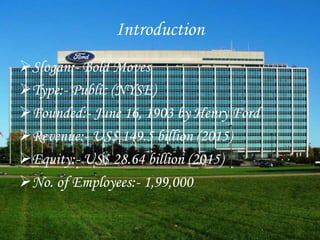

Equity shares are ordinary shares that are the main source of finance for companies, giving investors voting rights. There are different types like bonus shares and right shares. Equity shares provide rights to income, control, and liquidation. Ford Motors is a public company founded in 1903 that had $149.5 billion in revenue and $28.64 billion in equity in 2015, employing 199,000 people. Investing in equity shares provides advantages like control and risk but also disadvantages like higher risk and limited borrowing capacity.