The document summarizes the impact of GST on the textile industry in India. Some key points:

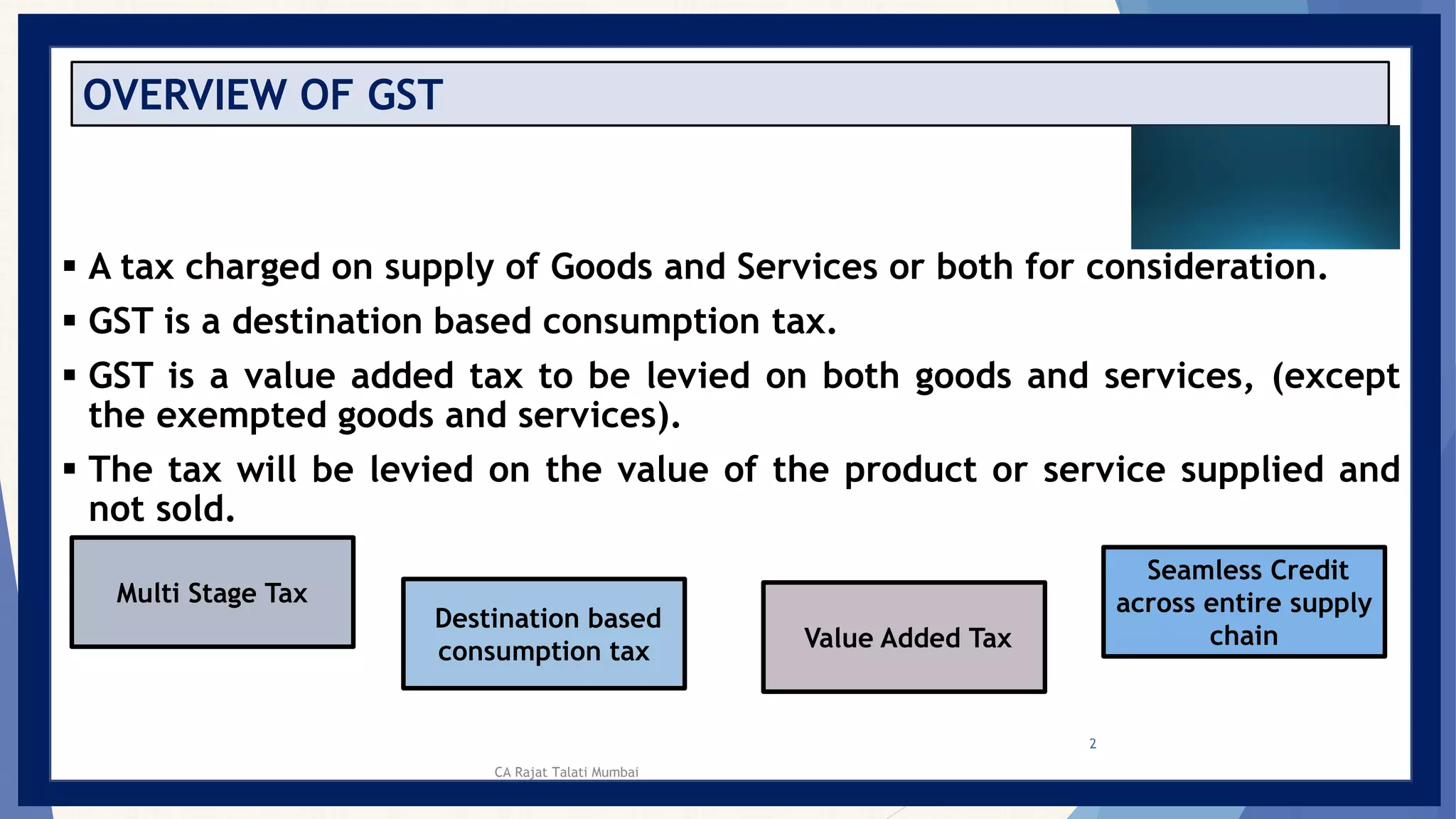

