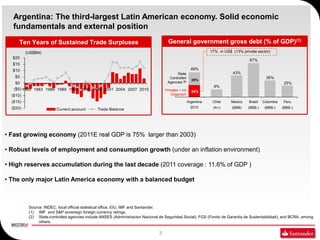

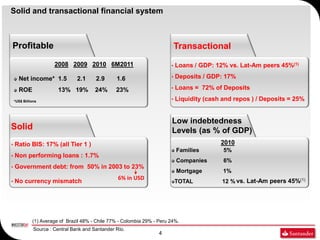

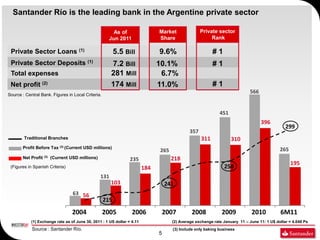

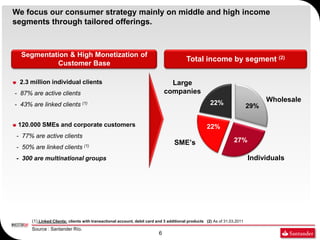

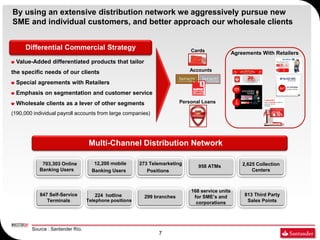

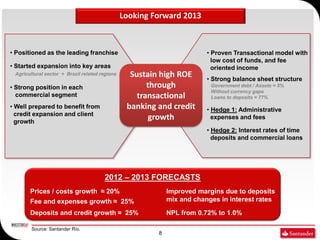

The document outlines forward-looking statements made by Banco Santander Río and Banco Santander, highlighting significant risks and uncertainties that could affect their business and financial performance. It presents Argentina's strong economic position and the bank's leading role in the private sector, underscored by solid financial metrics and strategic focus on middle and high-income segments. Additionally, it discusses the bank's future strategies for expansion and growth in various commercial sectors while managing risks associated with market fluctuations.