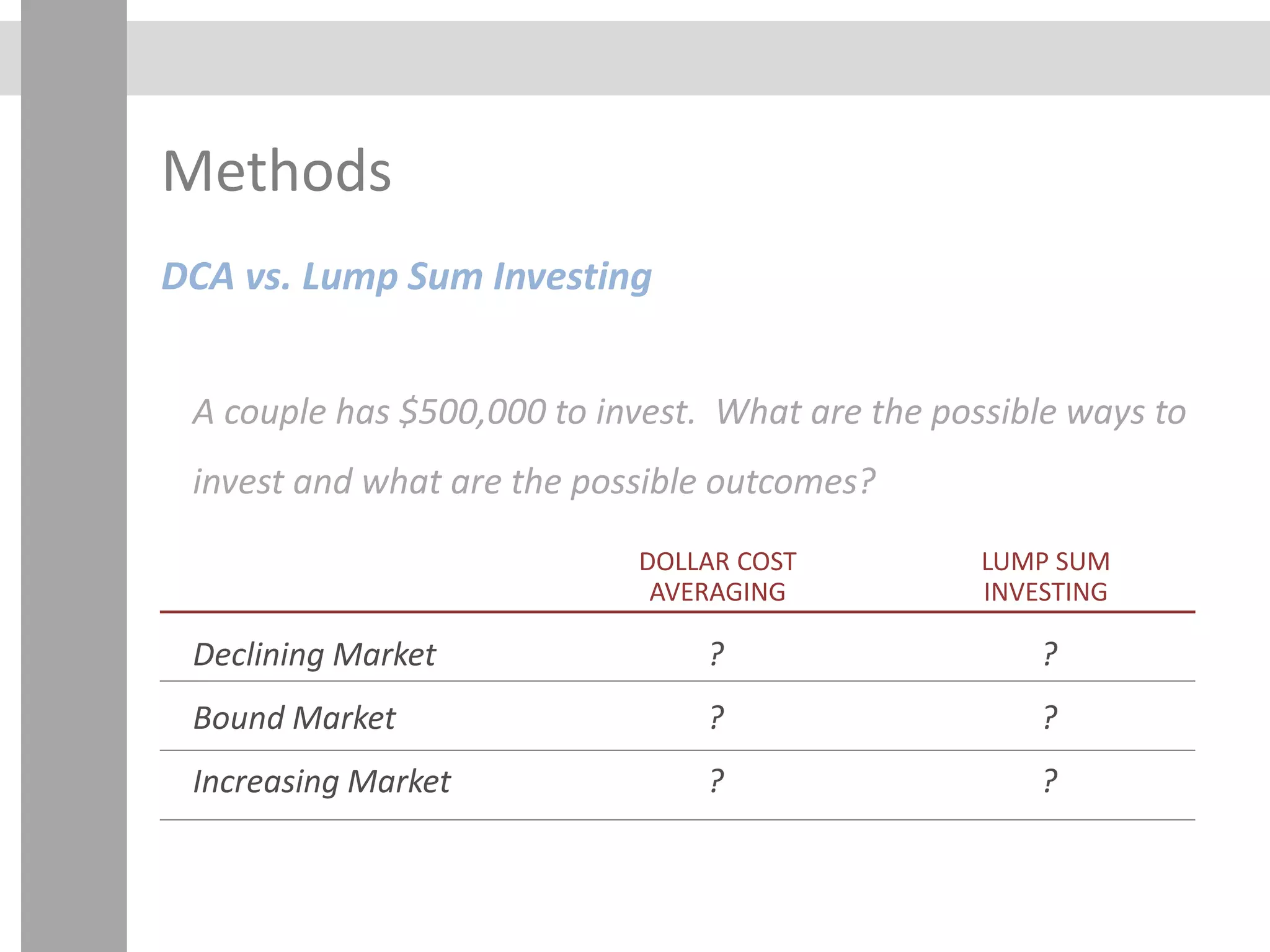

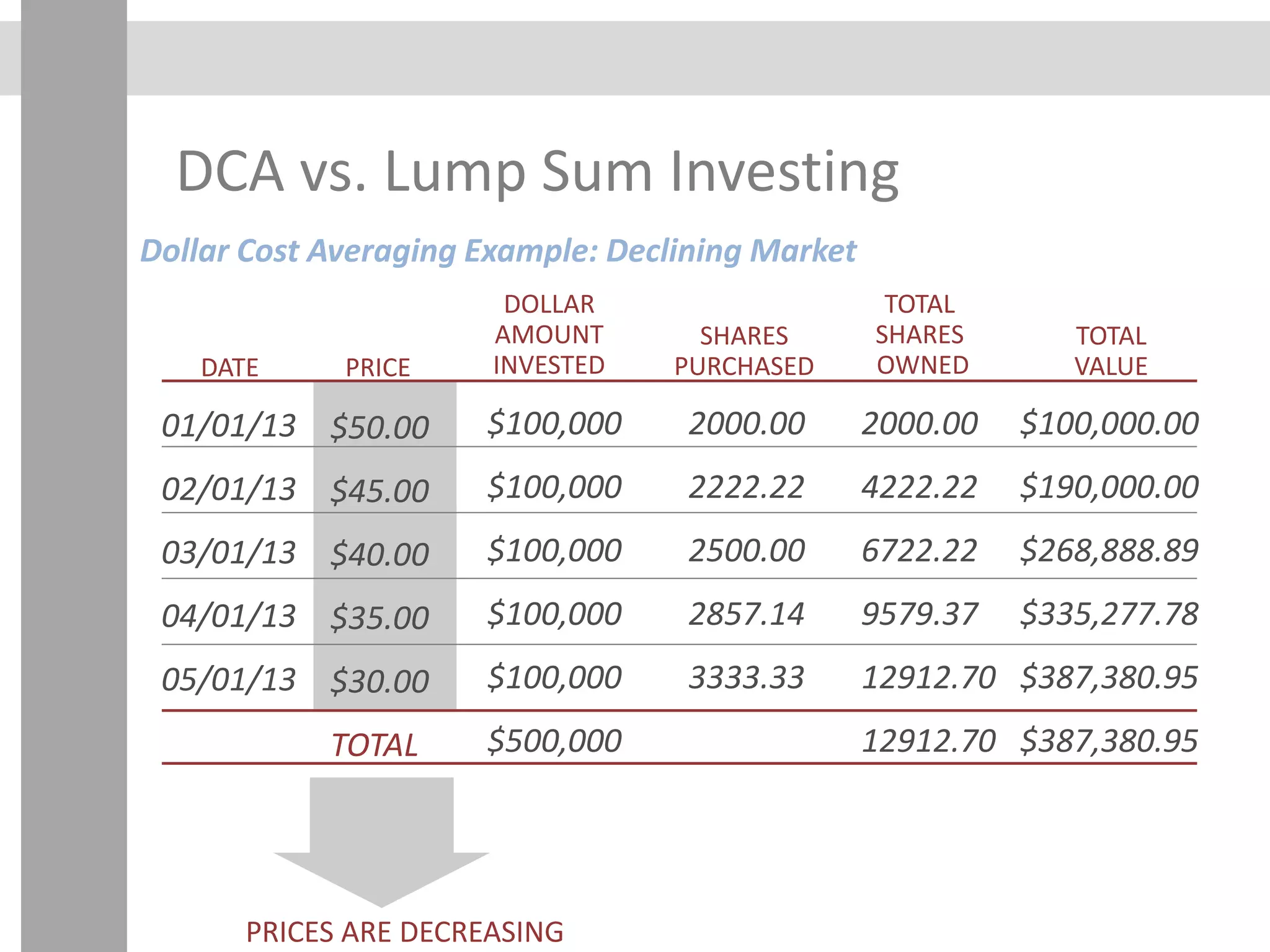

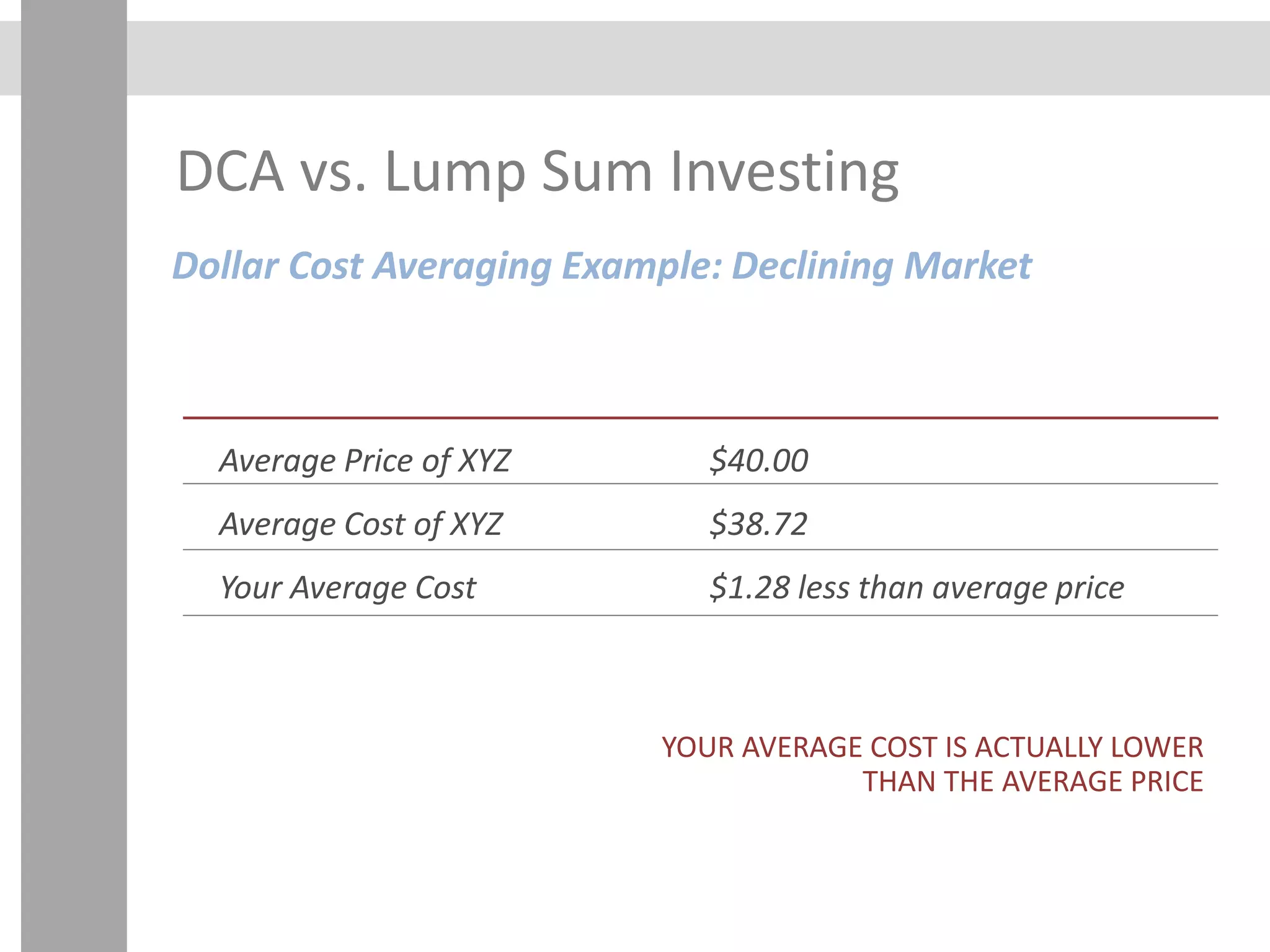

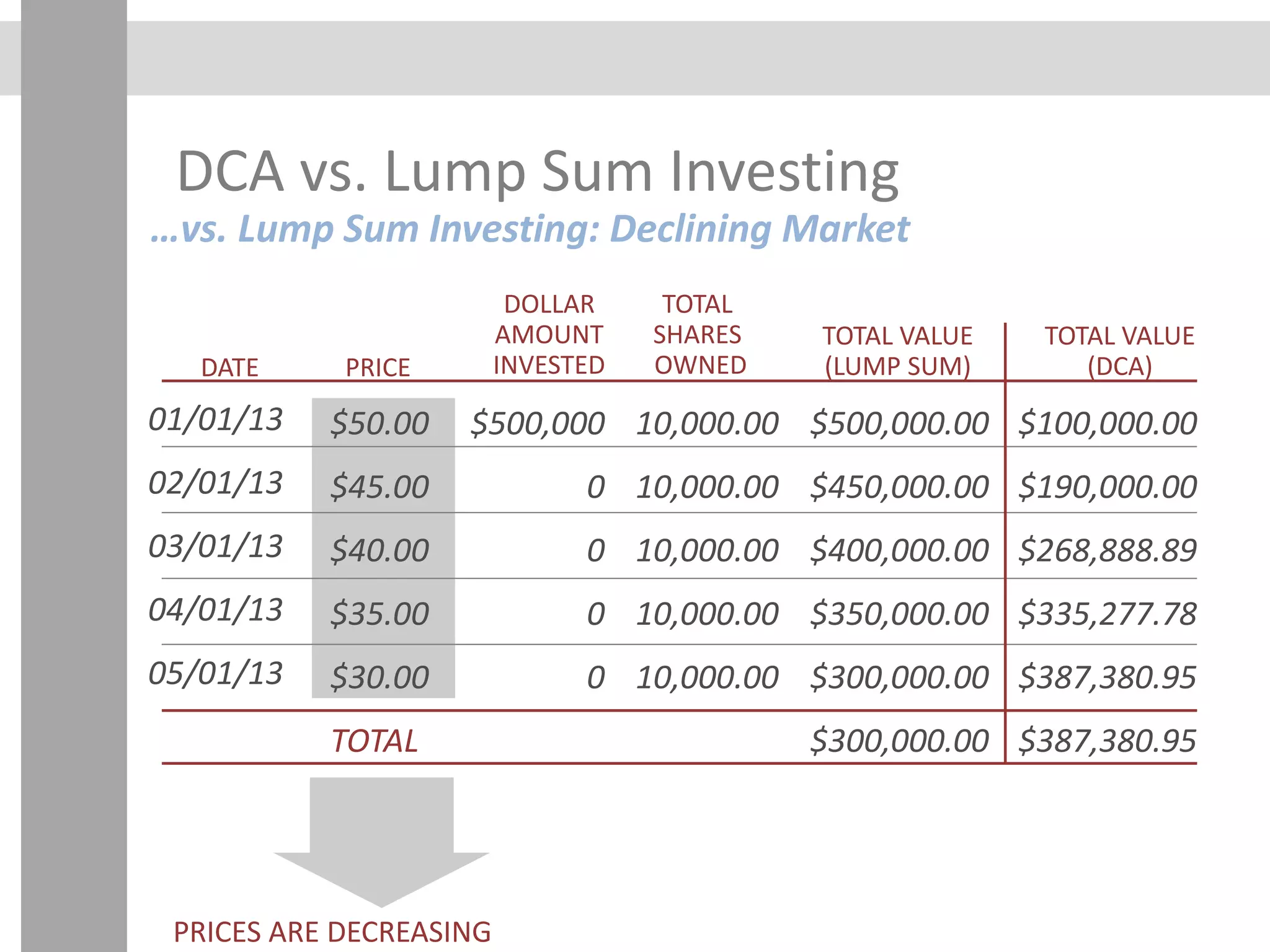