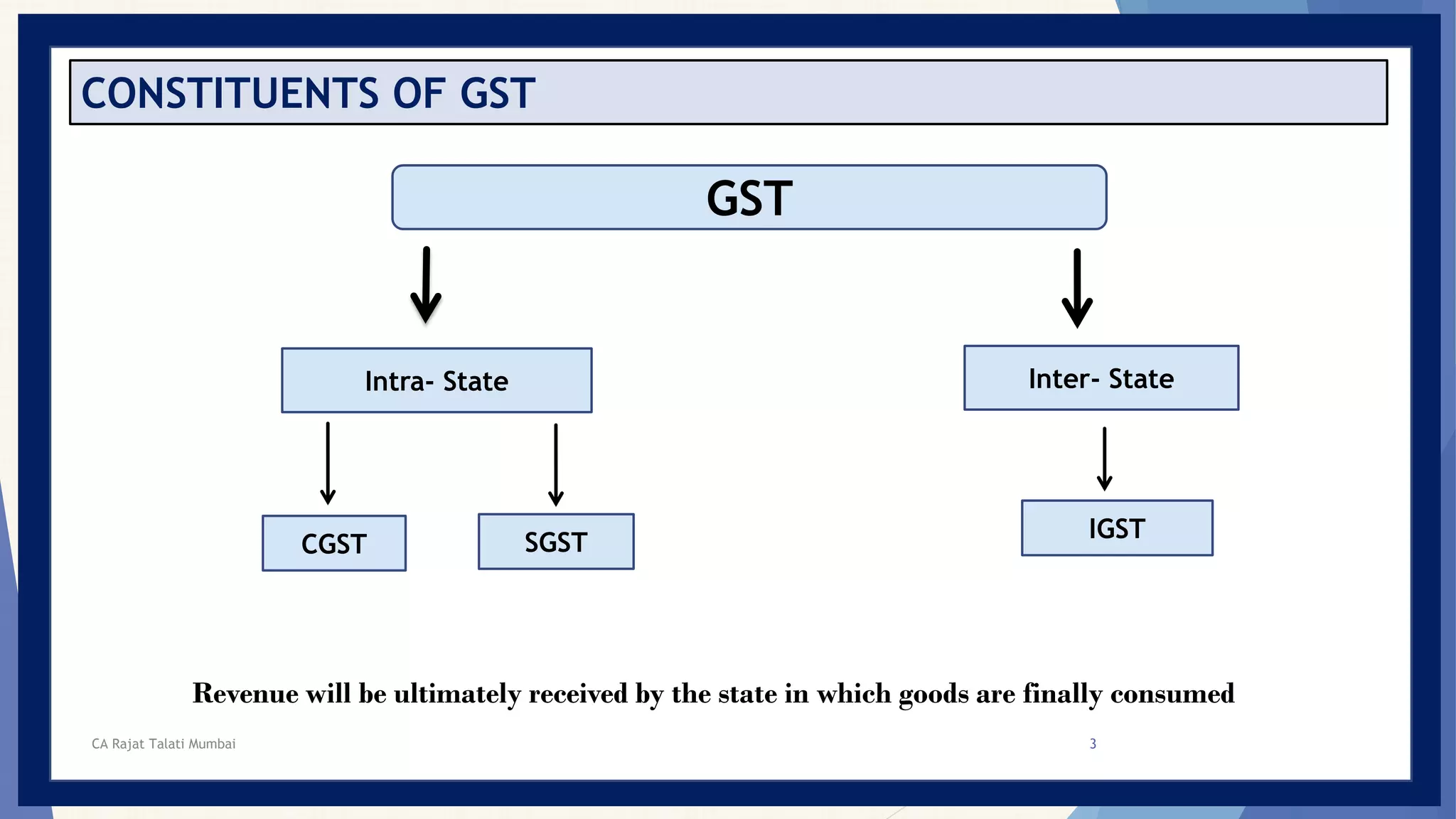

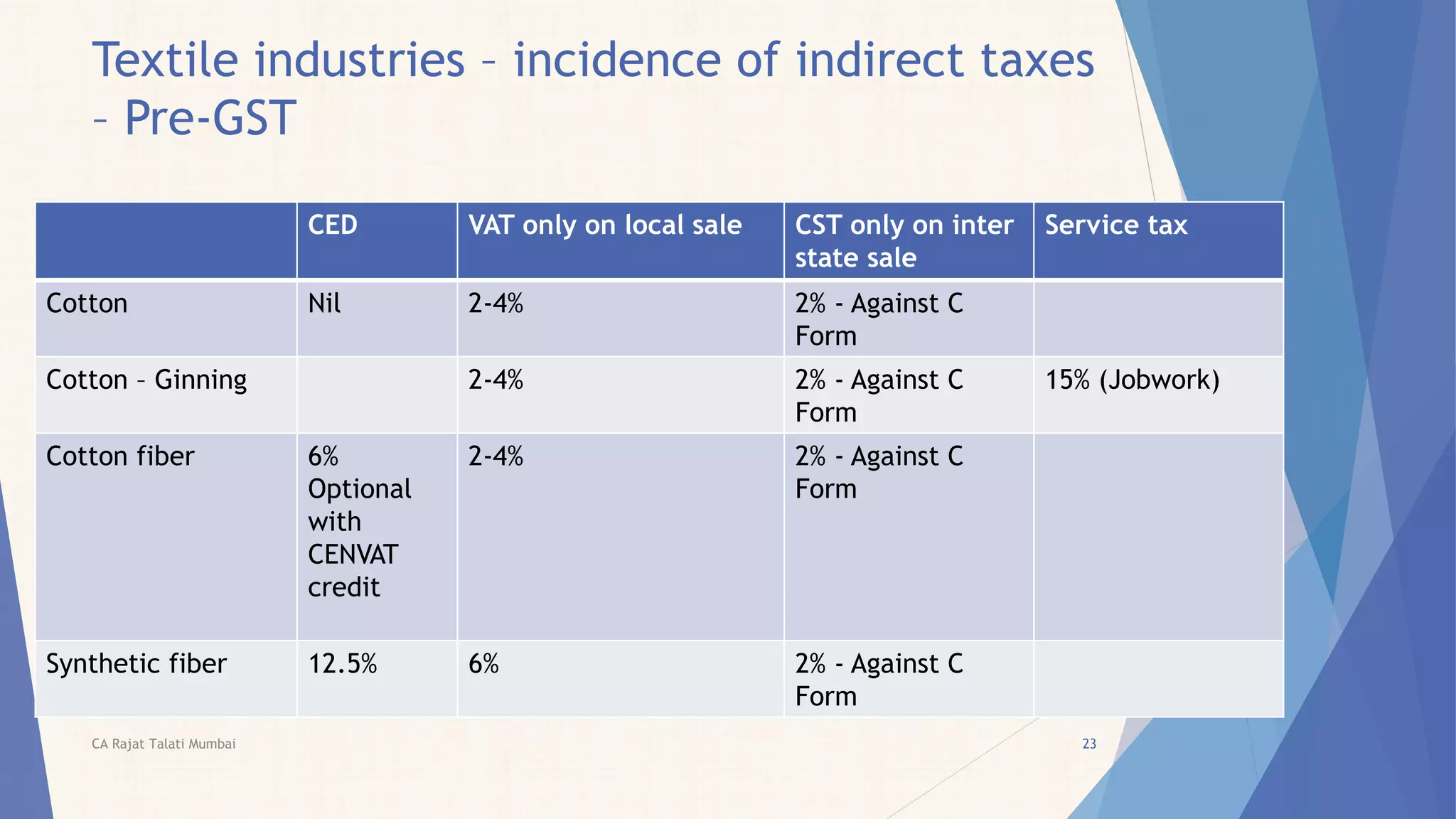

