1) The document outlines key lessons learned from a corporate finance course, including that companies should choose projects and capital structures that maximize shareholder value.

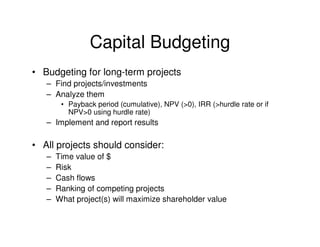

2) Capital budgeting involves finding and analyzing long-term investment projects using techniques like payback period, NPV, and IRR to select projects that maximize shareholder value.

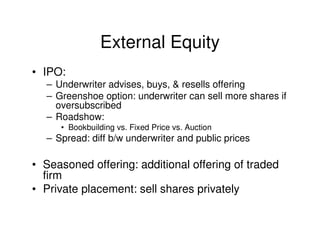

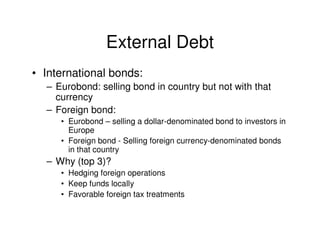

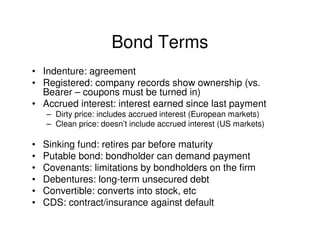

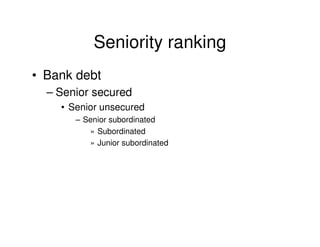

3) When raising external equity or debt, companies should consider the various financing options and terms to minimize their overall cost of capital.