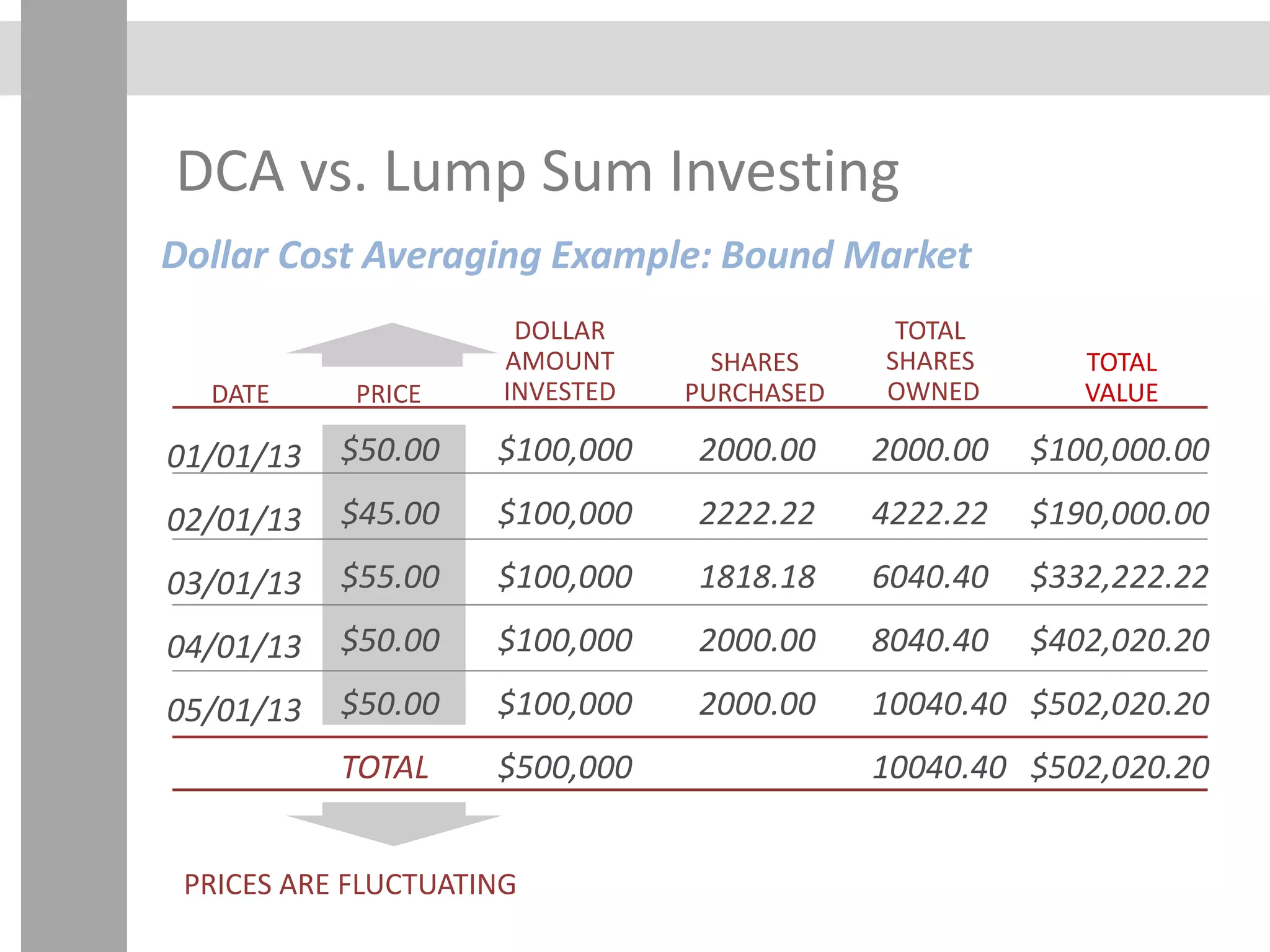

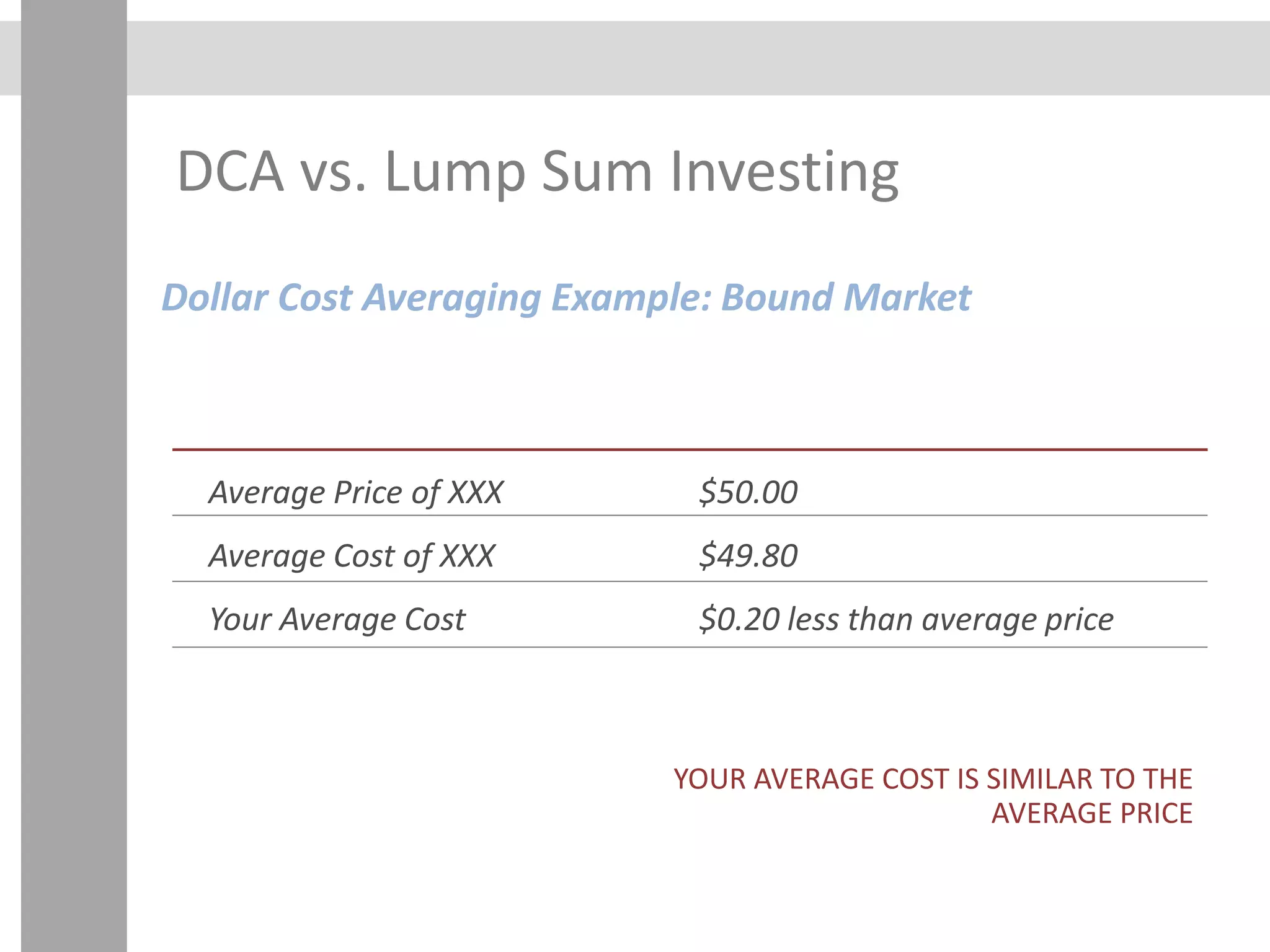

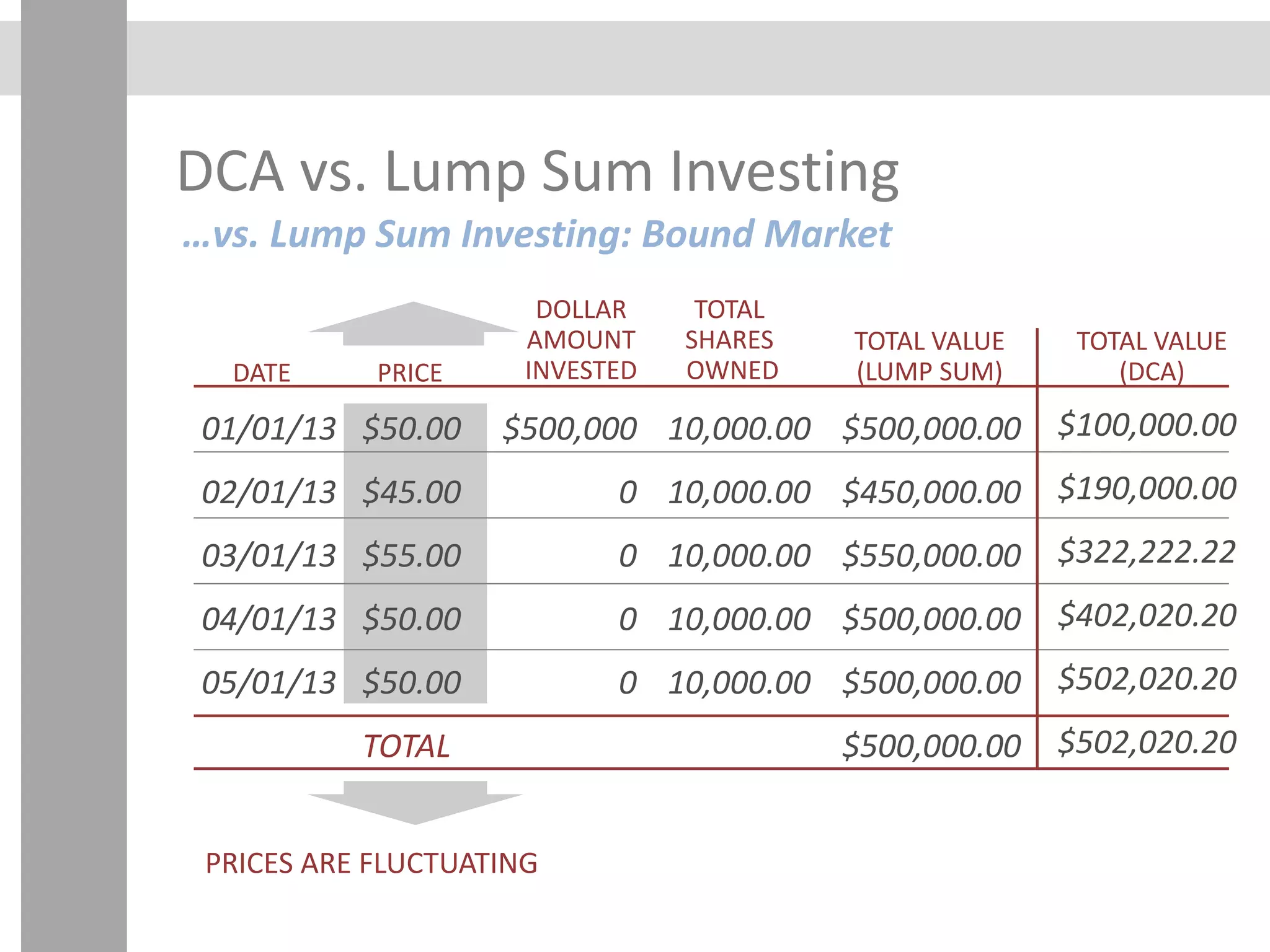

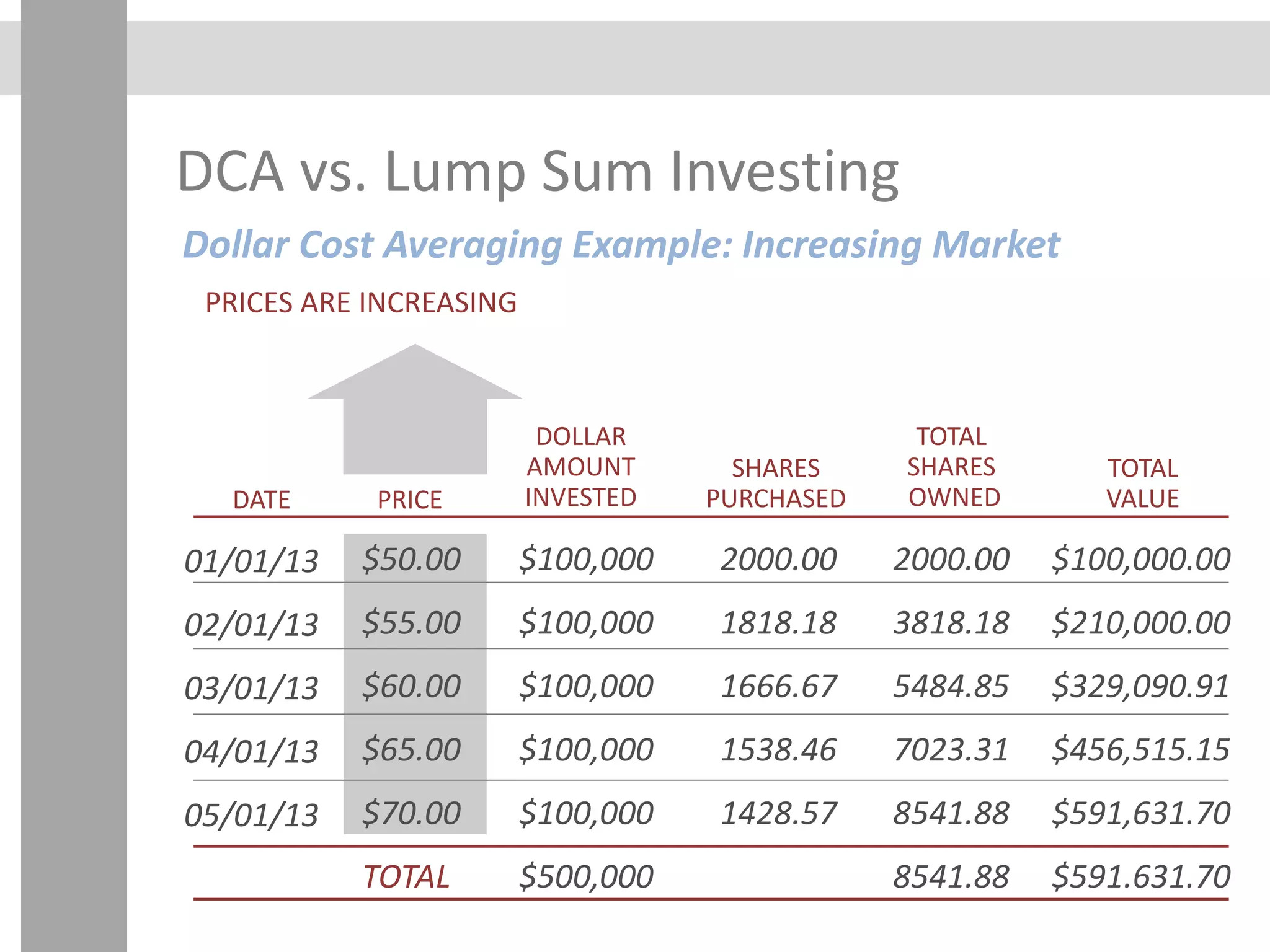

