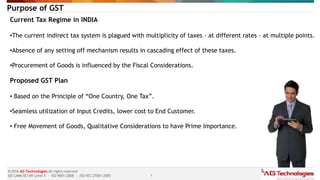

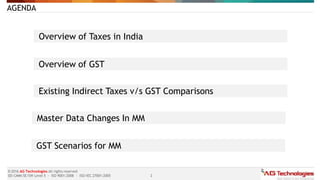

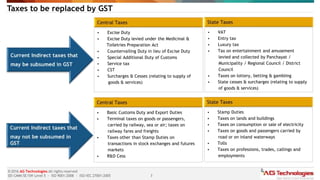

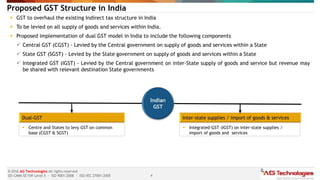

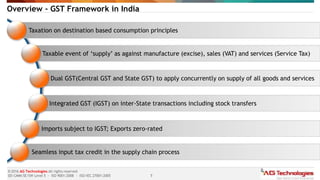

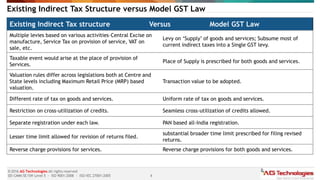

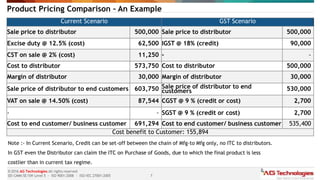

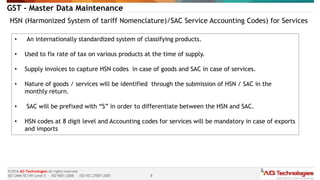

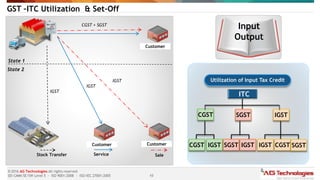

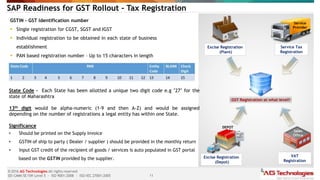

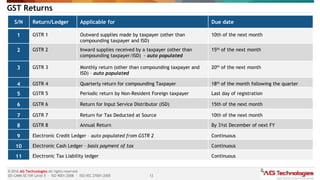

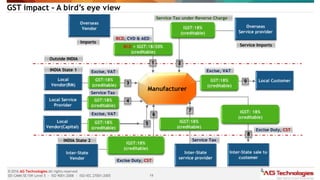

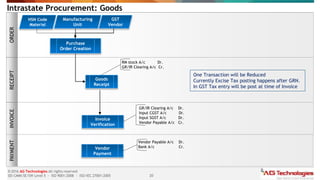

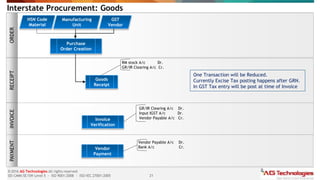

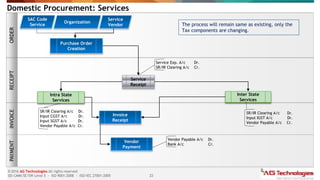

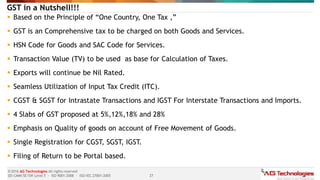

The document discusses India's proposed Goods and Services Tax (GST) plan. It notes that the current indirect tax system in India is plagued by multiple taxes at different rates levied at multiple points. The GST plan aims to introduce a single, unified indirect tax based on the principle of "One Country, One Tax." It is expected to allow for seamless input tax credits across India, lower costs for end customers, and make the movement of goods more free by prioritizing qualitative considerations. The document also provides details on the proposed GST structure and comparisons to the existing indirect tax structure.