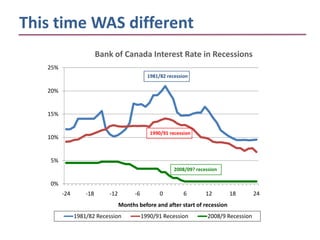

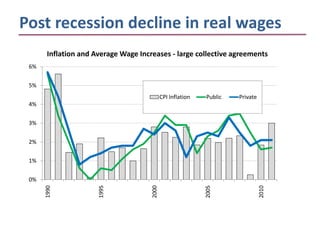

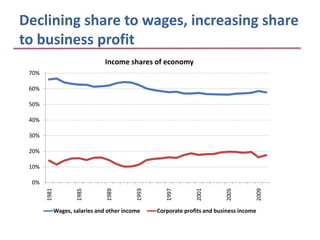

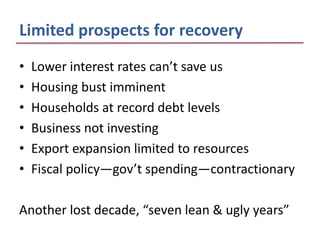

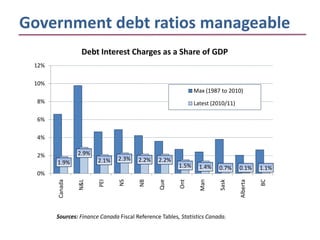

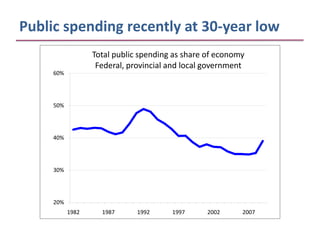

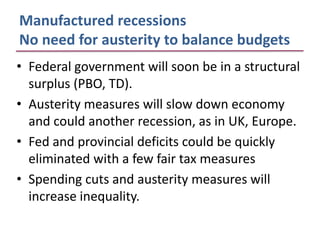

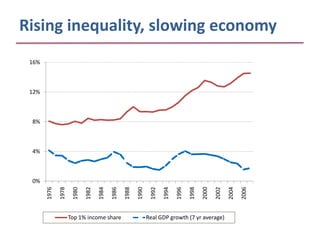

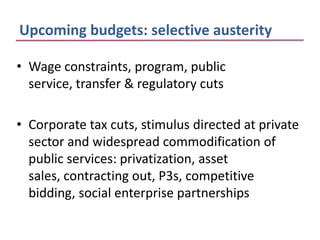

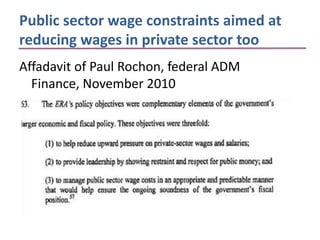

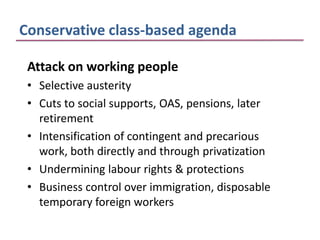

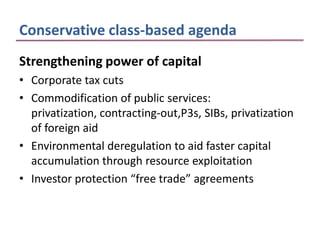

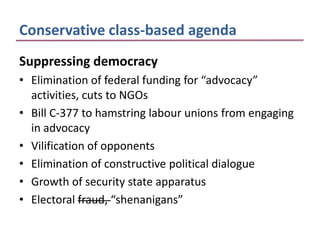

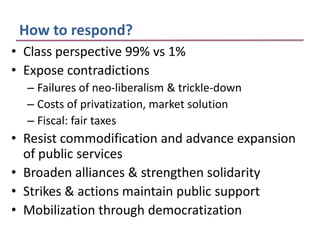

The document summarizes the economic impacts of austerity measures in Canada. It argues that [1] austerity will likely lead to another recession as it has in other countries, [2] government debt ratios are manageable and deficits could be eliminated through fair tax measures instead of spending cuts, and [3] austerity disproportionately impacts working people and increases inequality. The response should expose the failures of neoliberalism and privatization, advocate for fair taxes, resist commodification of public services, and build alliances through mobilization and democratic participation.