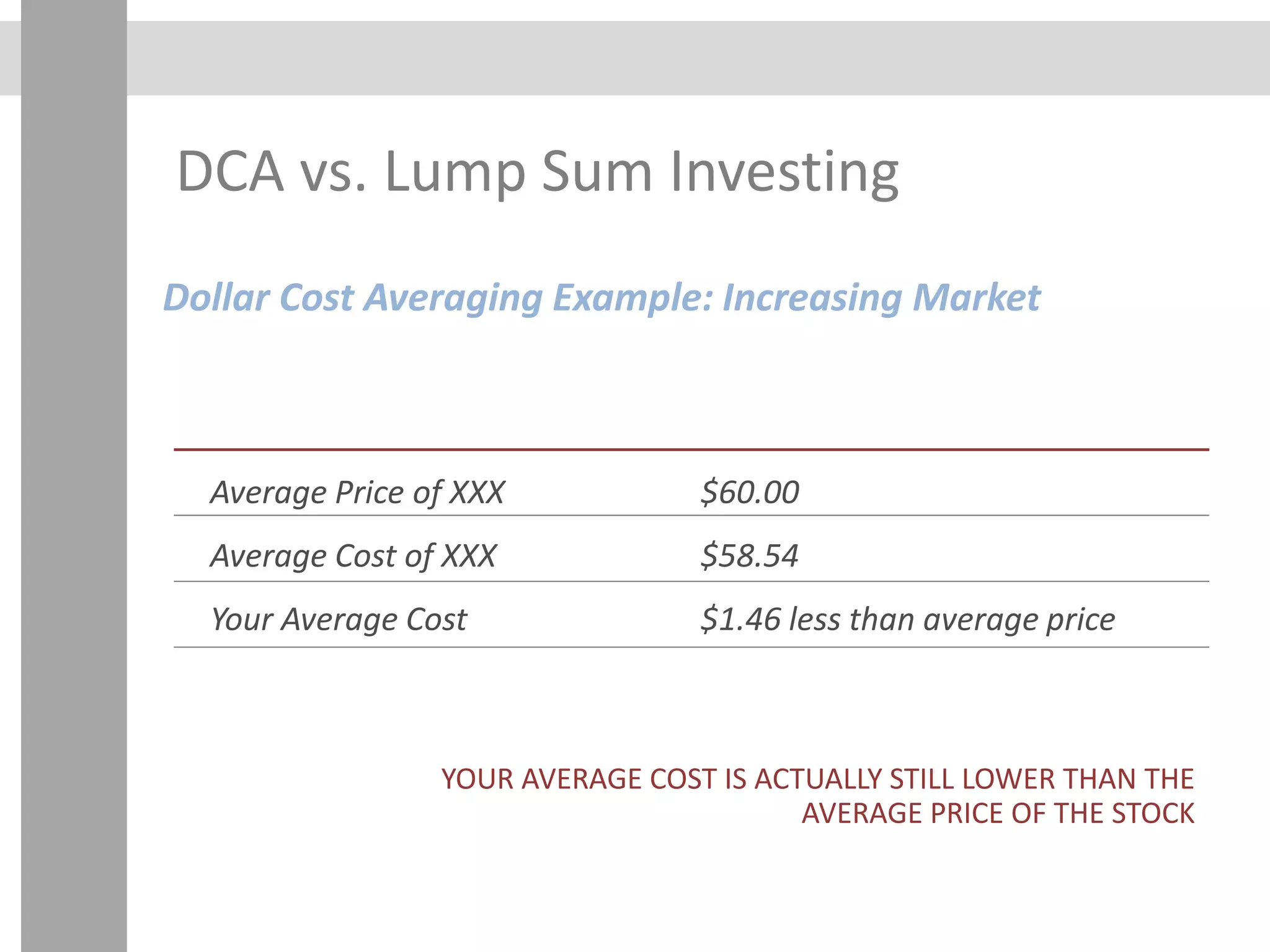

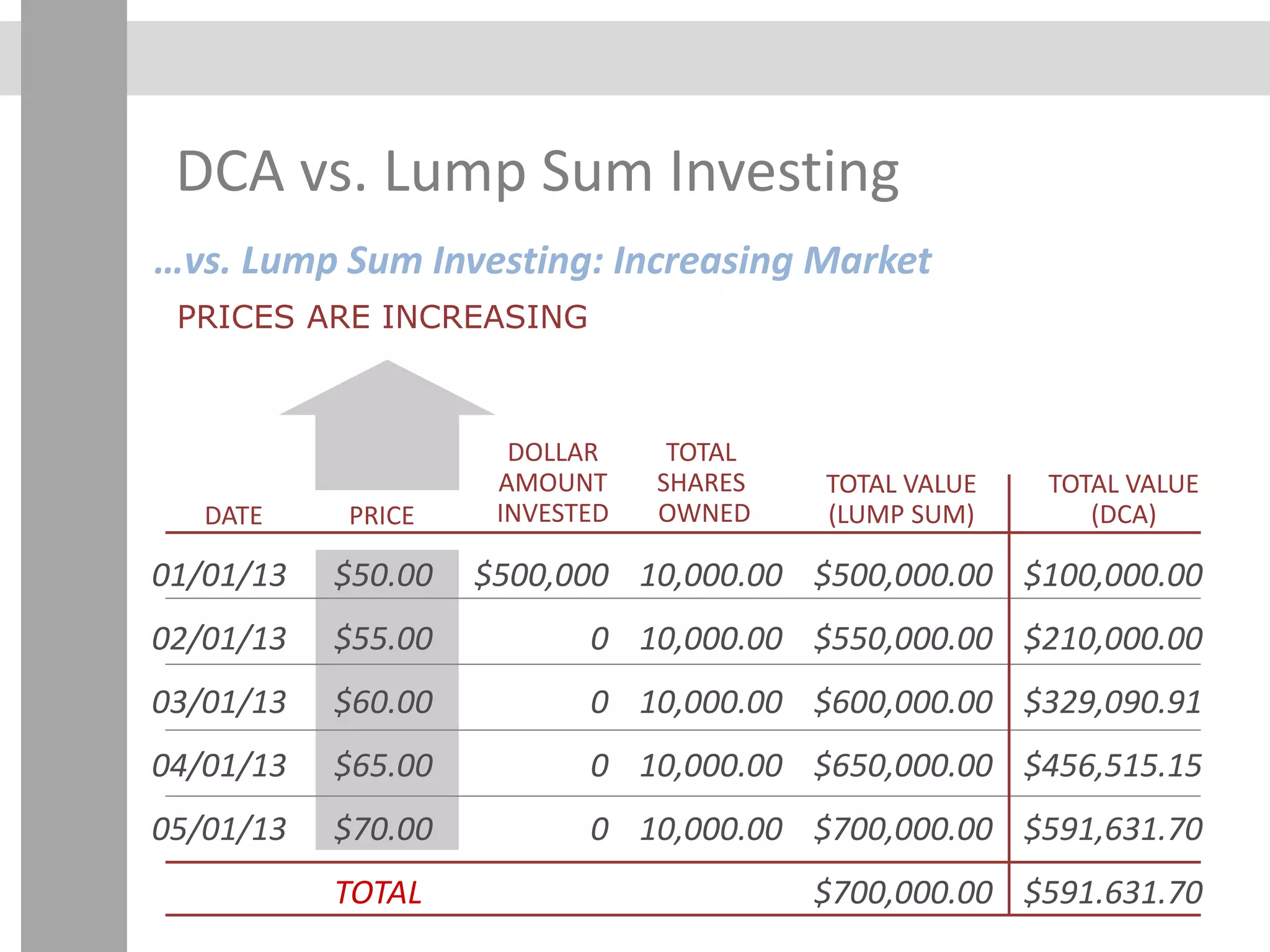

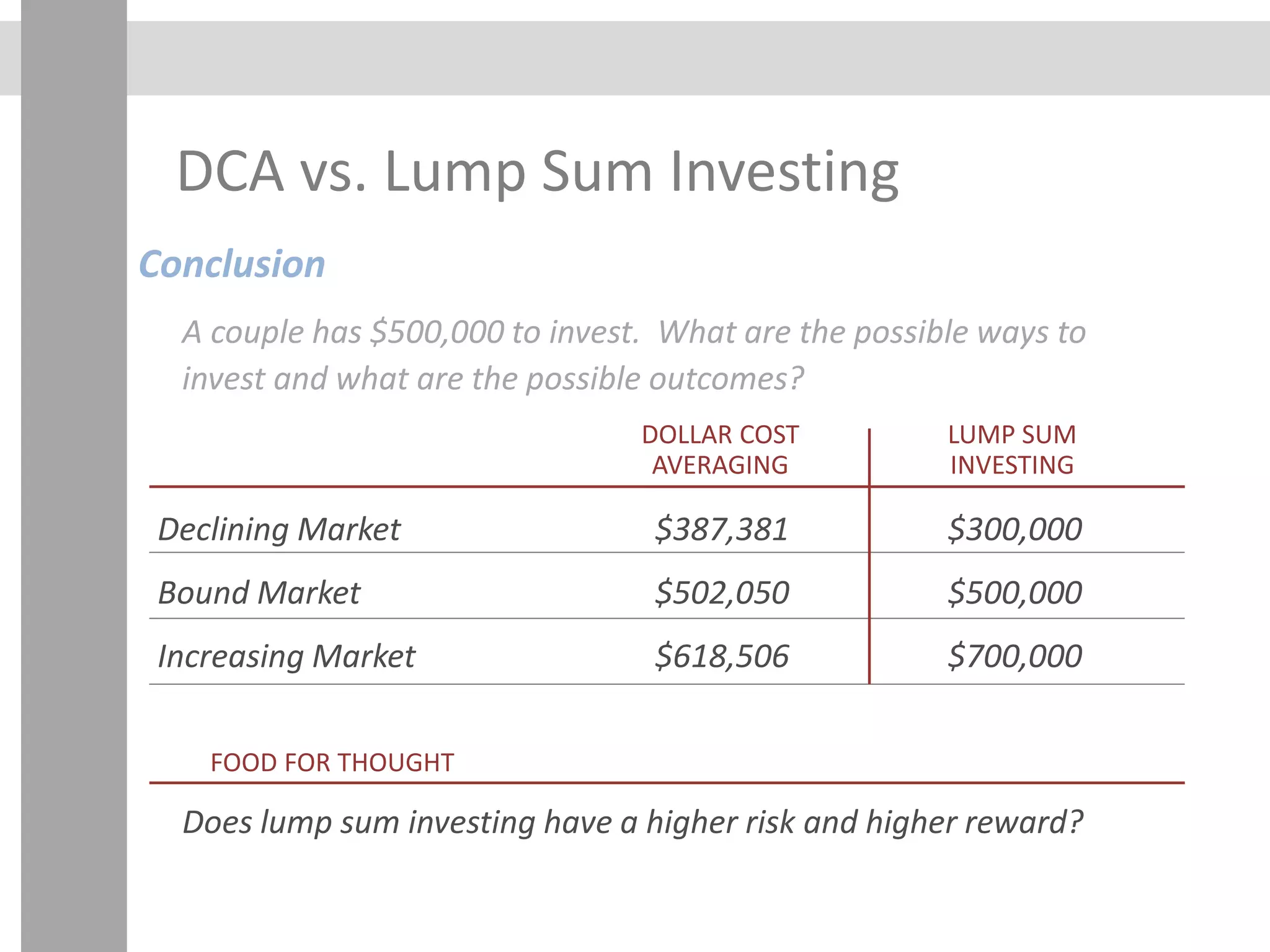

