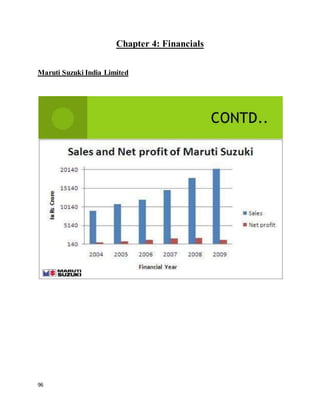

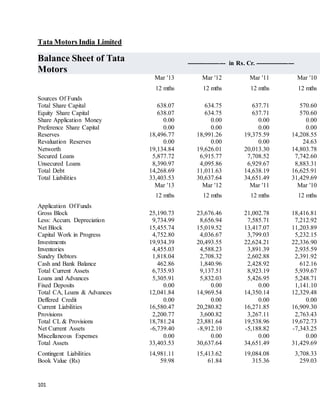

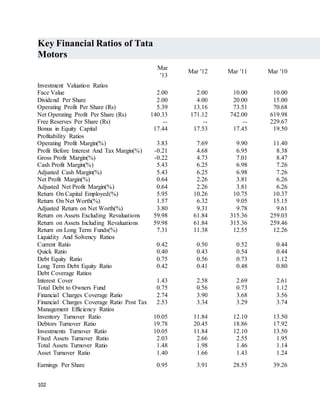

The document provides an overview of the Indian automobile industry and electronic industry. It discusses the history and evolution of the automobile industry in India since the late 19th century. It analyzes the key players in the industry such as Maruti Suzuki, Hyundai, and Tata Motors. It also examines the nature of competition in the industry and provides profiles of the top 3 players, Maruti Suzuki, Hyundai, and Tata Motors, discussing their market shares, products, revenues, and histories.

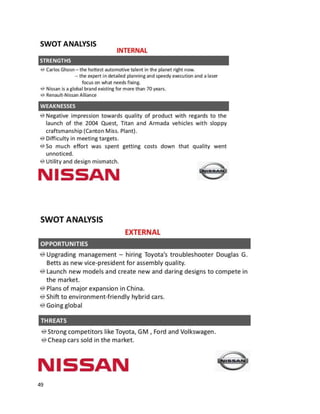

![5

unit. Aurangabad with Audi, Skodaand Volkswagen also forms part of the western

cluster. Another emerging cluster is in the state of Gujarat with manufacturing

facility of General Motors in Halol and further planned for Tata Nano at their plant

in Sanand. Ford, Maruti Suzuki and Peugeot-Citroen plants are also set to come up

in Gujarat.[13] Kolkata with Hindustan Motors, Noida with Honda and Bangalore

with Toyotaare some of the other automotive manufacturing regions around the

country.

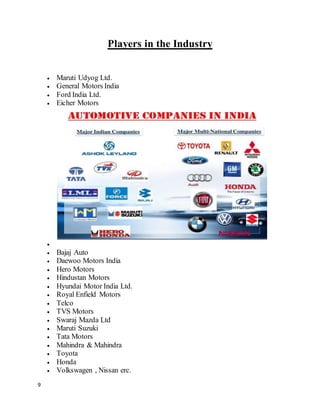

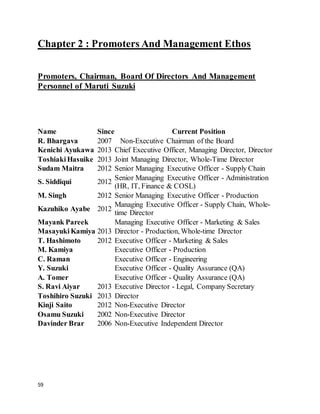

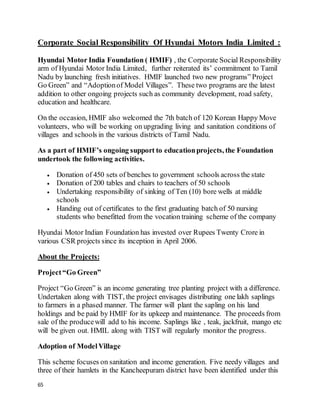

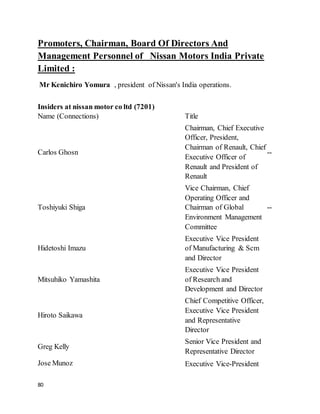

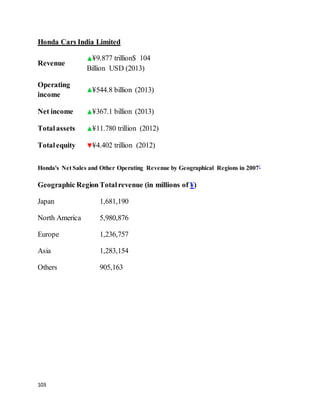

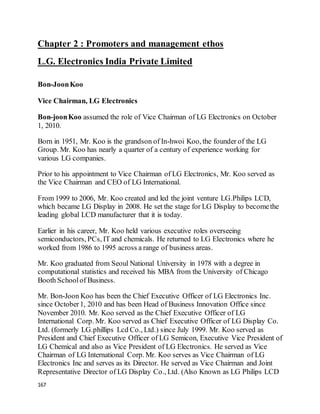

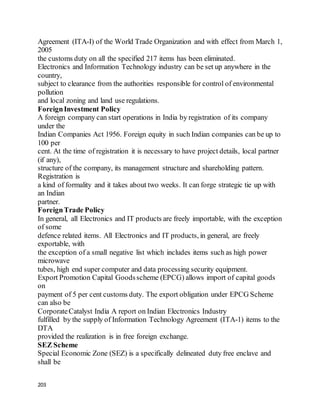

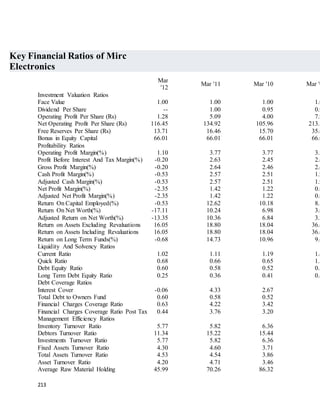

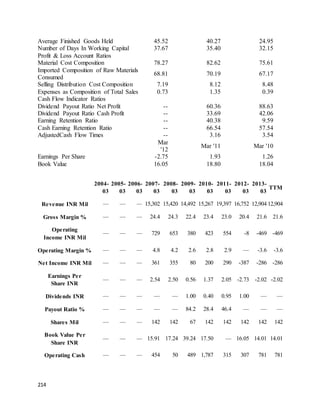

In 2011, there were 3,695 factories producing automotive parts in all of India.The

average firm made US$6 million in annual revenue with profits close to US$400

thousand.

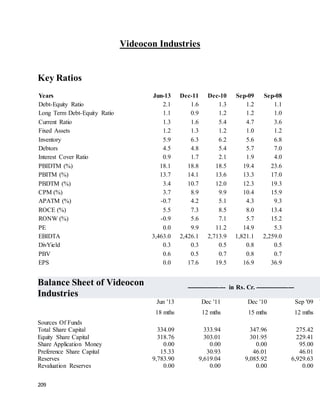

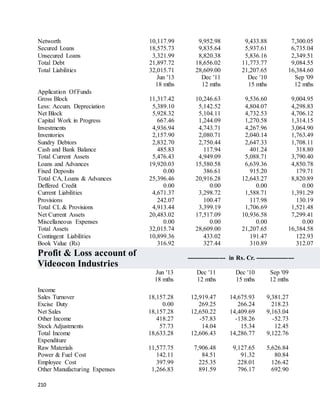

Size of the Industry 2.6 Million Units

Geographical

distribution

Jamshedpur, Pune, Lucknow, Gurgoan,

Delhi, Mumbai, Bangalore, etc

Output per annum Rs 2,000 crore per annum

Percentage in world

market

6-8%

Market

Capitalization

5% of the share](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-5-320.jpg)

