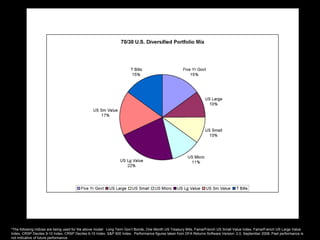

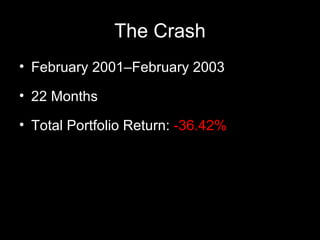

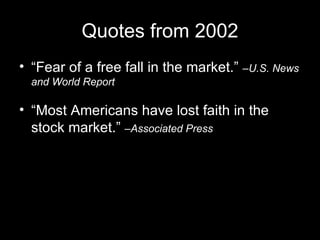

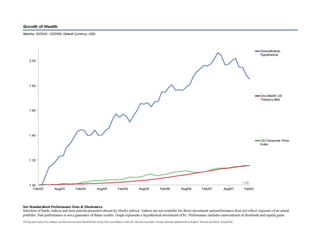

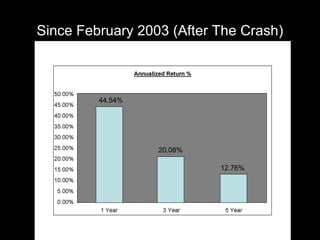

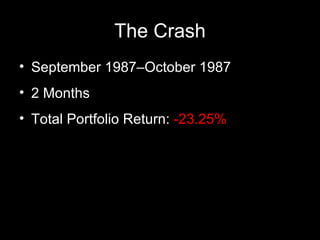

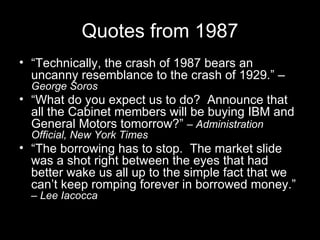

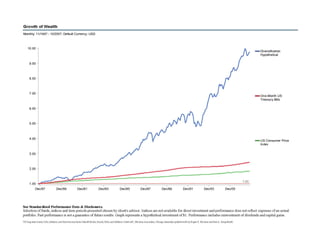

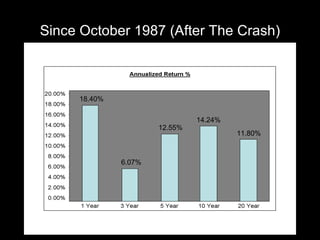

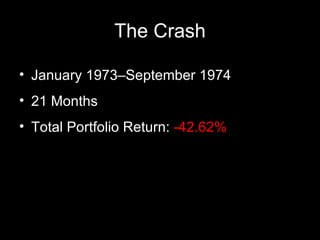

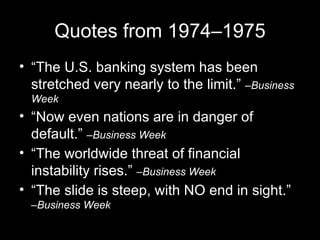

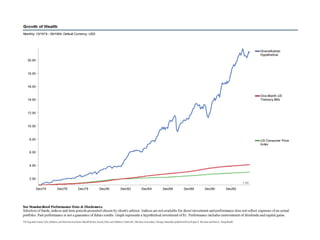

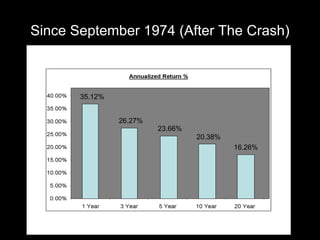

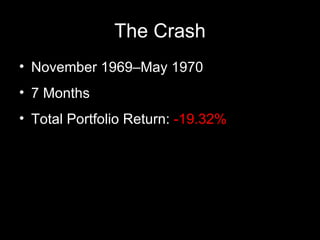

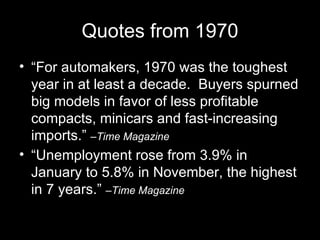

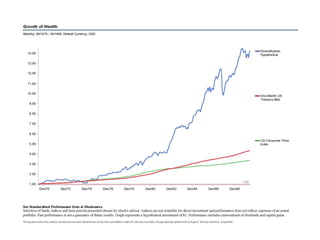

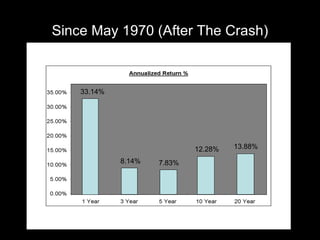

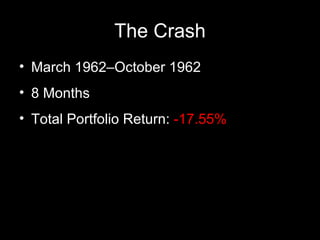

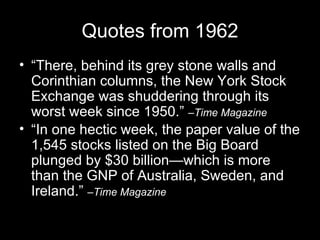

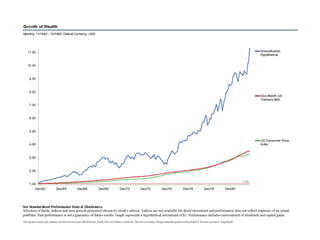

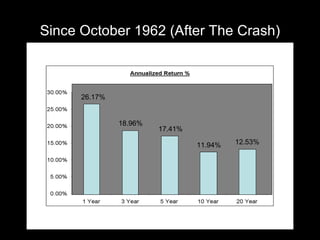

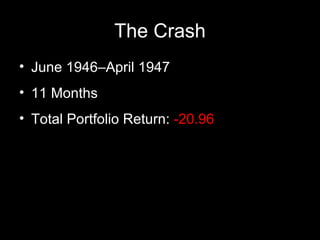

