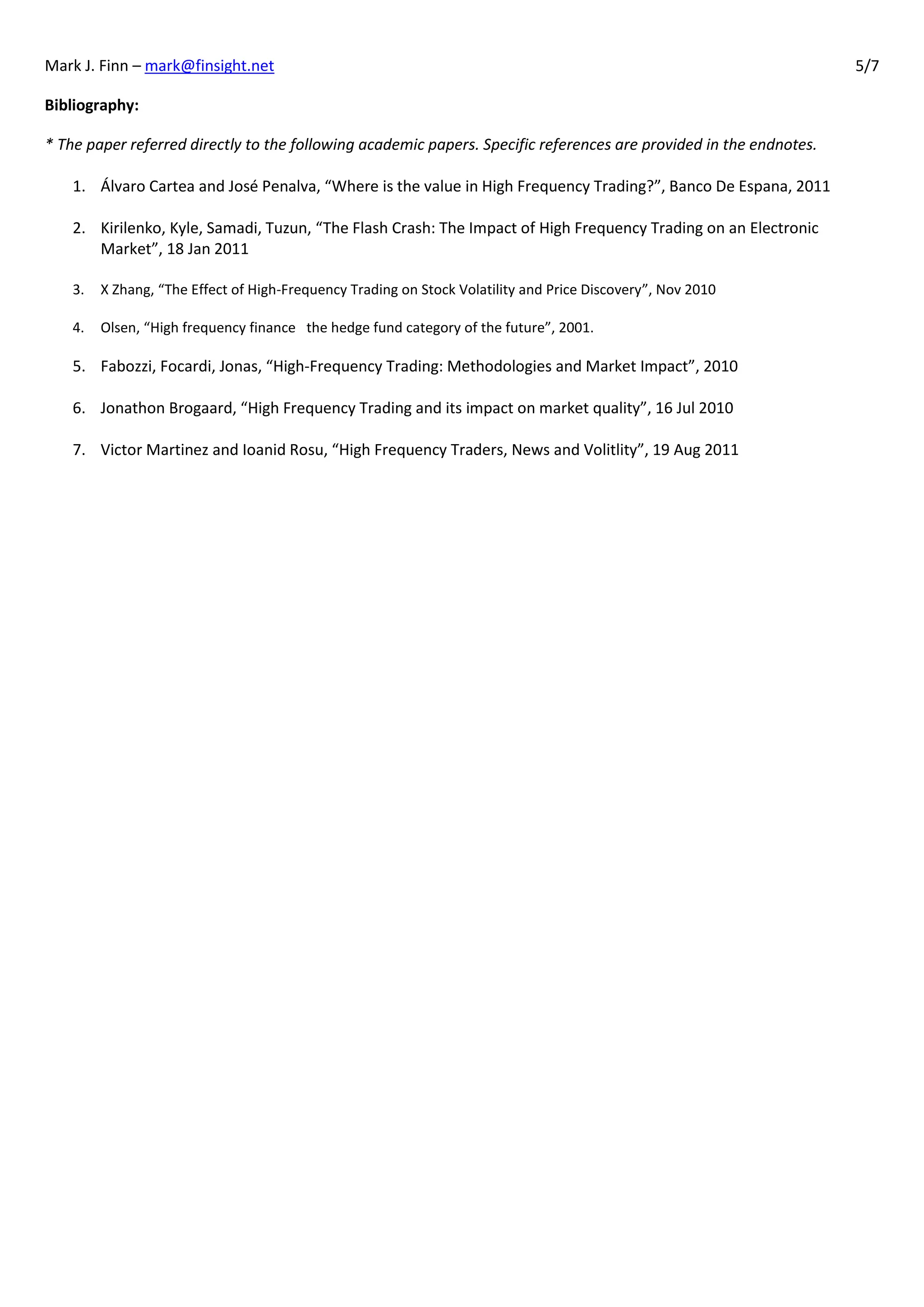

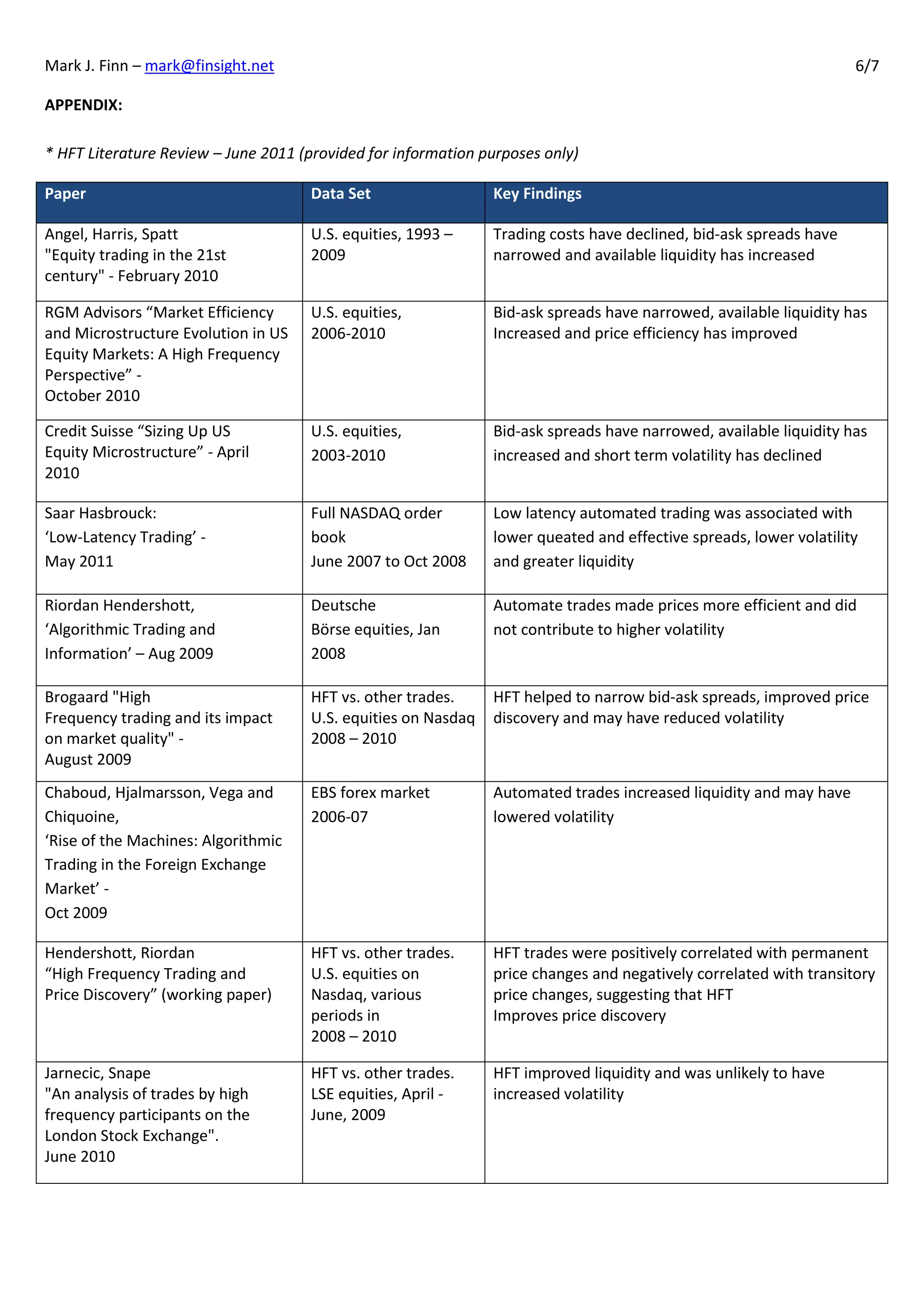

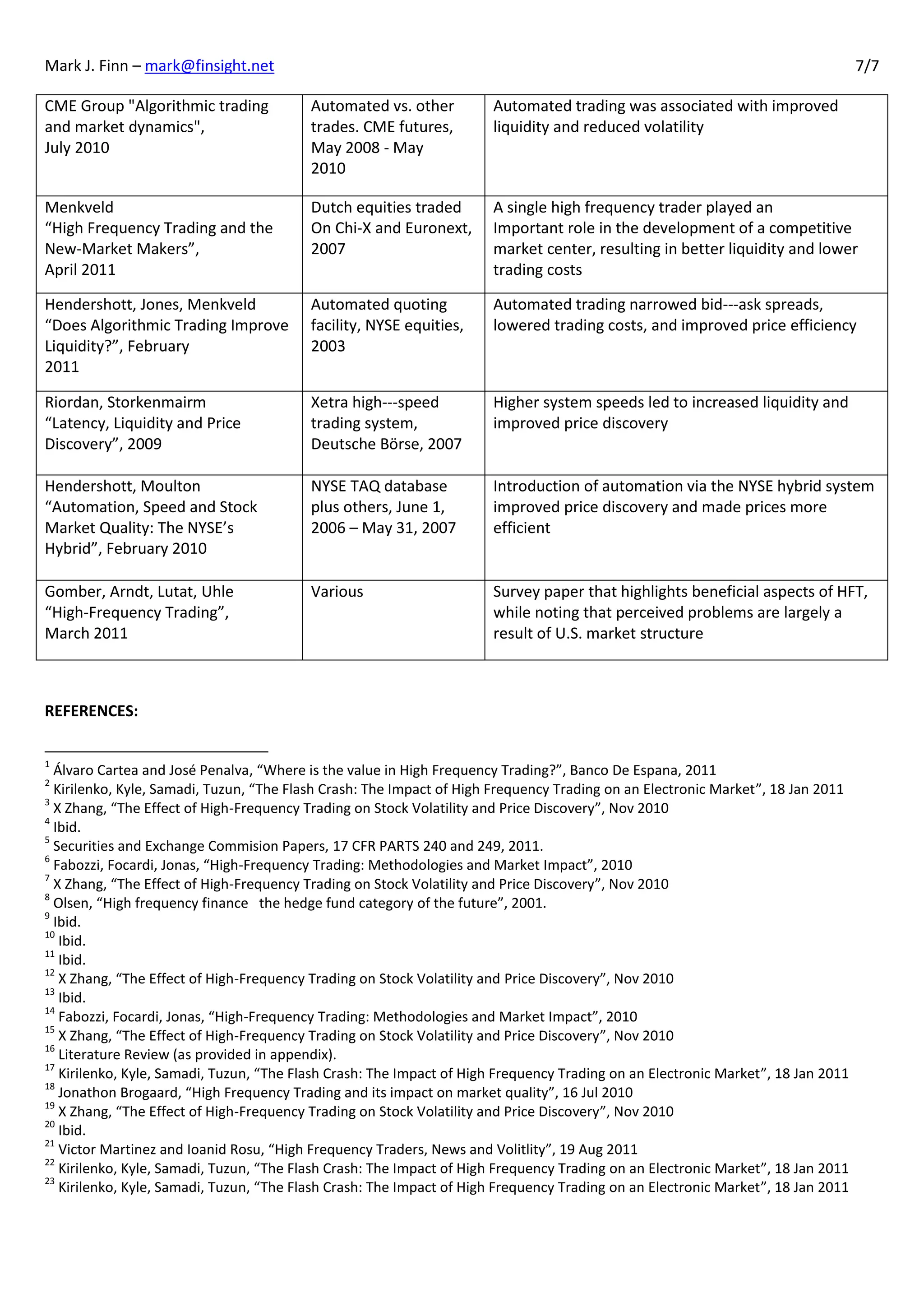

The document discusses the rise and impact of high frequency trading (HFT) on US capital markets, highlighting its dominance, accounting for over 70% of dollar volume trade. While HFT generally improves liquidity and price efficiency, its effects on volatility are debated, particularly in light of events like the 'flash crash' of May 6, 2010. The paper concludes that while HFT plays a significant role in trading, its interaction with traditional investors can cause excessive volatility, and the increasing competition in HFT may drive hedge funds to focus more on emerging markets.