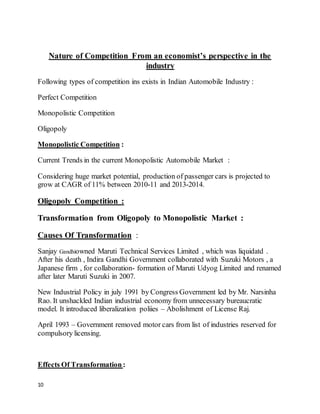

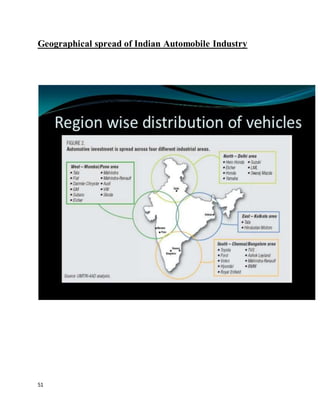

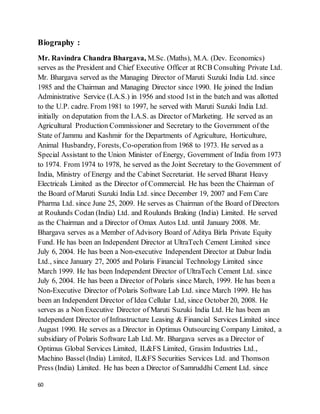

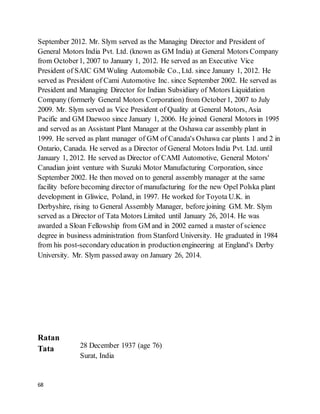

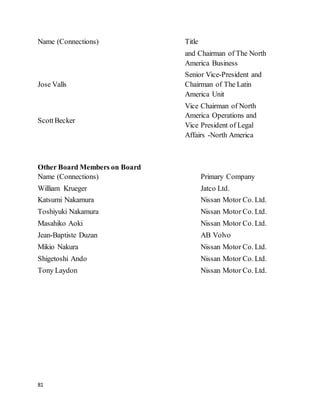

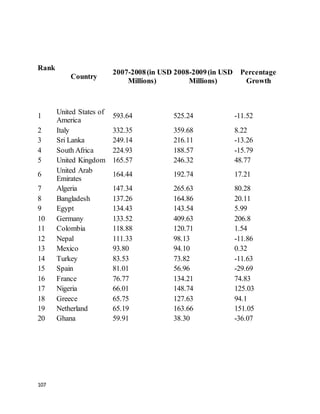

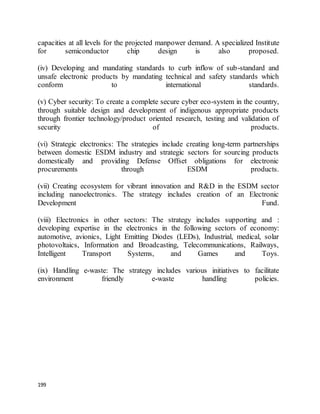

![13

Profile of Top 3 Companies

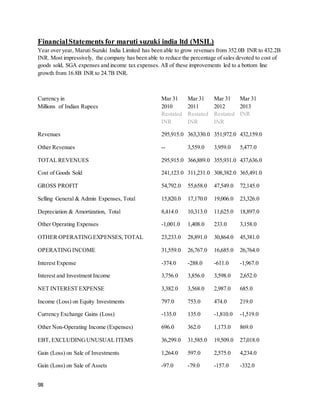

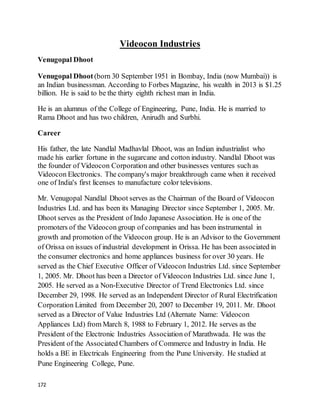

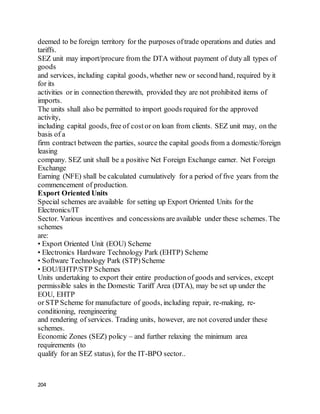

Maruti Suzuki India Limited

Type Public

Traded as

BSE: 532500

NSE: MARUTI

BSE SENSEX Constituent

Industry Automotive

Predecessor(s) Maruti Udyog Limited

Founded 1981

Headquarters New Delhi, India[1]

Key people

RC Bhargava[2] (Chairman)

Kenichi Ayukawa[3] (CEO &

MD)

Products Automobiles

Revenue

369.34 billion

(US$5.9 billion) (2012)[4]

Net income

16.81 billion

(US$270 million) (2012)[4]

Employees 6,903 (2011)[5]

Parent Suzuki[6]

Website www.marutisuzuki.com

Maruti Suzuki India Limited (/marut̪i suzuki/), commonly referred to as Maruti

and formerly known as Maruti Udyog Limited, is an automobile manufacturer in

India.[7] It is a subsidiary of Japanese automobile and motorcycle manufacturer

Suzuki.[6] As of November 2012, it had a market share of 37% of the Indian

passenger car market.[8] Maruti Suzuki manufactures and sells a complete range of

cars from the entry level Alto, to the hatchback Ritz, A-Star, Swift, Wagon R, Zen](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-13-320.jpg)

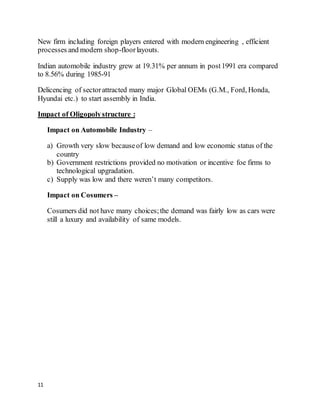

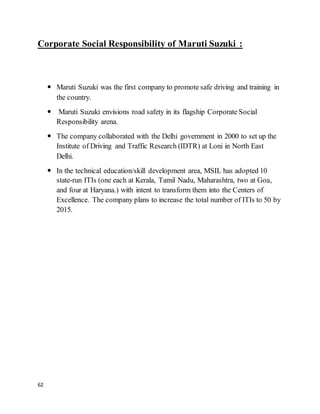

![14

and sedans DZire, Kizashi and SX4, in the 'C' segment Eeco, Omni, Multi Purpose

vehicle Suzuki Ertiga and Sports Utility vehicle Grand Vitara.[9]

The company's headquarters are on Nelson Mandela Road, New Delhi.[1] In

February 2012, the company sold its ten millionth vehicle in India.[10]

History

Originally, 18.28% of the company was owned by the Indian government, and

54.2% by Suzuki of Japan. The BJP-led government held an initial public offering

of 25% of the company in June 2003. As of May 2007, the government of India

sold its complete share to Indian financial institutions and no longer has any stake

in Maruti Udyog.[11]

Maruti Udyog Limited (MUL) was established in February 1981, though the

actual production commenced in 1983 with the Maruti 800, based on the Suzuki

Alto kei car which at the time was the only modern car available in India, its only

competitors - the Hindustan Ambassador and Premier Padmini - were both around

25 years out of date at that point. Through 2004, Maruti Suzuki has produced over

5 Million vehicles. Maruti Suzukis are sold in India and various several other

countries, depending upon export orders. Models similar to those made by Maruti

in India, albeit not assembled or fully manufactured in India or Japan are sold by

Pak Suzuki Motors in Pakistan.

The company exports more than 50,000 cars annually and has domestic sales of

730,000 cars annually.[citation needed] Its manufacturing facilities are located at two

facilities Gurgaon and Manesar in Haryana, south of Delhi. Maruti Suzuki’s

Gurgaon facility has an installed capacity of 900,000 units per annum. The

Manesar facilities, launched in February 2007 comprise a vehicle assembly plant

with a capacity of 550,000 units per year and a Diesel Engine plant with an annual

capacity of 100,000 engines and transmissions. Manesar and Gurgaon facilities

have a combined capability to produceover 14,50,000 units annually.

About 35% of [8] all cars sold in India are made by Maruti. The company is 54.2%

owned by the Japanese multinational Suzuki Motor Corporation per cent of Maruti

Suzuki. The rest is owned by public and financial institutions. It is listed on the

Bombay StockExchange and National StockExchange of India.[citation needed]](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-14-320.jpg)

![15

During 2007 and 2008, Maruti Suzuki sold 764,842 cars, of which 53,024 were

exported. In all, over six million Maruti Suzuki cars are on Indian roads since the

first car was rolled out on 14 December 1983.

