Foreign direct and portfolio investments refer to investments made by entities in one country into assets or businesses located in another country. Specifically, the document discusses:

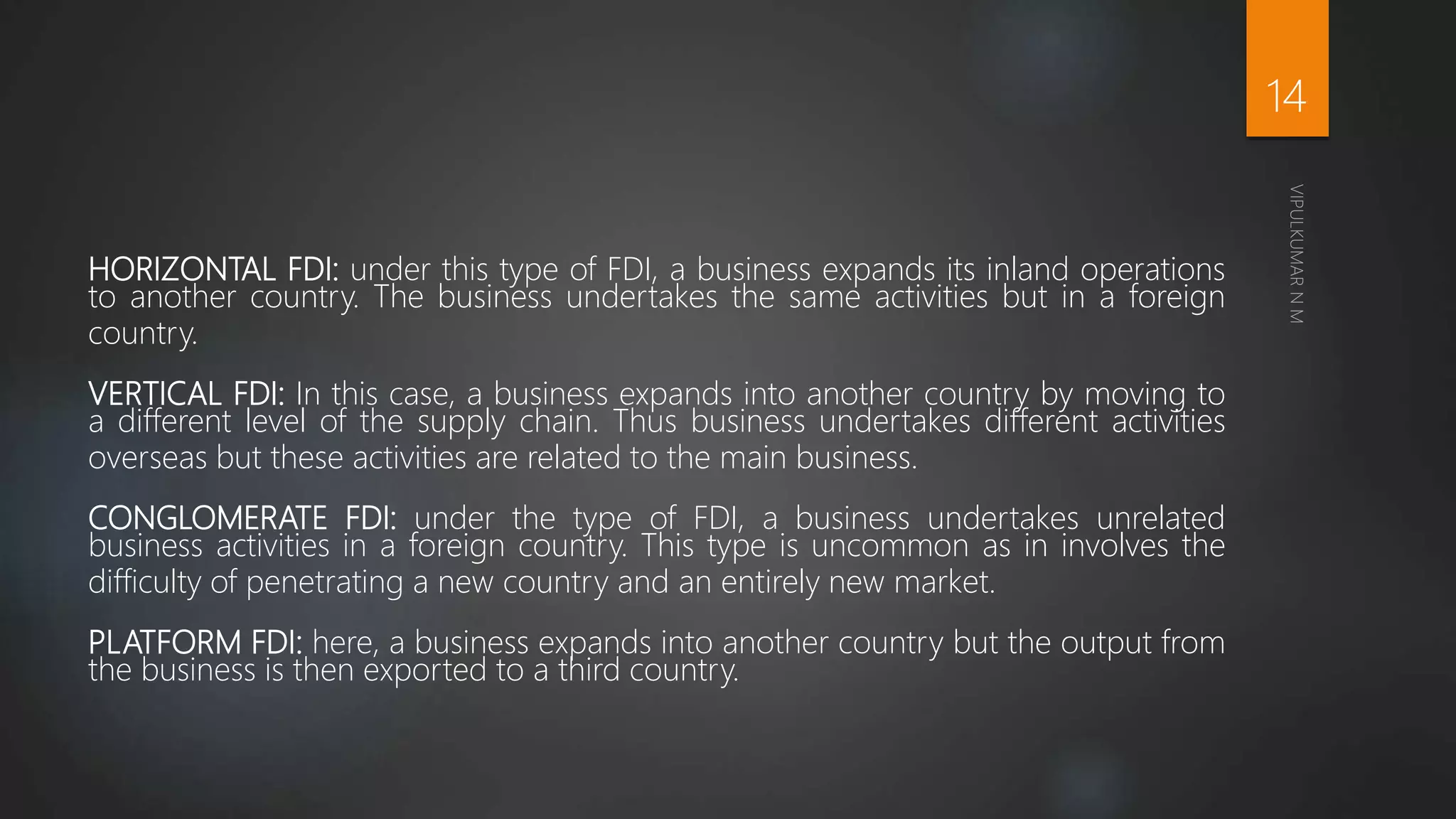