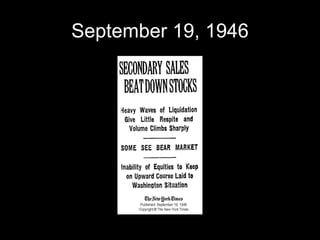

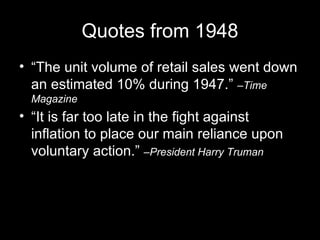

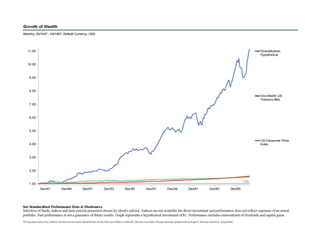

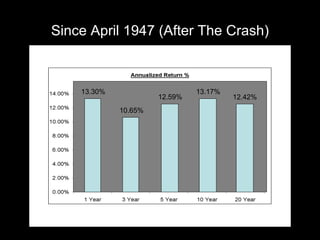

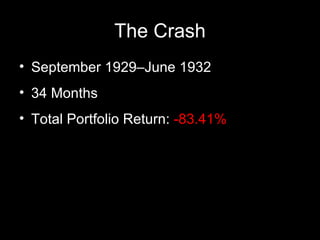

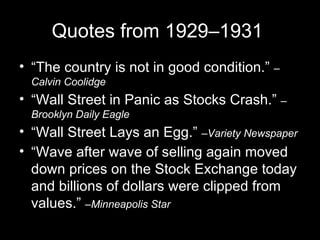

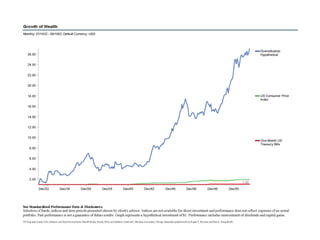

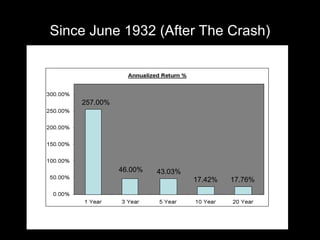

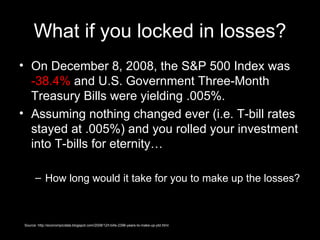

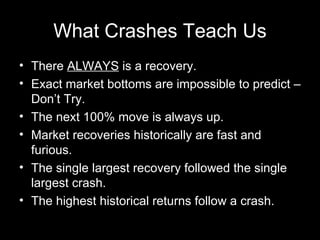

The document discusses historical stock market crashes, highlighting their frequency and recovery patterns since 1928, including investor sentiment and notable criticisms from various points in time. It emphasizes the volatility of stocks as a necessary factor for higher long-term returns, while providing performance data for several market downturns. Essential lessons note that market recoveries are generally swift and that timing market bottoms is challenging.