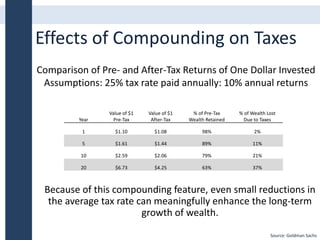

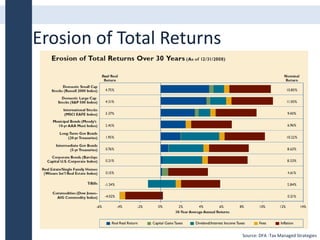

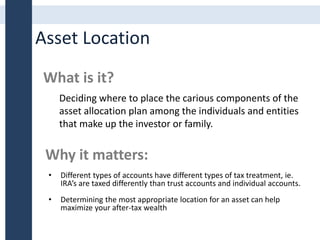

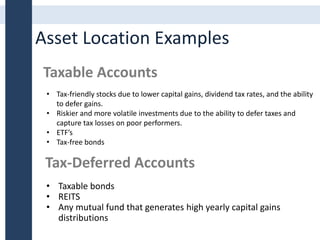

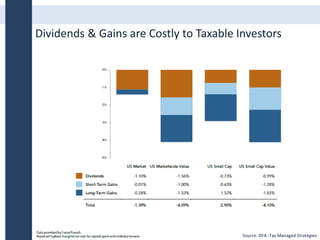

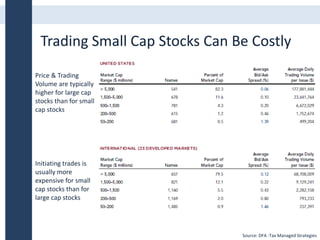

This document discusses how taxes and trading costs impact wealth management. It notes that maximizing pre-tax returns does not equal maximizing after-tax wealth, and taxes should influence decisions around asset allocation, location, and construction. While taxes are important to consider, they should not dictate investment choices. Examples show how taxes compound over time, reducing post-tax returns significantly, especially in taxable accounts. Proper asset location across individual, tax-deferred, and tax-free accounts can help maximize after-tax wealth. The document also cautions that trading costs, which often exceed stated fees, need to be considered.