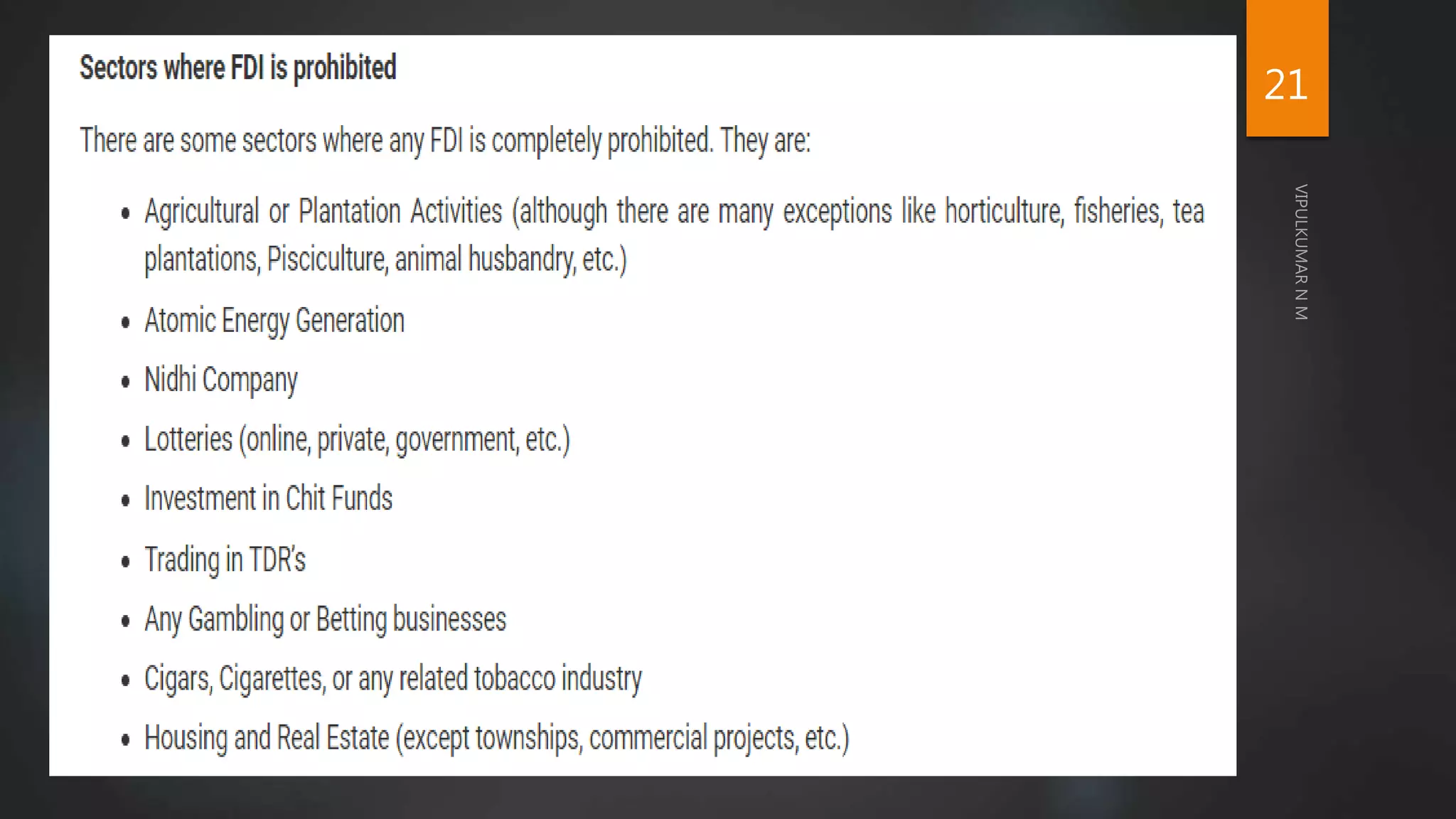

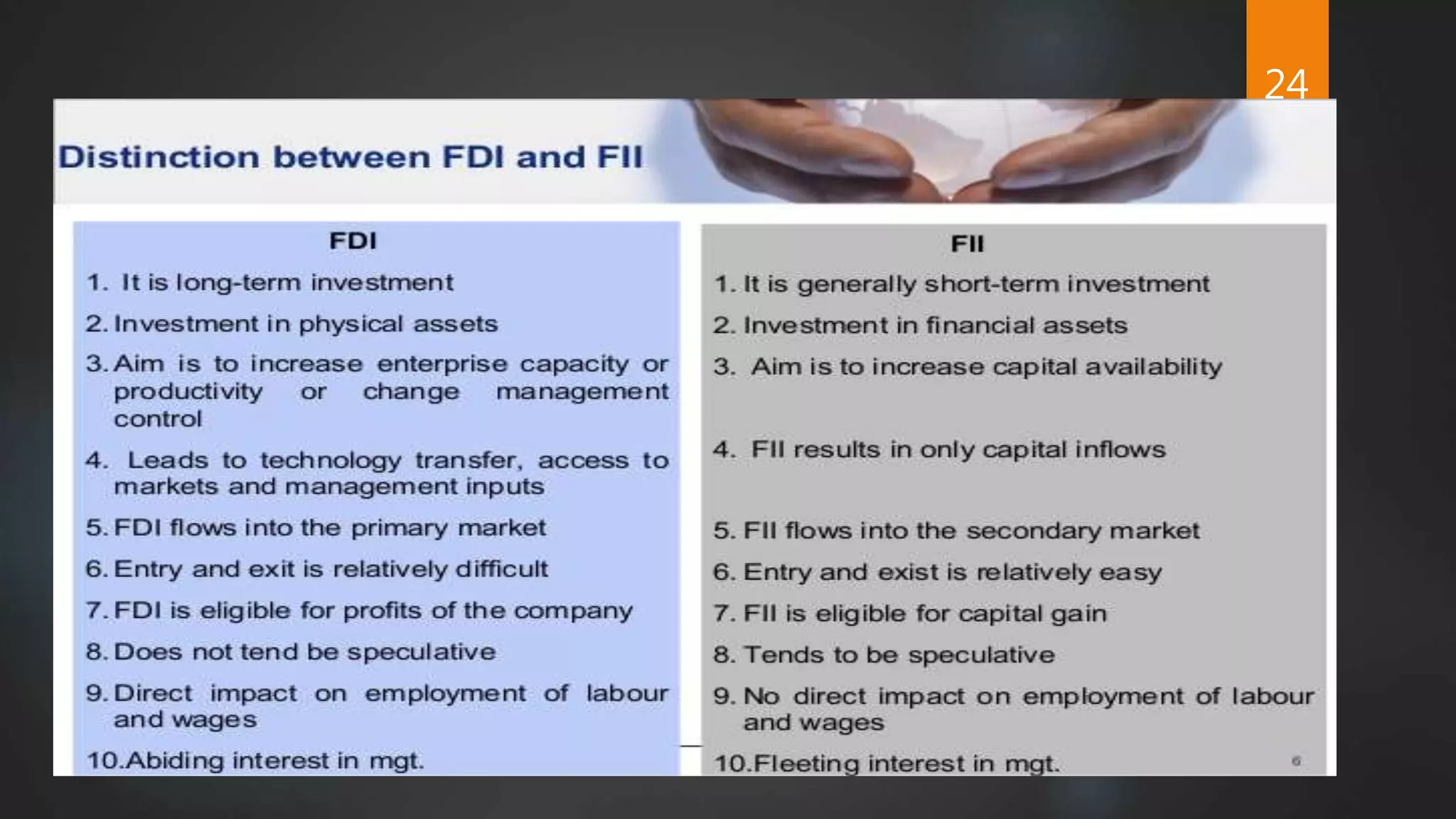

- Foreign direct investment (FDI) which involves controlling ownership of foreign assets or businesses. FDI can be horizontal, vertical, or conglomerate. Advantages include economic development, easier trade, jobs, and human capital development. Disadvantages include hindering domestic investment and political risk.

