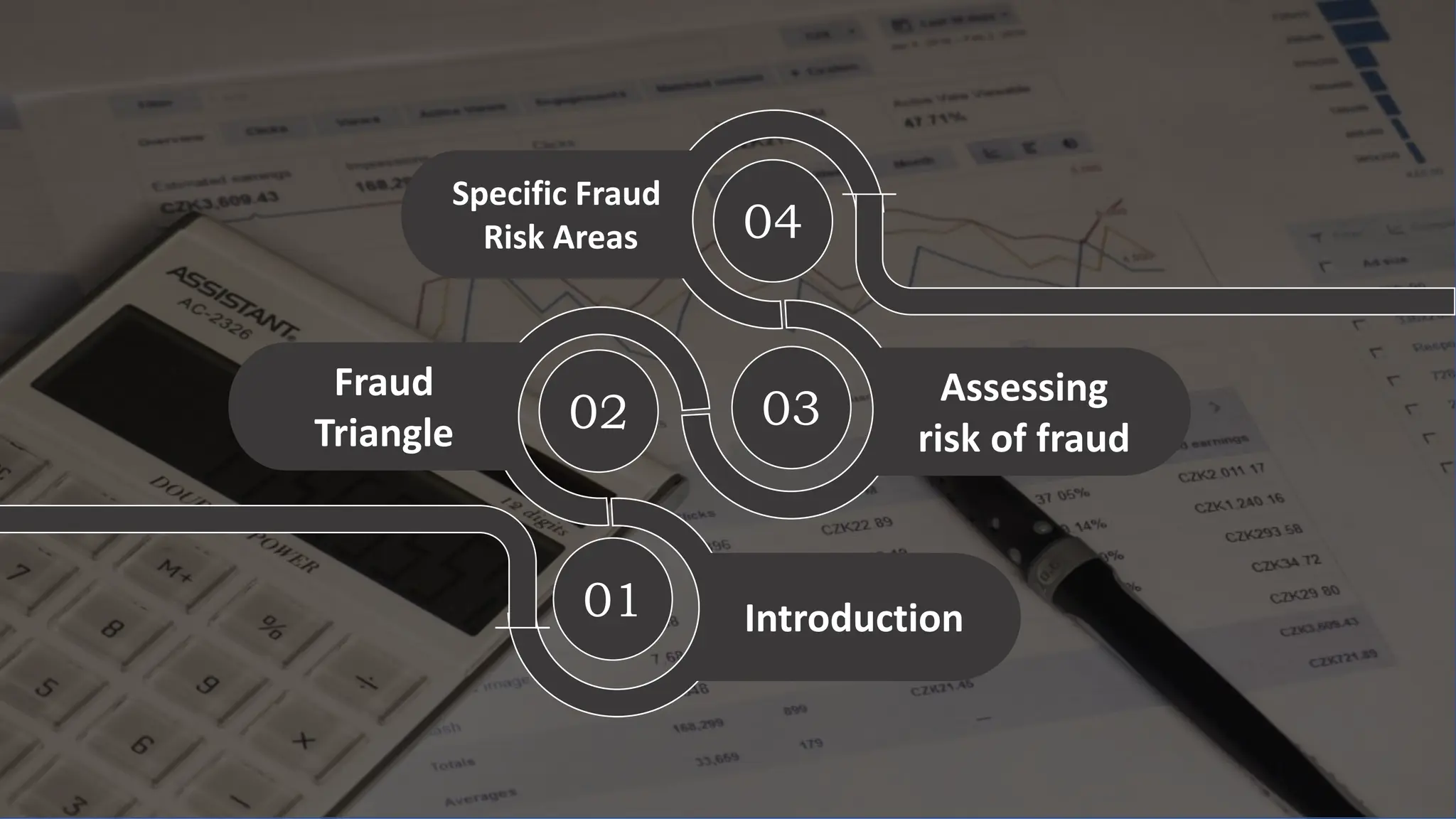

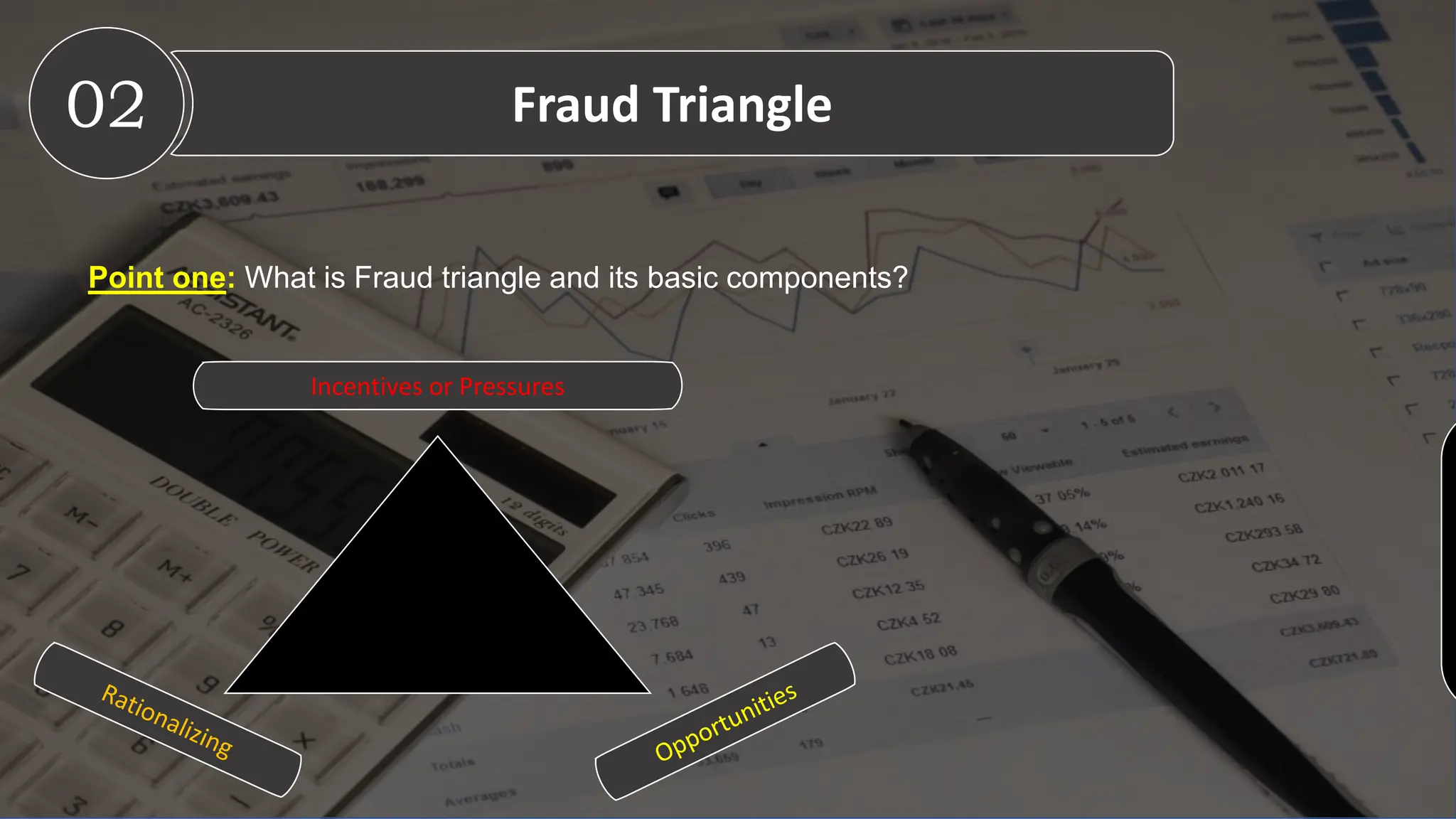

