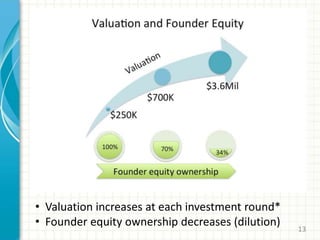

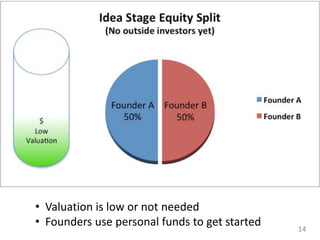

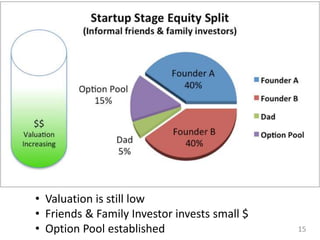

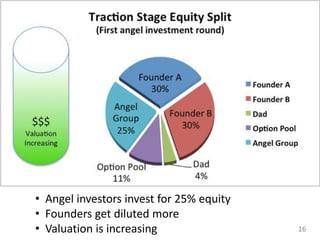

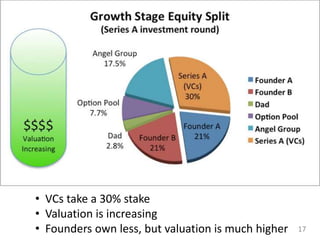

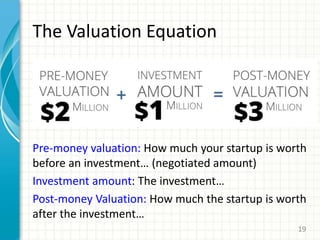

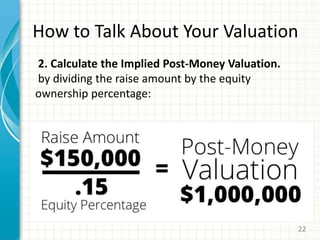

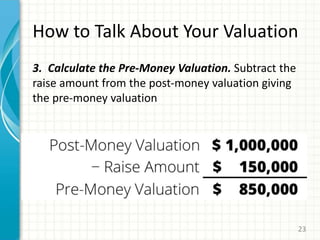

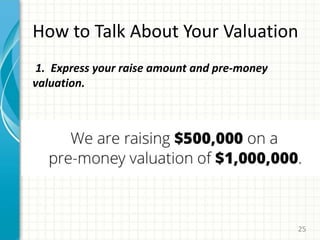

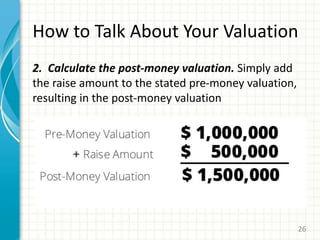

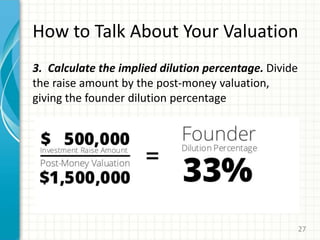

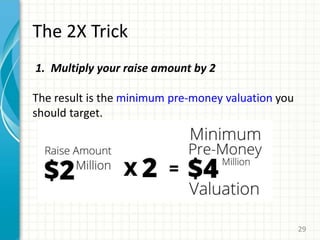

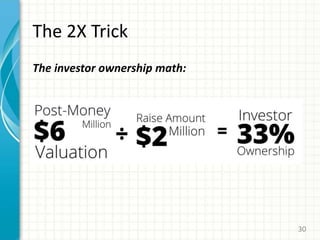

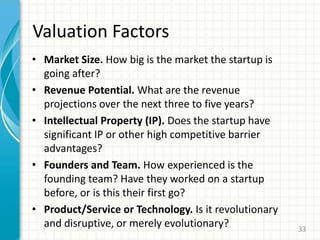

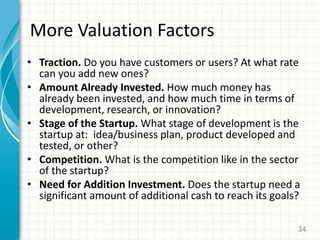

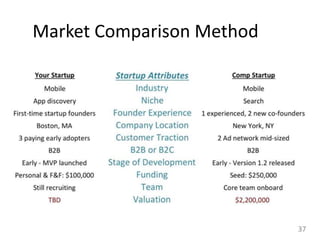

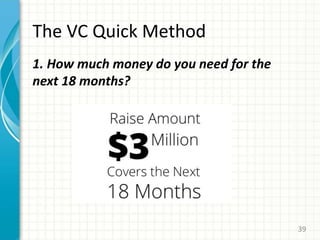

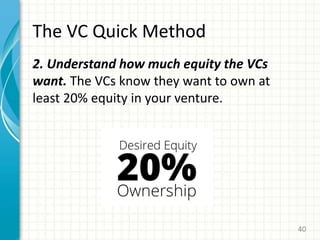

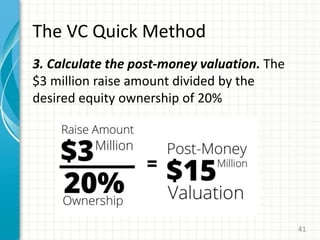

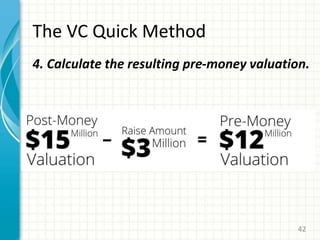

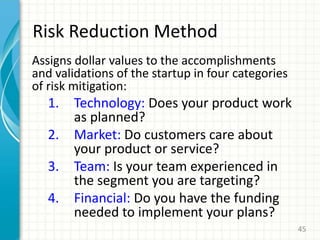

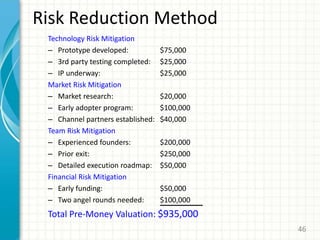

This document discusses the valuation of early-stage startups, emphasizing the importance of agreeing on a startup's worth before attracting outside investments. It outlines key factors affecting valuation, methods for calculation, and the impact of different funding stages on founder equity. Additionally, it offers strategies for discussing valuations with investors and various valuation methods used in the industry.