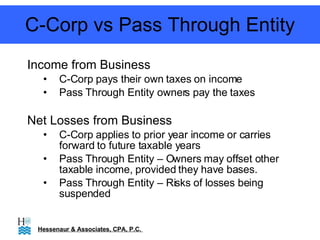

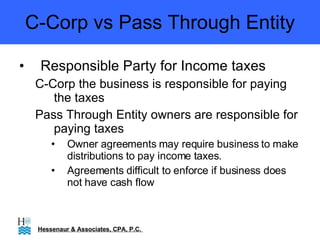

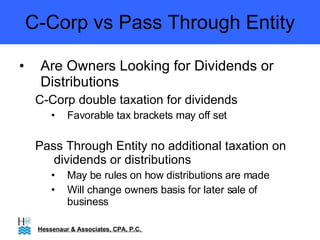

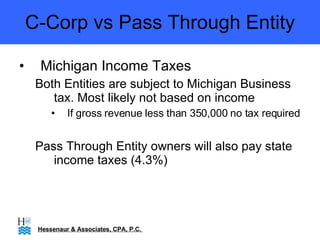

This document summarizes some key differences between C-corporations and pass-through entities (like S-corporations and LLCs) for startup businesses. It notes that C-corps pay corporate income taxes while owners of pass-through entities pay individual taxes. Losses can offset other income for pass-through entities but not C-corps. The document also discusses tax implications of distributions, sales, agreement of owners, and entity conversion. It recommends consulting professionals to determine the best structure based on the business goals and plans.