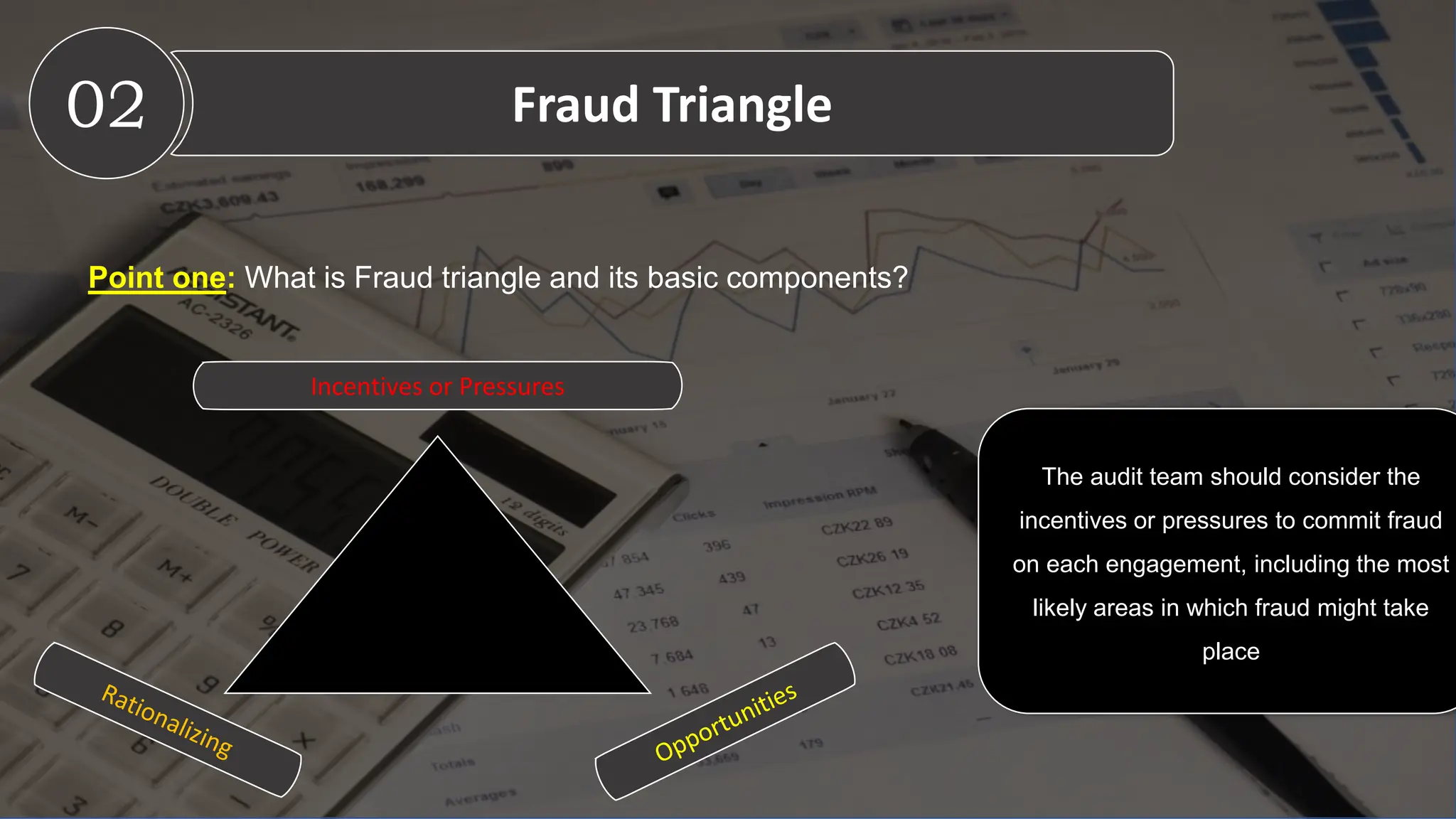

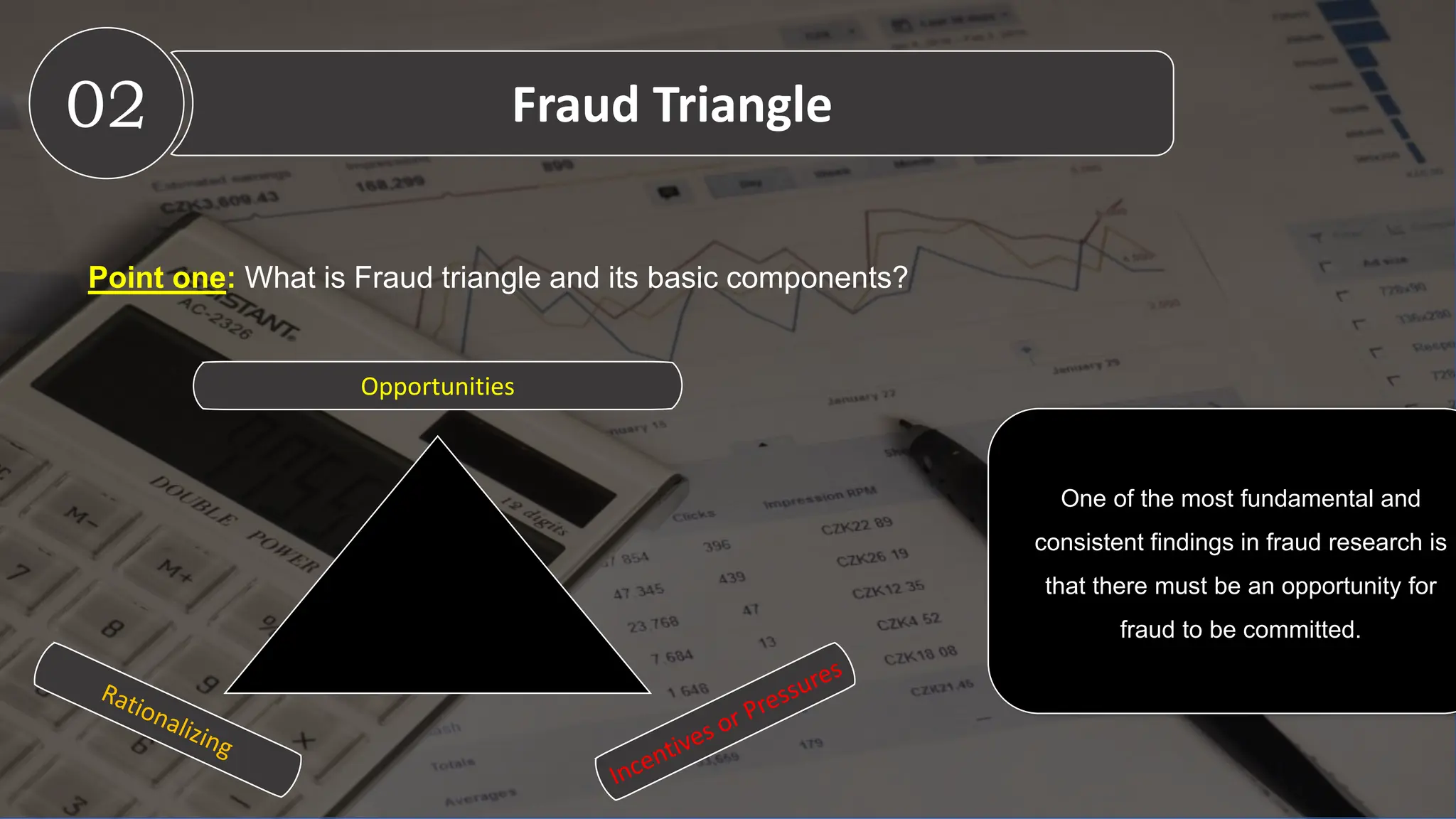

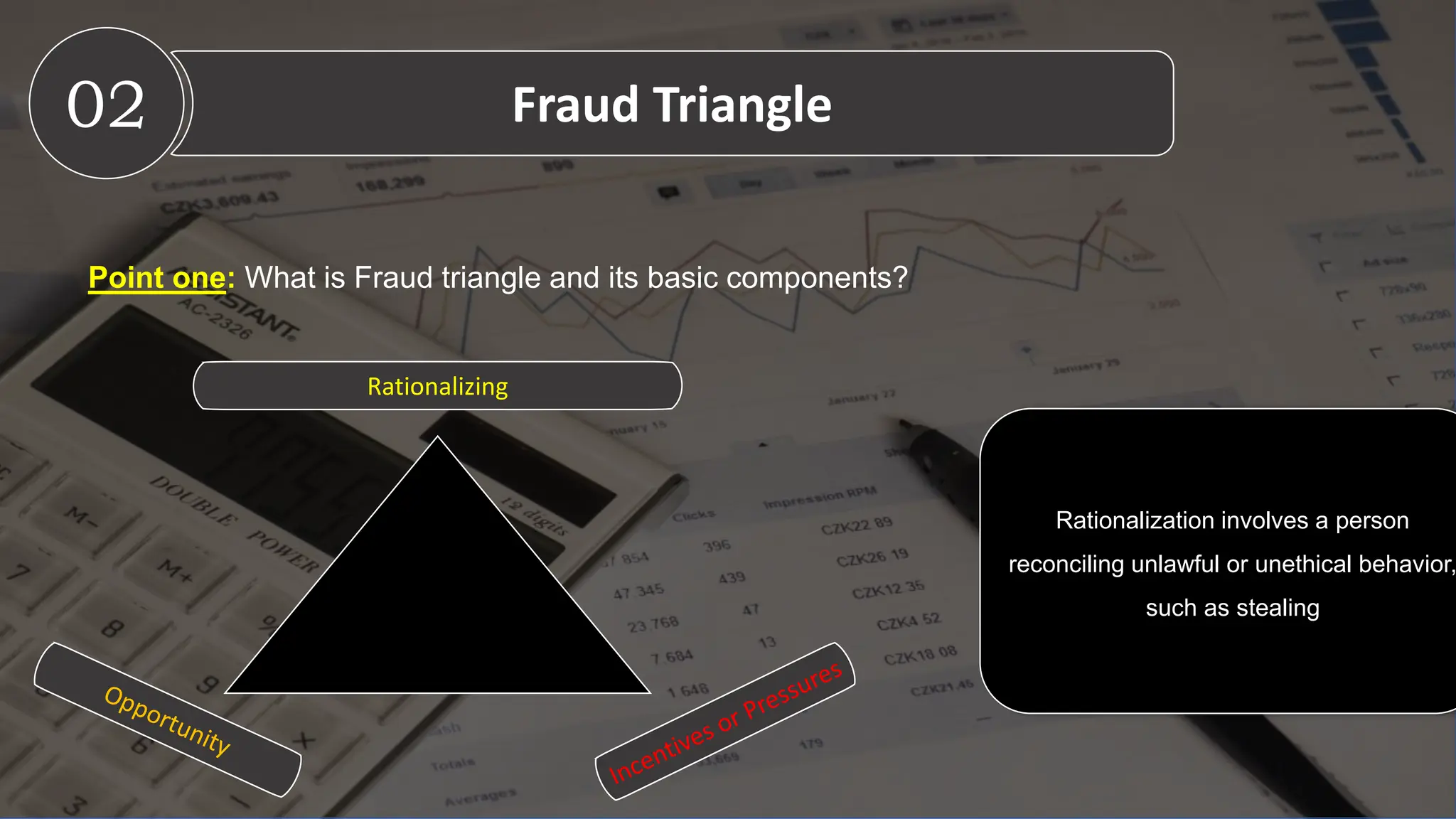