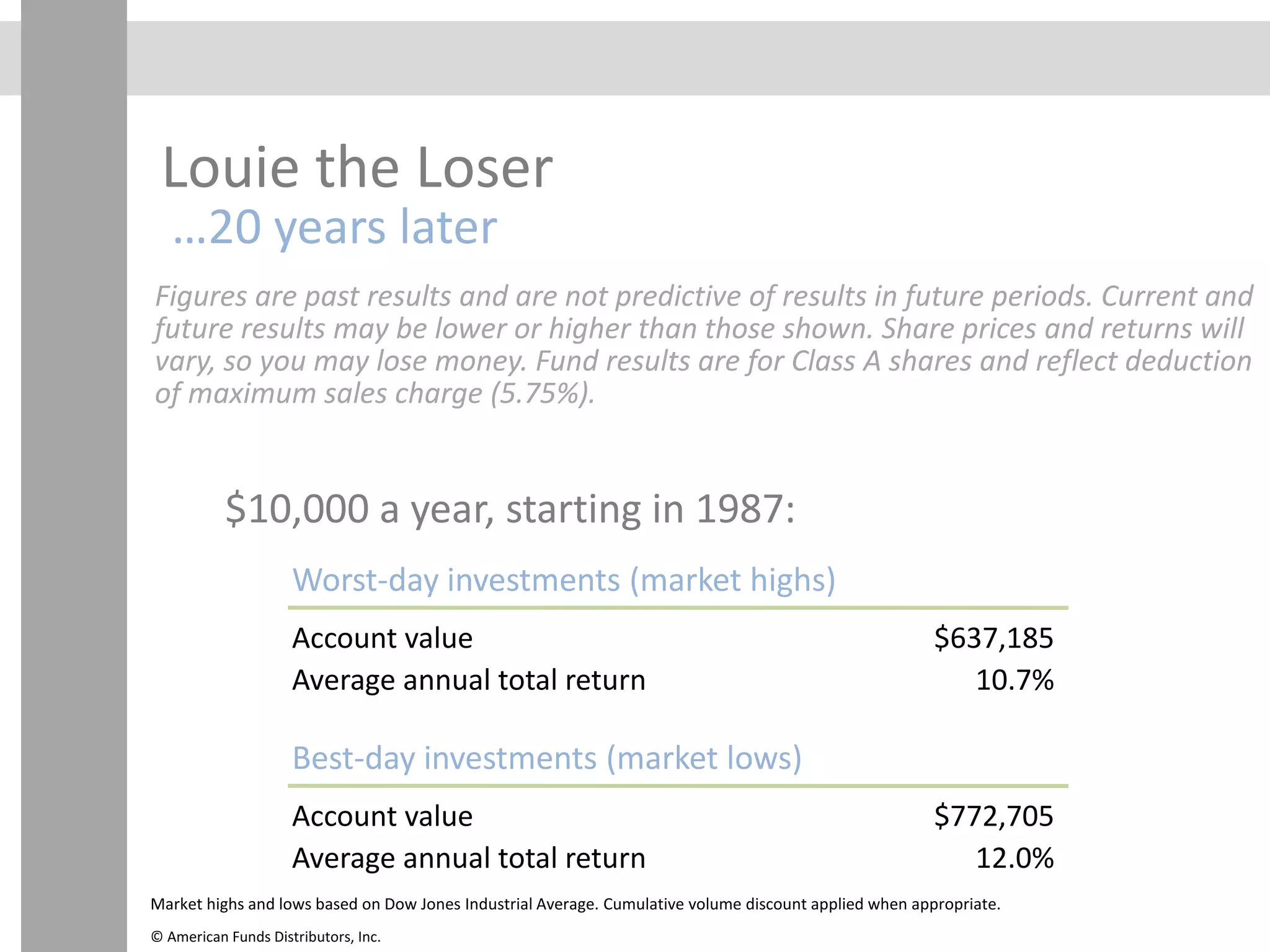

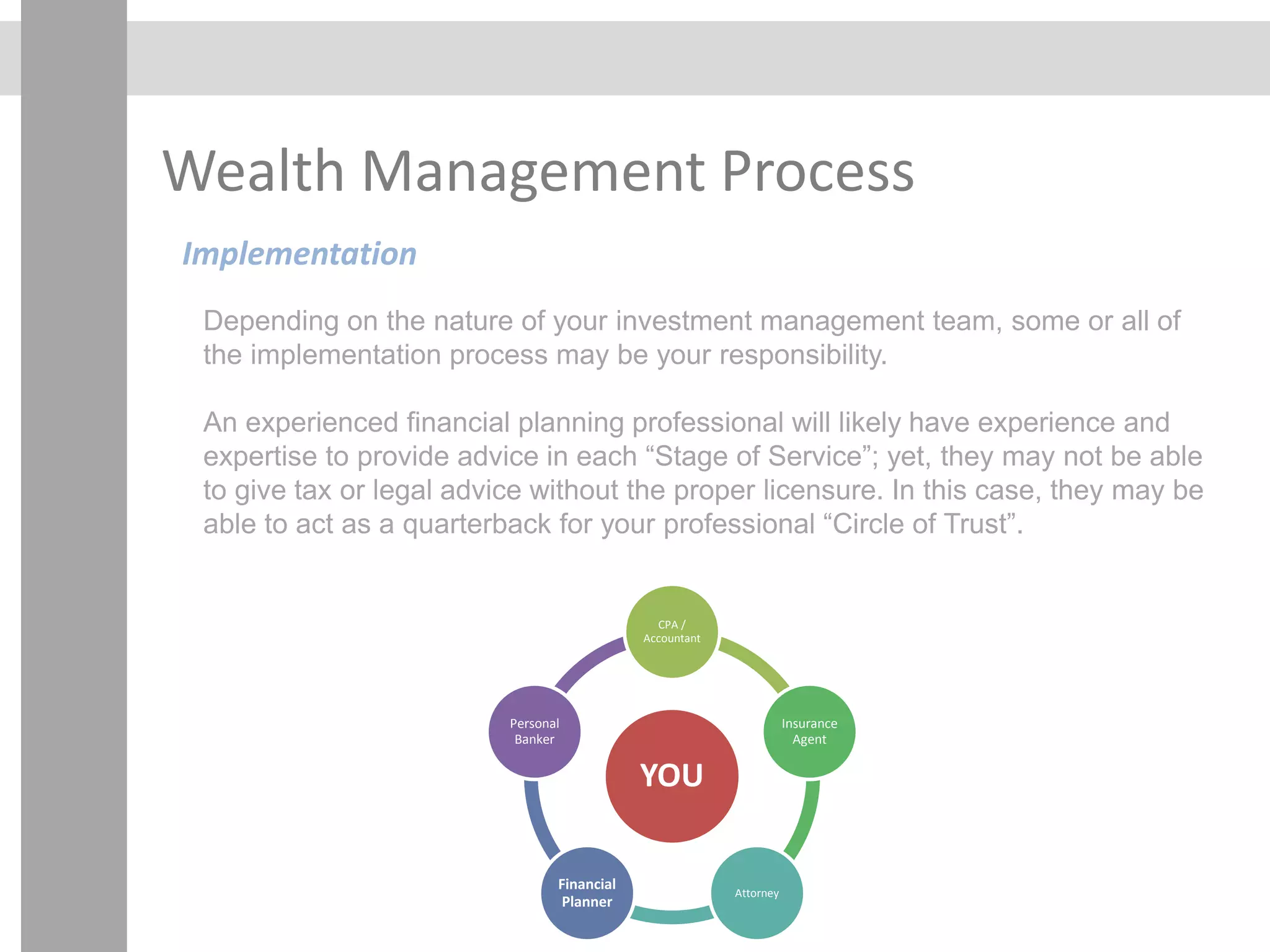

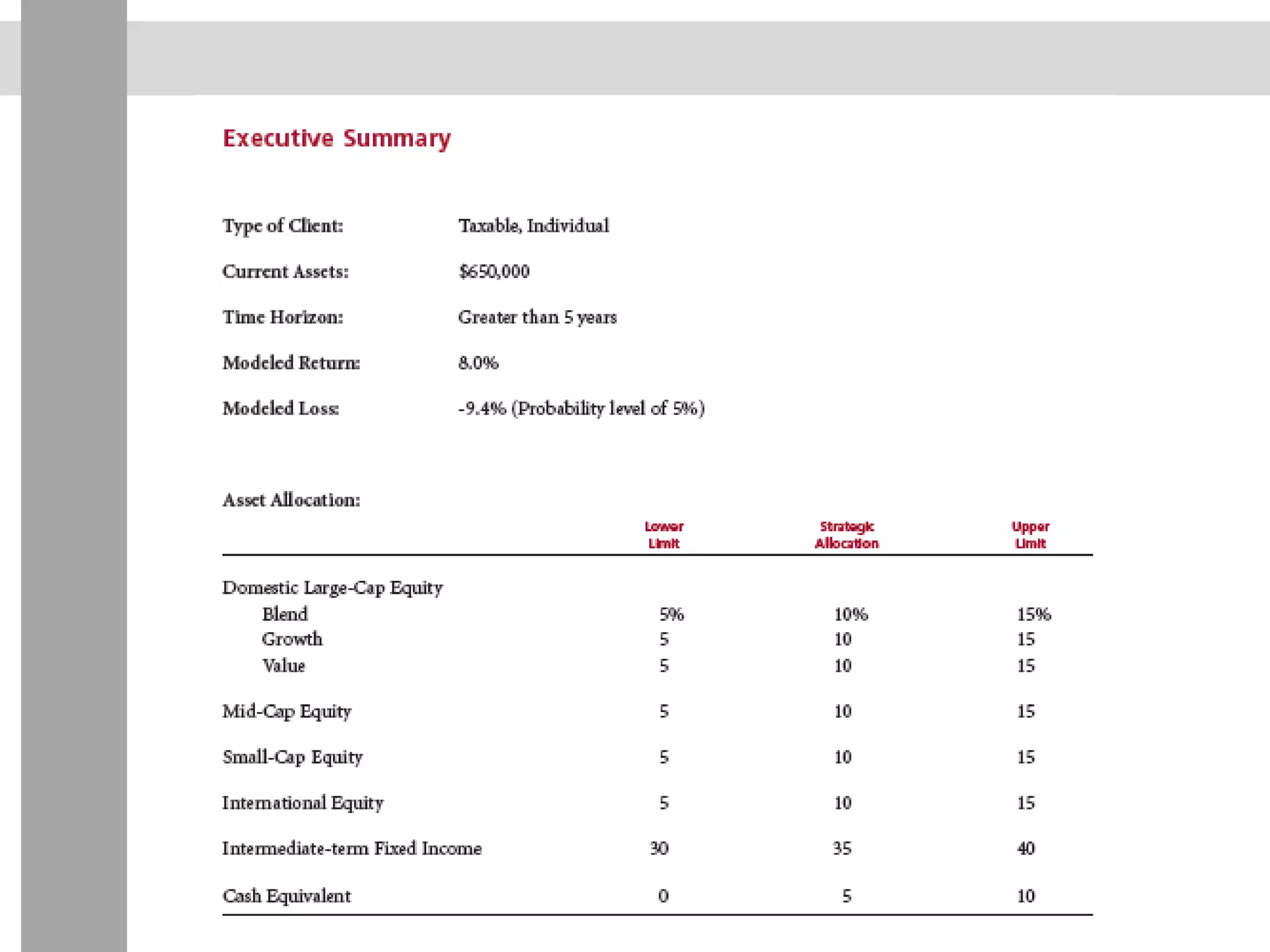

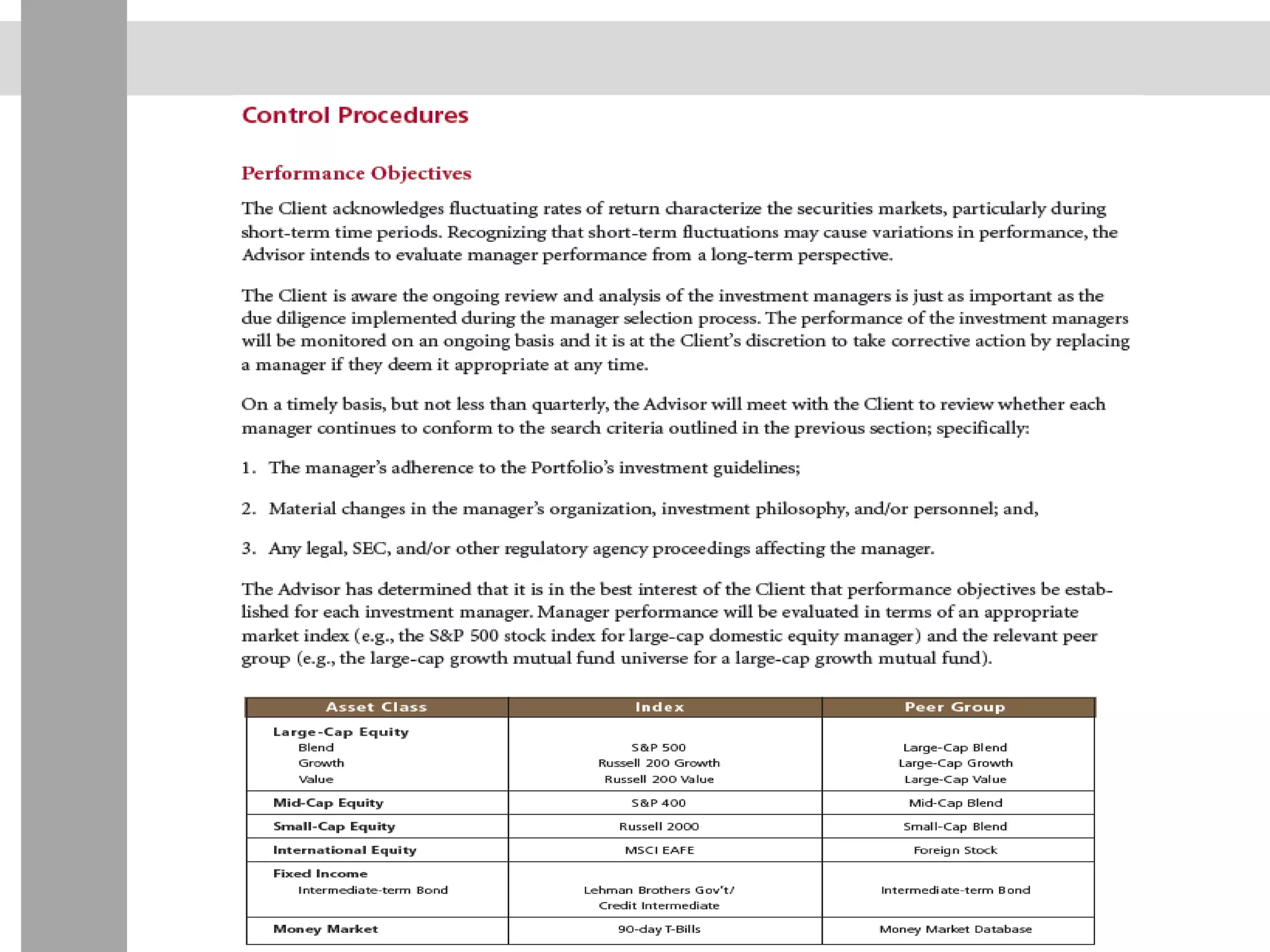