The Suzuki Motor Corporation, Maruti's main stakeholder, has been a global leader

in mini and compactcars for three decades. Suzuki’s strategy is to utilise light-

weight, compactengines with stronger power, fuel-efficiency and performance

capabilities. Nearly 75,000 people are employed directly by Maruti Suzuki and its

partners. It has been rated first in customer satisfaction among all car makers in

India from 1999 to 2009 by J D Power Asia Pacific.[12] Maruti Suzuki will be

introducing new 800 cc model by Diwali in 2012.The model is supposed to be fuel

efficient, and therefore more expensive.[13] With increasing market competition in

the small car segment, a new model along with the upcoming WagonR Stingray

will be the key fresh products for Maruti Suzuki India (MSI) to defend its market

share amid the ever increasing competition[14]

Products and services :

1. 800 (1983) (still distributed to some cities like Guwahati) Competes with

Tata Nano, Maruti Alto and Maruti Omni

2. Omni (launched 1984) Competes with Tata Nano, Tata Venture, Maruti 800

and Maruti Eeco

3. Gypsy King (launched 1985) India's first indegenious vehicle and first

compactSAV, competes with Mahindra Thar CRDe, Tata Sumo 4x4 and

ForceGurkha

4. WagonR (launched 1999) Competes with Nissan Micra Active, Maruti A-

star and Hyundai i10

5. Swift (launched 2005) Created a Maruti 800 rivalling benchmark, competes

with Tata Vista, Hyundai i20, SkodaFabia, Volkswagen Polo and Toyota

Etios Liva

6. SX4 (launched 2007) Soonto be replaced by the upcoming sedan

codenamed YL1, competes with Ford Fiesta, Hyundai Verna, Honda City,

SkodaRapid, Volkswagen Vento, Renault Scala and Nissan Sunny

7. Swift DZire (launched 2008) Competes with Mahindra Verito, Toyota

Etios, Ford Classic, Mahindra Verito Vibe, Honda Amaze, Chevrolet Sail,

SkodaFabia and Tata Manza

8. A-star (launched 2008) Competes with Chevrolet Beat, Nissan Micra

Active, Ford Figo and Maruti Wagon-R Stingray](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-15-320.jpg)

![16

9. Ritz (launched 2009) Competes with Maruti Swift, Tata Vista, Hyundai

Grand i10, Honda Brio, Nissan Micra, Renault Pulse and ToyotaEtios Liva

10.Eeco (launched 2010) Stripped down Versa with a lowered roof, in

competition with Tata Venture, Tata Winger Platinum, and in-house Omni

11.Alto K10 (launched 2010), competes in the economy class with the Tata

Indica, Hindustan Motors Ambassadorand Chevrolet Spark

12.Maruti Ertiga (launched 2012), seven seater MPV R3 designed and

developed in India, in competition with Toyota Innova, Mahindra Xylo,

Nissan Evalia, Ashok Leyland Stile and Tata Sumo Grande.[50] In early

2012, Suzuki Ertiga will be exported first to Indonesia in Completely Knock

Down car.[51]

13.Maruti XA Alpha based compactSUV to compete with the Ford EcoSport,

Mahindra Xylo Quanto, Nissan Terrano & Renault Duster will be launched

in the year 2014

14.Maruti Alto 800, launched in 2012, Competes with Tata Nano

15.Maruti Stingray, launched in 2013, Competes with Maruti A-star,

Chevrolet Beat and Chevrolet Sail](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-16-320.jpg)

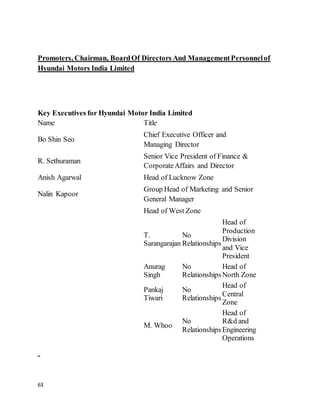

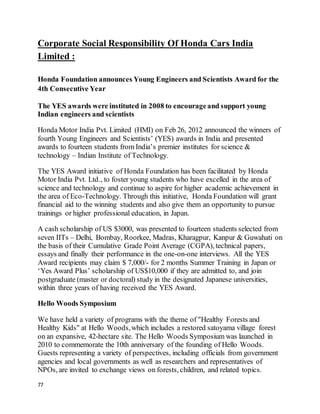

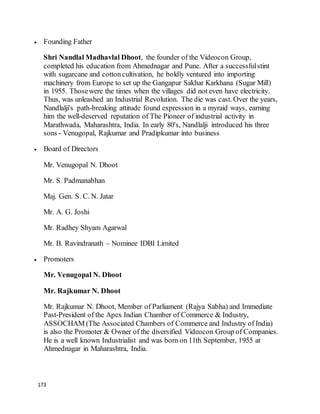

![22

Hyundai Motors India Limited

Drive your way

Type Subsidiary

Industry Automotive

Founded 6 May 1996

Headquarters

Sriperumbudur, Kanchipuram

district, Tamil Nadu, India

Key people Mr. Bo Shin Seo (MD)

Products Automobiles

Parent Hyundai Motor Company

Website www.hyundai.co.in

Hyundai Motor India Limited is a wholly owned subsidiary of the Hyundai

Motor Company in India. It is the 2Hyundai Motor India Limited is currently the

second largest auto exporter from India.[69] It is making India the global

manufacturing basefor small cars.

Hyundai sells several models in India, the most popular being the Santro Xing, i10,

Hyundai EON and the i20. On 3 September 2013, Hyundai launched its much-

awaited car, Grand i10 in petrol and diesel variants. Other models include the Getz,

Accent, Elantra, second generation Verna, Santa Fe and the Sonata Transform.

Hyundai has two manufacturing plants in India located at Sriperumbudur in the

Indian state of Tamil Nadu. Both plants have a combined annual capacity of

600,000 units. In the year 2007, Hyundai opened its R&D facility in Hyderabad,

employing now nearly 450 engineers from different parts of the country. Hyundai

Motor India Engineering (HMIE) gives technical & engineering supportin vehicle

development and CAD & CAE supportto Hyundai's main R&D centre in

Namyang, Korea.

In 2010, Hyundai started its design activities at Hyderabad R&D Centre with

Styling, Digital Design & Skin CAD Teams.](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-22-320.jpg)

![23

Hyundai Motor India Limited was formed in 6 May 1996 by the Hyundai Motor

Company of South Korea. When Hyundai Motor Company entered the Indian

Automobile Market in 1996 the Hyundai brand was almost unknown throughout

India. During the entry of Hyundai in 1996, there were only five major automobile

manufacturers in India, i.e. Maruti, Hindustan, Premier, Tata and Mahindra.

Daewoo had entered the Indian automobile market with Cielo just three years back

while Ford, Opel and Honda had entered less than a year back.

For more than a decade till Hyundai arrived, Maruti Suzuki had a near monopoly

over the passenger cars segment because TELCO and M&M were solely utility

and commercial vehicle manufacturers, while Hindustan and Premier both built

outdated and uncompetitive products.

History

HMIL's first car, the Hyundai Santro was launched in 23 September 1998 and was

a runaway success. Within a few months of its inception HMIL became the second

largest automobile manufacturer and the largest automobile exporter in India.

Hyundai Motor India Limited (HMIL) is a wholly owned subsidiary of Hyundai

Motor Company (HMC), South Korea and is the largest passenger car exporter and

the second largest car manufacturer in India. HMIL presently markets 6 models of

passenger cars across segments. The A2 segment includes the Santro, i10,eon and

the i20, the A3 segment includes the Accent and the fluidic Verna and the fluidic

elantra, the A5 segment includes the Sonata Transform and the SUV segment

includes the Santa Fe.

HMIL’s manufacturing plant near Chennai claims to have the most advanced

production, quality and testing capabilities in the country.[citation needed] To cater to

rising demand, HMIL commissioned its second plant in February 2008, which

produces an additional 300,000 units per annum, raising HMIL’s total production

capacity to 600,000 units per annum.

HMC has set up a research and development facility(Hyundai Motor India

Engineering - HMIE) in the cyber city of Hyderabad.

As HMC’s global export hub for compactcars, HMIL is the first automotive

company in India to achieve the export of 10 lakh cars in just over a decade. HMIL

currently exports cars to more than 120 countries across EU, Africa, Middle East,

Latin America, Asia and Australia. It has been the number one exporter of

passenger cars of the country for the sixth year in a row.[citation needed]](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-23-320.jpg)

![24

To supportits growth and expansion plans, HMIL currently has a 307 strong dealer

network and 627 strong service points across India, which will see further

expansion in 2010.[citation needed] In July 2012, Arvind Saxena, the Director of

Marketing and Sales stepped down from the position after serving the company for

7 long years.[1]

Products :

1. Hyundai Accent Executive (Launched 2011)

2. Hyundai Santro Xing (Launched 2003)

3. Hyundai Uber Cooli20 (Launched 2008)

4. Hyundai Next Gen i10 (Launched 2010)

5. Hyundai Grand i10 (Launched 2013)

6. Hyundai Fluidic Verna (Launched 2011)

7. Hyundai EON (Launched 2011)

8. Hyundai Neo Fluidic Elantra (Launched 2012)

Imported

1. Hyundai Terracan (2003–2007)

2. Hyundai Elantra (2004–2010)

3. Hyundai Tucson(2005–2010)

4. Hyundai Sonata Transform (2010–2011)

5. Hyundai Santa Fe (Launched 2010)

6. Hyundai Sonata (Launched 2010)](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-24-320.jpg)

![27

Marketing Mix

Product

The all-new “Hyundai Pa” is fully loaded with a range of exciting new features. It's

a perfect complement to your evolved tastes and lifestyle. And the best way to take

your driving pleasure to a brand-new high. European Styling. Japanese

Engineering. Dream-Like Handling.

The new Hyundai Pa is a generation different from Getz and Santro design. Styled

with a clear sense of muscularity, its one-and-a-half box, aggressive form makes

for a look of stability, a sense that it is packed with energy and ready to deliver a

dynamic drive.

