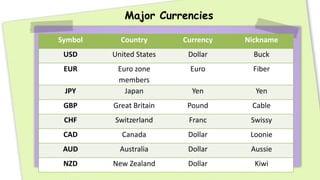

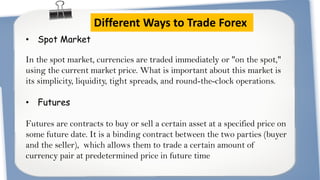

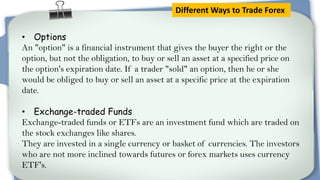

The document provides an overview of foreign exchange (forex) trading, which involves the exchange of currencies and operates in a 24-hour global market. It details various trading methods such as spot markets, futures, options, and exchange-traded funds, along with the benefits and risks associated with forex trading. Key benefits include market flexibility, liquidity, and low transaction costs, while risks include exchange rate, interest rate, and country risks.