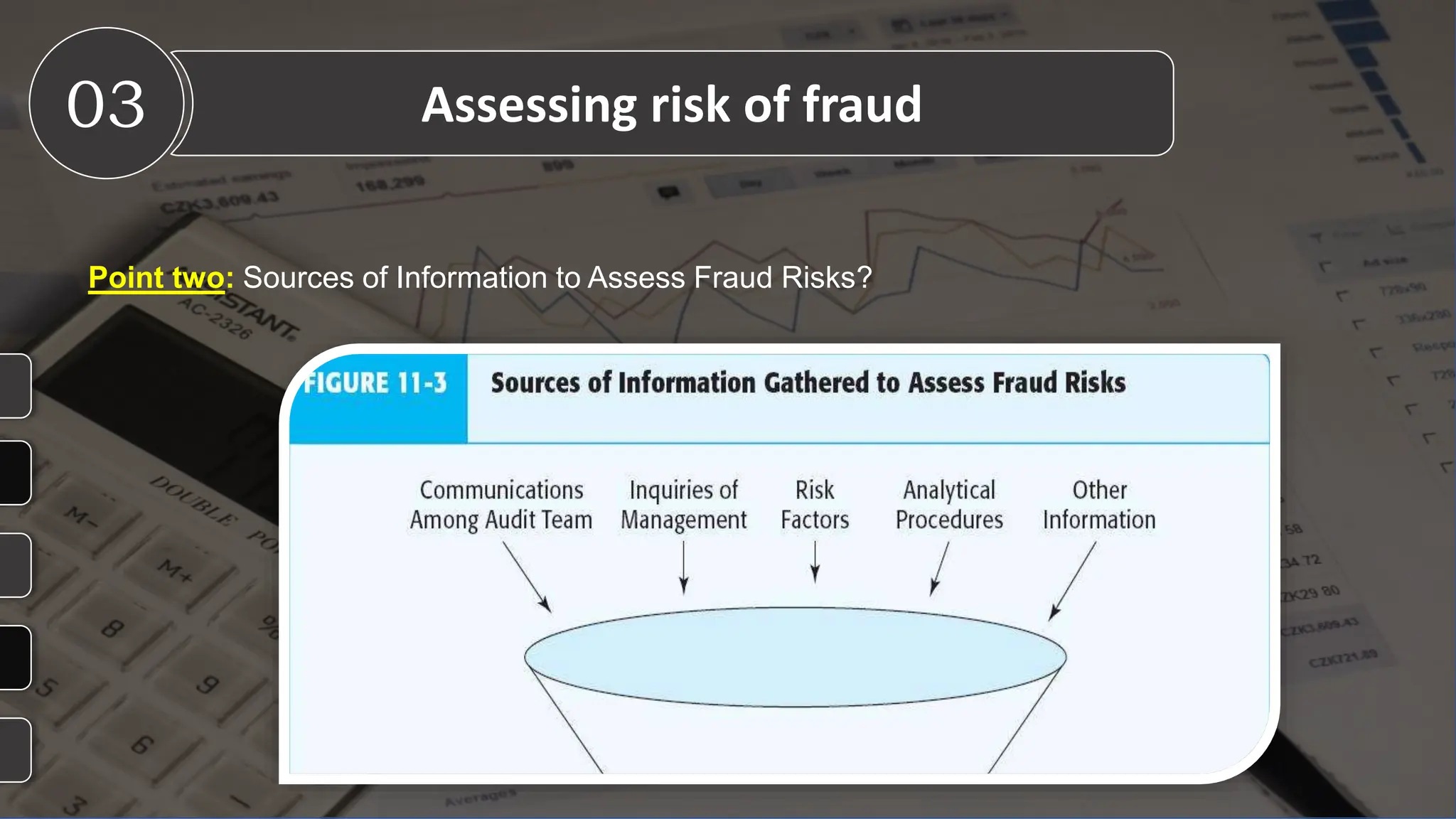

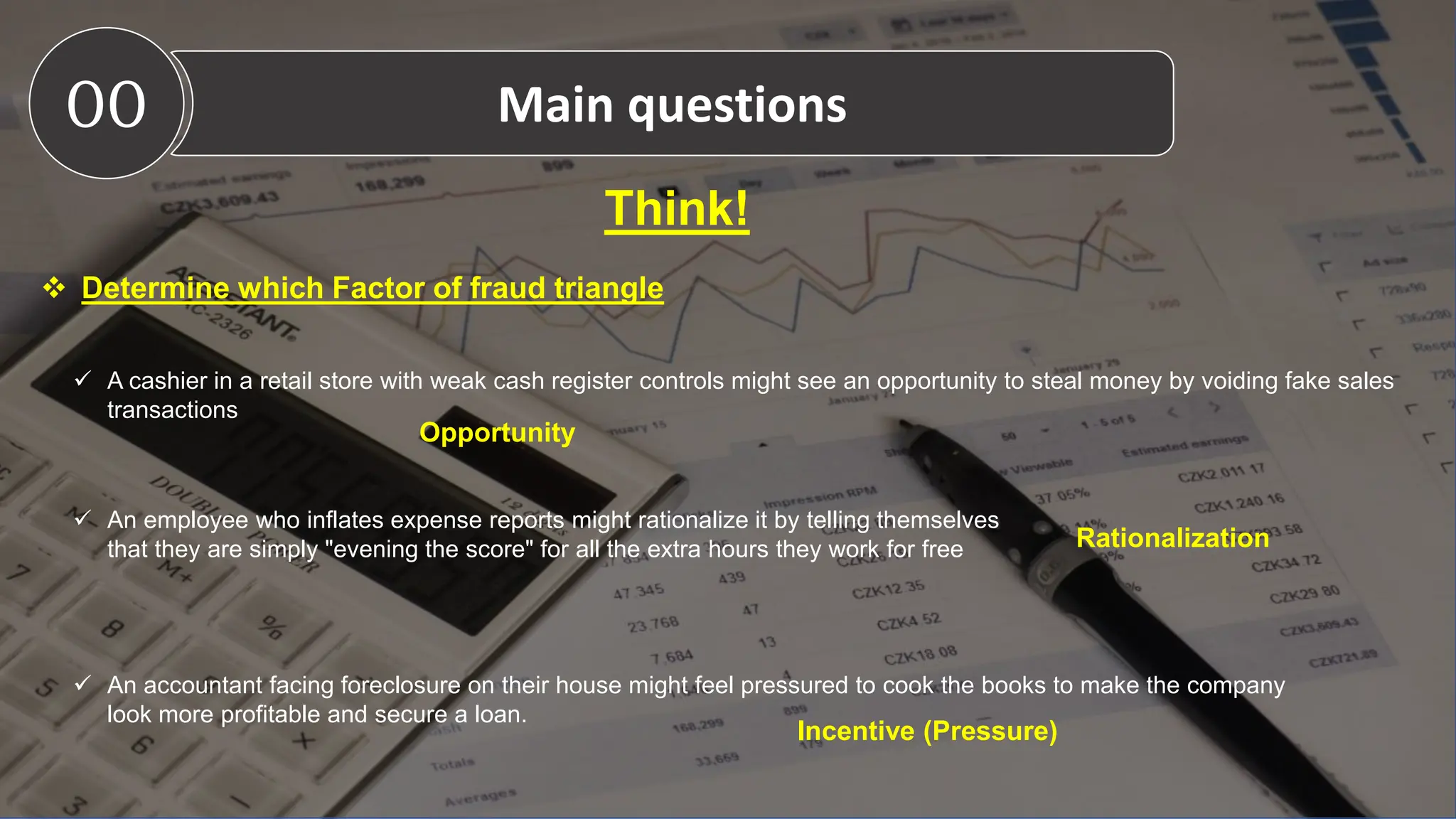