Price

Hyundai is expected to take Maruti heads on with the pricing of their upcoming

Hyundai Pa car. After launching cars for the masses since so many years, India’s

second largest automobile manufacturer is now targeting the premium segment

with their latest model from the Hyundai’s stable. The analysts predict the pricing

of this premium hunchback to start from Rs. 3 lakh.

This price range would practically rip apart Maruti’s offering in Zen Estilo, which

is priced at a higher tag of Rs. 3.5 lakh. Both the companies are known for their

value based offerings and Hyundai with their extensive service network and brand

reputation for making reliable cars should get the customer’s nod over their

competition.

The official pricing however is still not out. However, the company is said to be

studying the prospects oflaunching the base model at the 3 - lakh price tag.

Place

Sales and service network

As of March 2011, HMIL has 451 dealerships and more than 647 Hyundai

Authorised Service Centers in 340 cities across India. HMIL also operates its own

dealerships known as HyundaiMotor Plazas in large metros across India. HMIL

has the second largest sales and service network in India after Maruti Suzuki.[citation

needed]](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-27-320.jpg)

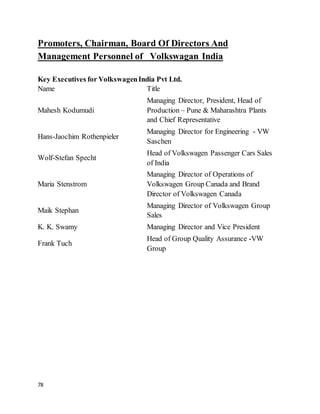

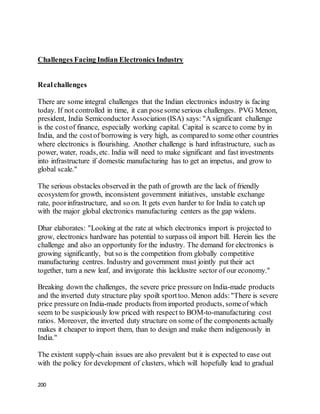

![32

Tata Motors

Type Public

Traded as

BSE: 500570 (BSE SENSEX

Constituent)

NSE: TATAMOTORS

NYSE: TTM

Industry Automotive

Founded 1945

Founder(s) J. R. D. Tata

Headquarters Mumbai, Maharashtra, India

Area served Worldwide

Key people

Ratan Tata (Chairman

Emeritus)

Cyrus Pallonji Mistry

(Chairman)

Karl Slym (died 26 January

2014, Managing Director)

Ravi Kant (Vice Chairman)

Products

Automobiles

Commercial vehicles

Coaches

Buses

Construction equipment

Military vehicles

Automotive parts

Services

Automotive design,

engineering and outsourcing

services

Vehicle leasing

Vehicle service

Revenue

US$ 34.7 billion (FY 2012-

13)[4]

Operating US$ 3.06 billion (2012)[4]](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-32-320.jpg)

![33

income

Profit US$ 2.28 billion (2012)

Totalassets US$ 28.05 billion (2012)

Totalequity US$ 6.44 billion (2012)

Employees 59,759 (2012)[4]

Parent Tata Group

Divisions Tata Motors Cars

Subsidiaries

Jaguar Land Rover

Tata Daewoo

Tata Hispano

Website www.tatamotors.com

Tata Motors Limited (formerly TELCO, short for Tata Engineering and

Locomotive Company) is an Indian multinational automotive manufacturing

company headquartered in Mumbai, Maharashtra, India and a subsidiary of the

Tata Group. Its products include passenger cars, trucks, vans, coaches, buses,

construction equipment and military vehicles. It is the world's sixteenth-largest

motor vehicle manufacturing company, fourth-largest truck manufacturer and

second-largest bus manufacturer by volume.[5]

Tata Motors has auto manufacturing and assembly plants in Jamshedpur,

Pantnagar, Lucknow, Sanand, Dharwad and Pune in India, as well as in Argentina,

South Africa, Thailand and the United Kingdom. It has research and development

centres in Pune, Jamshedpur, Lucknow and Dharwad, India, and in South Korea,

Spain, and the United Kingdom. Tata Motors' principal subsidiaries include the

British premium car maker Jaguar Land Rover (the maker of Jaguar, Land Rover

and Range Rover cars) and the South Korean commercial vehicle manufactuer

Tata Daewoo. Tata Motors has a bus manufacturing joint venture with Marcopolo

S.A. (Tata Marcopolo), a construction equipment manufacturing joint venture with

Hitachi (Tata Hitachi Construction Machinery) and a joint venture with Fiat which

manufactures automotive components and Fiat and Tata branded vehicles.

Founded in 1945 as a manufacturer of locomotives, the company manufactured its

first commercial vehicle in 1954 in a collaboration with Daimler-Benz AG, which

ended in 1969. Tata Motors entered the passenger vehicle market in 1991 with the

launch of the Tata Sierra, becoming the first Indian manufacturer to achieve the

capability of developing a competitive indigenous automobile.[6] In 1998 Tata

launched the first fully indigenous Indian passenger car, the Indica, and in 2008](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-33-320.jpg)

![34

launched the Tata Nano, the world's cheapest car. Tata Motors acquired the South

Korean truck manufacturer Daewoo Commercial Vehicles Company in 2004 and

purchased Jaguar Land Rover from Ford in 2008.

Tata entered the commercial vehicle sector in 1954 after forming a joint venture

with Daimler-Benz of Germany. After years of dominating the commercial vehicle

market in India, Tata Motors entered the passenger vehicle market in 1991 by

launching the Tata Sierra, a multi utility vehicle. Tata subsequently launched the

Tata Estate (1992; a station wagon design based on the earlier 'TataMobile' (1989),

a light commercial vehicle), the Tata Sumo (1994; LCV) and the Tata Safari

(1998; India's first sports utility vehicle).

Tata launched the Indica in 1998, the first fully indigenous Indian passenger car.

Although initially criticised by auto-analysts, its excellent fuel economy, powerful

engine and an aggressive marketing strategy made it one of the bestselling cars in

the history of the Indian automobile industry. A newer version of the car, named

Indica V2, was a major improvement over the previous version and quickly

became a mass-favourite. Tata Motors also successfully exported large quantities

of the car to South Africa. The success ofIndica played a key role in the growth of

Tata Motors.[7]

In 2004 Tata Motors acquired Daewoo's South Korea-based truck manufacturing

unit, Daewoo Commercial Vehicles Company, later renamed Tata Daewoo.[8]

On 27 September 2004, Tata Motors rang the opening bell at the New York Stock

Exchange (NYSE) to mark the listing of Tata Motors.[9]

In 2005, Tata Motors acquired a 21% controlling stake in the Spanish bus and

coachmanufacturer Hispano Carrocera.[10] Tata Motors continued its market area

expansion through the introduction of new products suchas buses (Starbus &

Globus, jointly developed with subsidiary Hispano Carrocera) and trucks (Novus,

jointly developed with subsidiary Tata Daewoo).

In 2006, Tata formed a joint venture with the Brazil-based Marcopolo, Tata

Marcopolo Bus, to manufacture fully built buses and coaches.[11]

In 2008, Tata Motors acquired the British car maker Jaguar Land Rover,

manufacturer of the Jaguar, Land Rover and Daimler luxury car brands, from Ford

Motor Company.[12][13][14][15]](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-34-320.jpg)

![35

In May 2009 Tata unveiled the Tata World Truck range jointly developed with

Tata Daewoo;[16] the range went in sale in South Korea, South Africa, the SAARC

countries and the Middle-East at the end of 2009.[16]

Tata acquired full ownership of Hispano Carrocera in 2009.[17]

In 2010, Tata Motors acquired an 80% stake in the Italian design and engineering

company Trilix for €1.85 million. The acquisition formed part of the company's

plan to enhance its styling and design capabilities.[18]

In 2012, Tata Motors announced it would invest around 6 billion in the

development of Futuristic Infantry Combat Vehicles in collaboration with

DRDO.[19]

In 2013, Tata Motors announced it will sell in India, the first vehicle in the world

to run on compressed air (engines designed by the French company MDI) and

dubbed "Mini CAT".

Tata Technologies

Tata Technologies Limited (TTL) is an 86.91% owned subsidiary of Tata Motors

which provides design, engineering and business process outsourcing services to

the automotive industry. It is headquartered in Pune (Hinjewadi) and also has

operations in Detroit, London and Thailand. TTL's clients include Ford, General

Motors, Honda and Toyota.

The British engineering and design services company Incat International, which

specialises in engineering and design services and productlifecycle management in

the automotive, aerospaceand engineering sectors, is a wholly owned subsidiary of

TTL. It was acquired by TTL in August 2005 for 4 billion.

European TechnicalCentre

The Tata Motors European Technical Centre (TMETC) is an automotive design,

engineering and research company based at the campus of the University of

Warwick in the United Kingdom. It was established in 2005 and is a wholly owned

subsidiary of Tata Motors. It was the joint developer of the World Truck.[34]](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-35-320.jpg)

![39

Facilities

HCIL's first manufacturing unit at Greater Noida commenced operations in 1997.

