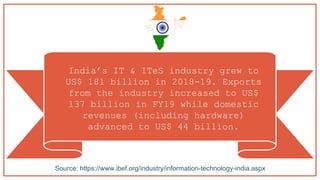

The document outlines the historical growth of the global and Indian software industries, highlighting key developments in operating systems, application and enterprise software, and the rise of cloud computing. It discusses the market size and growth projections, noting that India's IT and ITES industry reached $181 billion in 2018-19, primarily driven by exports to North America. The document also identifies major players and the role of industry associations like NASSCOM in market development and collaboration.