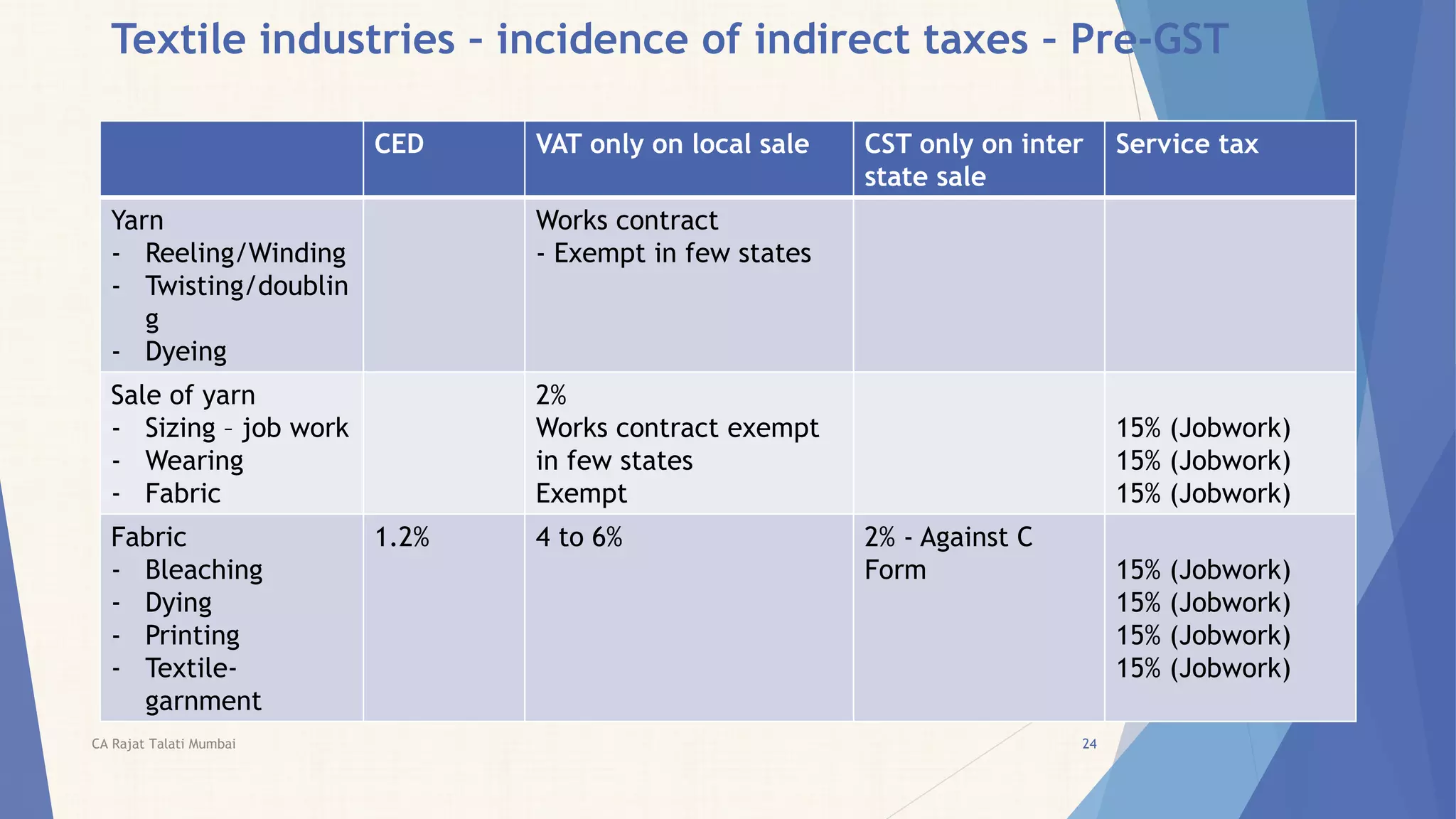

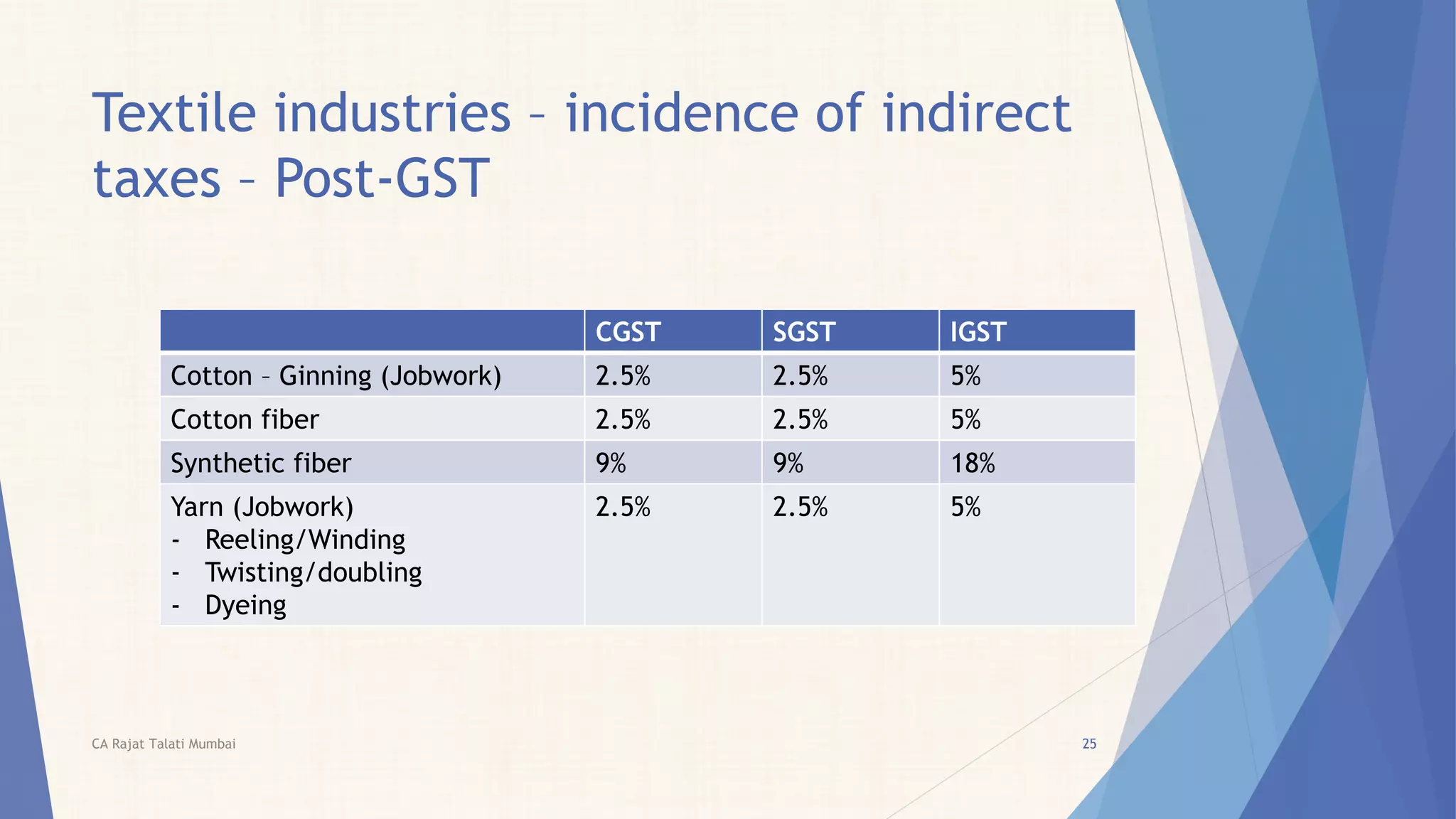

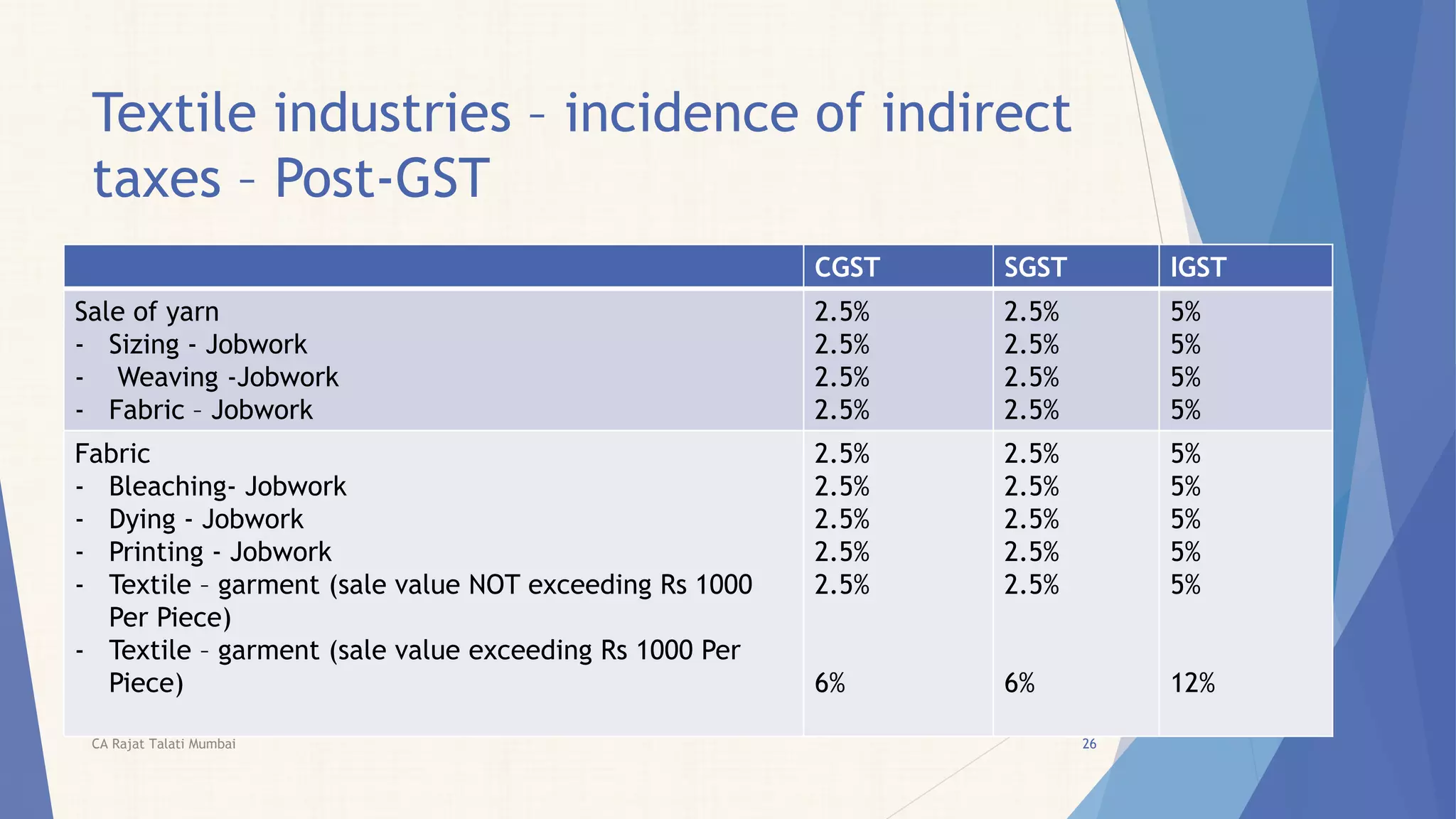

- Under GST, taxes like excise duty, VAT, CST etc. will be subsumed and replaced by CGST, SGST and IGST which will remove cascading of taxes and improve input tax credit flow.

- Overall tax incidence on textiles is expected to increase slightly due to higher GST rates compared to previous taxes. This may impact product mix in the industry.