Setup at an initial investment of over 4.5 billion, the plant is spread over 150

acres (0.61 km2). The initial capacity of the plant was 30,000 cars per annum,

which was thereafter increased to 50,000 cars on a two-shift basis. The capacity

has further been enhanced to 100,000 units annually as of 2008. This expansion led

to an increase in the covered area in the plant from 107,000 m² to over 130,000 m².

The company invested 7.8 billion in Bhiwadi for its second productionplant with

an annual productioncapacity of 50,000 units.[2] It operates under the ISO 9001

standard for quality management and ISO 14001 for environment management.

Honda setup its Third plant in India at Tapukara in Alwar District of Rajasthan,

spread over 450 acres with an investment of ₹3526 crores.[3]

HCIL produces the following vehicles in India for local and export markets:

Honda City (Launched 1998)

Honda Accord (Launched 2001, Production discontinued in 2013)

Honda Civic (Launched 2006, Production discontinued in 2012)

Honda Jazz (Launched 2009, Production temporarily discontinued in early 2013 in

anticipation of all-new model)

Honda Brio (Launched 2011)

Honda CR-V (Imported since 2003; 2013 model locally assembled)

Honda Amaze (launched April 2013)

Sales

HCIL has 152 dealerships across 98 cities in 20 states and 3 Union Territories of

India.[4]

It sold 55,884 units during the period April '09 - February '10 as against 45,052

units during the same period a year ago, recording an increase of over 24%. Honda

jazz is known as Honda fit in other countries.](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-39-320.jpg)

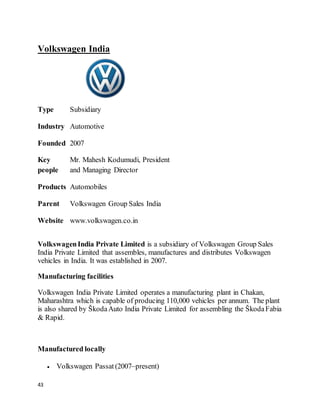

![44

Volkswagen Jetta (2008–present)

Volkswagen Polo (2010–2013)

Volkswagen Vento (2010–present)

Sales performance

In the year 2010, VIPL recorded sales of 32,627 vehicles against 3,039 vehicles

sold during the year 2009 and registered a sales growth of over 1,000%.[2]

Fan club

A group of Volkswagen car enthusiasts started a fan club for Volkswagen vehicle

owners and fans and created Volkswagen Fans Club Community Website on 24th

March, 2012. Registered members discuss about their Volkswagen vehicles and

share their knowledge. They help each other in solving issues and guide those

people who are seeking to purchase new Volkswagen vehicle.](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-44-320.jpg)

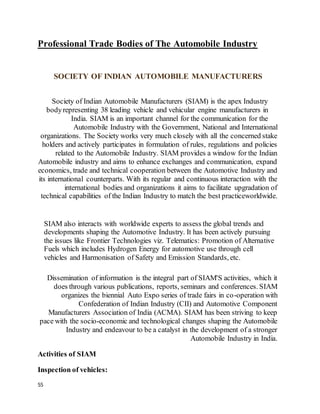

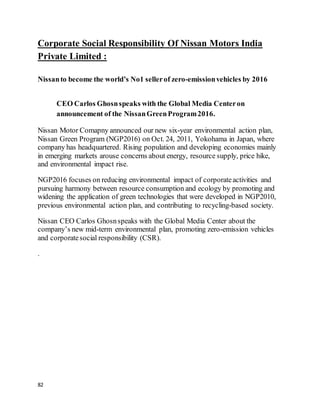

![47

Nissan Motors India Private Limited

Type Subsidiary

Industry Automotive

Founded 2005

Headquarters Chennai, Tamil Nadu[1][2]

Area served India

Key people

Mr. Kenichiro YOMURA ,

CEO and MD

Products Automobiles

Parent

Renault Nissan Automotive

India Private Limited

Website www.nissan.in

NissanMotorIndia Private Limited is the Indian subsidiary of NissanMotor

Company of Japan.[3]

History

Nissan Motor India Private Limited (NMIPL) started its operations in India in

2005, with the launch of the Nissan X-Trail (T30), which was imported as a

CBU.[3]

Manufacturing facilities

NMIPL's manufacturing plant in Chennai can manufacture 200,000 vehicles per

annum. The Chennai Plant has an additional 200,000 vehicles per annum capacity

exclusively for French car maker Renault's Indian arm Renault India Private

Limited. The plant's combined capacity is 400,000 vehicles per annum.](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-47-320.jpg)

![48

The plant in Oragadam with an investment of 45 billion (US$720 million) covers

an area of 650 acres (2.6 km2).[4] It will manufacture the Nissan Micra for the

Indian and European market, besides various other models for the Indian market.[5]

Manufactured locally

1. Nissan Micra (launched 2010)

2. Nissan Sunny (launched 2011)

3. Nissan Evalia (launched 2012)

4. Nissan Terrano(launched 10/09/2013)

Imported

1. Nissan X-Trail (Launched 2005)

2. Nissan Teana (Launched 2007)

3. Nissan 370Z (Launched 2010)

Sales and service network

NMIPL has appointed Hover Automotive India for the Sales, Service, Parts,

Marketing & Dealer Development functions for Nissan vehicles in India. Nissan

currently has 40 dealerships across 39 cities in 17 states and 1 Union Territory of

India.[6]](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-48-320.jpg)

![64

Mr. R. Sethuraman promoted as Director

Mr. RakeshSrivastava promotedas Sr. Vice President

Mr. R Sethuraman as Director Finance and Member of Board and Mr. Rakesh

Srivastava as Sr. Vice President, Sales and Marketing. Prior to this elevation,

Mr. R. Sethuraman was Senior Vice President, Finance and Member of the

Board of Directors of HMIL, while Mr. Rakesh Srivastava was Vice President,

National Sales and Marketing.

.

Mr Bo Shin Seo took over as the company's Managing Director, from Mr H.

W. Park, who is returning to Korea as the Chief Financial Officer of Kia

Motors. Mr Park goes back to his home country after a stint in India.

Prior to his elevation as Managing Director, Mr Seo was Executive Director –

Production, a position he held for two years.

“Mr Seo is an engineer by training, in his distinguished career he has been

Hyundai's ProductionHead at its Alabama plant in the US,” says a press release

from Hyundai India.

Chung Ju-yung a South Korean entrepreneur, businessman and the founder of

all Hyundai Groups of South Korea.

Born

Chung Ju-yung

November 25, 1915

Tongchon, Kangwŏn, [Korea]

(now Tongchon, North Korea)

Died

March 21, 2001 (aged 85)

Songpa District, Seoul, South

Korea

Nationality South Korean

Occupation Businessman

Known for

Founder and honorary chairman

of Hyundai.](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-64-320.jpg)

![67

Promoters, Chairman, Board Of Directors And

Management Personnel of Tata Motors :

JehangirRatanji Dadabhoy Tata (29 July 1904 – 29 November 1993) was a

French-born Indian aviator and business tycoon. He was the former Chairman of

Tata Sons. He became India's first licensed pilot in 1929. In 1983, he was awarded

the French Legion of Honour and, in 1992, India's highest civilian award, the

Bharat Ratna.[1]

Born

29 July 1904

Paris, France

Died

29 November 1993 (aged 89)

Geneva, Switzerland

Nationality Indian

Ethnicity Parsi

Occupation Former Chairman of Tata Group

Known for

Founder of TCS

Founder of Tata Motors

Founder of Titan Industries

Founder of Tata Tea

Founder of Voltas

Founder of Air India

Religion Zoroastrianism

Spouse(s) Thelma Vicaji Tata

Children None

Parents

R.D. and Suzanne Tata nee

Brière

Mr. Karl Slym served as the Managing Director at Tata Motors Limited from

September 13, 2012 to January 26, 2014. Mr. Slym joined Tata Motors in](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-67-320.jpg)

![69

Born

Residence Colaba, Mumbai, India[1]

Nationality Indian

Ethnicity Parsi

Alma mater Cornell University

Occupation

Former Chairman of Tata

Group

Religion Zoroastrianism

Awards

Padma Vibhushan (2008)

KBE (2009)

Signature

RatanTata, KBE (Born Ratan NavalTata on 28 December 1937) is an Indian

businessman of the Tata Group, a Mumbai-based conglomerate. He was the

chairman of the group from 1991-2012. He stepped down as the chairman on 28

December 2012 and now holds the position of Chairman Emeritus of the group

which is an honorary and advisory position. He will continue as the chairman of

the groups charitable trusts.[2]

Early life

Ratan Tata is the adoptive great-grandson of Tata group founder Jamsetji

Nusserwanji Tata.

Tata began his schooling in Mumbai at the Campion Schooland the Bishop Cotton

Schoolin Shimla, and finished his secondaryeducation at the Cathedral and John

Connon School.[4] He completed his B.S. in architecture with structural

engineering from Cornell University in 1962, and the Advanced Management](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-69-320.jpg)

![70

Program from Harvard Business Schoolin 1975.[5] Tata is a member of the Alpha

Sigma Phi fraternity.