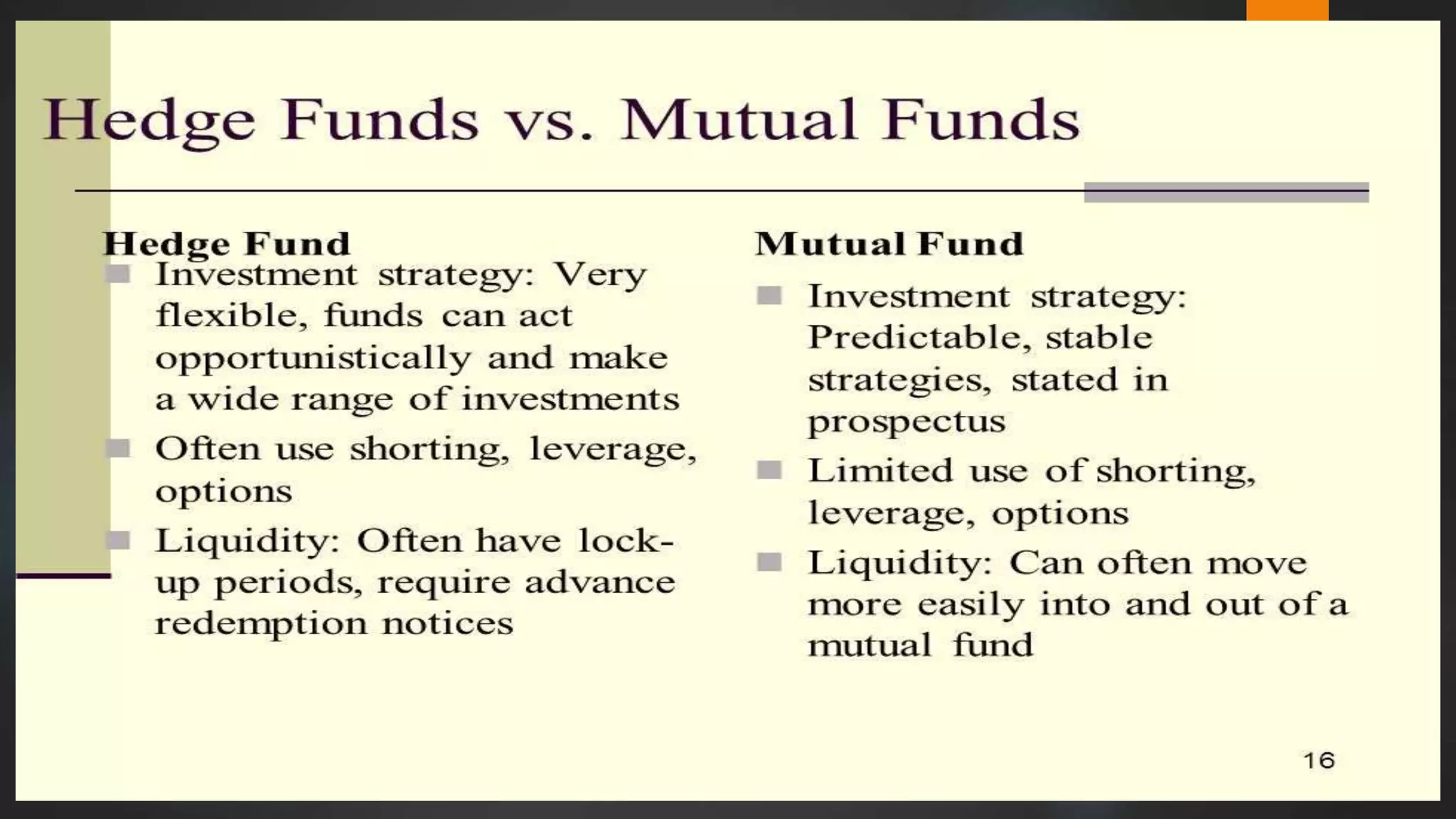

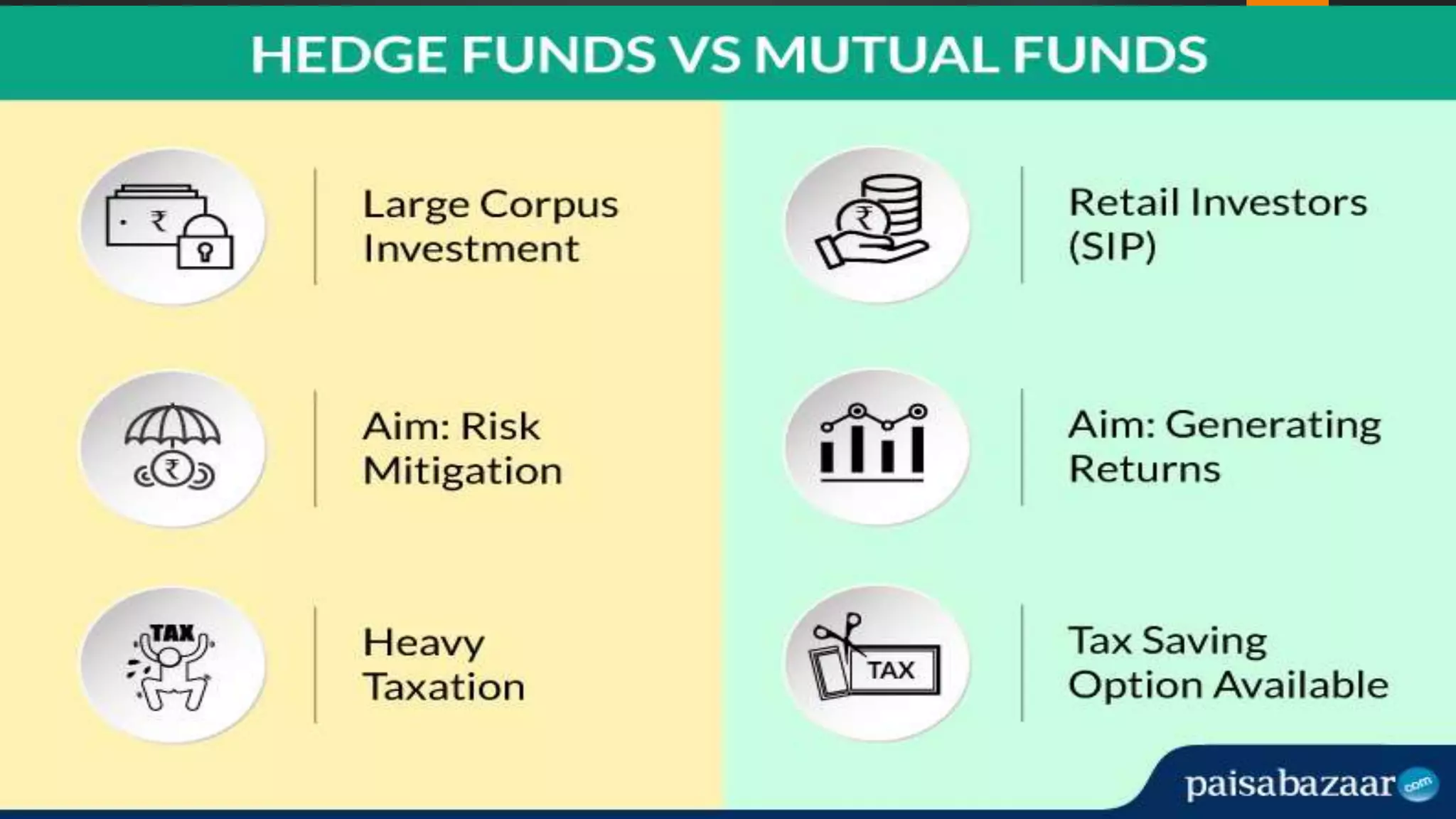

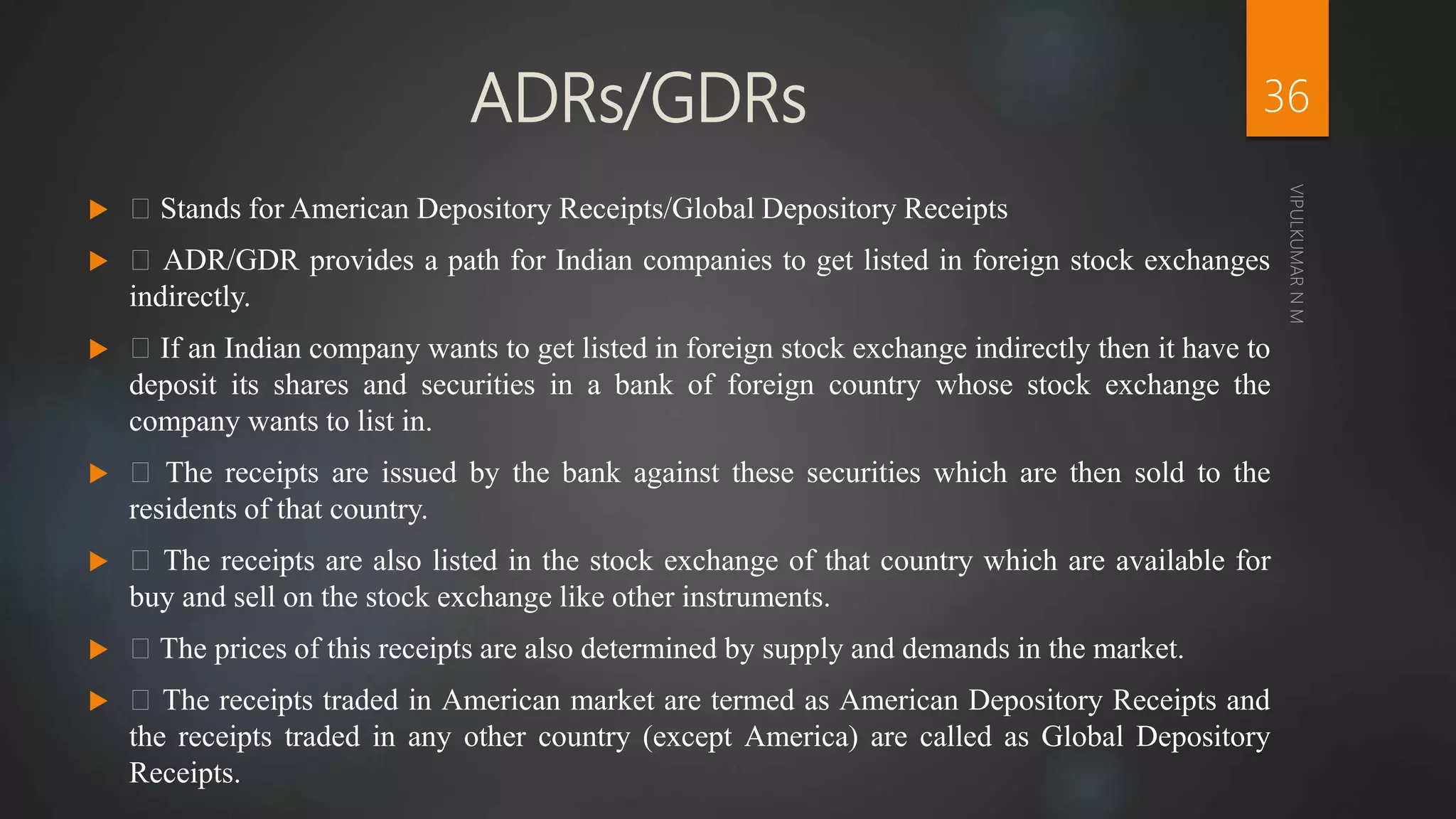

- Foreign portfolio investment (FPI) made through foreign institutional investors (FIIs) such as mutual funds. FIIs must register with regulatory bodies. There are limits on the amount and type of assets FIIs can purchase in another country to limit their influence.