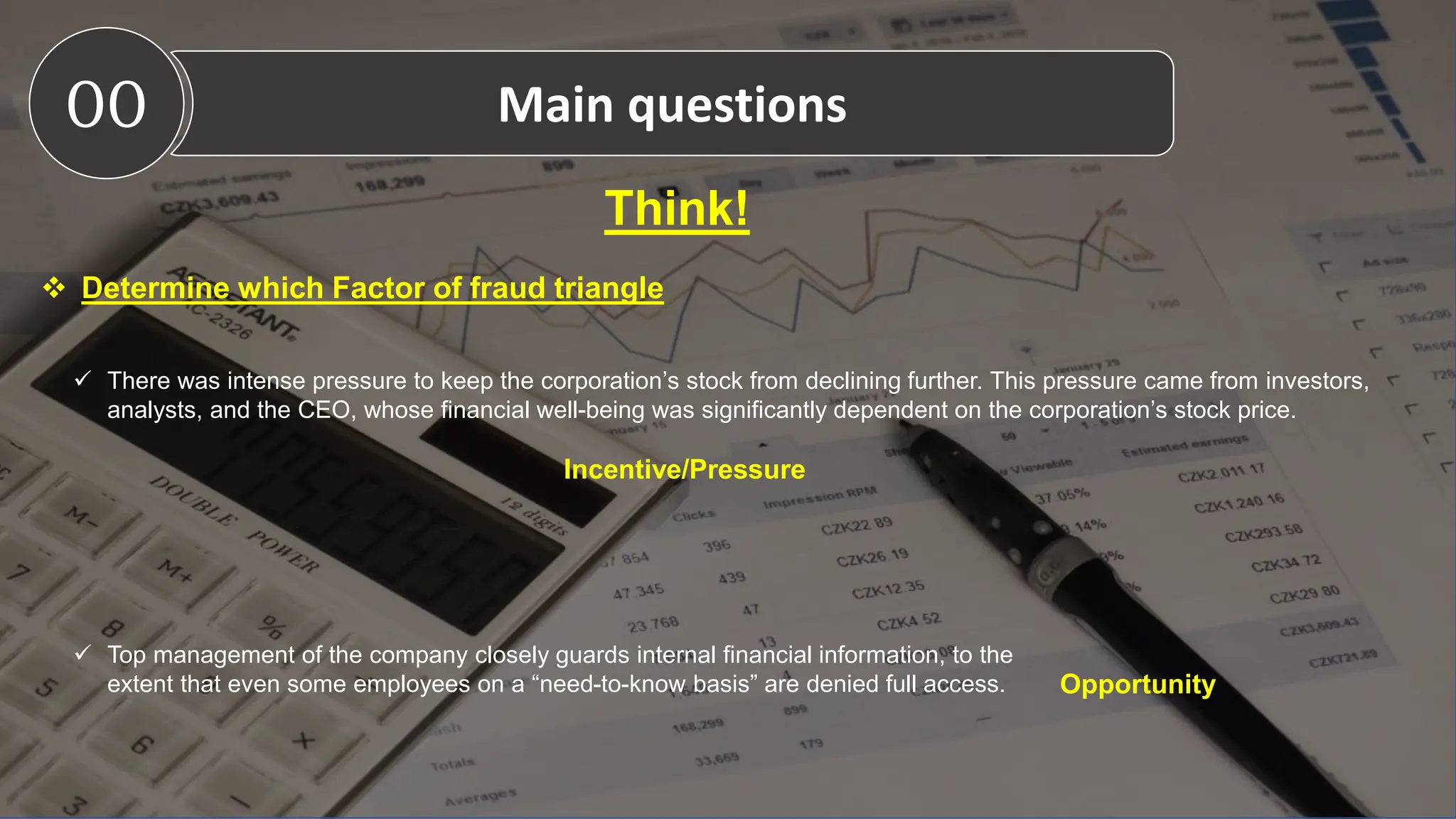

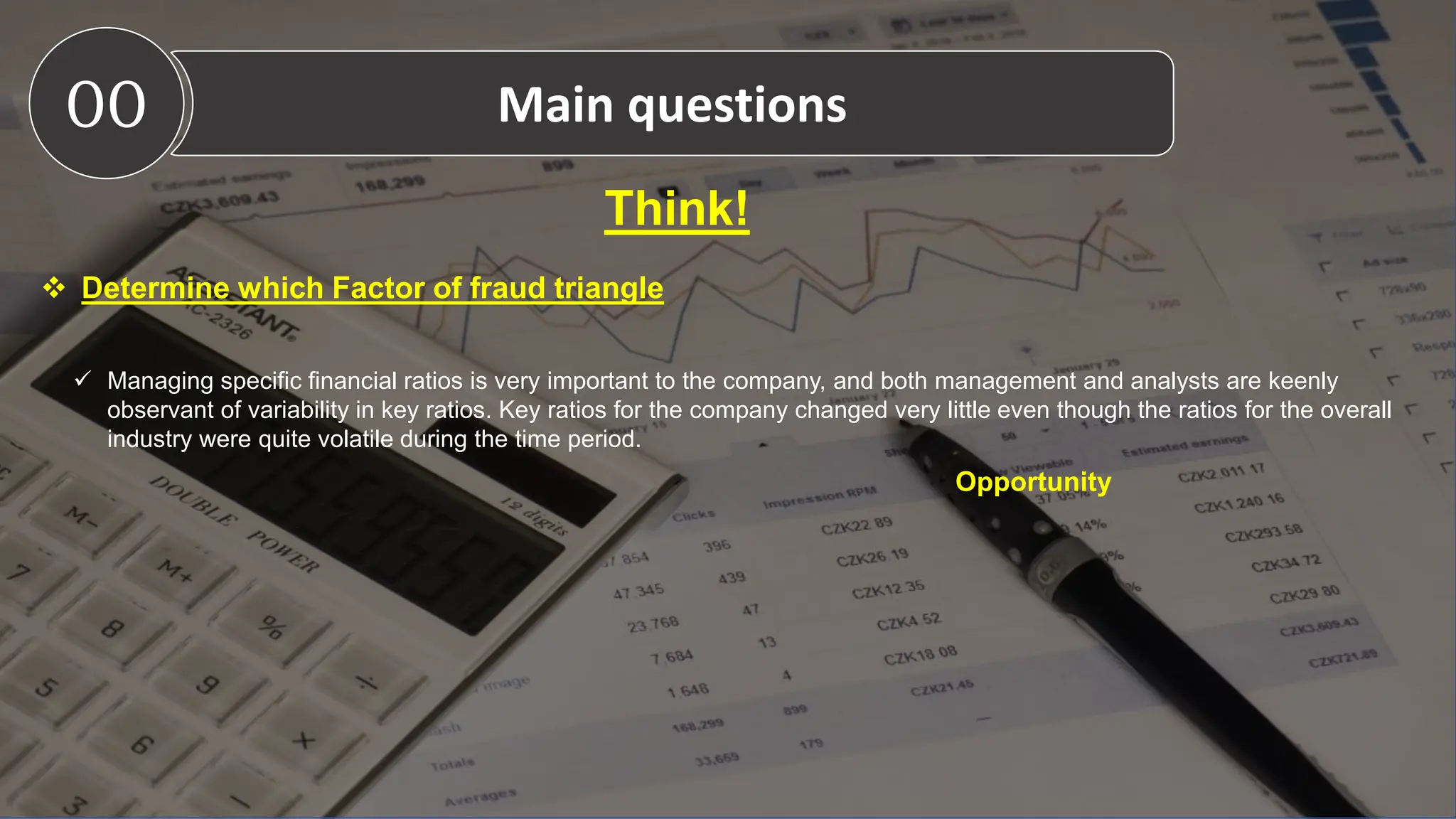

The document provides an overview of fraud auditing, focusing on the definition of fraud, its types, and the fraud triangle which consists of incentive, opportunity, and rationalization. It outlines the importance of assessing risk, professional skepticism, and corporate governance in detecting and preventing fraud. Furthermore, it emphasizes the auditor's role in documenting fraud assessments and the need for a culture of honesty within organizations.