Career

Tata began his career in the Tata group in 1962; he initially worked on the shop

floor of Tata Steel, shovelling limestone and handling the blast furnace.[6]

In 1991, J. R. D. Tata stepped down as Tata Industries chairman, naming Ratan as

his successor.

In 1991, Tata was appointed as the chairman of the Tata group. Under his

stewardship, Tata Tea acquired Tetley, Tata motors acquired Jaguar Land Rover

and Tata Steel acquired Corus, which have turned Tata from a largely India-centric

company into a global business, with 65% revenues coming from abroad. He also

pushed the development of the Tata Indica and the Tata Nano Ratan Tata retired

from all executive responsibility in the Tata group on December 28, 2012 which is

also his 75th birthday and he is succeeded by Cyrus Mistry, the 44-year-old son of

Pallonji Mistry and managing director of Shapoorji Pallonji Group.[7][8]

He is chairman emeritus of Tata Sons, Tata Motors, Tata Steel and a few other

group companies. He is also the chairman of the main two Tata trusts Sir Dorabji

Tata and Allied Trusts and Sir Ratan Tata Trust which together hold 66% of shares

in the group holding company Tata Sons.

Ratan Tata has served in various capacities in organisations in India and abroad.

He is a member of the Prime Minister's Council on Trade and Industry. Tata is on

the board of governors of the East-West Center, the advisory board of R&D's

Center for Asia Pacific Policy, the jury panel of Pritzker Architecture Prize -

considered to be one of the world's premier architecture prizes[9] and serves on the

program board of the Bill & Melinda Gates Foundation's India AIDS initiative.[10]](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-70-320.jpg)

![71

Cyrus Pallonji Mistry (born 4 July 1968) is an Irish businessman who became

chairman of Tata Group, an Indian business conglomerate, on 28 December

2012.[2][3] He is the sixth chairman of the group and the second not to be named

Tata, after Nowroji Saklatwala.[4] TheEconomist has described him as "the most

important industrialist" in both India and Britain.[5]

He is the youngest son of Indian construction magnate Pallonji Mistry.[6]

Cyrus Mistry

Born 4 July 1968 (age 45)

Nationality Irish[1]

Alma mater

Imperial College London

London Business School

Occupation Chairman of Tata Group

Spouse(s) Rohiqa Mistry

Children 2

Parents

Pallonji Mistry

Patsy Perin Dubash

Early life and education

Mistry studied at the Cathedral & John Connon Schoolin Mumbai.[7] He graduated

from the Imperial College, London with a BEng in civil engineering and holds a

Master of Science in management from the London Business School. He is a

fellow of the Institution of Civil Engineers.[8][9]

Career

Mistry has been managing director of Shapoorji Pallonji & Company, which is part

of the Shapoorji Pallonji Group. He joined the board of Tata Sons on 1 September

2006, a year after his father retired from it.[1] He served as a Director of Tata Elxsi](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-71-320.jpg)

![72

Limited, from 24 September 1990 to 26 October2009 and was a Director of Tata

Power Co. Ltd until 18 September 2006.[citation needed]

In 2012, Mistry was appointed as the chairman of Tata Sons. In addition, he is also

chairman of all major Tata companies including Tata Industries, Tata Steel, Tata

Motors, Tata Consultancy Services, Tata Power, Tata Teleservices, Indian Hotels,

Tata Global Beverages and Tata Chemicals.[citation needed](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-72-320.jpg)

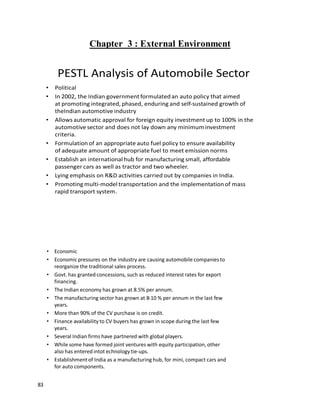

![86

Automobile Industry Regulations in India

The automotive regulations in India are governed by the Ministry of Road

Transportand Highways (MoRT&H) which is the nodal ministry for regulation of

the automotive sectorin India.[1][2]

In India the Rules and Regulations related to driving license, registration of motor

vehicles, controlof traffic, construction & maintenance of motor vehicles etc are

governed by the Motor Vehicles Act, 1988 (MVA) and the Central Motor Vehicles

rules 1989 (CMVR).

The CMVR - Technical Standing Committee (CMVR-TSC) advises MoRT&Hon

various technical aspects related to CMVR. This Committee has representatives

from various organisations namely; Ministry of Heavy Industries & Public

Enterprises (MoHI&PE), MoRT&H, Bureau of Indian Standards (BIS), Testing

Agencies such as Automotive Research Association of India (ARAI), Vehicle

Research and Development Establishment (VRDE), Central Institute of Road

Transport(CIRT), industry representatives from Society of Indian Automobile

Manufacturers (SIAM), Automotive Component Manufacturers Association

(ACMA) and TractorManufacturers Association (TMA) and representatives from

State TransportDepartments.

CMVR-TSC is assisted by another Committee called the Automobile Industry

Standards Committee (AISC) having members from various stakeholders in

drafting the technical standards related to Safety. The major functions of the

committee are as follows:

Preparation of new standards for automotive items related to safety.

To review and recommend amendments to the existing standards

Recommend adoption of such standards to CMVR Technical Standing

Committee

Recommend commissioning of testing facilities at appropriate stages

Recommend the necessary funding of such facilities to the CMVR Technical

Standing Committee

Advise CMVR Technical Standing Committee on any other issues referred

to it

AISC submits the draft safety standards in the form of recommendations to

CMVR-TSC for final approval. The CMVR – TSC looks into the](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-86-320.jpg)

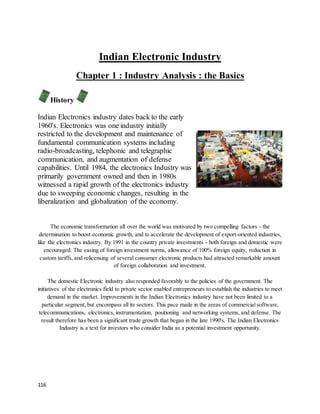

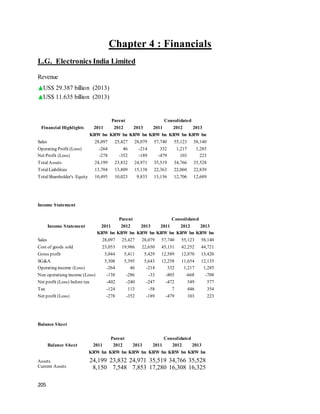

![104

VolkswaganIndia

Production output 5,771,789 units (2012)

Revenue €103.942 billion (2012)

Profit €21.7 billion (2012)

Sales performance

In the year 2010, VIPL recorded sales of 32,627 vehicles against 3,039 vehicles

sold during the year 2009 and registered a sales growth of over 1,000%.

NissanMotors India Limited

Sales performance

In the year 2007, NMIPL recorded sales of 533 vehicles. Nissan Motor India has

sold more than 13,000 units of its flagship model Micra since sales began in July

2010.

Production

output

4,889,379 units

(2012)[4]

Revenue ¥9.63 trillion (2012)[5]

Operating income ¥523.5 billion (2012)[5]

Profit ¥342.4 billion (2012)[5]

Total assets ¥12.8 trillion (2012)[5]

Total equity ¥4.51 trillion (2012)[6]](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-104-320.jpg)

![106

Exports in the industry

India's automobile exports have grown consistently and reached $4.5 billion in

2009, with United Kingdom being India's largest export market followed by Italy,

Germany, Netherlands and South Africa. India's automobile exports are expected

to cross $12 billion by 2014.

In 2008, South Korean multinational Hyundai Motors alone exported 240,000 cars

made in India. Nissan Motors plans to export 250,000 vehicles manufactured in its

India plant by 2011.[83] Similarly, US automobile company, General Motors

announced its plans to export about 50,000 cars manufactured in India by 2011.

In September 2009, Ford Motors announced its plans to set up a plant in India with

an annual capacity of 250,000 cars for US$500 million. The cars will be

manufactured both for the Indian market and for export.

In 2009 India (0.23m) surpassed China (0.16m) as Asia's fourth largest exporter of

cars after Japan (1.77m), Korea (1.12m) and Thailand (0.26m) by allowing foreign

carmakers 100% ownership of factories in India, which China does not allow.

Hyundai, the biggest exporter from the country, now ships more than 250,000 cars

annually from India. Apart from Maruti Exports' shipments to Suzuki's other

markets, Maruti Suzuki also manufactures small cars for Nissan, which sells them

in Europe. Nissan will also export small cars from its new Indian assembly line.

Tata Motors exports its passenger vehicles to Asian and African markets, and is in

preparation to launch electric vehicles in Europe in 2010. The firm is also planning

to launch an electric version of its low-cost car the Tata Nano in Europe and in the

U.S. Mahindra & Mahindra is preparing to introduce its pickup trucks and small

SUV models in the U.S. market. Bajaj Auto is designing a low-cost car for Renault

Nissan Automotive India, which will market the productworldwide. Renault

Nissan may also join domestic commercial vehicle manufacturer Ashok Leyland in

another small car project.

