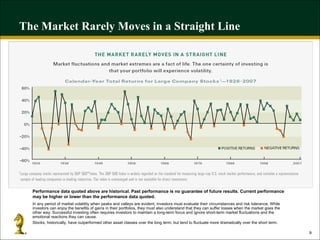

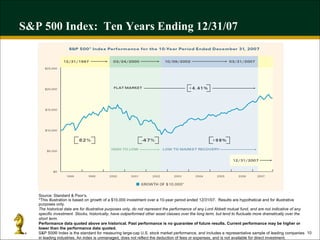

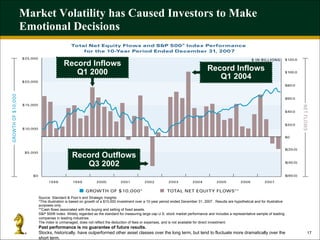

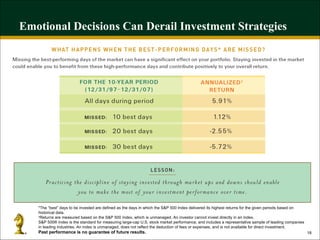

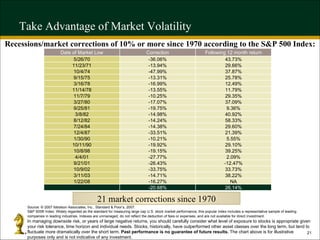

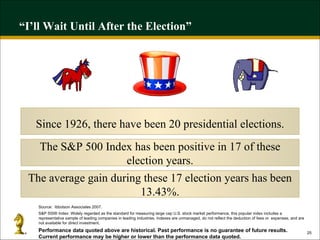

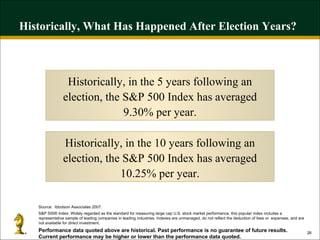

1) The document discusses market volatility over the past 10 years and how it has caused investors to make emotional decisions that can adversely impact long-term investment performance.

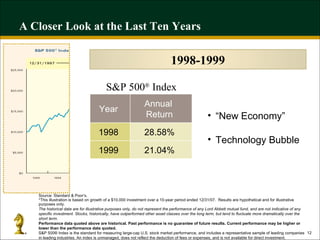

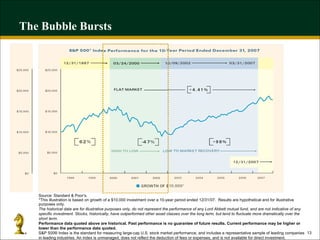

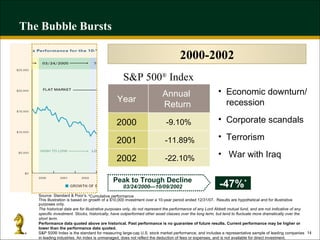

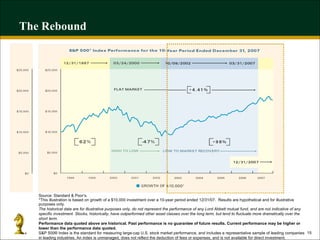

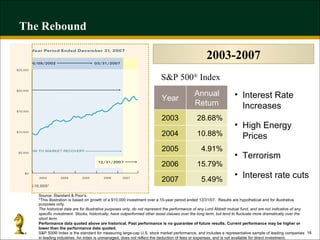

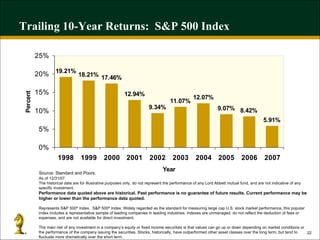

2) It analyzes periods like the technology bubble of 1998-1999, the market crash from 2000-2002, and the rebound from 2003-2007.

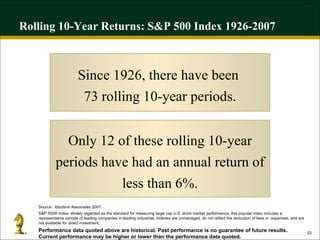

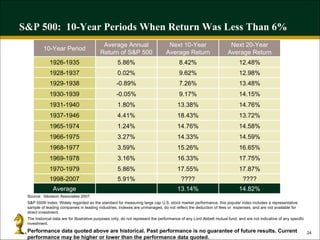

3) It emphasizes that the market rarely moves in a straight line and that successful investing requires maintaining a long-term focus despite short-term fluctuations and emotional reactions.