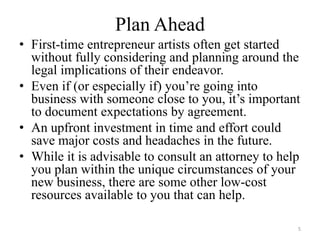

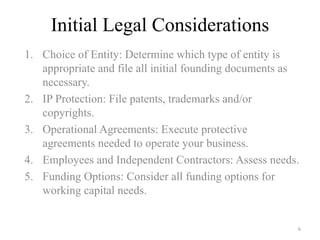

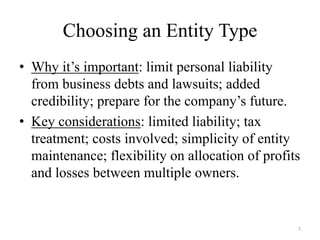

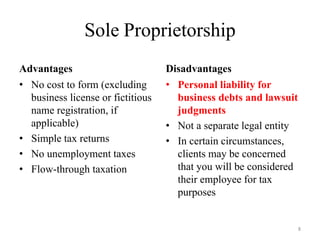

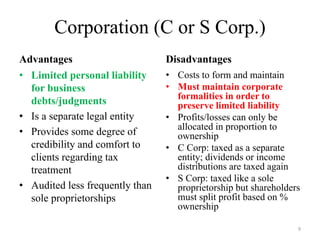

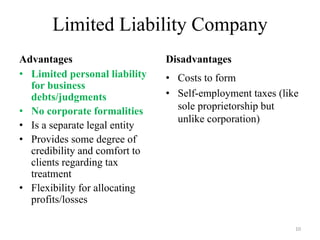

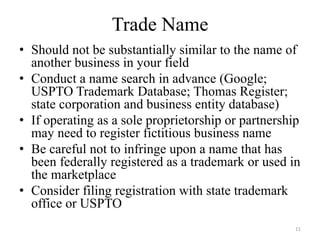

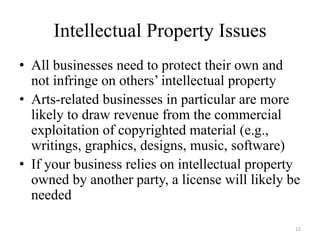

This document provides information for creative professionals starting their own business. It discusses advantages and disadvantages of entrepreneurship, initial business considerations like market opportunity and competitive advantages, and choosing an entity type. Key legal considerations for starting a business are also outlined, including intellectual property protection, copyright ownership, and using nondisclosure agreements. The speaker is an entertainment attorney who will provide legal guidance on these business start-up topics.