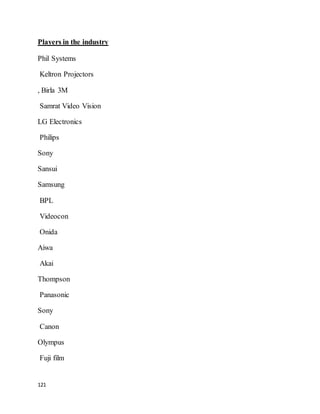

Following are the top 20 export countries of Indian Automobiule Industry :](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-106-320.jpg)

![139

Videocon Industries Limited

Videocon Industries Limited is a large diversified Indian company headquartered

in Gurgaon, Haryana. The group has 17 manufacturing sites in India and plants in

Mainland China, Poland, Italy and Mexico. It claims to be the third largest picture

tube manufacturer in the world. The group is a US$5 billion glob The Videocon

Group emerges as a $2.5 billion global conglomeratecontinuing to set trends in

every sphere of its activities from aconference room sized assembly line in 1979 to

having state-of-the-art manufacturing facilities in 17 different locations all over the

globe.Todaytheword‘VIDEOCON’is synonymouswith millions ofIndiansall over the

globe. Through its consumer electronics and homeappliances products it has

enriched the lives of millions of Indians.And since being the only true Indian brand

amongst the largeplethora of Korean and German brands Videocon has managed

tocarve its own niche in the market be the market leader.

"The Indian Multinational"

Type Public Company

Traded as

BSE: 532129

NSE: VIDEOIND

Industry Conglomerate

Founded 1979

Founder(s) Venugopal Dhoot[1]

Headquarters Gurgaon, India

Key people

Venugopal Dhoot

(Chairman & managing

director)[1]

Products

Consumer Electronics

Home Appliances

Components

Office Automation

Mobile phones](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-139-320.jpg)

![140

Wireless

Internet

Petroleum

Satellite television

Power

Revenue

181572.7 million

(US$3.0 billion)(2012–13)[2]

Net income

-716.3 million

(US$−12 million)(2012–13)[2]

Employees 9,000 (2012)

Subsidiaries

Videocon Telecom

Videocon d2h

Videocon Consumer

Electronics & Home

Appliances

Website

www.videocon.com

videoconworld.com

Corporate profile

The Videocon group's core areas of business are consumer electronics and home

appliances. They have recently diversified into areas such as DTH, power, oil

exploration and telecommunication.

Consumer electronics

In India, the group sells consumer products like colour televisions, washing

machines, air conditioners, refrigerators, microwave ovens and many other home

appliances, through a multi-brand strategy with the largest sales and service

network in India.[5]

Since the entry of Korean Chaebols and their rising popularity in the Indian

market, Videocon from a stand-point of market leader has seen a slow decline to

become a no 3 player in India. The company continues to do well in the washing

machine and refrigerator segment but has significantly lost ground in the consumer

electronics space[6]](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-140-320.jpg)

![141

Mobile phones

In November 2009, Videocon launched its new line of mobile phones.[7] Videocon

has, since launched a number of handsets ranging from basic colour FM phones to

high-end Android devices. In February 2011, Videocon Mobile Phones launched

the hitherto unknown conceptof 'Zero' paise (1 paise is the 100th unit of 1INR) per

second with bundled SIM cards of Videocon mobile services for 7 of its handset

models.

In June 2013, Videocon Mobiles launched its own flagship smartphone Videocon

A55HD in India for Rs. 13,499.[8]

Oil and gas

An important asset for the group is its Ravva oil field with one of the lowest

operating costs in the world producing 50,0000 barrels of oil per day.[9]

DTH

In 2009, Videocon launched its DTH product, called 'd2h'. As a pioneering offer in

the Indian DTH market, Videocon offered LCD & TVs with built-in DTH satellite

receiver with sizes 19" to 42".

Telecommunication

Videocon Telecommunications Limited has a licence for mobile service operations

across India. It launched its services on 7 April 2010 in Mumbai.

MajorAchievements of Videocon Industries Ltd:

One of the world's largest and most respected CRT glassmanufacturers

Firing the largest furnace of its kind in the world with a tank sizeof 3300 sq ft

One of the few companies in the world to convert sand to TV

One of the largest and most acknowledged CPT manufacturer in the world

Manufactured India's first rust-free Washing Machine](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-141-320.jpg)

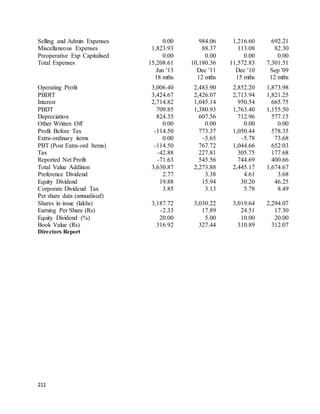

![145

Bottom Companies

Onida Electronics

Mirc Electronics Pvt. Ltd.

Type Public BSE: 500279

Industry Consumer electronics

Founded 1981

Headquarters Mumbai, Maharashtra , India

Revenue

15284.6 million

(US$250 million)

Employees 1500

Website www.onida.com

Onida is an electronics brand of Mirc Electronics, based in India. Onida is well

known in India for its colour CRT televisions.

History

Onida was started by G.L. Mirchandani and Vijay Mansukhani in 1981 in Mumbai.

In 1982, Onida started assembling television sets at their factory in Andheri,

Mumbai. It was established as "Mirc Electronics" in 1981.[4] Since then, Onida has

evolved into a multi-product company in the consumer durables and appliances

sector. Onida achieved a 100% growth in ACs and microwave ovens and a 40%

growth in washing machines last year.

Onida came out with the famous caption 'Neighbour's Envy, Owner's Pride'.

Another popular theme of the ads was a devil complete with horns and tail in the

1980s. The devil was replaced by a married couple later.[5] Onida has a network of

33 branch offices, 208 Customer Relation Centers and 41 depots spread across

India.[6] As on 31 March 2005, Onida had a market capitalization of

3014.6 million.](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-145-320.jpg)

![146

Mirc Electronics won an “Award for Excellence in Electronics” in 1999, from the

Ministry of Information Technology, Government of India.[7] Onida with its Sales

& Marketing office in Dubai reported a 215 per cent export growth in two years,

setting the base for an increased robustinternational presence.

Products

Onida brand has following range of products.

1. LCD TVs

2. Plasma TVs

3. Televisions

4. DVD and Home Theater Systems

5. Air Conditioners

6. Washing machines

7. Microwave Ovens

8. Presentation Products

9. Inverters

10.Mobile phones

11.LED TV

12.LCD monitor

13.LCD TV](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-146-320.jpg)

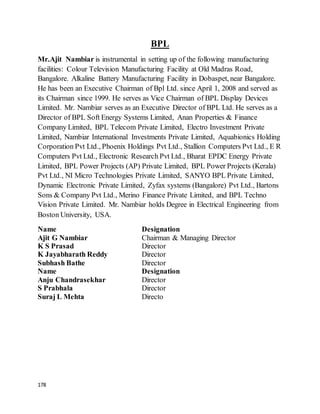

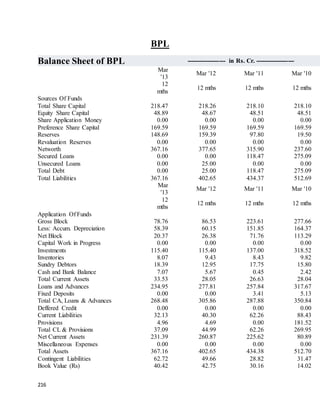

![149

British Physical Laboratories Group (BPL)

British PhysicalLaboratories Group (BPL) is an Indian electronics company [1]

that deals with consumer appliances (such as refrigerators and washing machines),

home entertainment products and health care devices.

Type Public (BSE: 500074)

Industry Electronics

Founded 1963

Headquarters Bengaluru, India

Products

Medical equipment,

televisions, refrigerators,

washing machines,

microwaves & audio

equipment

Revenue

118.50 crore

(US$19 million)

Operating

income

Rs 90 Crores

Net income

Rs 77 Crores (Extraordinary

income inclusive)

Employees around 250

Website www.bpl.in](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-149-320.jpg)

![169

Samsung Electronics India Limited

B. D. Park No

Relationships

Managing Director, Chief Executive

Officer of Samsung South-West Asia

Operations and President of Samsung

South-West Asia Operations

--

H. B. Lee No

Relationships

Chief Executive Officer of South West

Asia Regional Quarters and President

of South West Asia Regional Quarters

--

SameerGarde No

Relationships

Head of Enterprise Business --

MaheshKrishnan No

Relationships

Business Head of Home Appliances

and Vice President

46

Raj Kumar Rishi No

Relationships

Business Head of Audio Visual (AV)

Business and Vice President of Audio

Visual (AV) Business

--

Vineet Taneja

B.Tech., PGDM

No

Relationships

Head of Mobile and Digital Imaging

Business

49

Ravinder Zutshi No

Relationships

Deputy Managing Director

Lee Kun-hee

(born January 9, 1942) is a South Korean business magnate and the Chairman of

Samsung Electronics. He had resigned in April 2008, owing to Samsung slush

funds scandal, but returned on March 24, 2010. In 1996, Lee became a member of

the International Olympic Committee. With an estimated net worth of

$12.6 billion, he and his family rank among the Forbes richest people in the world.

