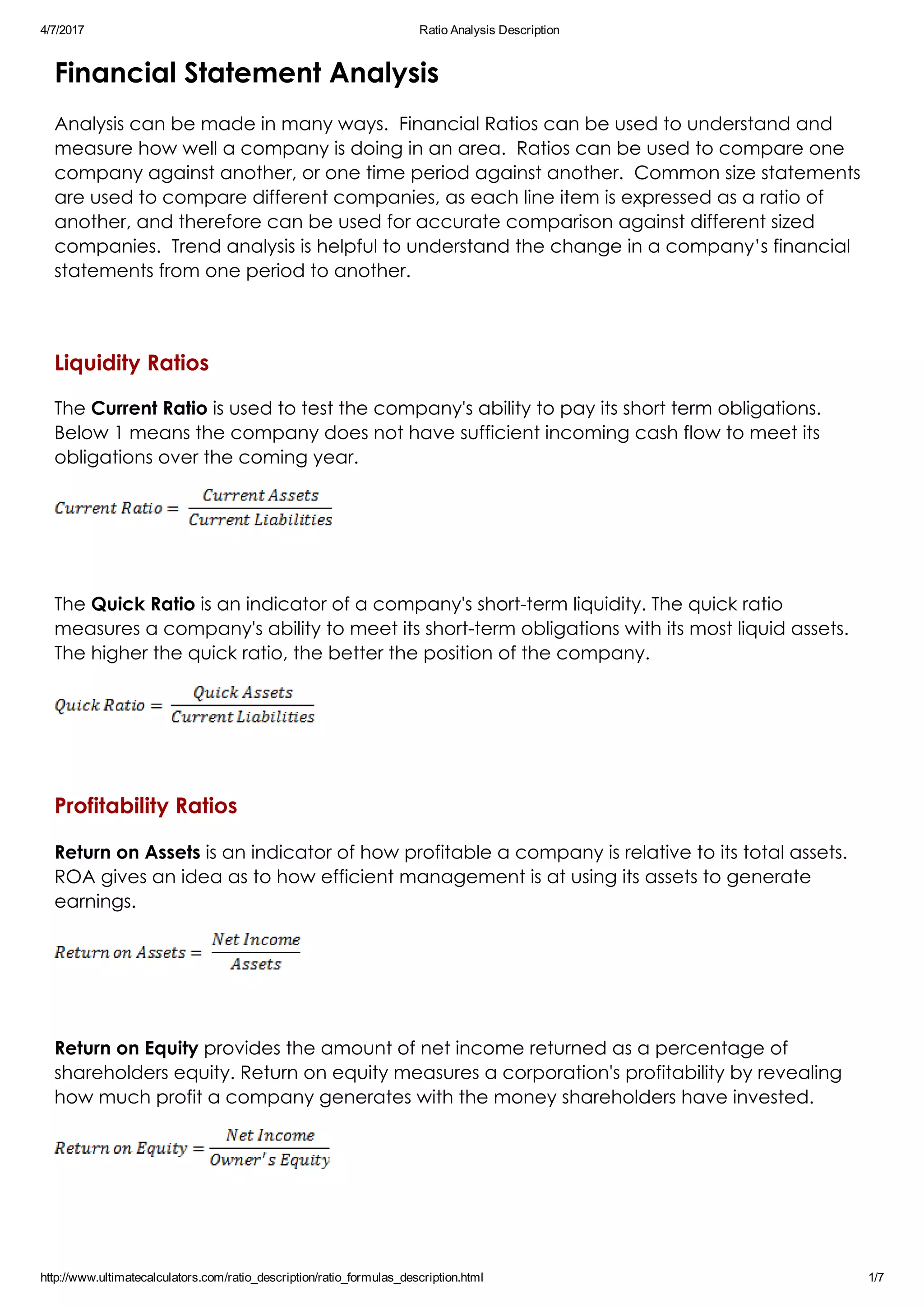

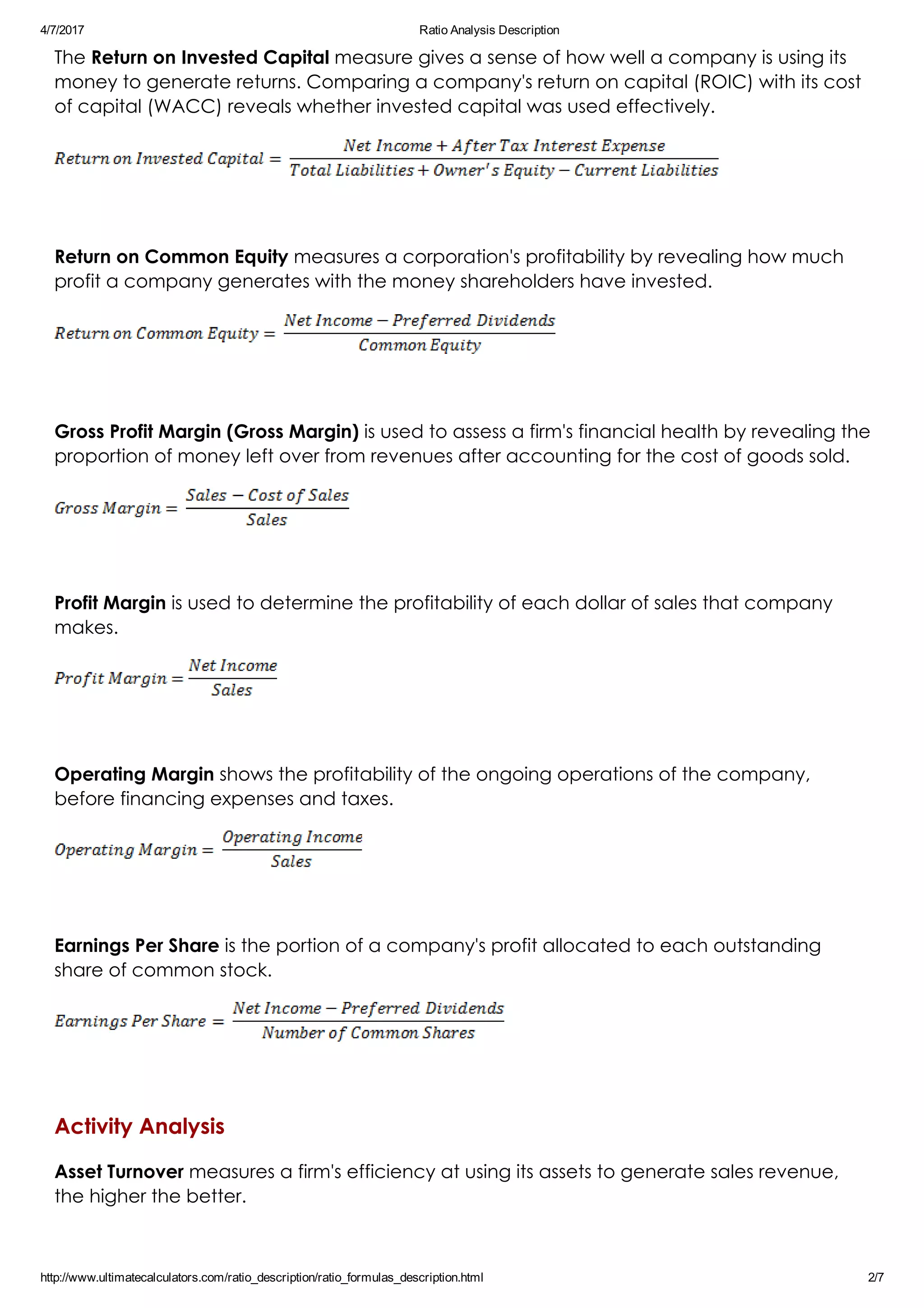

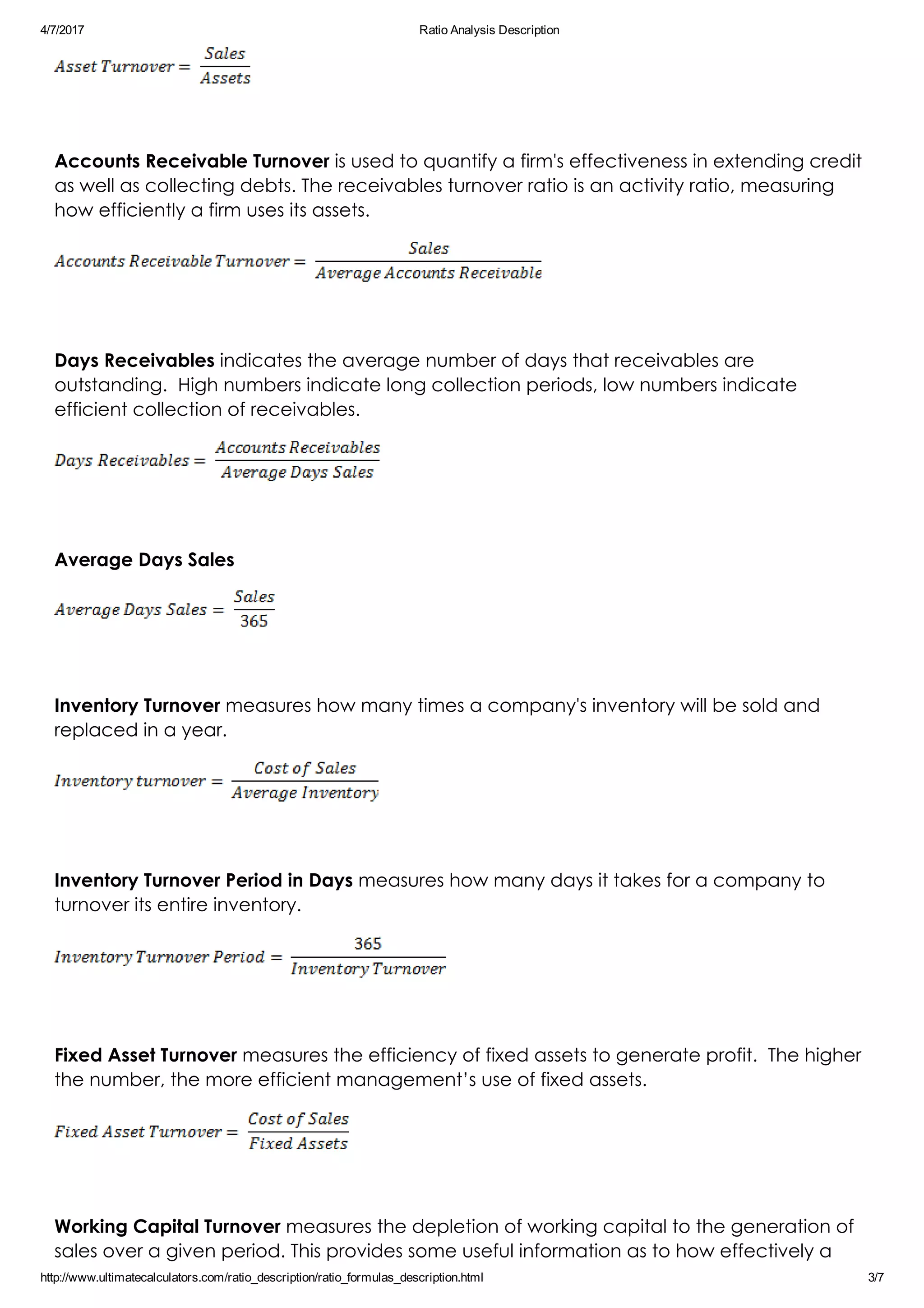

