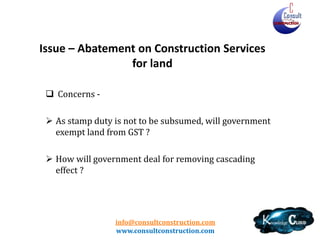

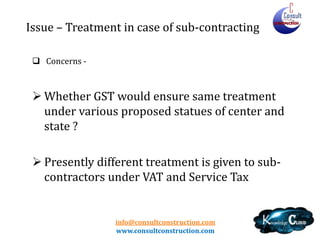

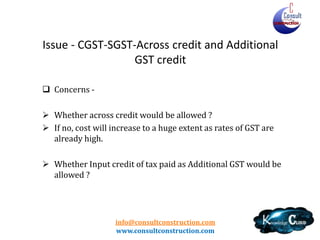

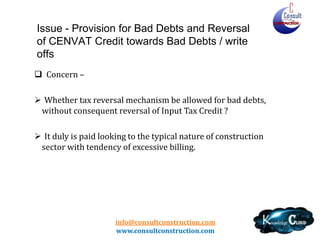

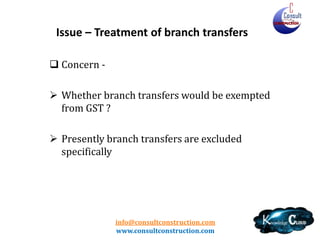

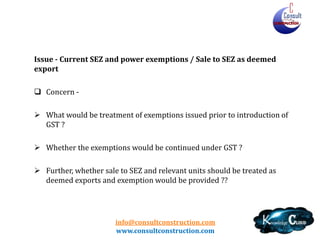

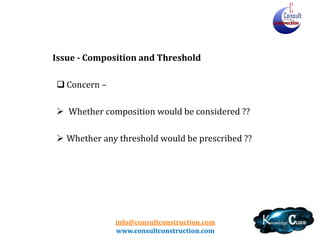

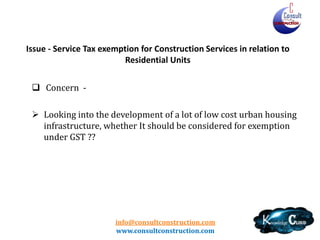

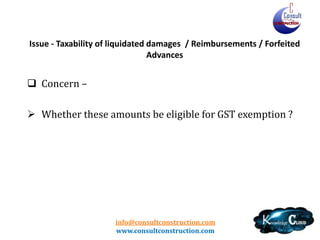

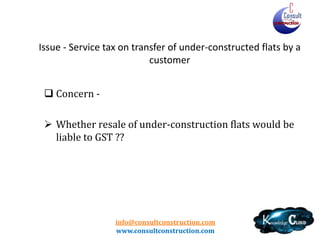

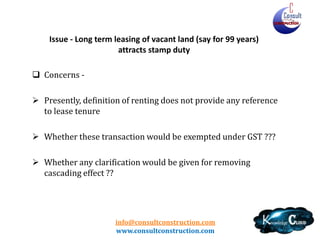

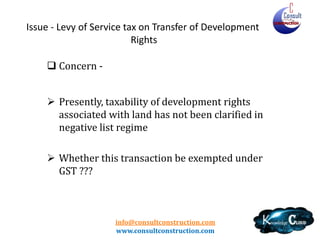

Consult Construction is a consulting firm offering governance, compliance, and IT services tailored for the construction sector, with focus areas including corporate governance, tax compliance, and project management. The document discusses concerns related to the implementation of GST, particularly its impact on taxation, exemptions, and operational transition in the construction industry. Additionally, it highlights various issues such as service tax on construction services, input tax credits, and tax liabilities for ongoing contracts, while seeking clarity on legislative changes influencing the sector.