He is the third son of Samsung founder Lee Byung-chull.[3]

Early life](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-169-320.jpg)

![170

Lee has a degree in economics from Waseda University and an MBA from George

Washington University.

Samsung

Lee Kun-hee joined the Samsung Group in 1968 and took over the chairmanship

on December 1, 1987, just two weeks after the death of his father and Samsung's

founder Lee Byung-chull.[4] In the early 1990s, believing that Samsung Group was

overly focused on producing massive quantities of low-quality goods and that it

was not prepared to compete in quality, Lee famously said in 1993 "Change

everything except your wife and kids" and true to his word attempted to reform the

profoundly Korean culture that had pervaded Samsung until this point. Foreign

employees were brought in and local employees were shipped out as Lee tried to

foster a more international attitude to doing business.

Under Lee's guidance, the company has been transformed from a Korean budget

name into a major international force and arguably the most prominent Asian

brand worldwide. One of the group's subsidiaries, Samsung Electronics, is now one

of the world's leading developers and producers of semiconductors, and was listed

in Fortune magazine's list of the 100 largest corporations in the world in 2007.

TodaySamsung's revenues are now 39 times what they were in 1987, it generates

around 20 percent of South Korea's GDP, and Lee is the country's richest man.[5]

On April 21, 2008, he officially resigned, and stated: "We, including myself, have

caused troubles to the nation with the special probe; I deeply apologize for that,

and I'll take full responsibility for everything, both legally and morally."[6] On

December 29, 2009, the South Korean government moved to pardon Lee Kun-hee.

On March 24, 2010, he announced his return to Samsung Electronics as its

chairman.

Awards

In 2004, Lee received the Legion of Honour from French government at

Paris.

In September 2006, Lee received the James A. Van Fleet Award from the

Korea Society.](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-170-320.jpg)

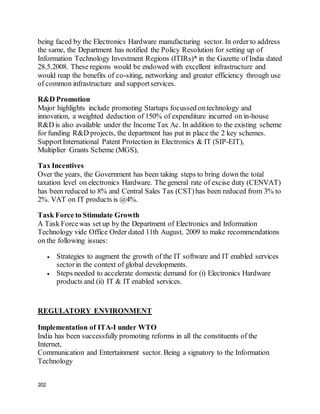

![195

Indian Posts and Telegraphs Accounts and Finance Service) are under the

administration and supervision of the Ministry of Communications and

Information Technology.

The Government of India, Ministry of Communications & Information

Technology, Department of Electronics and Information Technology (formerly

the "Department of Information Technology") has a mission to promote the e-

Development of India through a multi-pronged strategy of e-Infrastructure creation

to facilitate and promote e-governance, promotion of the Electronics &

Information Technology-Information Technology Enabled Services (IT-ITeS)

Industry, providing support for the creation of Innovation/Research &

Development (R&D), building a knowledge network and securing India's

cyberspace

NationalPolicy on Electronics

NationalPolicy on Electronics is formulated by the Government of India to boost

India's Electronics Systems and Design Manufacturing industry and improve its

share in global market. The policy was drafted in 2011 by the Department of

Information Technology of the Ministry of Communication and Information

Technology.[1][2] It is the first of the three policies for IT, Telecom and Electronics

released by the government.

Salient features

The strategies included in the policy are listed below.

1. Provide incentives through Modified Special Incentive Package Scheme (M-

SIPS)

2. Setting up of Semiconductor Wafer Fabrication facilities

3. Preferential market access to domestically manufactured electronic products

4. Provide incentives for setting up of 200 Electronic Manufacturing Clusters

(EMCs) - setting up of greenfield EMCs and upgradation of brownfield

EMCs

5. Establish a stable tax regime and market India as a destination to attract

investments

6. Create a completely secure cyber ecosystemin the country](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-195-320.jpg)

![227

VAT on IT items is @4% and non-IT electronic items is @12.5%. CST is

2%.

About Electronics and Computer Software Export PromotionCouncil

Electronics and Computer Software Export Promotion Council (ESC), sponsored

by the Government of India is India’s largest Electronics and IT trade facilitation

organization. Starting in 1989, with an export performance of US$ 200 million,

ESC has successfully steered India’s Electronics and Software Exports to US$ 65

billion during 2010-11 with membership of over 2200 exporters today. ESC

facilitates global interests of foreign companies interested in establishing business

linkages in India. ESC’s excellent match – making services help interested ICT

companies to locate a reliable partner in India for their business requirements.

In an Industry where the degree of technological obsolescenceis very high, ESC is

striving hard to elevate India’s position in the international trading arena of the

Electronic and Computer Software.

Some Mergers and Acquisitions in the electronic industry

Acquisition of Thomson SA by Videocon

Videocon through a Wholly Owned Offshore Subsidiary acquired the Colour

Picture Tube (CPT)businesses from Thomson S.A having manufacturing facilities

in Poland, Italy, Mexico and China along with supportresearch and development

facilities.

Acquisition rationale

The acquisition came at a time when Thomson was facing a fall in demand in

developed markets for television with CPTs and was moving more towards Flat-

screen and Plasma Television. However, Videocon saw an opportunity in the

emerging countries for CPTs and hence pursued with the acquisition. Besides, the

acquisition gave Videocon, the access to advanced technology giving the company

control over an R&D facility in Agnani, Italy. The major reasons behind this

acquisition were:[10]

Costcutting – Videocon was better positioned to shift the activities to low-cost

locations and also it could integrate the operations with the glass panel facility in](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-227-320.jpg)

![228

India with the CPT manufacturing facilities acquired from ThomsonS.A.

Videocon wanted to leverage its position in the existing parts of the business and

this acquisition would give it a strong negotiation position and could reduce impact

of glass pricing volatility. Videocon could also reduce the costs byupgrading and

improving the existing productionlines.

Vertical Integration – The acquisition helped Videocon in vertically integrating

its existing glass-shell business where it had been enjoying substantially high

margins.[11] Videocon’s glass division had the largest glass shell plant in a single

location. This gave the company an unrivaled advantage in terms of economies of

scale and a leadership position in the glass shell industry. The acquisition also gave

Videocon a ready-market for its glass business and it was part of Videocon’s long-

term strategy to have a global vertically-integrated manufacturing facility.

RationalisationofProduct Profile – Videocon modified its productprofile to

cater to the changing market needs like moving away from very large size picture

tubes to smaller ones.[12] Apart from the overall strategy Videocon also had a plan

on the technological front. It wanted to improve the setup for the production line

and line speed post-merger. Its focus was to increase sales while reducing the costs

and thereby improving the productivity of the existing line. The company also

wanted to foray in a big way into LCD panels back-end assembly . On the sales

front the company wanted to leverage on the existing clients of Thomsonand build

relation as a preferred supplier to maximise sales. Also, Videocon could benefit

from OEM CTV business with the help of Videocon’s CTVdivision, invest for

new models and introduction of new technologies.[13]

Thomson’s perspective

In 2005 Thomsonplanned entry into the high-growth digital media and technology

business. Also, Thomsonwanted to exit consumer and electronics businesses as

they were incurring significant losses. After sale of its TV business to Chinese

group TCL, and Tubes to Videocon, Thomsondivested from the audio/video

accessories business which was the last unit of its consumer electronics business.

The need to divest are quite evident from the losses that it incurred in these

businesses particularly that the unit that it sold off to Videocon, the Optical

Modules activity, and the Audio/Video & Accessories businesses which totalled

around €749 million for 2005. Moreover Thomsonhad done some acquisitions that

were in line with boosting their revenues in the following years. [14]

Other competitors for the acquisition](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-228-320.jpg)

![229

When Videocon entered the race for the colour picture tubes manufacturing

capacity of ThomsonSA in November 2004, there were 16 other bidders.

Videocon stood slim chances given the fact that it had to battle it out with players

like LG, Philips, Samsung and Matsushita, Daewoo and several Chinese

manufacturers but finally managed to close the deal. The deal catapulted Videocon

into the No. 3 slot in the global pecking order for CPTs. An official of Videocon

said on the deal "The word is out in the world that India and Indian companies are

not just a good bet by themselves, but also a hedge against China.“[15]

Thomson’s exit from Videocon

Thomsonis looking to sell out its share in Videocon (a 10 percent share via GDRs)

and in most likelihood it would be bought by Videocon itself. Thomsonwould be

exiting at a loss as it had acquired the stake at around 400 (US$6.50) per

share.The deal is expected to happen at current market prices. Videocon’s GDR is

currently traded at around $5.06 on the Luxembourg StockExchange. On the

Bombay stockexchange its trading around 150 against the 52-week high of 868

in Jan 2008.](https://image.slidesharecdn.com/projectreport-150131042627-conversion-gate01/85/Project-report-industry-analysis-229-320.jpg)