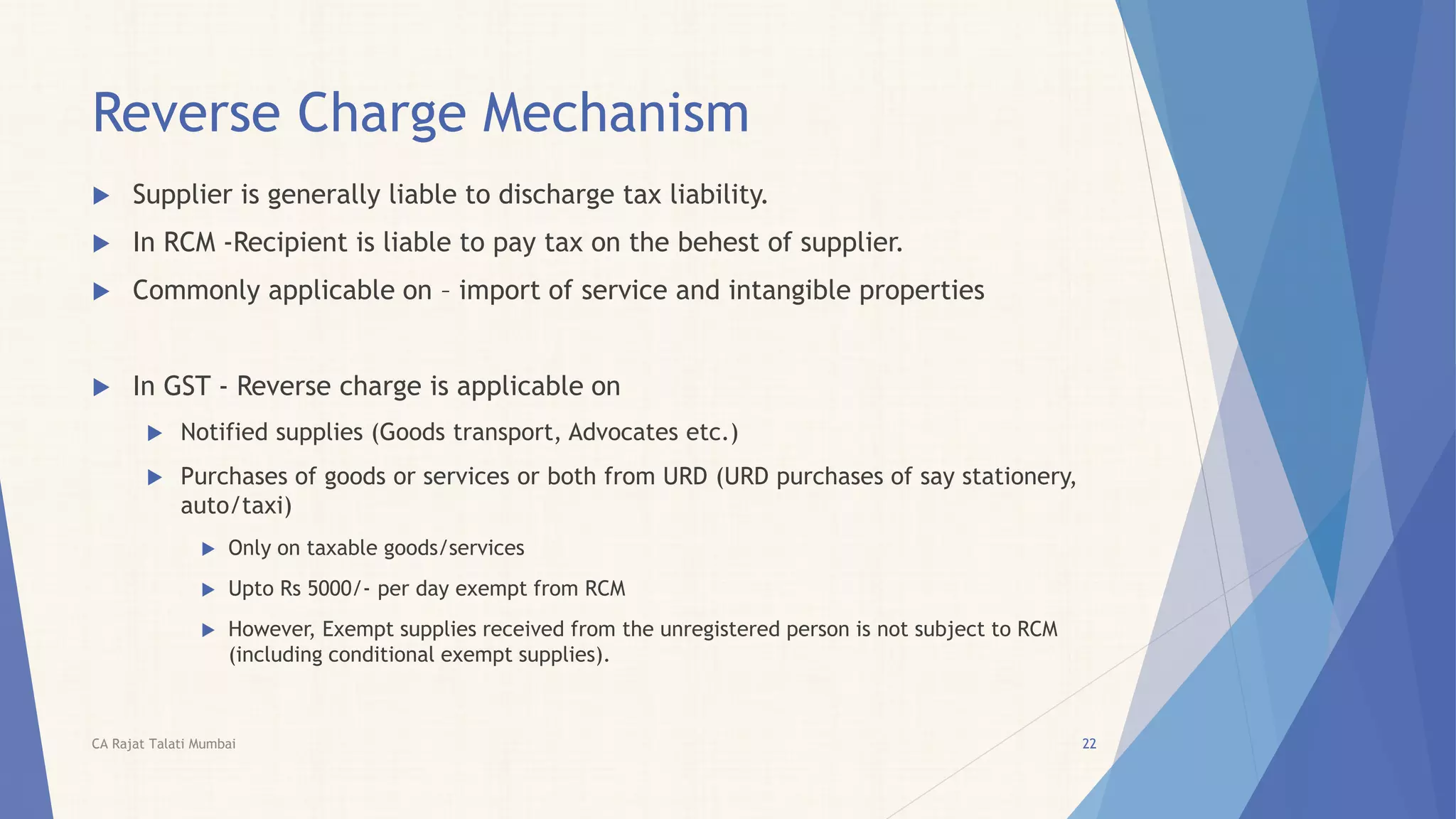

- Compliance burden is also expected to increase initially due to transition challenges but compliance overall will improve in the long run.