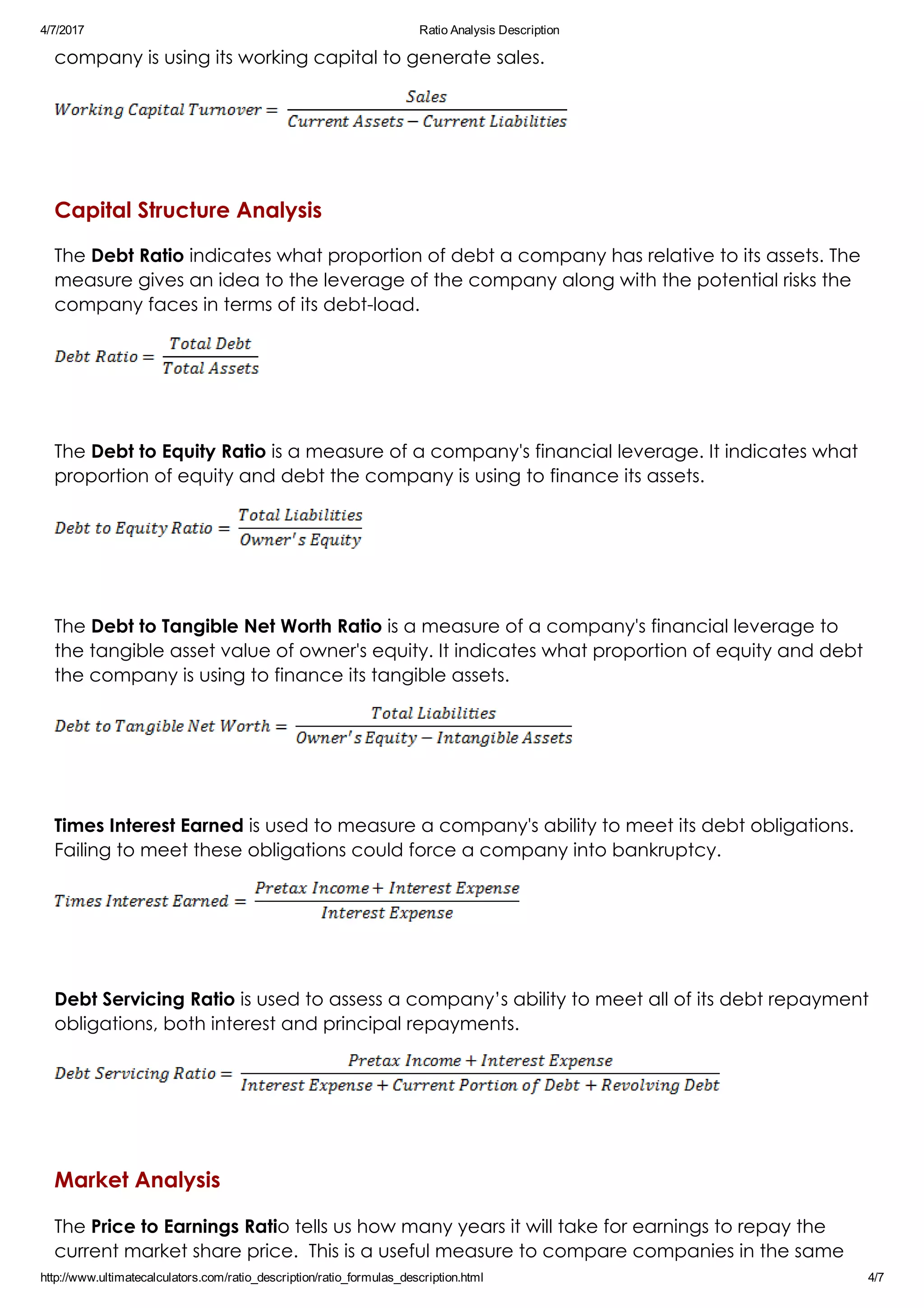

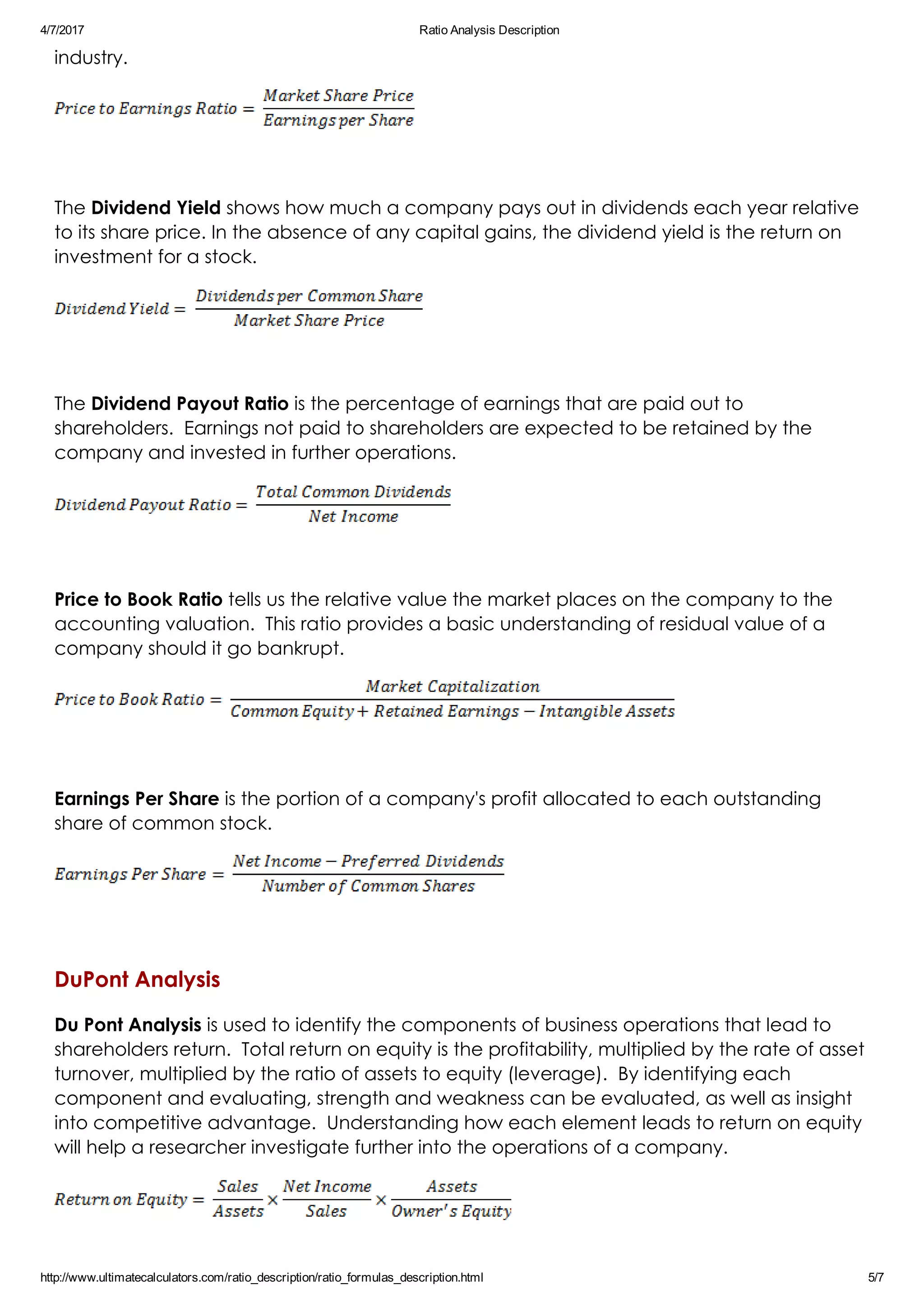

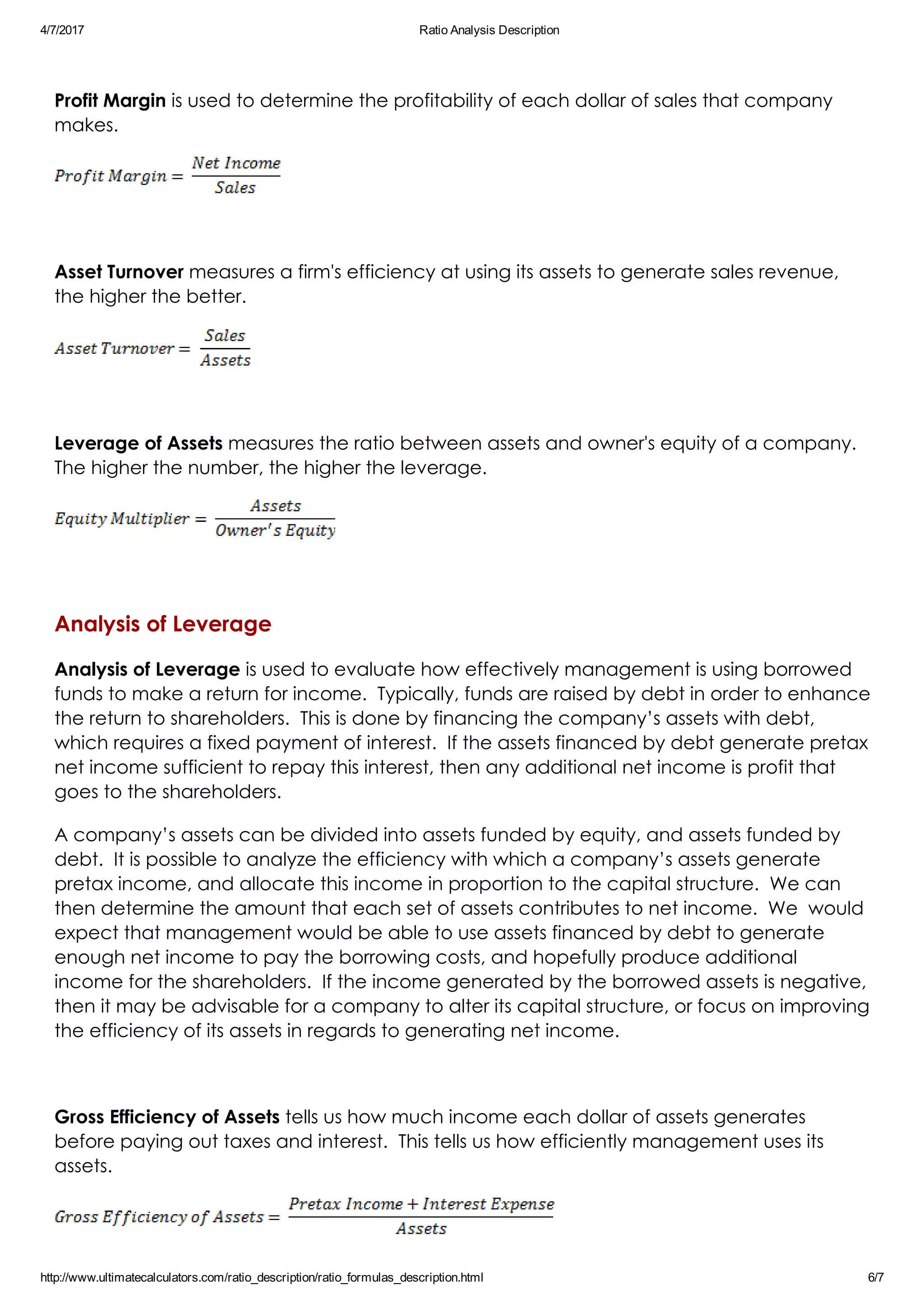

