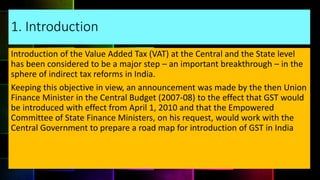

The document discusses key aspects of introducing the Goods and Services Tax (GST) in India such as the proposed dual GST model, administrative issues, and the need for an IT infrastructure to support GST implementation. It recommends a dual GST model with a central and state component that is implemented through a common IT network to streamline compliance. The network aims to simplify tax administration, respect state autonomy, and enable automation to reduce leakages while unifying the domestic market.