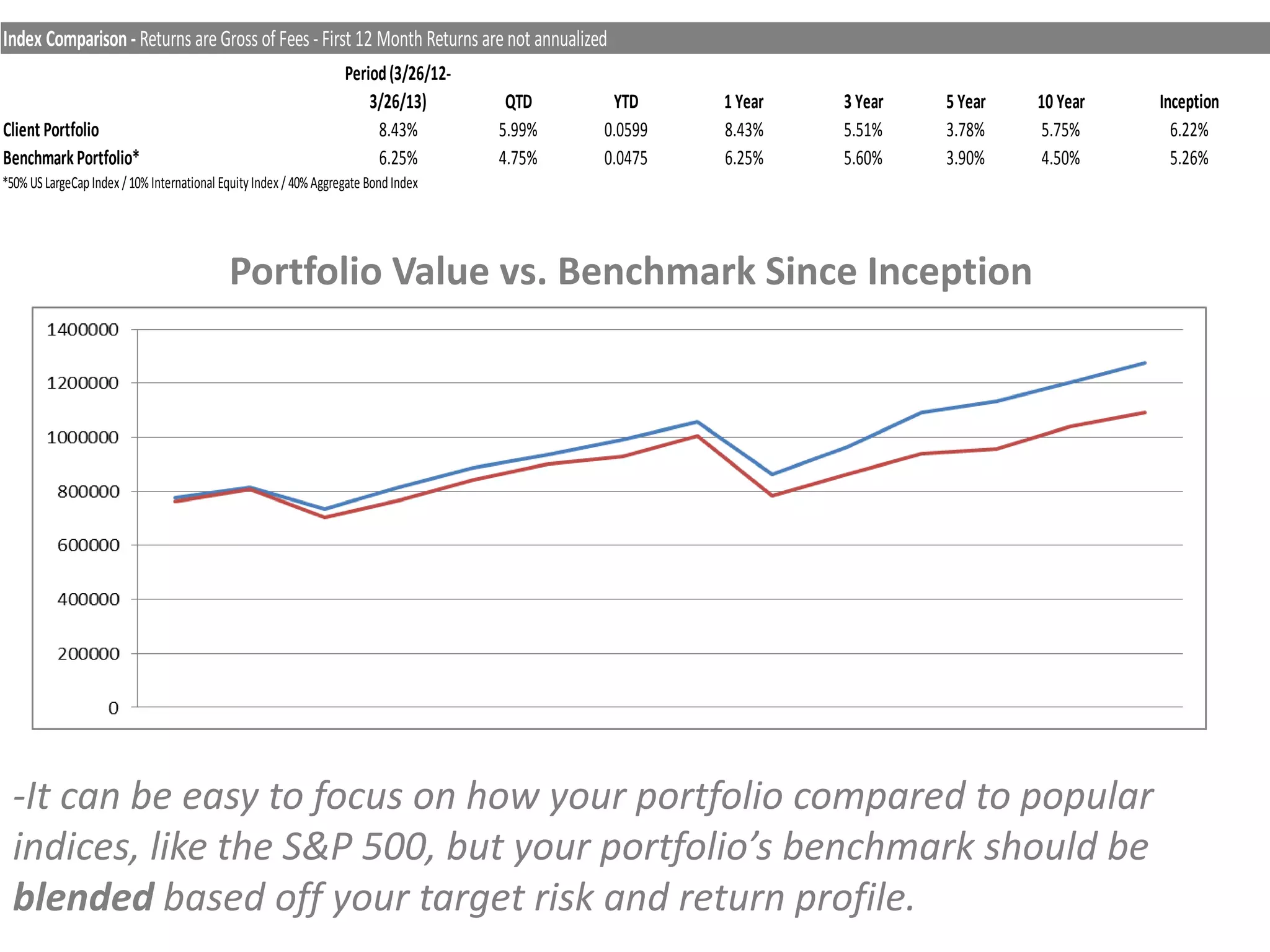

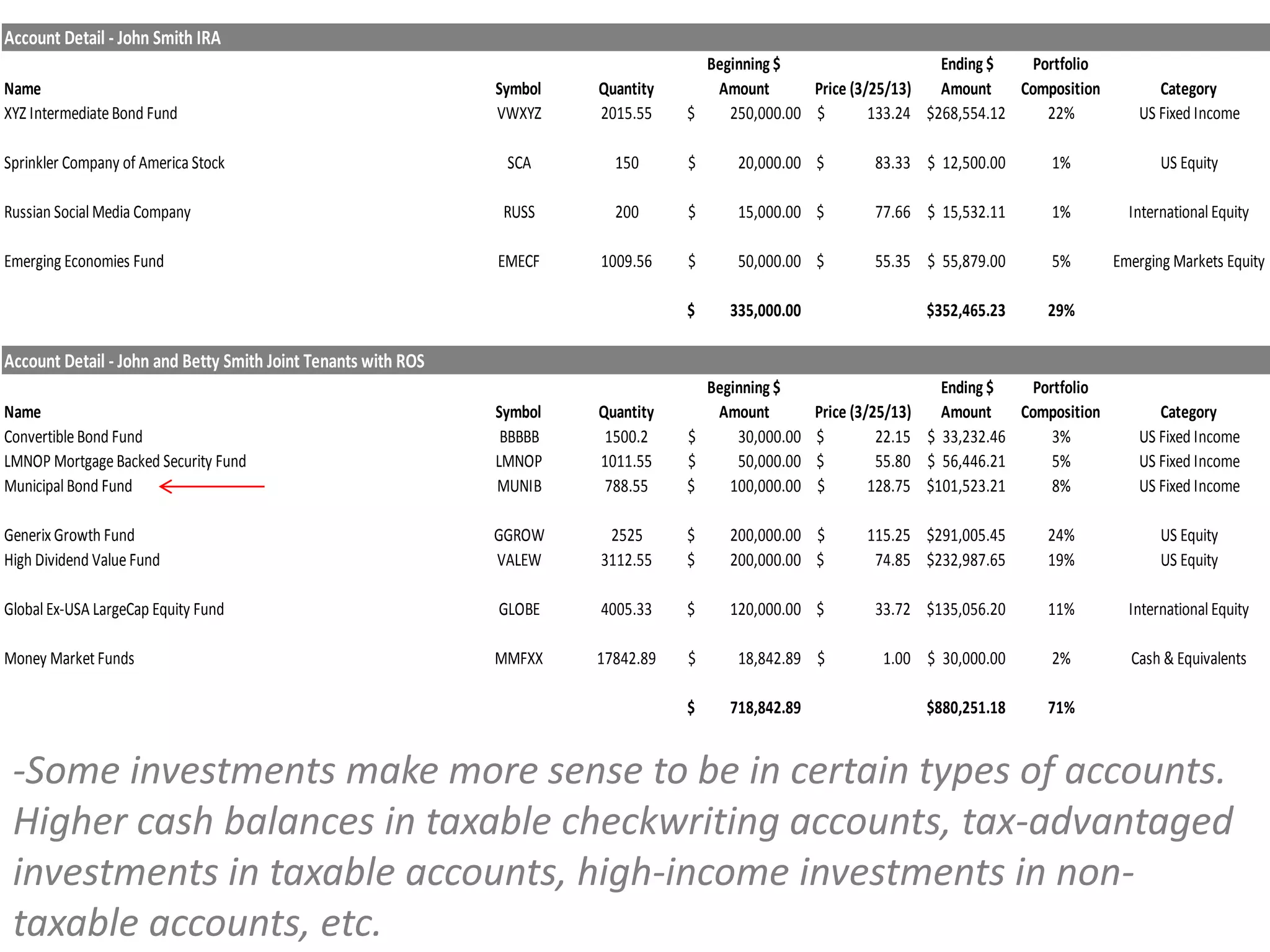

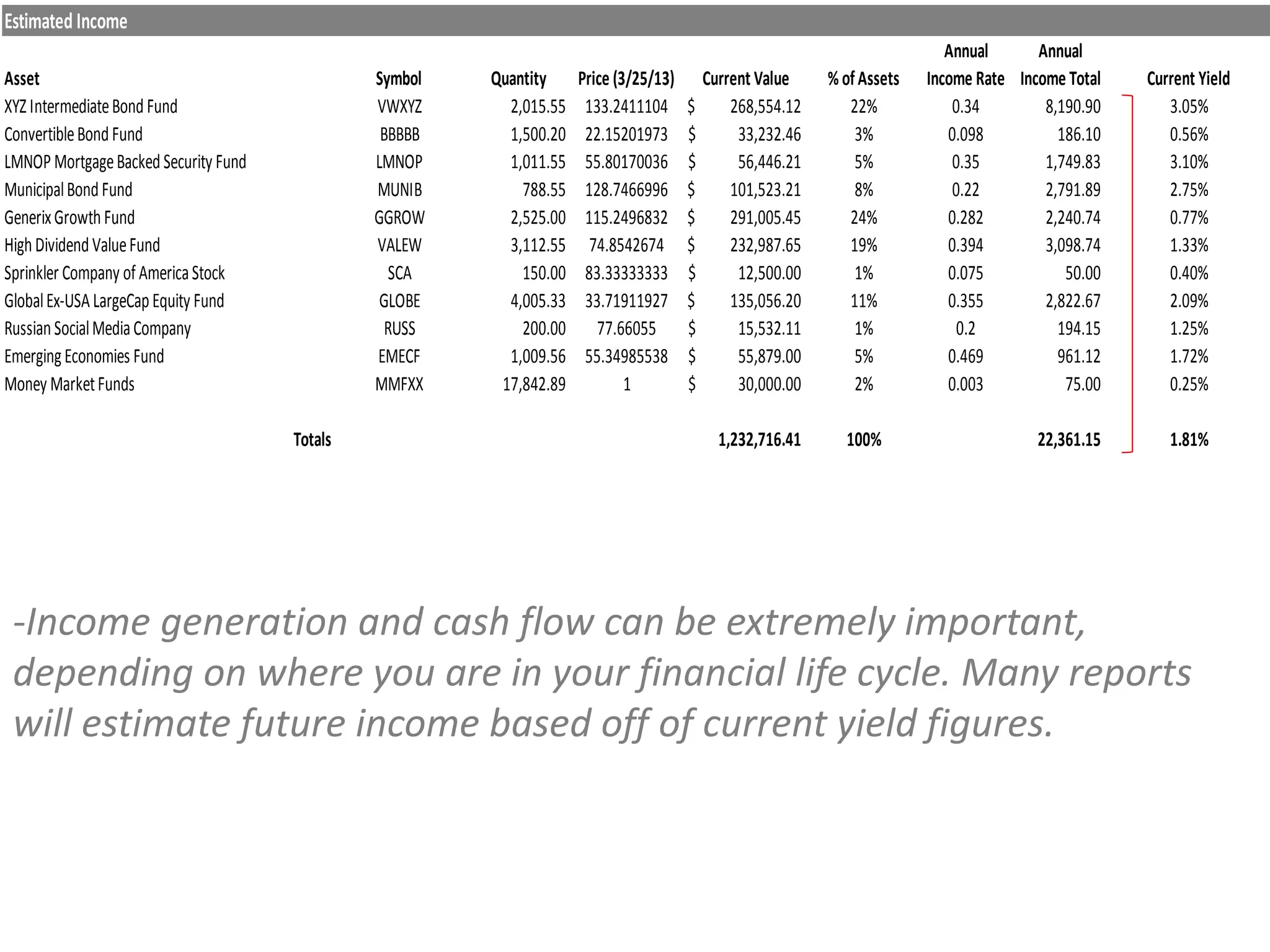

The document discusses wealth management processes such as managing investments, selecting investment managers, developing an investment policy, and monitoring performance. It provides examples of dollar cost averaging versus lump sum investing in different market conditions and concludes that while lump sum investing carries higher risk, it also provides higher potential rewards. The document also covers selecting financial advisors and developing an investment policy statement to guide investment decisions.