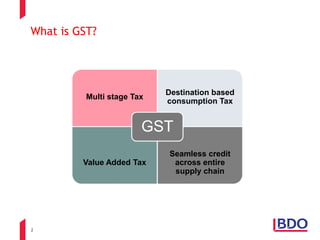

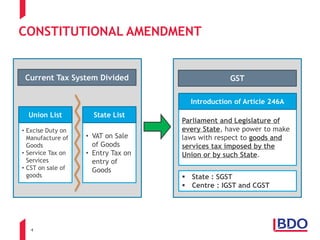

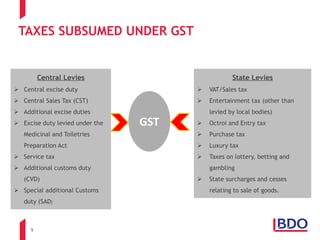

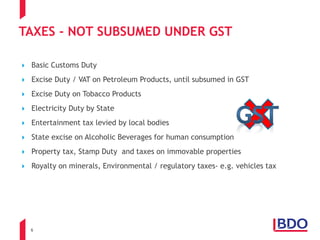

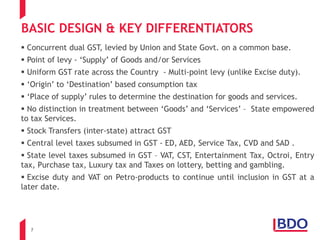

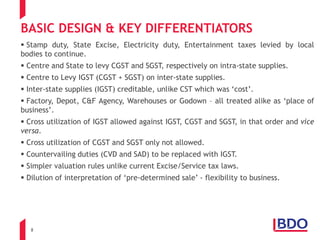

GST is a multi-stage, destination-based indirect tax applicable throughout India that replaced multiple taxes levied by the central and state governments. Key objectives of GST were to establish an economically efficient and neutral tax system that is simple to administer. GST subsumed many central and state taxes such as excise duty, VAT, and service tax into a single tax to mitigate cascading of taxes and make India a unified market. It was implemented on July 1, 2017 through a constitutional amendment that empowered both parliament and state legislatures to levy GST.