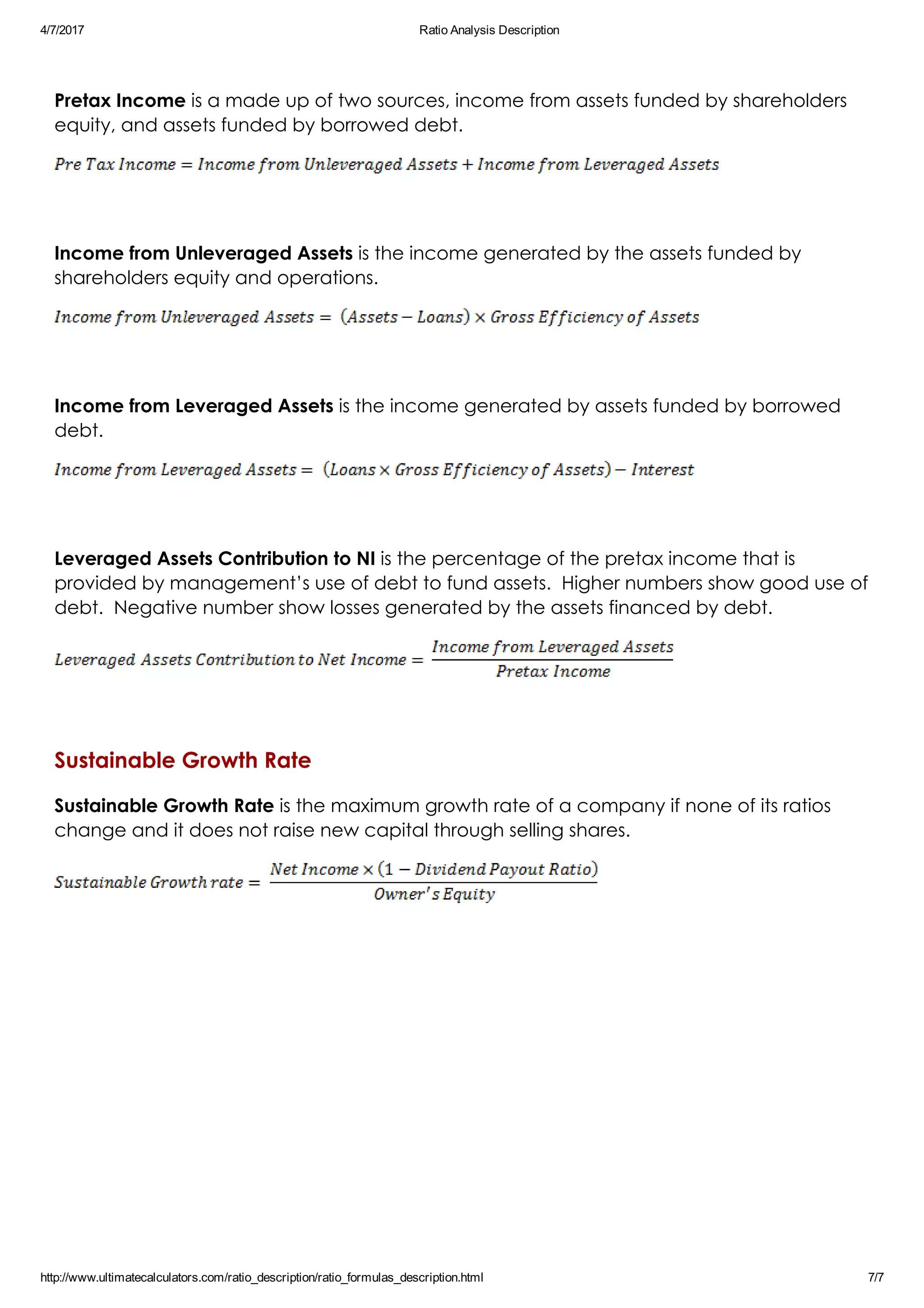

This document provides descriptions and explanations of various types of financial ratios used in ratio analysis. It discusses liquidity ratios like the current ratio and quick ratio, profitability ratios such as return on assets and return on equity, activity ratios including asset turnover and inventory turnover, capital structure ratios like the debt ratio, and market ratios like the price to earnings ratio. It also covers DuPont analysis, analysis of leverage, and sustainable growth rate. The ratios can be used to evaluate different aspects of a company's financial health and performance over time.