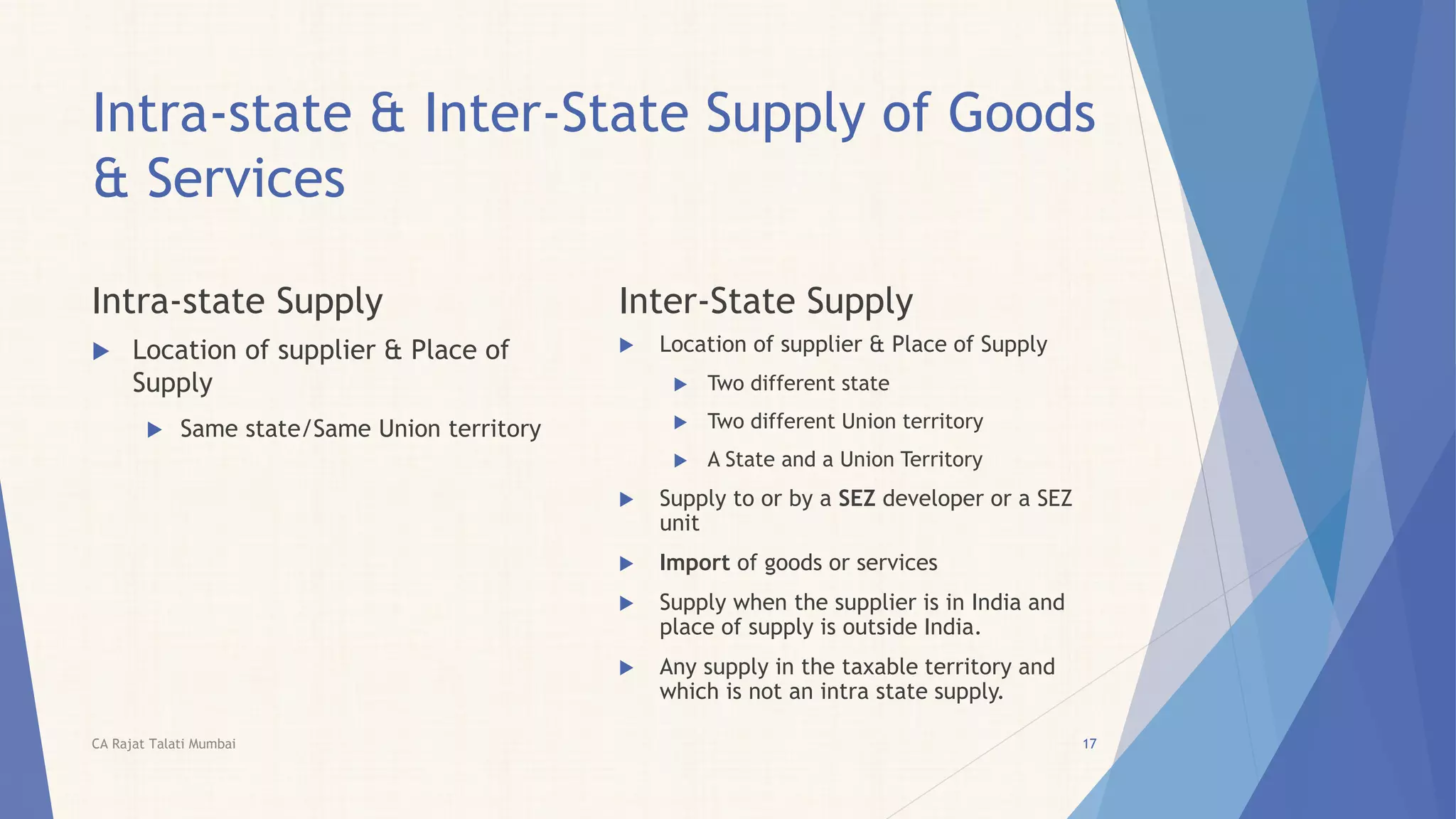

- Inter-state trade barriers will be removed, improving competition and organized

![EXISTING TAX STURUCTURE

Present Tax

Structure

[5 Important

Constituents]

Excise Duty

Entry No. 84,

List I, Schedule

VII

Taxable Event is

Manufacture

Service Tax

Residuary Entry

No. 97, List I,

Schedule VII

Taxable Event is

Provision of

Service

Sales Tax /

VAT/ CST

Entry No. 54 of

List II (VAT) and

92A of List I

(CST)

Taxable Event is

Sale

Customs

Duty

Entry No. 83,

List I, Schedule

VII

Taxable Event is

Import & Export

Entry Tax/

Entertainme

nt Tax

Entry No. 52

&62 List II,

Schedule VII

Taxable Event is

Entertainment

& Entry of

Goods

6

CA Rajat Talati Mumbai 6](https://image.slidesharecdn.com/impact-of-gst-on-textile-industry-170826063828/75/Impact-of-gst-on-textile-industry-6-2048.jpg)

![Activities to be treated neither as supply of

goods nor supply of services [Schedule III] -

excerpt

Services provided by employee to employer

Sale of land

Sale of building is not a supply except where it is constructed with the

intention to sale it. E.g. residential or commercial complex constructed by

Construction Company for the purpose of sale to intended buyer will be

considered as supply of service.

Actionable claims is not a supply. However, lottery, betting and gambling is

considered as supply for the purpose of GST.

13CA Rajat Talati Mumbai](https://image.slidesharecdn.com/impact-of-gst-on-textile-industry-170826063828/75/Impact-of-gst-on-textile-industry-13-2048.jpg)

![Impact on Textile Industry

Incidence of tax on garment & …… even after considering the full ITC would be

more

Could be shift in blended fabric towards more use of manmade fiber.

Higher incidence of tax on cotton based yarn.

No fiscal barrier in interstate trade

Incidence of tax on capital goods will reduce as full ITC available

Since, other than Basic Customs Duty every other taxes is available as ITC [IGST, SGST &

CGST]

Improved compliance

Better control on allowance of ITC

Higher Revenue to the Govt

Competitive market for organized sector.

CA Rajat Talati Mumbai 28](https://image.slidesharecdn.com/impact-of-gst-on-textile-industry-170826063828/75/Impact-of-gst-on-textile-industry-28-2048.jpg)