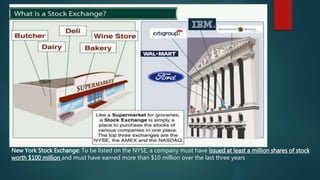

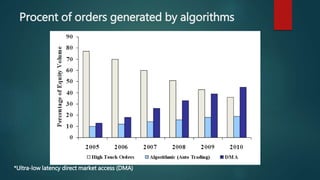

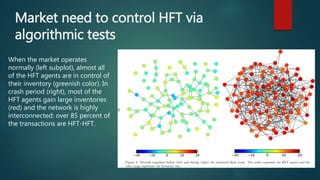

To be listed on the NYSE, a company must meet specific financial requirements. High-frequency trading (HFT) is a significant part of modern trading, accounting for a large percentage of market operations, but can also lead to flash crashes, dramatic declines in security prices in very short timeframes. Companies like HFT Brokers in Poland and Nanex are notable players in the HFT space, providing various services to traders and requiring regulatory oversight.