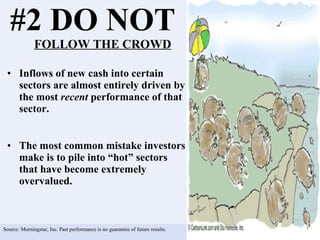

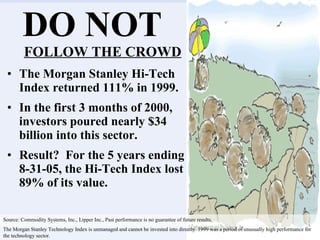

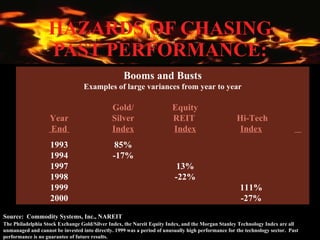

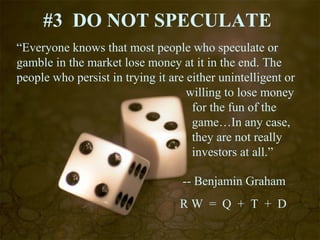

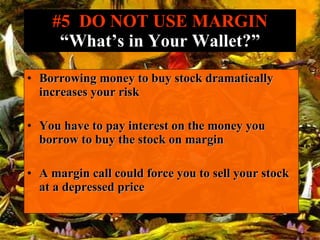

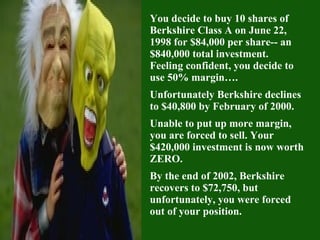

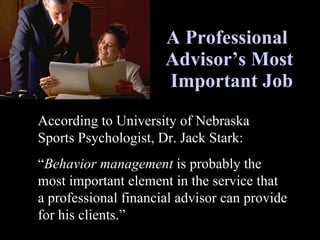

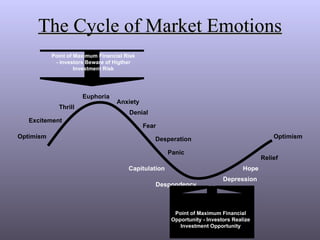

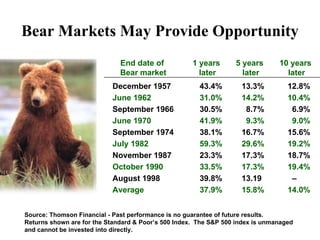

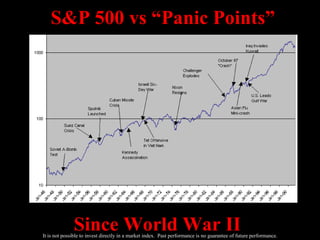

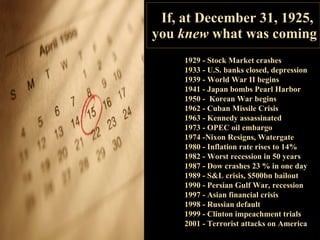

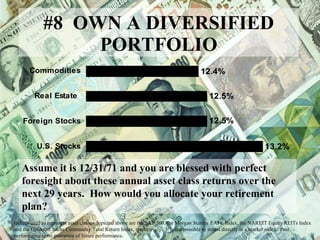

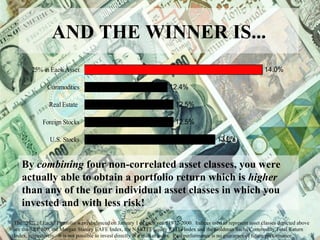

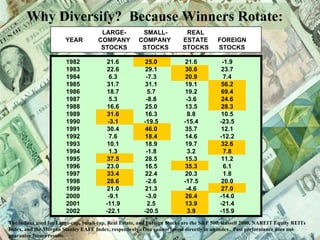

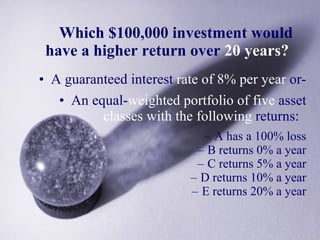

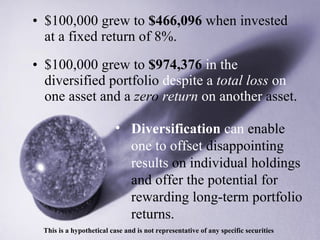

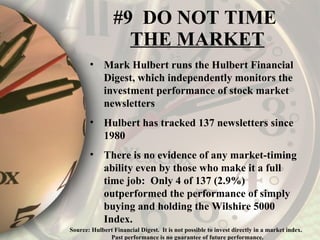

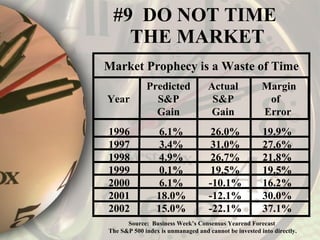

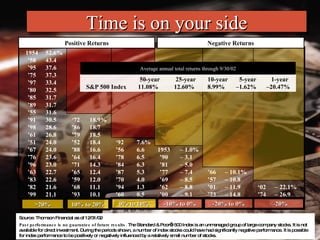

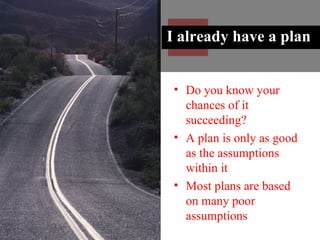

The document provides 10 ways to achieve wealth, including having a long-term financial plan, not following crowd behavior in the market, avoiding speculation and margin trading, hiring a professional advisor, not letting emotions override logic, owning a diversified portfolio, and regularly updating your financial plan. It emphasizes the importance of long-term investing and avoiding risky behaviors driven by emotions or rumors. Diversification across asset classes is recommended to reduce risk and improve long-term returns.