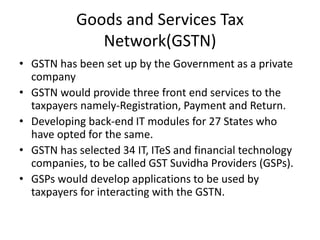

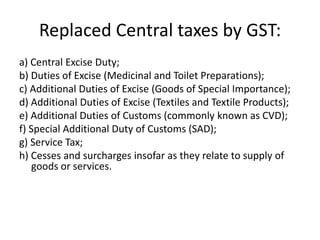

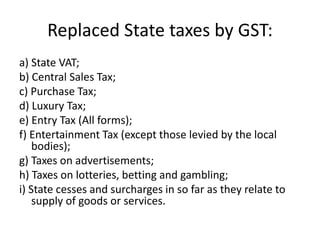

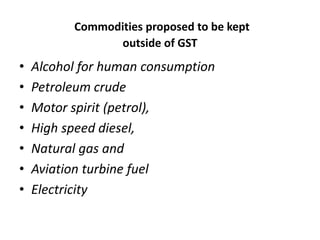

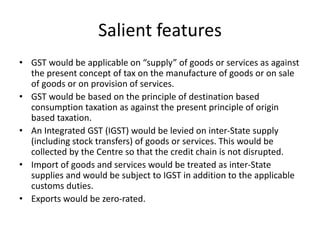

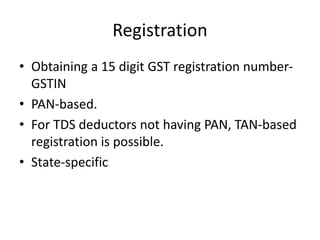

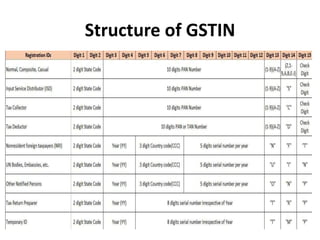

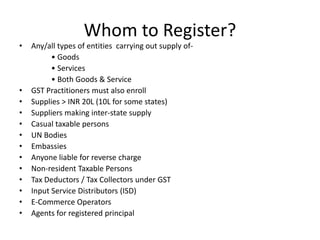

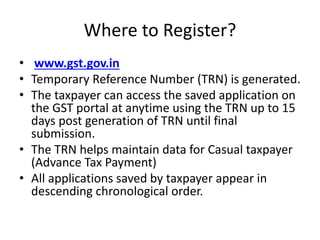

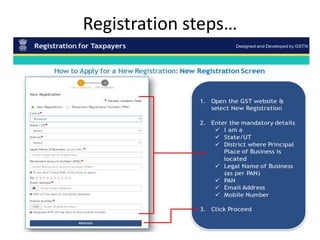

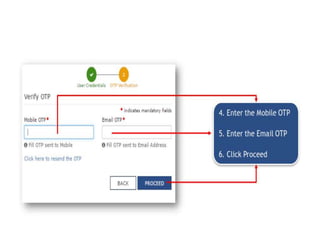

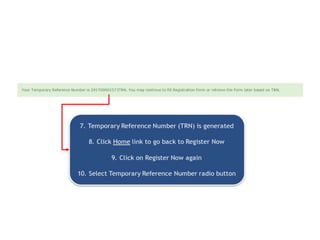

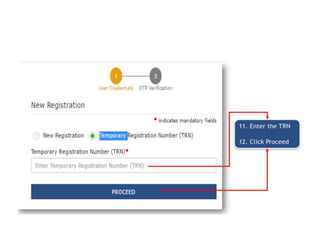

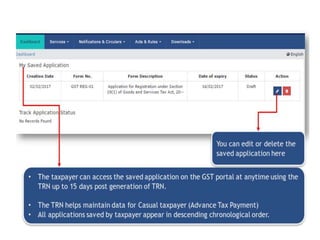

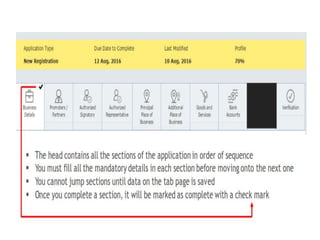

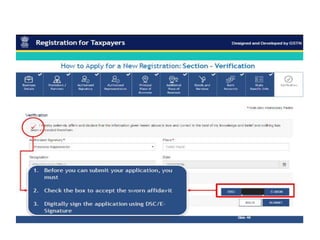

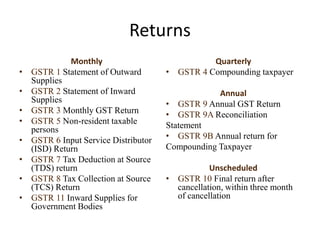

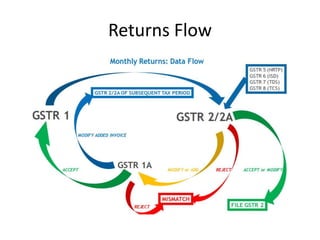

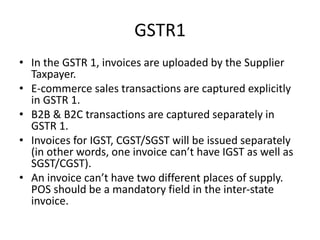

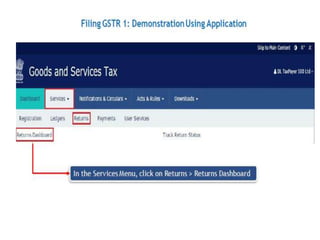

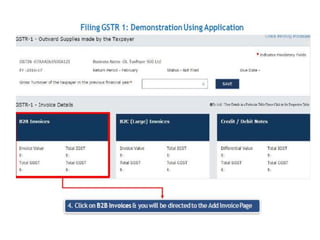

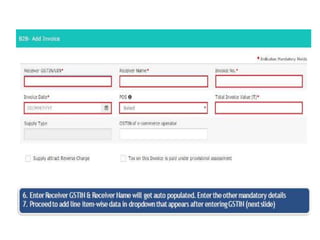

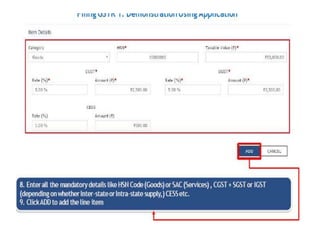

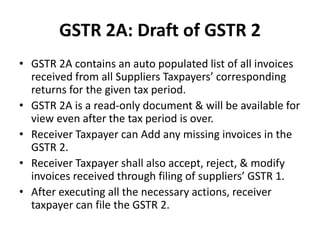

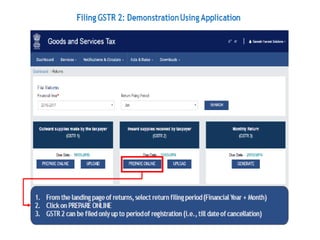

