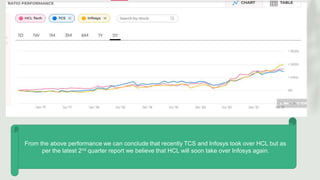

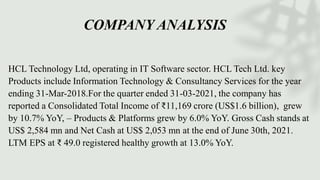

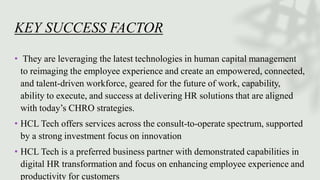

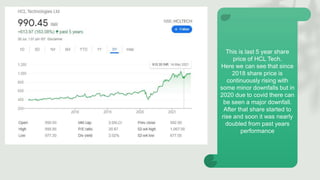

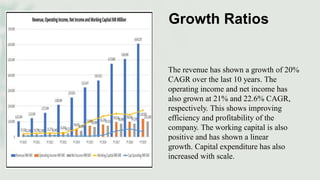

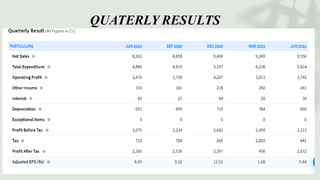

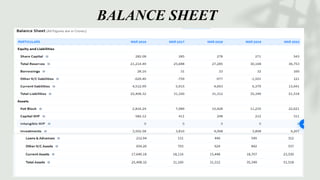

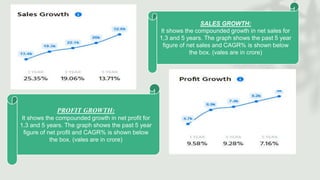

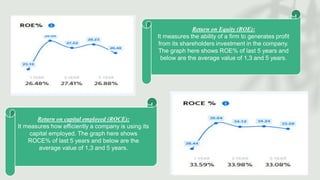

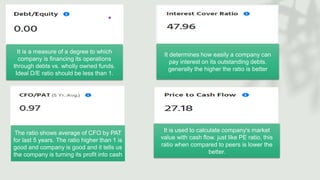

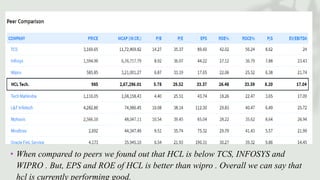

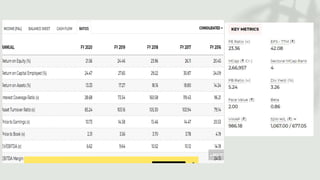

HCL Technologies, established in 1976, has diversified into four main verticals and reported a strong financial performance, with a recent revenue growth of 16.7% year-over-year. The company operates in various sectors and is benefiting from India's competitive IT landscape, although it faces challenges in maintaining its market position against peers like TCS and Infosys. Despite anticipated slowdowns in revenue growth, HCL Tech is deemed a solid long-term investment due to its strong fundamentals and consistent profitability.