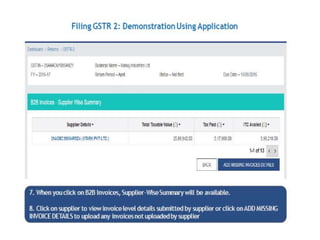

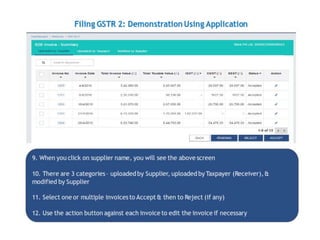

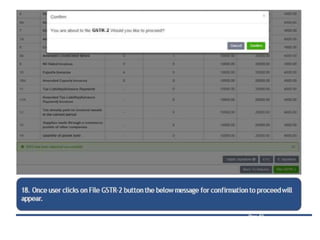

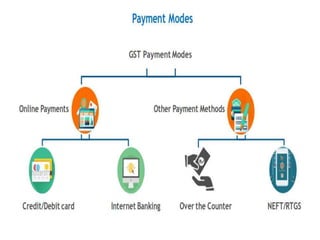

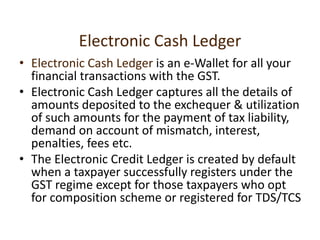

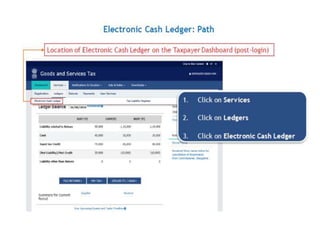

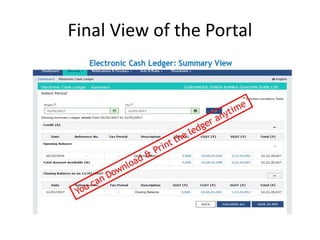

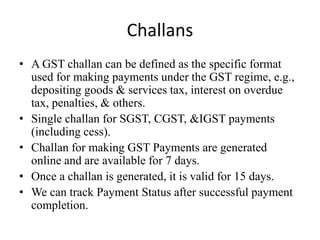

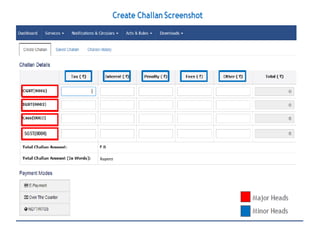

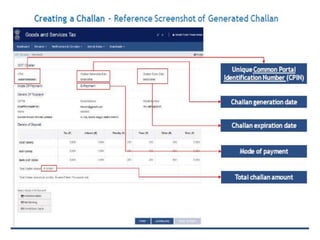

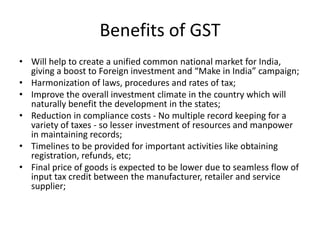

The document provides an overview of Goods and Services Tax (GST) procedures and rules in India. It discusses key aspects of GST including the 122nd constitutional amendment that introduced GST, the Goods and Services Tax Council, the GST Network system, taxes subsumed under GST, registration procedures, filing of returns, payment methods, and benefits of GST such as creating a unified market, reducing compliance costs, and lowering final prices. In summary, the document outlines the legislative and administrative framework for implementing GST in India with the goal of simplifying and harmonizing indirect taxes.